Most people define “financial independence” as having 25 times your annual expenses. For example, if you spend $40,000 per year, you need $1 million (25 *$40,000) to be financially independent.

Let’s explore what financial independence looks like visually.

Pretend this tiny red block represents $1,000 in annual spending:

![]()

Maybe you spend it on Chipotle, Netflix, buying groceries, paying rent, attending concerts, buying clothes, paying bills, taking vacations, or whatever else. It simply represents $1,000 you spend each year.

Now pretend this tiny green block represents $1,000 in savings:

![]()

For every tiny red block, you need 25 tiny green blocks to be financially independent:

![]()

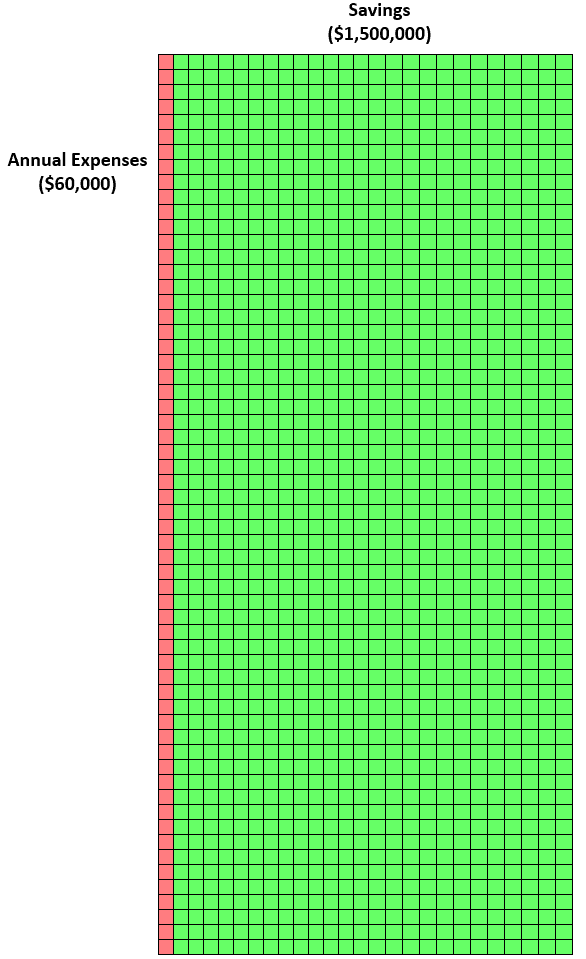

So if you spend $30,000 per year, you need $750,000 to be financially independent. Here’s what that looks like:

Or if you spend $60,000 per year, you need $1.5 million in savings. Here’ what that looks like:

Going from spending $30,000 per year to $60,000 per year increases the amount you need to save to reach financial independence by $750,000. That’s mind-boggling. It’s because for every additional $1,000 you spend each year, you need $25,000 more in savings.

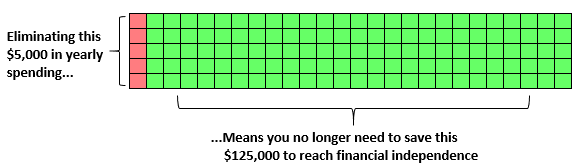

But on the flip side, for every $1,000 less you spend each year, you need $25,000 less in savings to reach F.I.

For example, if you can reduce your spending each year by $5,000, you would need to save $125,000 less to reach F.I.

When you think about expenses this way, it becomes pretty clear that even tiny recurring expenses can actually have a huge impact on how much you need to save.

For example, in a recent post I mentioned that I save about $1,500 each year by bringing my lunch to work instead of eating out. That might not sound like much, but it means I need to save about $37,500 less (25 * $1,500) to reach financial independence.

In that same post I mentioned that I can save almost $1,000 each year by using my Keurig instead of buying a coffee every morning. This means I need to save $25,000 less to reach F.I. all because I make my own coffee. That’s a pretty good trade-off.

Most people who have been able to reach F.I. in a ridiculously short period of time have figured out this simple math: when your annual expenses are low, it dramatically decreases how much you need to save. This means you can reach F.I. much quicker than most people.

For example, if you spend less than $40,000 per year on average, you don’t even need one million dollars to be financially independent. That’s the power of low expenses.

The most effective way to lower your annual expenses is to develop daily money-saving habits like packing your lunch and making your own coffee. Or by reducing how much you spend on entertainment by taking advantage of free entertainment provided by nature. These little habits can reduce how much you need to save to reach financial independence by thousands of dollars.

So, start looking for ways to reduce your yearly spending. Less spending means less savings needed to be financially independent, which means a shorter mandatory working life, which means more freedom to do what you love and live life to the fullest.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Ah, yet again, such an awesome graphic to show FI math. I love all of your graphs and charts… keep them coming! 🙂

Thanks so much, Mrs. Adventure Rich! 🙂

Great block charts! Really opens up your eyes to visually see it this way and solidifyng that a little reduction can go a LONG way. I’d like to add that also finding ways to do things yourself instead of relying on other people – also a great way to minimize savings. Every time we think about hiring someone to do something, we should think is there a way I can learn and do this myself or an alternate and just as much acceptable way to accomplish this task without resorting to paying an outside person.

That’s a great way to save money, and I’ve noticed that’s another popular trend among the FIRE community. It’s pretty incredible how much you can save once you learn to troubleshoot your own problems. Between Google and YouTube you can figure out how to fix/repair almost anything that breaks without relying on a professional to come out and fix it for you. Thanks for the feedback SMM 🙂

This is a great visual. I love this angle rather than the usual…”if you cut cable and save $100/month a year, this is how much you’ll have in 1 years.” This shows the huge impact that it can have for a long time when you have sustained low spending.

Thanks so much! Sometimes visualizations can get a point across more effectively than just words 🙂

This is a fascinating way of looking at the long term effects of spending/saving. I found this part in particular to be mind-boggling :

“But on the flip side, for every $1,000 less you spend each year, you need $25,000 less in savings to reach F.I. For example, if you can reduce your spending each year by $5,000, you would need to save $125,000 less to reach F.I. ”

That’s such a motivating way of looking at spending, especially when there’s something else you’d rather spend your time on like blogging. Thanks for sharing another great post! I’ve really been enjoying your blog lately. Keep it up!

The math is pretty incredible once you look at the difference that tiny changes in annual spending can make. This is the real secret behind how people reach F.I. in 10 years or less: their annual spending is incredibly low.

And thanks for the encouraging words about the blog, I really appreciate it 🙂

Exceptional visual! I think it’s a great example of the lowering expenses aspect of achieving an early retirement. Thanks for sharing this!

Thanks Zed! 🙂 And agreed – once you can visually see the impact of lowering your annual expenses, it becomes pretty obvious that the key to reaching F.I. incredibly quickly is to simply lower your spending.

Great post and visuals! I couldn’t agree more, if one is on the way to FI/RE, the savings rate is the key factor. Just increase it e.g. from 50% to 60% and it works as s real turbo.

Cheers

Agreed! Savings rate is the number one factor that determines when you’ll be financially independent. I’m glad you liked the graphics 🙂

Love this to help my wife and kids understand what I’m talking about!

Thank you!

I’m glad these charts could help you and your family, Cito! 🙂

Hi Zach, thank you! I like the green and red visuals. Makes it even clearer.

Thanks so much, Lyn! I’m glad the visuals helped make the concept clearer 🙂

I love this visualization of FI. I can see how it could be used as a turning point for someone just learning the numbers and the path to FI. Very cool.

Thanks, Angela! Glad you liked it 🙂

Pretty cool us of visuals to see how much more money you need to reach FI.

Thanks, Joe!