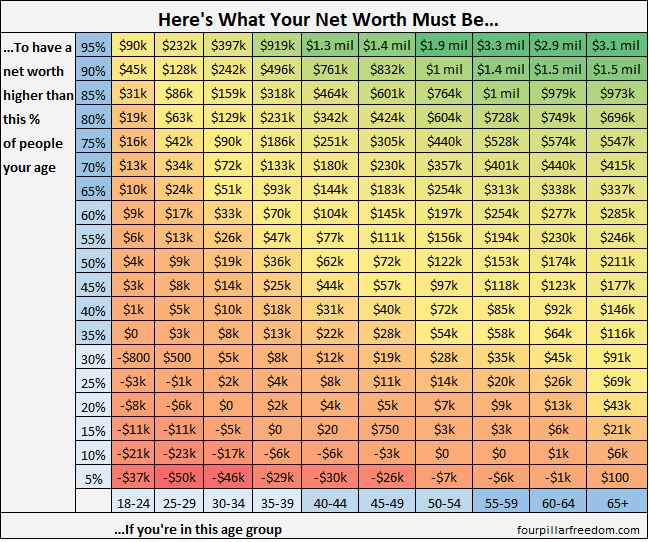

Net worth is one of the most common ways to measure overall financial health. But net worth is closely linked to your age – if you’re older, you’ve had more time to work and save than a young person right out of college. Naturally, the older you are the higher your net worth tends to be.

Recently I got my hands on some net worth data for U.S. age brackets. I decided to make a grid to visualize the data…

This grid shows how your net worth stacks up against people who are similar to you in age (in the United States).

An example of how to interpret this graph: If you’re in the 18-24 age group, you need to have a net worth of at least $10,000 to have a higher net worth than 65% of people in your age group.

Some Interesting Observations

- If you’re in the 18-24 age bracket and have a net worth of $1, you have a higher net worth than 35% of your peers. (As recently discussed on Twitter, Ty from Get Rich Quickish pointed out that most people in this age bracket have student loans, auto loans, and consumer debt so it makes sense that most of them have a negative net worth.)

- If you’re in the 30-34 age bracket, you only need $19,000 to have a higher net worth than half of your peers.

- One out of every four people in the 55-59 age range have a net worth of less than $20,000

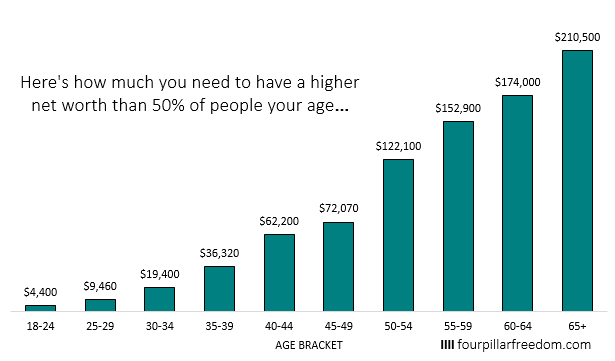

“Middle of the Road”

In order to be in the “middle of the road” and have a net worth higher than exactly half of the people in your age group, here’s how much you need:

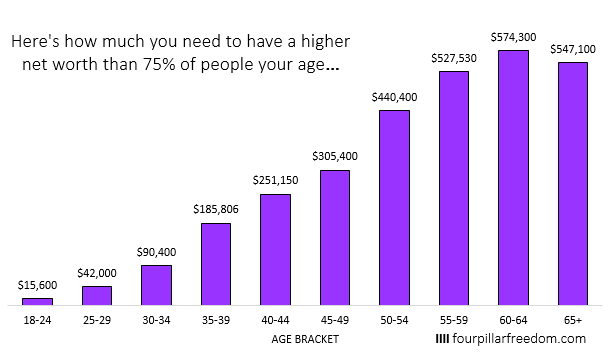

“Financially Savvy”

In order to be “financially savvy” and have a net worth higher than 75% of the people in your age group, here’s how much you need:

“Financial Powerhouse”

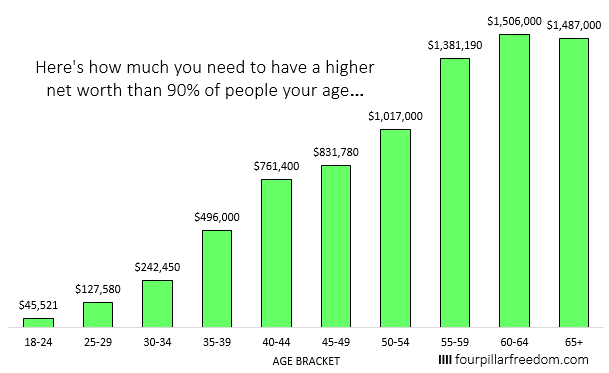

In order to be a “financial powerhouse” and have a net worth higher than 90% of the people in your age group, here’s how much you need:

If your net worth isn’t as high as you’d like, start focusing on your savings rate. Look for ways to live more frugally. Be sure to focus on your income (especially if you’re young) and keep investing simple with index funds. Building wealth takes time. Here’s some more resources that may help you on your financial journey:

My personal recommendations for products and services: Recommendations

A three part series on how to live more frugally: part 1, part 2, part 3

Why income usually matters more than investment returns: Here’s How Much Investing Returns Matter Based On Your Portfolio Size

Sign up to have my most recent articles sent straight to your email inbox for free ?

[jetpack_subscription_form subscribe_text = “” title=””]

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Oh gosh, this just speaks volumes about the amount of debt we’re carrying nowadays. I think too many people aren’t focusing on their net worth and instead are completely happy with having enough cash in the bank to cover bills.

I know right? I was amazed at how high up on the net worth scale you could be in each age bracket just by being debt-free. It just goes to show how serious the debt situation is for most Americans.

Great chart I love it! I know there are differing opinions about this but is this chart taking into consideration your primary “home equity” in calculating net worth?

The data is unclear, but if I had to guess I would say yes, it does include home equity. Net worth is just calculated from (all your assets) – (all your debts) so I would imagine home equity is included in assets.

Wow. These numbers are astonishing, and you’ve made them so easy to understand. I don’t understand why basic personal finance literacy is not a required subject in all high schools.

Mr. G and I were just talking last night about what percentage of people our age might be where we’re at in our financial journey. Pretty amazing to see that just by sharing the FIRE dream when we got married, we quickly went from Financially Savvy to Financial Powerhouse.

Also – impressive to see that you’re already a Financial Powerhouse at 23!!

The numbers are pretty shocking for each age group. It highlights the debt problem most Americans have. Also, I think personal finance should be mandatory in high school as well but unfortunately it isn’t for most. And thanks for the kind words! 🙂