3 min read

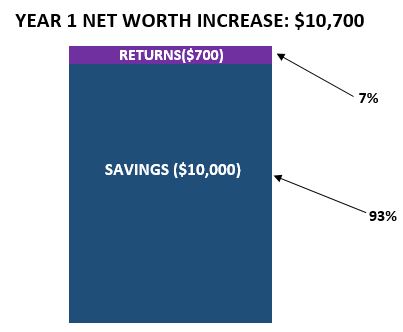

Suppose you invest $10,000 in the stock market in a given year and earn a 7% return on your investment.

At the end of the year, you have your initial $10,000 plus $700 in investment returns for a total of $10,700.

This means 93% ($10,000 / $10,700) of your net worth growth came from savings and only 7% ($700 / $10,700) came from investment returns.

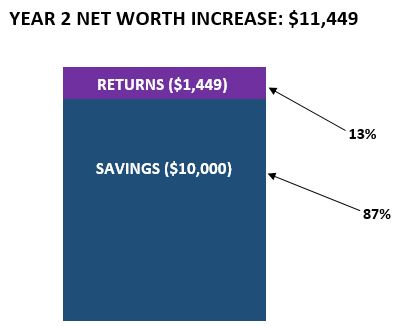

Suppose the next year you invest another $10,000 and again earn a 7% return.

This year you would earn $1,449 (($10,700 + $10,000) * 7%) from investment returns.

This means 87% ($10,000 / $11,449) of your net worth growth came from savings and 13% ($1,449 / $11,449) came from investment returns.

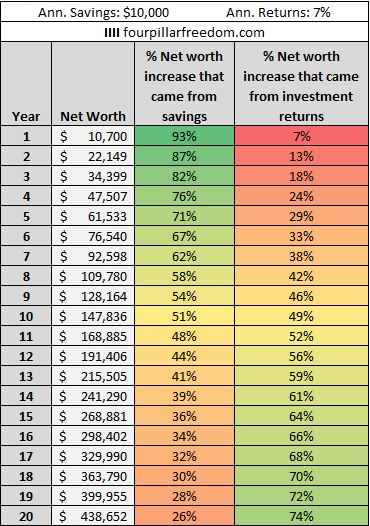

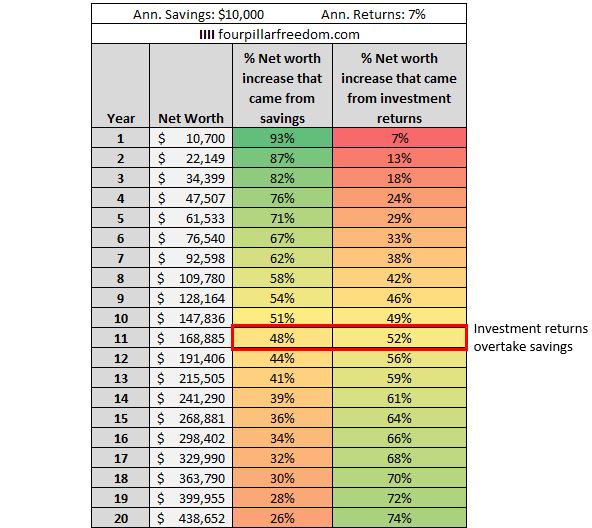

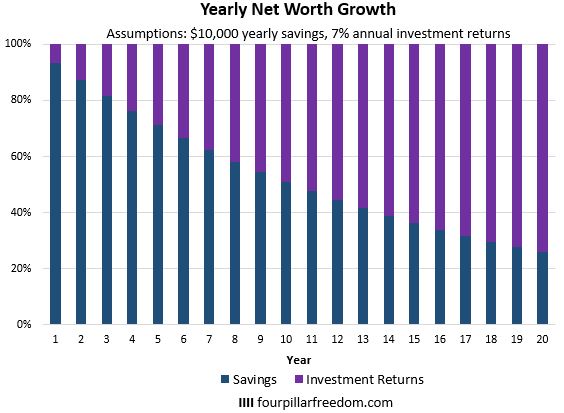

If we keep doing these calculations each year, we’ll find that investment returns account for more and more of yearly net worth increases as time goes on:

In year 1, investment returns only account for 7% of net worth growth.

In year 2 they account for 13% of net worth growth.

Then 18% in year 3…

Notice how it takes about 11 years for investment returns to account for more yearly net worth growth than savings:

After that point, investment returns become the primary force that pulls net worth higher.

Here’s another way to view these numbers:

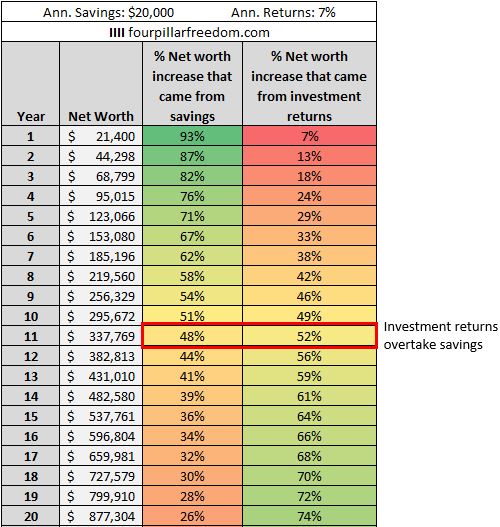

It turns out that no matter how much you save each year, these numbers hold true. For example, suppose you saved $20,000 consistently each year instead of $10,000:

Only the net worth numbers change. The percentages stay the same.

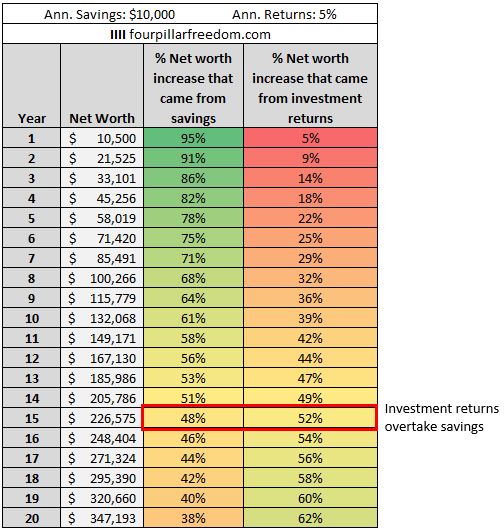

But what if you earn less than 7% annual returns on your investments? Suppose you save $10k each year again but instead earn 5% annual returns:

We see a similar pattern: Investment returns slowly begin to account for more net worth growth over time, but in this scenario it takes about 15 years for returns to become more important than savings.

This brings up an interesting question: How long does it take for investment returns to overtake savings for different annual return amounts?

This table reveals the answer:

This table assumes you consistently save the same amount each year.

The lower your annual investment returns, the longer it takes for returns to overtake savings. Even with a fairly high 8% annual return, it takes a decade for investment returns to become more important than savings. This illustrates just how important savings are in the beginning of your net worth journey.

Keep in mind that for this analysis we assumed you invested the same amount each year. It’s likely that as you get older, your yearly income will increase and you’ll be able to save more each year.

To see how increased savings impact these numbers, feel free to download the Excel spreadsheet below that allows you to modify the annual savings, annual savings increase, and annual investment returns:

Download Spreadsheet: savings_vs_returns

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Love these charts! I feel this is especially important for those who are constantly chasing the next get rich investment. Even a really great return takes quite some time to even out to just saving more.

Couldn’t agree more! Investment returns are great, but more than likely they won’t make you rich in the short-term

Really interesting!

I was hoping that a “rule” similar to “the rule of 72” could exist for this, but the results aren’t liniar. Will have to think about it a little more, maybe a rule can be devised that will benefit the community!

Cheers

Hamster

Interesting point, Hamster. I’ll have to look at the numbers a little more myself to see if any rule exists

Zach,

As always, I love when math supports people’s posts. I especially want to thank you for showing the results after a 5% return. I am one of those who believes 5% is a conservative growth rate. So if everything works in a 5% yielding environment, everything else is gravy.

Also points out how slow and boring investing is.

Thanks for the kind words, Church! I usually like to use a 5% return assumption as well to be on the conservative side. As you said, no matter what type of returns you receive, it’s a long slow road to wealth in most cases.

Interesting view of the data, Zach.

Most people tend to focus on the how much you save as the biggest impact on how much you’ll get. And it is if viewed from that perspective.

The other consideration is how much you need. Obviously, saving more – regardless of the target amount – will get you to that target sooner. But this post highlights the level of effort / impact of saving more or less given an assumed rate of return.

It’s helpful. Good stuff. Thanks. – Mike

Glad you found this analysis helpful, Mike! Thanks for the feedback

Very cool analysis and thanks so much for the spreadsheet! It’s super fun to mess with. It looks like my savings rate is high enough ($68k/yr) that investment returns on my NW of $285K won’t overtake my savings until I have about a million dollars, which is way more than I need to retire 🙂 . Interesting. Also I’m loving how this post connects and contrasts with your other post about how a high savings rate can overshadow investment returns (no matter what they are).

https://fourpillarfreedom.com/heres-how-savings-investment-returns-impact-the-quest-to-save-1-million/

$68k/yr is an incredible savings amount, congrats on such an impressive number! Glad you enjoyed the analysis along with how it connects to my previous post 🙂

Hey Zach,

Another great post!

Those charts really help to illustrate the point.

It’s clear that savings rate at the beginning of your investing journey is really important until investment returns takeover.

I like to think of investing and compound interest (i.e. investment returns) like rolling a snowball down a snow covered hill. At first you have a small handsized snowball and it does not really roll by itself (no inertia). But as you add more snow to it and push it around, it really starts to grow. When it gets to the size of a snowman it will roll and create it’s own momentum, while attracting more snow. If you are at the top of a mountain, you could end up with a financial avalanche!

Love the snowball analogy, Leon! You nailed it. Net worth growth is slow at first and relies on savings, but as time goes on, investment returns propel your numbers higher and higher at a faster rate

I love the charts too. I had a feeling it would take about 20 years for returns to overtake savings, but your chart is much more analytical. Nice job.

Of course, not all years are good so that might account for my pessimistic guess. 🙂

Glad you enjoyed the charts, Joe!