3 min read

I love when high-net-worth bloggers share their financial journeys because I always see a similar trend: It takes years to save the first $100k, but after crossing that threshold, compound interest starts pushing net worth higher at a faster and faster rate as each year passes.

Today I want to explore the math that explains why net worth begins to take off like a rocket ship after crossing the $100k threshold.

Related: The only personal finance tool I personally use to track my net worth is Personal Capital. It’s completely free to use and it makes tracking your net worth a breeze.

The Math

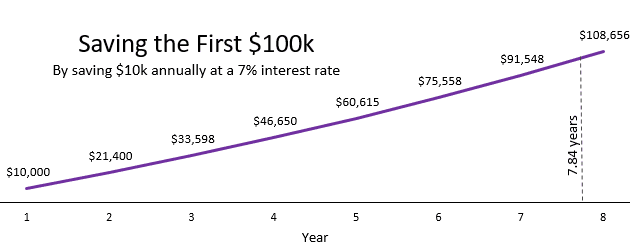

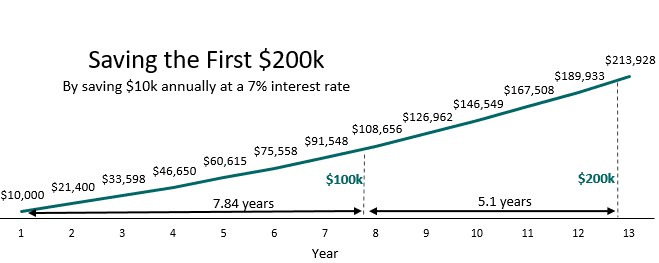

Consider our friend Shannon who saves and invests $10,000 every year. At a 7% annual interest rate, her net worth will grow to $100k in 7.84 years.

If Shannon continues to invest $10k per year at a 7% interest rate, she’ll be able to save her next $100k in only 5.1 years.

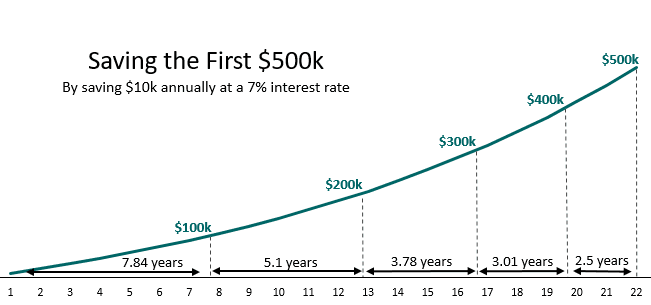

As time goes on, Shannon will be able to save each additional $100k in shorter and shorter amounts of time.

Although she is saving the exact same amount each year, the money she already saved is working for her behind the scenes, pushing her net worth higher at a faster rate each year.

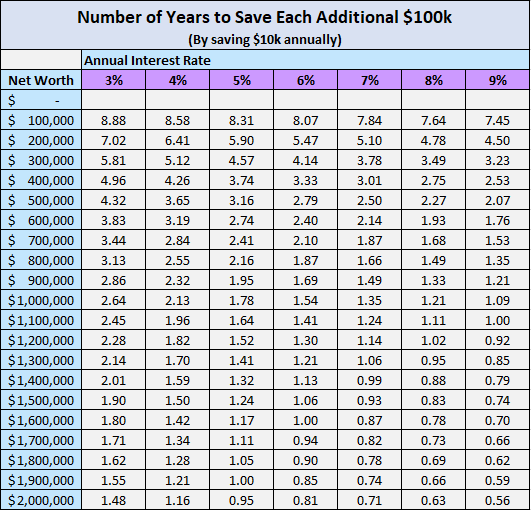

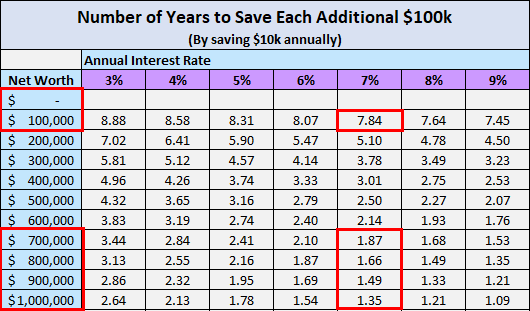

Here is a chart that shows how long it would take to save each additional $100k (up to $2 million) based on different annual interest rates:

If we stick with the example of Shannon investing $10k each year at a 7% interest rate, there’s a mind-boggling stat to be seen: To increase her net worth from $0 to $100k, it will take her 7.84 years. But to increase her net worth from $600k to $1 million, it will only take 6.37 years.

This illustrates just how insanely powerful compound interest is once you have a few hundred thousand dollars saved up. As Charlie Munger said, getting the first $100k is a b*tch, but once you cross that threshold, your savings begin to do the heavy lifting for you.

Notice in the chart above that it takes 7 – 8 years to save the first $100k no matter what annual interest rate your savings grows at. This is because the amount you save matters far more than your investment returns when you’re just starting out.

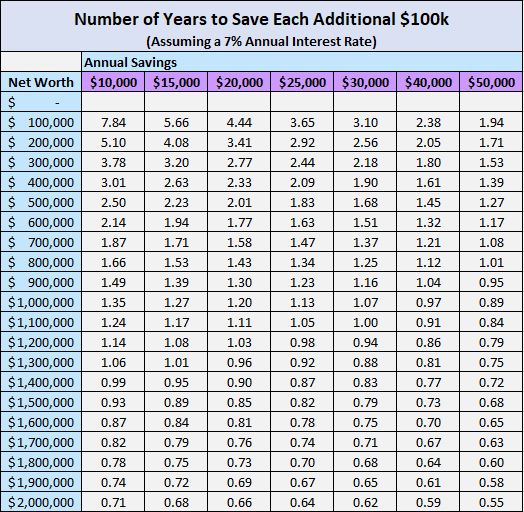

As an additional resource, here’s a chart that shows how long it will take to save each additional $100k based on different annual savings. This chart assumes a 7% annual interest rate on investments.

The Math Works at Every Level

Saving $10k per year at a 7% interest rate is just a hypothetical scenario I chose to explore here. The math holds true for every amount of savings and every interest rate, though. As time goes on, your net worth will ramp up faster and faster each year due to compound interest.

Unfortunately, the magic of compound interest doesn’t tend to reveal itself until you cross the $100k net worth mark. It’s around that point that you have enough savings for interest to have a noticeable impact.

There’s an important lesson to be learned here: Don’t be discouraged if it takes you longer than you hoped to save your first $100k. This is by far the hardest $100k to save and will likely take you the longest to save. I’m still chasing it myself. I recently crossed this milestone myself! But once you cross that point, the road only gets easier from there.

I should also mention that I didn’t account for any increases in income here. More than likely, as you get older your income will increase, which means you’ll be able to save more and more each year. This increased savings combined with compound interest will help you increase your net worth even faster than what these charts show.

Further Reading:

Charlie Munger: The First $100,000 is a B*tch

Buy Less Stuff. Buy More Assets.

Working One Day a Week Can Be Worth $100,000

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Compound interest is one of those things where no matter how much I understand it, it always still amazes me.

I sent this to my wife because she just crossed over that 100k threshold recently and I think it’s really exciting to see how much it starts to snowball from there.

Same here! Every time I do any type of analysis on compound interest, I’m always shocked at the results. Hopefully your wife finds value in this post, thanks for sharing it 🙂

Awesome analysis. Does this assume that you’re only dumping money into one type of investment account? Say all 100k was saved in a 401k bucket. What about if someone’s networth is spread across different buckets that sums up to 100k?

Thanks, Johan! This doesn’t make any assumptions about what type of investment account you’re dumping your savings in. The math holds true whether or not the entire $100k is in your 401(k) or spread across different buckets that sums up to $100k.

Nice post 4-pillar freedom 🙂 I really like how you explained the graphs. Can you do a second case where someone saves 25k a year? It seems like at 10k a year even with compound interest its way too long – 22 years. Which to be fair is a point often cited in why we should save a much bigger percentage of our paychecks.

Thank you! I actually just added a new chart (based on your suggestion) towards the bottom of the post that shows how long it takes to save each $100k based on different annual savings 🙂

These charts should make us all very excited and drive us to do more! Thanks for putting them together. And the best part it, they don’t account for boosts like income increases or tax return savings that can allow you to save more 🙂

Thanks, SMM! You’re right, these charts are on the conservative side considering they don’t account for income increases in any way 🙂

Mathematically, it is the same whatever the amount. If you saved 5K annually and plotted it in multiples of 50K, you would get the exact same graph! You would get to 50K, 100K, 150K, 200K, 250K at the same points in time.

I don’t know if it is the magic of going up in the number of digits, but somehow once you get to 100K, you feel like you got somewhere. Your returns are now not a few orders of magnitude less than your savings, but suddenly non negligible. I think the comparison with what we save is what makes 100K number magical. What do you think?

I think just knowing that you have six-figures in the bank provides a feeling of euphoria. $100k doesn’t make you rich by any means, but it certainly gives you flexibility to switch jobs, take time off, feel more secure, etc. It can also provide some financial peace of mind.

Love all the charts and graphs in this post. Still gonna be chasing that first $100k for a while. But I’m excited to watch it grow when it finally does happen!

Thanks, Erin! Best of luck in reaching your first $100k 🙂

Hopefully hitting the $100K mark sometime this year! Excited to have all that extra money going to work for me 🙂

I like putting together conservative estimates too as it feels that much better when you beat them! Nice work putting this all together!

Thank you! Best of luck in getting to that first $100k 🙂

Power of compounding is amazing. But, assuming a 7% average returns is a little too high. In doing all my math I assume 4% ROI. S&P 500 has a dividend of around 2.0%. I would recommend using a more conservative ROI. Even if takes a little longer to get to 100k. If reached earlier even better.

7% annual returns may be a bit on the high end, but keep in mind I didn’t account for any increase in contributions each year. Most people are able to save more and more as they get older. The increased contributions could easily offset the higher returns, especially in the early years.

Hi Zach,

I recently started reading your blog. I’m 48 and have been investing in my 401k for 24 years so I started similar to you. 7% return assumption is a good assumption assuming that you keep your 401k invested in stock mutual funds and eventually getting to a high of about $12,000 per year in contributions. I have since dialed back to about $4000 per year and plan to stay at that until I retire because I want more cash flow now that I have achieved a sizable amount in my 401k. My history was I was invested in a 60/40 mutual fund from 1994 until 1999 and then I read John Bogle’s Mutual fund book and shifted to 90/10 stocks/bonds. I have lived through the dot.com market crash and the housing crash in the stock markets but continued to be 90/10 until very recently. I am now shifting beck to about a 70/30 split and will continue for the next 5 years to get down to 60/40. If you stay invested in stock funds and do not move them during the crashes you will be fine. Also, increase your contributions during the market crashes and then by the time you are 48 years old, you will have about 500k-600k in your retirement savings.

As someone who has already made the trip that is a great explanation. I always tell people when they mention they hit that 100k milestone that I thought it was much harder than the first million but I’ve never seen the math worked out like this, great post!

Glad to hear these numbers matched your financial journey! It is pretty incredible to see the time it takes to achieve the first $100k compared to the time it takes to go from something like $600k – $100k.

I am interested in the formulas you used to derive the spreadsheet so I can tweak the settings and do some simulations. I haven’t been able to find a formula to determine number of years to save $X. Would you be able to share your spreadsheet or formulas?

Thanks for the great post. This was enlightening even though I should have known this intuitively.

Thanks, Kevin! I just added the Excel spreadsheet that I used at the bottom of the post. It has all the formulas I used. 🙂

The issue is that it works the same way with debt. When you start out, the interest payment of $10 or $20 per month seem trivial. Let it build up a little, however, and suddenly you’re doing everything you can to just pay the interest payments each month and never paying any of the principle down. Then you have some little event hit your life and find yourself unable to even pay the interest and seeing your payments increase every month as you accelerate towards bankruptcy. Conversely, when you pay off a debt, it is really hard at first because you’re paying all sorts of interest, but easy at the end because you’re paying mostly principle.

Great minds must think alike because I just wrote a blog post called how I went from $5k to six-figures in 6 years. It’s a worthy goal for anyone. Nice post.

Thanks,

Miriam

Love how clear and easy this is – but it’s making me wish I’d started saving more sooner to get that kick start ? To be fair, our net worth is above $100k but since we have less than that in traditional retirement accounts, this still feels totally valid.

This is an awesome post…I hit 100K all in a single retirement account 403B…just elated!! It took me 10 years to do it though. I started contributing at 39 which it would have been sooner… now with this post Zach, I can see the difference in my savings as it materialize towards a robust financial retirement schedule. Compound interests is amazing!! Thank You.

Congrats on hitting $100k in a single account, Marie! That’s impressive. Glad you found this post so helpful as well 🙂

Very true. However doesn’t account for market decreases by 50% beginning in 2000 and 2007.

Dude, this is really great. I came over here from BAS and I will definitely keep reading this site. Been on the FIRE path for a bit, about two years accumulating, and this is the first time I’ve seen a chart demonstrating how effective compound interest is after that 100k hump! And, it’s kind of nice to see someone writing who, if I read that correctly, is also in the camp of folk who haven’t hit that 100k mark yet. Here’s to reaching for that $100k milestone!

Thanks B.C. – glad to hear you enjoyed this post! I actually passed $100k a couple months ago and am now focusing on $200k. Thanks for the feedback!

Oh nice, congrats! I lot a little catching up to do then lol

Thank you! Here are a couple posts where I share details of my $100k net worth journey:

https://fourpillarfreedom.com/net-worth-update-22-august-2018-flying-past-100k/

https://fourpillarfreedom.com/answers-to-your-questions-how-did-i-save-100k-in-2-years/