2 min read

My entire financial philosophy in six words:

Buy less stuff. Buy more assets.

An asset is anything that tends to increase in value over time or pays you money simply for owning it. Some examples are real estate, stocks, bonds, websites, and businesses.

When you spend one dollar on a material thing, that dollar is gone forever. But when you spend one dollar acquiring an asset, that asset becomes your employee that works relentlessly to earn money for you.

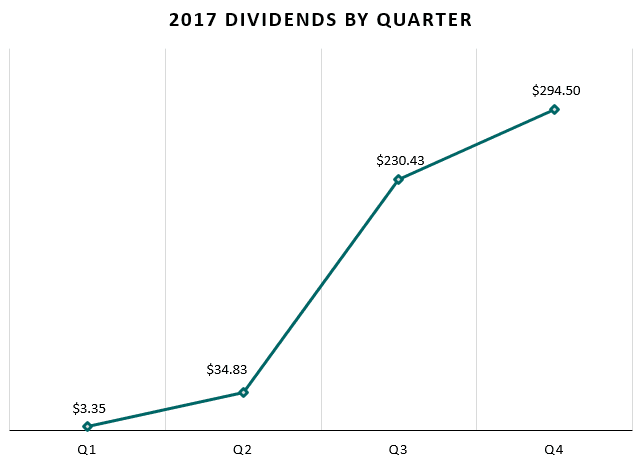

A great example is dividend-paying stocks or REITs, which pay you cash dividends every three months (sometimes every month) just for owning them. Here’s a look at how much I earned in dividend income each quarter last year:

Most of the increase came from me buying more dividend-paying assets each quarter, but part of it also came from increased dividend payouts.

So, not only do these investments pay me on a regular schedule, but they often increase how much they pay me without any effort on my part.

That’s a pretty good deal if you ask me.

Another example is stock index fund investing. I personally invest all of my 401(k) contributions in an S&P 500 index fund, which has historically been a wonderful wealth-building machine for investors.

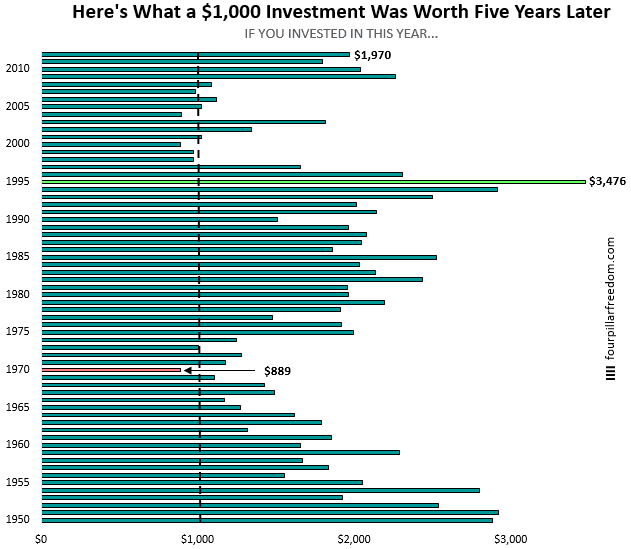

Here’s a look at what a $1,000 investment in the S&P 500 has historically been worth five years after the initial investment:

Notice how the initial investment of $1,000 is usually worth more after five years.

Even during the worst five-year return in which your $1,000 dropped in value to $889, that’s still $889 more than if you had blown that $1,000 on something you didn’t need five years prior.

The Gift That Keeps on Giving

Investing in an asset is like buying a gift for yourself that just keeps giving you more and more money over time.

Suppose you have $1,000 in savings. If you buy a stock with a 3% dividend yield, you’ll receive $30 in cash dividends during the first year. If you reinvest that $30, you’ll have $1,030 earning a 3% yield.

If the stock increases its dividend payout, your money will compound even faster. Also, if you need the money in the future, you can likely sell your stock at a higher price than you bought it at.

(This example doesn’t take into account taxes, but you get the idea)

Instead, suppose you spend that $1,000 on new car speakers. Each year, the speakers will happily pay you a whopping $0 for owning them. In fact, you’ll probably have to spend more money over the years to repair and maintain them.

Don’t worry, though. When you need the money, you should be able to sell them on Craigslist for $80.

The Connection Between Joy, Spending, and Assets

If we’re honest with ourselves, most of us will find that there are only a handful of things that bring us real joy.

Most of these things are inherently free – spending time with friends, family, embracing nature, creating stuff, etc.

In general, spending money on experiences bring us more happiness than spending on material things. But occasionally material things do provide value – laptops, smartphones, headphones, etc.

The trick is to identify the handful of material things and experiences that bring you joy and spend without feeling guilty on those things.

Then, with all the money left over, invest in assets. Heck, if possible, build your own assets like a website or a small business.

The idea here is simple. Buy lots of little money-making assets and avoid buying lots of little money-sucking material possessions.

Repeat for many years.

Watch how both your finances and your freedom begin to expand.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I always love your illustrations that you include in your posts making your messages more undeniably obvious. Another great read!!

Thanks so much, Amy! Glad you’re enjoying the visuals 🙂

Hi 4PF. Great post. I spent many years wasting money before figuring this out. My younger self could have really used this wisdom. Happy investing!

Thank you! Best of luck on your own financial journey 🙂

So true. Watching my net worth grow honestly brings me more happiness than buying/owning lots of things.

That’s exactly how I feel! Thanks for reading 🙂

I like how you discuss how buying less stuff leads gives you the ability to buy more assets. My wife and I learned about FIRE last year and realized we have achieved FI.

However, we have continued to cut savings and invest the extra left over money. Using the word saving can sound boring, but describing it as buying more assets sounds more exciting to me. I never really thought that I am still “buying stuff,” in this case assets that will appreciate in value and pay me dividends. It almost makes me want to put a category on my spending reports for “Asset purchases.” Thanks for the post!

I think reframing it as “buying assets” makes it more intriguing and motivating as well. Makes it feel like you’re buying future income streams, which is a bit like buying future time and freedom.