5 min read

A few days ago I shared that I saved $100k in 2 years. Since then, I’ve been receiving a lot of questions via Twitter and email like:

How can I replicate your results?

What did you invest in?

What tools did you use?

Any secrets?

Here are my answers to those questions.

Question: How can I replicate your results?

There are three factors that affect how long it takes you to save $100k: income, lifestyle, and investments.

1. Income

Income matters a lot. If you’re fresh out of college, you’ll be on the bottom of the salary totem pole. The obvious advice is to get a degree that offers a decent starting salary. I personally earned a bachelor’s degree in statistics and had a starting salary of $52k as a data analyst straight out of college.

I wanted a higher salary so I went and got my master’s degree in statistics. Keep in mind that this doesn’t make sense for every field. The income jump that comes with a master’s degree in math/stats occupations can be substantial, which is why I decided to get mine. In fact, most jobs I applied to required a master’s degree to even be considered for the position.

Through working full-time and earning scholarships, I also was able to pay out of pocket for my 1-year master’s program. Shortly after, I applied to ten different companies and eventually landed a job as a data scientist with an $80k salary.

Keep in mind that if getting a graduate degree in your field requires 2+ years and heavy student loan debt, it may not be worth the cost.

Outside of your day job, you can utilize side hustles to boost your income even further. I personally tutored people in statistics. During one 30-day span I was able to earn over $1,000 through tutoring alone.

There are plenty of side hustle opportunities out there thanks to the growing gig economy. For example, my sister works as a vet technician and earns around $640 per week at her day job. Through dog-sitting on Rover she brings in another $200 per week, boosting her income by over 30% doing something she enjoys.

Related: How to find real-life side hustle ideas that aren’t a waste of time

It’s important to keep in mind that not all side hustles are created equal. Some pay more than others. Frankly, some are not worth your time (cough cough, taking online surveys).

So, whether you decide to pursue higher education and/or side hustles, it’s important to increase your income if you hope to reach $100k as fast as possible.

2. Lifestyle

It’s great to earn a high income, but unless you’re able to save a significant chunk of it, you won’t get anywhere fast.

The three biggest lifestyle expenses for most people are housing, transportation, and food. If you can get these three under control, you can accidentally overspend in other categories and still have a rock solid savings rate.

Housing

During the one year I spent getting my master’s degree, I worked full-time and I lived at home with my parents. I was fortunate that I had zero housing costs during this time, which helped me save 80% or more of each paycheck. Once I landed my new job, I moved out and got an apartment with a roommate. We split the $1,222 monthly rent, which meant I only paid $611 each month.

Transportation

I have driven a Honda Civic since college, so I have successfully avoided any ridiculously high car costs.

Food

I typically spend around $300-350 per month combined on groceries and dining out. I could tighten the belt a little on this food spending, but I get too much joy from Chipotle to do so.

3. Investments

The last factor that impacts how long it takes you to save $100k are your investments. And to be honest, these don’t matter much at all starting out. Income and lifestyle are far more important.

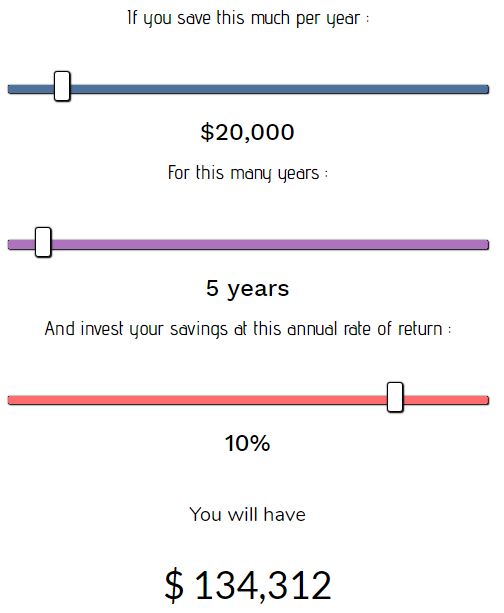

Someone who saves $20k per year and earns impressive 10% annual returns will have $134k after five years:

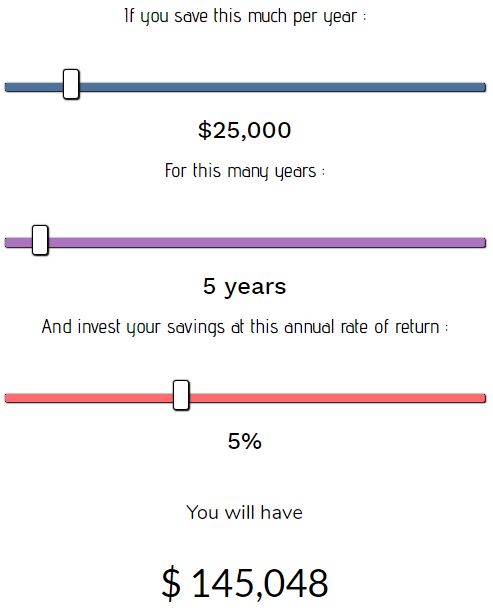

Contrast that with someone who saves $25k per year but only earns 5% annual returns. They’ll have $145k after five years:

Many people are quick to tout the power of investment returns and compound interest, but the amount you save matters far more than your investment returns in the early years. Compound interest only becomes powerful during later years.

It’s a good idea to start investing as early as possible, but keep in mind that investment returns won’t impact your journey from $0 to $100k as much as you may think.

Question: What did you invest in?

Starting out, I attempted to outperform the stock market through buying and selling individual stocks. This was a mistake. Eventually I discovered the math that explains why index funds are so hard to beat. I read the Stock Series by J.L. Collins along with The Bogleheads’ Guide to the Three-Fund Portfolio and became convinced that index funds offered the simplest, most effective method of investing.

I still hold a few individual REITs (Real Estate Investment Trusts) that give me exposure to real estate and pay me dividends each quarter, but my days of picking individual stocks and REITs are over. Now, I typically invest exclusively in VTI, the Vanguard Total Stock Market ETF.

Question: What tools did you use?

I used Personal Capital (and still do) to track my net worth and investments for free each month. I used a simple Excel spreadsheet to track my spending each month. I have heard that Mint is a great tool for tracking spending as well, but I have never personally used it.

Through tracking my numbers consistently, I never went more than 30 days without knowing my exact financial situation.

If you want to grow your own net worth, I recommend tracking your finances. You should know where your money is flowing each month. This helps you identify areas where you can cut down on spending and potentially increase your income.

Question: Any Secrets?

Only one secret: To grow wealth, you need to understand human behavior and psychology.

Understanding a few big ideas will carry you far. Namely,

Most people don’t care about your failures. Many people are scared to ask for a promotion, apply to a new job, reach out to new clients, etc. because they fear failure. The truth is, nobody cares. Nobody is tracking your failures. Everyone is too consumed with tracking their own failures. Once you understand this at a deep level, you can start making more attempts. You’ll fail more, but you’ll also succeed more. The failures will become irrelevant and fall away. The successes will push you forward towards a higher income.

Most people don’t care about your lifestyle. Understand the “Rich Man in the Car Paradox”, which states that when you see someone with a fancy new car, you don’t care about the person inside the car, but rather you think about how cool it would be if you owned that car. This is why upgrading your house, car, lifestyle, etc. to impress others is a waste of time.

Humans adapt quickly. Whether you choose to live frugally or lavishly, you’ll adapt to both lifestyles quickly. The only difference is that frugal living leads to a high savings rate and financial freedom while a lavish lifestyle leads to a low savings rate and perpetual dependence on a day job.

It’s nearly impossible to time the market and outperform the market. Rookie investors think they can buy and sell individual stocks at the perfect times to outperform the market. This is much harder than it looks, though. And it almost always leads to underperforming the market. The sooner you realize that buying index funds for the long haul is the simplest, most effective way to earn higher returns with lower risk, the better off you’ll be.

Thanks to everyone who reached out with questions 🙂

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Interesting Zach, thank you for sharing.

“Nobody is tracking your failures. Everyone is too consumed with tracking their own failures. ”

That is something powerful right there. Never thought about it this way. I’m going to work on this.

Thanks Mr. Robot! Glad that ideas resonated with you so much. It has certainly helped me become more bold and make more attempts (ask for promotions, apply to more jobs, try to land more tutoring clients) without letting the fear of failure hold me back

Great tidbits on what moves the needle the most when just starting out. Keep up the good work.

Thanks you! Glad you found some of the info useful 🙂

Definitely gonna try and use Personal Capital! I have money socked away in a savings account, Acorns, and a life insurance account for retirement. Not to mention my checking account. Even though I live with my parents, I pay our car insurance instead of rent, which is $500 out of my pocket. I feel like I’m all over the place!!

Personal Capital is great for aggregating all of your accounts in one place. This helps a lot with tracking your cash flow and your net worth each month. Hope you find as much value in it as I do 🙂

why do you invest in ETF of the index fund rather than admiral or investor shares of the same index fund since VTI ETF price is much higher than admiral or investor shares.

VTI and VTSAX (the admiral shares) are the exact same thing. The prices are different simply because the total outstanding shares are different.

I really liked your explanation

Thanks Gloria!

Wow, seems like we have the exact same methods for saving six-figures so quickly. Great minds think alike!

Awesome to hear that our tactics are so similar!