6 min read

I’m 24 years old. Yesterday I shared that my net worth exceeded $100,000. Here’s how I accomplished this feat.

The short version: I graduated college debt free with a master’s degree through a combination of working retail jobs and earning scholarships. Upon graduating, I landed a job as a data analyst earning $52k per year. After one year I took my current job as a data scientist that pays $80k per year. All the while I lived on less than $1,500 per month. This meant I was able to save thousands of dollars each month, which I mostly invested in the stock market.

The long version: Grab a cup of coffee. Here come the details.

The Beginnings

Growing up, I loved creating things from scratch. Lego blocks were my toy of choice. I’d spend hours in my room constructing towers that surely failed to meet building codes.

This love of creation naturally lead me to take an interest in architecture. Fast forward to my junior year of high school. I took the one architecture class offered by the school. And I was terrible. Not only that, but I didn’t enjoy it much. So, I spent the next couple of years thinking about what I should pursue instead.

Fast forward to high school graduation. A family friend recommended I pursue actuarial sciences since I was good with numbers. So, going into my freshman year of college I declared that to be my major.

Shortly after, I discovered the grueling exams and long hours that came with being an actuary. I quickly lost interest. I switched majors to statistics and decided that I would instead try to become a data scientist. Four years later I held both my bachelor’s and master’s degree in statistics.

Undergrad

As a senior in high school, I had no clue what college I should attend. Instead of diligently comparing several options, I applied to only one: the exact same college 20 minutes from my house that my older brother had attended seven years prior. I got accepted and decided that I would commute to class during my first year.

I planned on transferring to a different university at some point, one further from my house. But one year turned into two, which turned into three, and before I knew it I had my bachelor’s degree.

During these undergrad years I worked at a few different retail stores earning minimum wage and working 20 – 30 hours per week while attending class full-time. A combination of scholarships and measly earnings allowed me to pay for each semester as I went. This meant I didn’t need to take out any student loans.

At the time, I didn’t think much of this decision to work while being a student. I thought it was normal to pay for college out of pocket. Looking back, I realize this was a wonderful decision that gave me a massive financial head start upon graduating.

Grad School

For some college majors, the difference between salary for someone with a bachelor’s degree and a master’s degree can be substantial. Statistics was one of those majors. Based on research I had done, I knew that a master’s degree would help me earn a significantly higher salary in the corporate world.

So, I decided to stay at the same undergrad college which offered a 4+1 program. This meant I could get my master’s degree in statistics with only one additional year of classes.

Shortly after graduating with my bachelor’s degree, I landed a job as a data analyst with a $52k salary at a firm near my college. I decided to work full-time and attend classes full-time as well. For five days a week I would go to work from 9 to 5 and sprint to classes from 5:30 – 8 in the evening.

I had no life during this year. Between work, classes, and studying, I was swamped. I wouldn’t recommend this approach for most people, but if I had to do it over again I wouldn’t change a thing. By living at home during that year and earning a full-time salary, I was able to save over $30,000 by the time I graduated with my master’s degree.

My First Job

Upon receiving my first corporate job offer with a $52k salary, I decided to negotiate.

I asked for $57k.

They held at $52k.

I countered with $55k.

They held. I folded. I had no leverage anyway.

Although the salary wasn’t as high as I would have liked, the skills I picked up on the job were invaluable. My coding, writing, and presentation skills all improved. This experience would form the foundation I would need to land my next job as a data scientist.

My Current Job

After graduating with my master’s degree, I received the news that a salary increase would be unlikely for at least another year at my current job.

Instead of complaining, I decided to send out my resume to ten different companies. Only one responded. Turns out, I only needed one.

Fast forward a few weeks. I landed the new role as a data scientist with a salary of $80k, more money than I had ever seen in my life.

This new job was also an hour away from my house, which meant I needed to move closer and get my own apartment.

Maintaining Low Spending

I decided to get my first apartment with a close friend who happened to be attending graduate school at the university near my workplace.

This decision also turned out to have serious financial benefits. Our monthly rent was $1,222. Splitting it 50/50 meant I only paid $611 each month. I also kept driving the same Honda Civic I had during college.

The decision to share an apartment with a roommate and not upgrade my car have been the two biggest reasons I have been able to consistently live on around $1,500 or less each month over the past year.

My Investments

I first discovered the concept of investing during my junior year of college. As most beginners do, I decided to invest in individual stocks and attempt to trade in and out of positions on a monthly basis. Needless to say, I underperformed the market.

Towards the end of college, I stumbled upon the Jim Collins Stock Series and became enlightened to index fund investing. Instead of picking individual stocks, I began investing in total stock market index funds.

Now, I have a dead simple investment approach:

I earn thousands of dollars more than I spend each month. I funnel these savings into total stock market index funds in my 401(k) first. Then, I invest in similar index funds each month in my brokerage account. Then, any leftovers get dropped into my All Savings account.

Nothing too fancy.

The Path

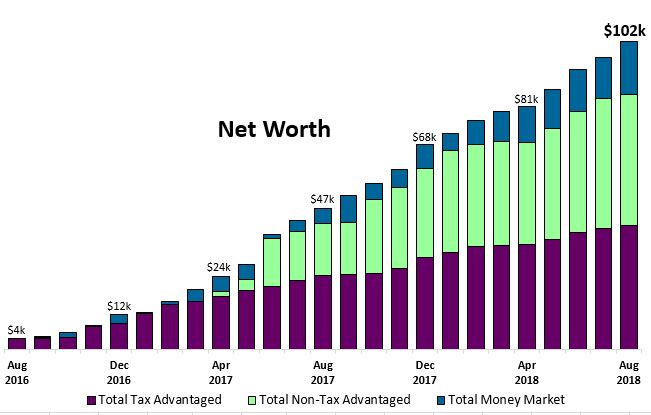

I have been tracking my net worth since August 2016, a couple months after graduating undergrad. Here’s a look at my net worth progression over these past two years:

My path so far has been slow and steady. I haven’t picked any runaway stocks. I haven’t hit the lotto. My salary isn’t astronomically high. Simply living below my means and investing 60 – 70% of my income each month has helped me stack $100k in only two years.

Some Tips for Anyone Aspiring to Save Their First $100k

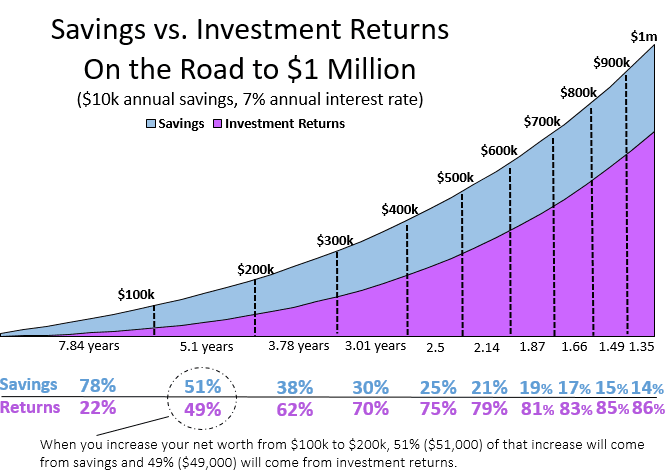

As I have written before, saving your first $100k is all about maintaining a high savings rate. It’s great to invest your savings in stocks, but the majority of your first $100k will come from savings, not investment returns.

This chart illustrates that point. It shows how much of your net worth will come from savings vs. investment returns if you consistently save $10k each year and earn 7% annual investment returns:

In the beginning, the bulk of your net worth growth will come from savings. It’s only as you continue to save that investments begin to make a difference over time.

This is why the amount you save matters far more than the investment returns you earn when you’re starting out.

This is why it’s important to minimize lifestyle expenses. Housing and transportation are the two big expenses that prevent most people from saving a majority of their income. The more you can find ways to keep these two expenses low, the more you’ll be able to save each month.

With that said, being frugal will only get you so far. You need a decent income to create a gap between your earning and spending. Not only that, but you need to be able to increase your income without increasing your spending as well.

Unfortunately, most people have a tendency to upgrade both their cars and their houses as their income increases. They feel the need to “reward” themselves for all their hard work by upgrading their lifestyles.

What most people fail to realize is that through buying fancier houses and newer cars, you’re not rewarding yourself for hard work. You’re creating more work for your future self in order to afford those things.

Financial Tools

I only use two financial tools.

The first is Personal Capital. I use it to track my net worth each month. It’s completely free and it makes it incredibly easy to see all of my account balances in one place. As they say, “what gets tracked gets managed.”

The other tool I use is a simple spreadsheet where I record my total spending each month. I don’t keep a budget. For me, tracking my spending is easier and more effective.

Most people know exactly how much they make, but very few know how much they spend.

Track your spending. Learn where your money is flowing each month. Then identify areas where you can tighten the belt.

Looking Forward

Saving my first $100k is just the beginning for me. Next, I have my eyes on $200k. Through saving 60 – 70% of my income each month and investing the majority of those savings into index funds, I’m confident that the next $100k will come even faster than the last.

Thanks for reading 🙂

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Simple approach but I love it. I was able to save $100k in about 3 years following the same approach but with a slightly lower savings rate since I was living in Sydney (one of the most of the expensive cities in the world). Great to hear a similar story!

$100k in 3 years living in Sydney is incredible. My $100k was obtained living in a fairly low cost midwest city in the U.S. Thanks for sharing and best of luck on your own journey!

Zach,

Congrats on the milestone. Thanks for sharing the extended version of your story. This will serve as a great example for high school students approaching graduation. Education can be an incredible investment when a good degree is attained. The returns far outperform any index fund over a lifetime.

-RBD

Thanks, RBD! I agree, a college education offers more value than it costs assuming you attend a college that isn’t terribly expensive and you obtain a degree that holds value. It has certainly paid off for me so far.

Hi Zach, We are a lot a like, except I’m 30 years older than you. I had about $50K at the age of 24. Roughly the same as the $100K you have now taking into account inflation. Much of my journey and the principles you preach are the same with a couple exceptions:

1) The economy wasn’t that great in the late 80’s/early 90’s. A big increase in comp by changing jobs wasn’t easy. I had to grind out small salary increase for years before making some moves to leverage higher pay when the economy heated up in the late 90s. So congrats on that. Not letting complacency or the past employer get in your way.

2) There were no financial tools. Spreadsheets were in their infancy. There was no internet or apps or smartphones. Few had personal computers. I tracked my networth with hardcopy statements, pencil and paper.

My point is a few things have changed. In fact the world is dramatically different in many ways. But the basics of earning, spending and investing are pretty similar to 30 years ago.

Tom

Hey Tom,

Thanks for sharing the details of your own journey. Technology has certainly made it easier for young people to have the means to pursue wealth at a much quicker rate than previous generations. Not only the financial tools, but simply the financial blogosphere has made it easier for information and ideas to spread quicker among people. I was fortunate to discover the concept of financial independence at a young age and I attribute this to the fact that I had access to the internet and could read blogs of writers who have achieved F.I. long before me.

Congrats, Zach! I could read this and choose to feel jealous, because it took me a lot longer to get that $100k: I didn’t make nearly the same salary, I had student loans, I frittered money away on dumb stuff. But really, it’s all about the principles and habits. I was able to save a lot of money even when I made $54k. I also chose to rent for as little money as I could without sacrificing my lifestyle. Totally one of the main reasons I’ve been able to save in big cities.

Thanks Luxe! I have definitely had the dual factors of a high salary and low cost of living working in my favor, which is the main reason I was able to hit $100k in just 2 years. I’m always impressed at how much you can save living in a big city. I do agree it’s all about principles and habits. It’s all about creating a sizable, consistent gap between income and spending, then simply investing the difference over the long haul. Thanks for your thoughts 🙂

Okay, I’m even more impressed now that I realize you’re six years younger than me. Well done!

Thanks Angela!!

Congrats! Great story!

Thanks Fabian!

Congratulations! Saving $100k by age 24 is a huge accomplishment. Living at home and working to pay for college were very smart decisions that obviously paid off. Can’t wait to see when you hit $200,000!

Thanks Mrs. Farmhouse Finance! I appreciate the kind words 🙂 Living at home and working through college were indeed two huge factors that helped me reach $100k in only two years. Hopefully the next $100k will come even faster!

Thanks for the feedback 🙂

Hey Zach!

I remember the days you would talk about hitting your first $100K, and how you looked forward to it. I’m so glad the day has finally come. I’m incredibly amazed by you. This is a great achievement for such a young age, and you should be very proud of yourself.

It’s interesting to read about how hard you worked when you were younger. Juggling a part-time job and paying for your college fees, and then juggling a full-time job and your masters! It’s incredible. I also juggled a part-time job while I was in college, and that was super helpful in helping me to save money, but I never ran at the same intensity that you did. I really applaud you and I’m so stoked that all your hard work has paid off.

The first $100K is always the hardest, and you’ve done it. Congratulations! I’m sure your net worth will start increasing exponentially from here on out. 🙂

Hey Liz,

Thanks for the kind words! It’s a milestone I am stoked to pass as well and I’ve been looking forward to it since I first started tracking my net worth two years ago. Juggling school and work could be pretty intense at times during college (as someone who did the same, you probably know what I mean), but it all paid off in the end and it gave me a huge financial head start. Thanks again 🙂