3 min read

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO.

I’m in the middle of reading Atomic Habits, the new book by James Clear that outlines how tiny changes in daily habits can lead to remarkable results over time.

In one chapter, James talks about the difference between systems and goals:

“Goals are about the results you want to achieve. Systems are about the processes that lead to those results.

- If you’re a coach, your goal might be to win a championship. Your system is the way you recruit players, manage your assistant coaches, and conduct practice.

- If you’re an entrepreneur, your goal might be to build a million-dollar business. Your system is how you test product ideas, hire employees, and run marketing campaigns.

- If you’re a musician, your goal might be to play a new piece. Your system is how often you practice, how you break down and tackle difficult measures, and your method for receiving feedback from your instructor.

Now for the interesting question: If you completely ignored your goals and focused only on your system, would you still succeed? For example, if you were a basketball coach and you ignored your goal to win a championship and focused only on what your team does at practice each day, would you still get results?

I think you would.”

The equivalent thought experiment in personal finance might be:

If you’re an individual and you ignored your goal to accumulate $1 million and focused only on growing the gap between your income and your expenses, would you still get results?

I think you would.

The Metrics That Matter

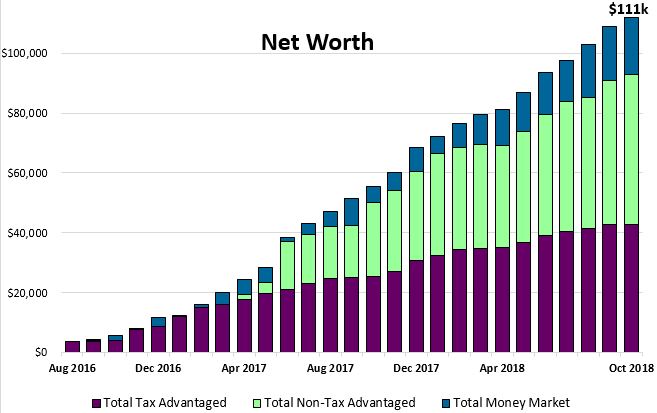

One of my first financial goals was to hit a net worth of $100k. I recently surpassed this number a couple months ago not because I wanted to, but simply because the systems I had in place naturally lead to a higher net worth. Specifically, I:

- Consistently saved 60% or more of my income each month

- Shared an apartment with a roommate for a year and had a monthly rent of only $611

- Drove a fairly cheap Honda Civic

- Tracked my monthly spending

- Invested consistently in low-cost total market index funds

- Picked up a side hustle of blogging and stats tutoring to boost my income

- Increased my data science skill set to jump from a $52k/year to $80k/year job

Related: Answers to Your Questions: How Did I Save $100k in 2 Years?

By focusing most of my energy on these processes that were within my control, my net worth naturally increased each month.

The road to a higher net worth was bumpy, though. Some months my net worth jumped up by $7,000 or more while other months it only increased by $2,000:

Since most of my portfolio is invested in stocks, market fluctuations can have a noticeable impact on my net worth growth from month to month. I can set a goal for myself to increase my net worth by $5,000 each month, but ultimately I can’t control how the stock market will behave.

This is why I find it more important to track the gap between my income and my expenses each month, rather than my net worth.

I keep an Excel spreadsheet where I log my total spending and total income each month. I know that as long as the gap between these two numbers stays wide enough, my net worth will naturally grow.

Systems First

James Clear goes on to explain the fallacy of focusing on goals, instead of systems:

“Goals create an either-or conflict: either you achieve your goal and are successful or you fail and you are a disappointment. You mentally box yourself into a narrow version of happiness. This is misguided. It is unlikely that your actually path through life will match the exact journey you had in mind when you set out. It makes no sense to restrict your satisfaction to one scenario when there are many paths to success.

A systems-first mentality provides the antidote. When you fall in love with the process rather than the product, you don’t have to wait to give yourself permission to be happy. You can be satisfied anytime your system is running. And a system can be successful in many different forms, not just the one you first envision.”

I love that line: “You can be satisfied anytime your system is running.” For me, I am satisfied during any month when I’m able to save 60% or more of my income. I’m satisfied when I don’t spend excessively on shit I don’t need and when I’m able to boost my side hustle income through blogging and stats tutoring.

I still track and share my net worth each month, but I recognize that the most important metric is the gap between my income and spending because it’s the one metric that I completely control.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

When your index funds pay distributions during the year (dividend and/or capital gains), do you auto-reinvest (DRIP) it or you chose to receive cash and then buy more shares yourself manually? This is for non-retirement accounts.

Also I wonder if there’s any tax implications between DRIP or the manual way? I’m not sure if DRIP will save you tax at end of the year over the manual way or it does not matter what way (DRIP or manual) you chose to go with dividend/capital gains, you have to pay the same amount of tax.

Thanks

Hey Ellen,

I automatically reinvest any dividends. Whether you automatically reinvest or manually reinvest, you’ll pay the same amount in taxes.

Zach,

Great point…maybe that’s why I don’t religiously track my net worth like I used to. Now I just focus on keeping our system running: debt avoidance, frugal living, hardcore savings, and regular investing. I’m happy to just keep that system going because it yields results. Best of luck following, maintaining, and tweaking your successful system!

Completely agreed – I focus on keeping my system running smooth. Awesome to hear that you do the same 🙂

We never had a goal to save $1M. We paid off the house in eight years, paid off cars and drove them for a long time, opened IRA and 401K, saved and invested. We just did the pieces to eliminate debt and grow our savings. We knew what $ amount was in each account, but we never added it all up to new worth until early last year. It was $1.8M, not including the house. This all in 20 years. We were focused on the pieces with no clear goal and it still happened. Our habits are still there, we haven’t changed a thing.

Awesome to hear, RE@54. That just shows how important habits truly are.

After this past month, I understand why you would want to track something other than “Net Worth.” My portfolio is also down more than I normally save in a month so it’s down for this month. I normally also track my spending vs income but mostly I look at my “Net Worth” report for my over all score. This month doesn’t look so pretty. I figure it makes up for the months when my net worth was up, mostly because of market gains.

I found the below picture on another site, unfortunately I didn’t include where I found it.

https://s3-us-west-2.amazonaws.com/media.forumbee.com/i/072f73c6-7339-420e-b558-bc5a7e2b45fc/h/547.jpg

To me, this is just one of those down months, where I didn’t have any control. They happen. I just fill up my report with notes to say “It wasn’t my fault.”

Believe you are on the right track to focus on process. Tracking spending seems like a good alternative when the markets are down.

Haha I love that you note “It wasn’t my fault”, because some months that’s simply true. You can’t control how the market behaves. Thanks for the feedback!

I had a feeling you’d be reading this excellent book, Zach! You seem to already have mastered the power of good habits. I’m reading it right now, too, and I love it.

I agree in the power of tracking behaviors and systems rather than goals (except to check in periodically and make tweaks to the systems if of course). Big goals can actually become paralyzing. Focusing on the daily, weekly, quarterly is so much more doable.

Very cool to hear that you’re also in the middle of reading Atomic Habits, Lin! It’s a fantastic book. And agreed with you – focus on the daily, tiny habits and the larger goals naturally take care of themselves.

Goals are important, as they help define the “what”. Without a tangible means of achieving them however, a goal is just an empty pipe dream.

Strategy is important, as it defines the “how”. Without tangibly defining where the goal posts are, there is no way to determine the effectiveness of the activities or actions being undertaken in pursuit of that goal.

Net worth is simply a means of keeping score, charting progress towards a goal. However just monitoring it alone won’t achieve the desired goal, because monitoring isn’t the same as doing.

The framework approach you outline implements a strategy geared towards achieving your goals, it leads to tangible actions being taken. The net worth tracking monitors your progress.

Both elements are important. Neither can succeed without the other.

Agreed with you – both elements serve a purpose. Thanks for the feedback, indeedably!