4 min read

Morgan Housel recently wrote an excellent article on how your savings rate is largely within your control, while investment returns are largely outside of your control.

Here’s my favorite bit from that article:

Investment returns have a lot of potential to make you rich and achieve your goals. But whether a strategy will work, and how long it will work for, and whether markets will cooperate, is always a question.

Personal savings and frugality – finance’s conservation and efficiency – are parts of the money equation that are largely in your control and have a 100% chance at being as effective in the future as they are today.

This is one of the most important concepts to understand in personal finance. No matter what your financial goal is, whether it’s to save up a few hundred grand and pursue entrepreneurship or accumulate a few million bucks before retiring, the one factor that’s mostly within your control is your savings rate.

The type of house you buy, car you drive, neighborhood you live in, and lifestyle habits you develop are all choices. Likewise, the industry you work in, the skills you choose to acquire, and the side hustles you start are also choices. And these choices largely determine how much you’re able to save and invest each year.

And while you can’t control how your investments perform, you can control how much you invest. Fortunately, the amount you invest often matters more than the returns you earn. To find out why, let’s run some numbers.

Why the Amount You Invest is So Important

Suppose your goal is to save as much money as possible in 10 years. Let’s assume you start with $0 and you invest all of your savings each year into an S&P 500 index fund.

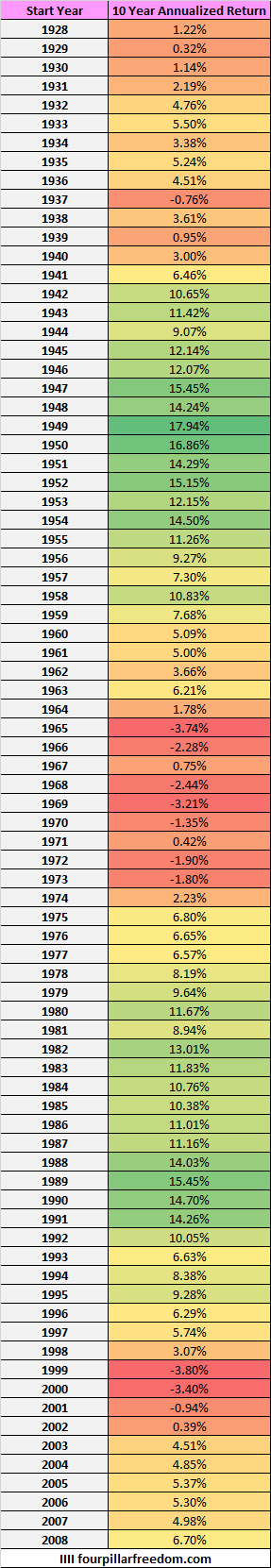

Here’s a look at the inflation-adjusted annualized 10-year returns for the S&P 500 since 1928:

The bad news is that the S&P 500 has done pretty poorly in some 10-year periods. For example, during the 10-year stretch from 2000 through 2009, the S&P 500 delivered -3.4% inflation-adjusted annual returns.

The good news is that if you’re able to save and invest a huge chunk of your income each year, you increase your chances of hitting your financial goals despite earning poor investment returns.

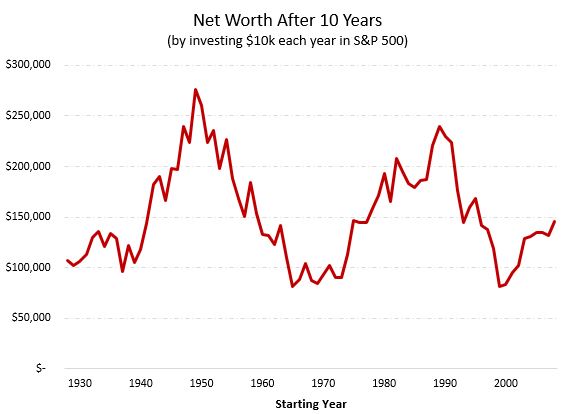

For example, suppose your goal is to save $250,000 in 10 years. If you saved and invested $10,000 each year for 10 years, here is how much you would have been able to accumulate during every 10-year period since 1928:

Depending on the year that you started investing, the amount that you could have accumulated over the course of 10 years would have varied wildly.

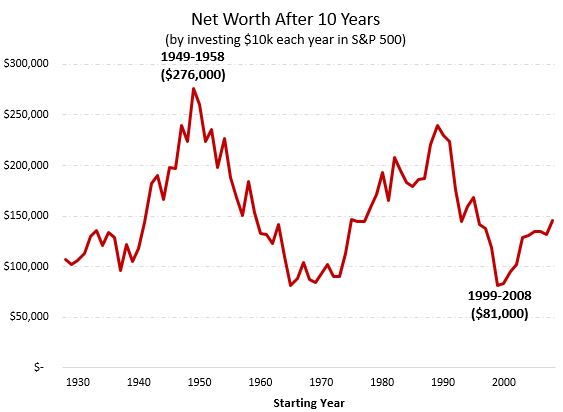

For example, someone who saved and invested $10,000 each year from 1949 to 1958 would have accumulated $276,000. Conversely, someone who saved and invested $10,000 each year from 1999 to 2008 would have accumulated just $81,000:

This means that you would have hit your target of saving $250,000 in just 2% of all 10-year periods since 1928.

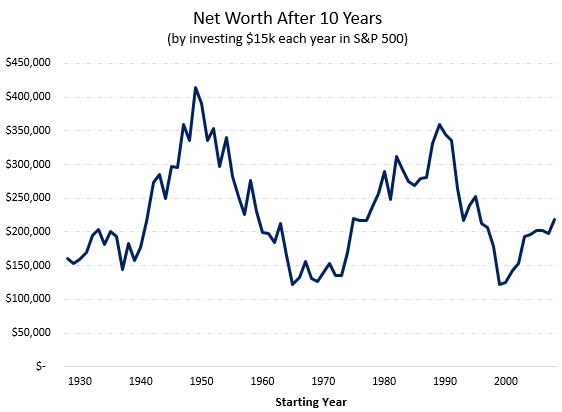

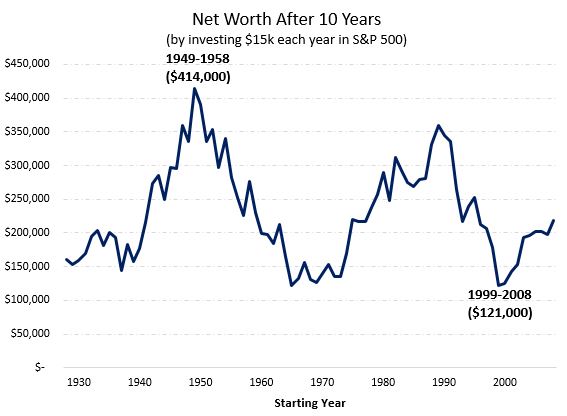

Consider instead if you invested $15,000 each year. Here’s how much you would have accumulated during each 10-year period:

The total amount you end with is 1.5 times higher in each period compared to the last scenario where you only invested $10k each year.

This means during the best 10-year stretch (1949-1958) you would have accumulated $414k and during the worst stretch (1999-2008) you would have accumulated $121k:

In this scenario, you would have hit your target of saving $250,000 in 36% of all 10-year periods since 1928. That’s a huge jump from the previous 2%.

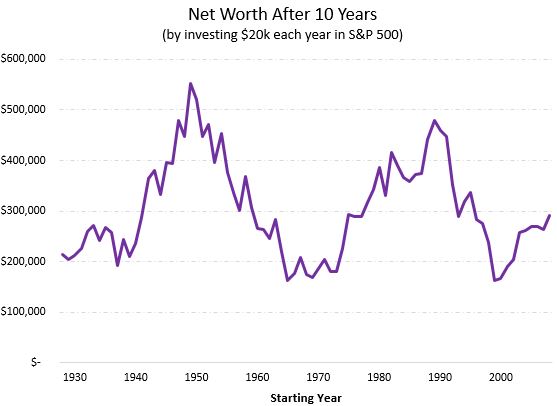

Lastly, consider instead if you invested $20k each year for 10 years. Here’s how much you could have accumulated during each 10-year period:

In this scenario, you would have hit your target of saving $250,000 in 68% of all 10-year periods since 1928.

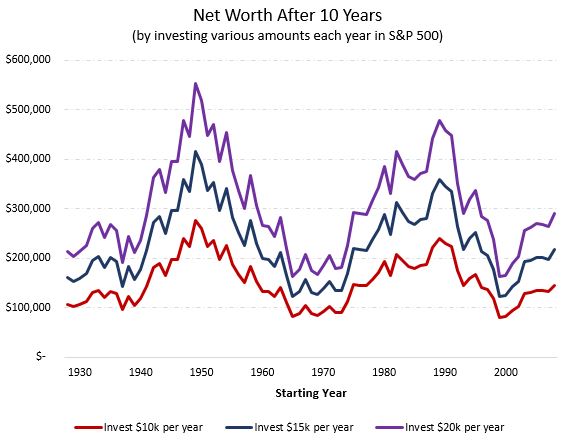

Here’s a look at how much you would have saved during each 10-year period for all three scenarios:

Notice the clear pattern here: the investment returns are the same in each scenario, but the ending net worth amounts vary based on how much you actually invested each year.

You can’t control what type of investment returns the market will deliver, but you can control how much you invest each year, which has a huge impact on your net worth over the long haul.

Conclusion

Most people assume that you need stellar investment returns to achieve your financial goals. And while investment returns do certainly help, they’re mostly outside of your control. You’re better off focusing on the things within your control, namely, growing your income and keeping your spending in check. By doing so, you’ll have more money left over each year to save and invest.

The lesson here is simple: focus on your lifestyle and let your investments do what they may.

Morgan Housel may have said it best:

My personal investments are designed to maximize for sleeping well at night, not necessarily scouting for the highest returns. But my wife and I are so good at happily living an efficient life – you can call us cheap – that adding our lifestyle efficiency to our investment returns leaves us better off than others who may earn higher returns.

Investing alpha is hard and often fleeting, but the lifestyle version is more in your control and permanent. There are those who can earn excellent returns and live an efficient life. Warren Buffett, living in the same house he bought in his 20s, is the best example.

But the idea that there are two ways to improve your financial wellbeing, and one is more in your control with higher odds of success than the other, is as overlooked in finance as it has been with energy.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I love how you use graphics to show your point! This is a great read for anyone on edge about investing.

It looks to me that your potential for earnings are way greater than your potential for loss. Save what you can and let the market do it’s thing!

Totally agree with this. There are things you can easily control (savings) and things you can’t easily control (returns). The other thing you can control is time. The earlier you start the easier it is to turn that 10 year period into a 11 or 12 year or 20 year period.

Also, the thing that I would add to your analysis is that dividends should help the 10 year returns picture (or did you already include that?).

Hi,

The journey to FIRE is simple as below:

1) Consistent investment in stock from the remuneration from the full-time employment. Such investment strategy will lead to the increase in generated dividend.

2) Maintain or reduce (if possible) the expense.

It does not matter how the market is faring. As long as the generated dividends cover the expense, one will have the option at his/her disposal.

WTK