4 min read

I’m 25 years old. Here is some money and life advice I wish I had received at age 18.

Less Self-Help Books, More Creating Stuff

I’ve always loved reading. I preferred fictional books when I was younger, but around age 18 or 19 I started to get into self-help books. My desk was often filled with books on habits, positive mindset, and productivity.

What I didn’t realize at the time, though, was that I lacked a domain to apply all of this knowledge to. I wasn’t building a small business, working on a website, or creating anything. I knew about the importance of habits, but I didn’t have a need to develop any specific habits.

Instead, I should have been spending more time creating stuff like websites. Once I did start creating sites, I picked up some technical skills. Namely, I learned:

- How to communicate ideas effectively through writing (Four Pillar Freedom)

- How to write HTML, CSS, and JavaScript

- How to design sites that are user friendly

- How to earn income online

- How to teach a difficult subject in a way that’s easy to understand (Statology)

I also gained some insight into the nature of progress, habits, and growth. Namely, I learned:

- What it’s like to build a community online (Collecting Wisdom)

- The incredible progress I could make by developing a daily writing habit (600+ blog posts in two years on Four Pillar Freedom)

- Earning income online can be a long, difficult, often discouraging process and that persistence and patience are the ingredients of success

I never would have picked up any of these skills or insights if I had simply sat at my desk and kept reading self-help books.

Net Worth is the Wrong Metric to Track

Around age 21, I became interested in personal finance. I started to consume finance books, blogs, podcasts. But one mistake I made early on was focusing too much on my net worth number.

I began to track my net worth each month, hoping to see it increase consistently every 30 days. Instead, I should have been focusing purely on picking up rare and valuable skills and growing my income as much as possible.

If you have a huge chunk of your net worth tied up in investments like stocks, then stock market fluctuations can heavily impact your net worth from one month to the next. It’s possible that you could earn a healthy income while keeping your expenses low in a given month, yet because of a stock market downturn, your net worth could drop.

Related: Is Net Worth the Wrong Metric to Track?

This is why focusing on growing the gap between your income and expenses is a better approach. If you grow this gap consistently, your net worth will take care of itself.

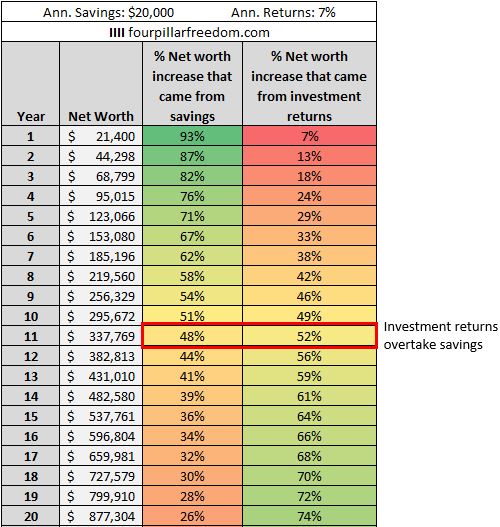

Also, in the early years, the amount you save matters far more than the investment returns you earn.

As I demonstrated in this post, someone who saves and invests $20k per year earning 7% annual returns would experience more net worth growth each year from their savings rather than their investment returns for the first decade of their net worth journey:

Nobody is Tracking Your Failures

As an 18-year-old, I wish I knew that nobody was tracking my failures nearly as closely as I thought.

Nobody was aware of how many internships I applied to and got denied for. Nobody cared about my GPA or any scholarships I earned. Nobody was monitoring my progress closely at all.

Everyone has their own failures, worries, and fears to deal with; they don’t have the time each day nor the mental capacity to keep track of all my failures.

If I had this realization sooner, I would have applied to even more internships, attended more career fairs, experimented with more websites, attempted to make more online products, reached out to more potential clients for tutoring, etc.

I would have made more attempts if I knew that most failures fall away while successes remain.

Passion is Cultivated, not Discovered

I wish I knew earlier on that “passion” was something that was cultivated, not something that was discovered.

From ages 18 to 22, I worked at a handful of retail and entry-level jobs. While these jobs helped me earn some extra spending money, I didn’t feel deeply passionate about any of them. I had a vague sense in my head, though, that once I found the “right” job that I would feel a sense of meaning and fulfillment in the work I did.

However, I didn’t find this fulfillment in my first professional internship. I didn’t find it in my first corporate job, either. Nor my current job.

It has taken a few years, but I’ve finally realized that I’m unlikely to just stumble upon a passionate corporate career.

Related: Why I Can’t Imagine Enjoying Any Corporate Job

The good news, though, is that I have found areas of work that I’m passionate about outside of my day job. Namely, blogging, creating websites, and statistics tutoring. Through enough work and persistence, I’ve been able to cultivate and monetize these passions.

In fact, over the last several months, I’ve been able to use these enjoyable income streams to cover 60-70% of my total monthly expenses and I hope to be able to cover 100% of my total living expenses very soon through these income streams.

To my 18-year-old self: your “passion” isn’t just hiding out there somewhere waiting to be discovered by you. You have to pursue work you find interesting, experiment with many different types of work, and ultimately cultivate a passion from the ground up. And as you pick up more skills and get better at that work you find meaningful, you’ll be able to monetize that work and gain freedom from a 9-5 job in the process.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Great post.

My biggest problem was constantly being stuck in research mode. I can research a topic to death, but the follow through is what’s important.

I agree that everyone should focus more on growing their income and reducing their expenses. You’ll be way better off!

Great article!

Absolutely love this article!

Especially love this as a better metric to track –> This is why focusing on growing the gap between your income and expenses is a better approach <–

I'm sending this to my siblings who are both in their 20s.

Thanks again for sharing.

These are all very good points. Lots of people still don’t understand this at 30 or 40. You are way ahead of most people. Great job.

I really like the point about self-help books. They’re great, but it’s even better to work on a project. You can learn a ton of stuff from building a website and other projects.

I like the point about passion too. IMO, real passion comes from being great at something. That takes time.

Nobody is tracking your failures is such an important concept. As a life-long perfectionist who hates showing any type of weakness, I still struggle to remember this in my 40s.

I’m better when I just try without the fear of failure. For me, that’s been one of the freeing parts of financial independence – less worry about needing to be perfect professionally.

“Passion is cultivated, not discovered.” I could not agree more with you Zach and I hope many 18-20’s year olds read this because it is such an important life lesson. Like you, I too went through a lot of jobs and internships in my college years in an attempt to “discover” my passion. It’s only years later that I realized that passion doesn’t just fall into our laps but is created through pursuing our interests.

On another note, just want to say I recently discovered your blog and love your writing!