3 min read

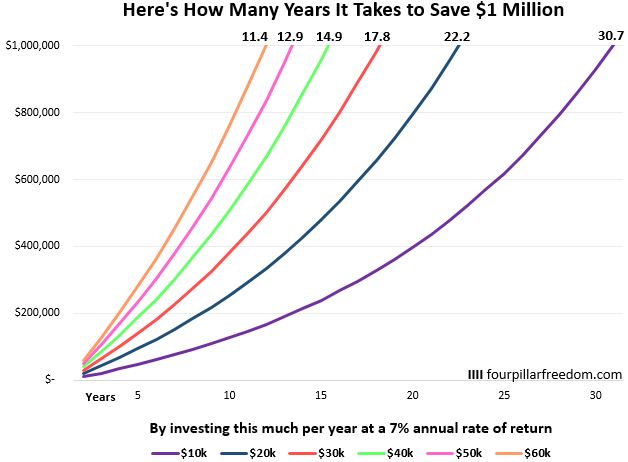

If you invest $10,000 per year and earn a 7% annual rate of return, you can accumulate $1 million in a little under 31 years.

If instead you invest $20,000 per year and earn 7% returns, you can reach $1 million in just over 22 years.

That’s nearly nine years sooner. Just from saving an extra $10,000 per year. Or $833 per month. Or $192 per week. Or $27 per day.

Let’s check out how long it takes to save $1 million based on some other yearly investment amounts.

Moving from $10k to $20k allows you to reach $1 million almost nine years sooner. Moving from $20k to $30k chops off another four and a half years.

If you can save and invest $60k per year, you can go from $0 to $1 million in just over 11 years. Not bad.

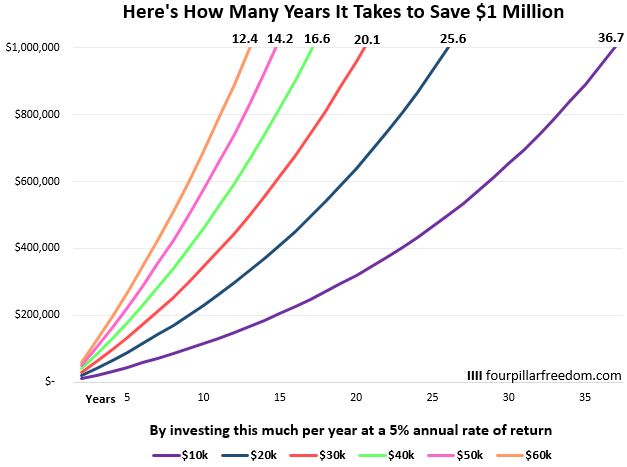

But what if you only earn 5% annual returns? Here’s what that chart looks like:

By investing $10k per year at a 5% rate of return, it will take over 36 years to accumulate $1 million. By bumping this number up to $20k per year, you can reach $1 million 11 years sooner.

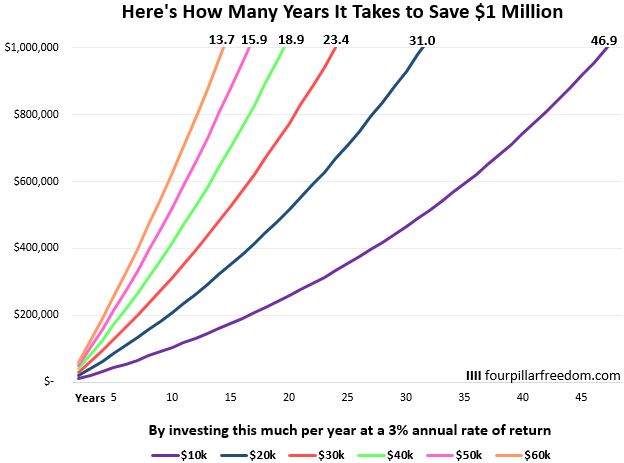

But what if you only earn 3% annual returns? Here’s that chart:

By investing $10k per year at a 3% annual return, it would take over 46 years to save $1 million.

These three charts illustrate an important idea: the less you invest per year, the more you rely on investment returns to help you reach $1 million.

Notice that by investing $60k per year at a 7% return, you can hit $1 million in 11.4 years. Even when you reduce that annual return to 3%, you can still hit $1 million in 13.7 years. The amount you invest each year is so high that sub-par investment returns barely slow you down.

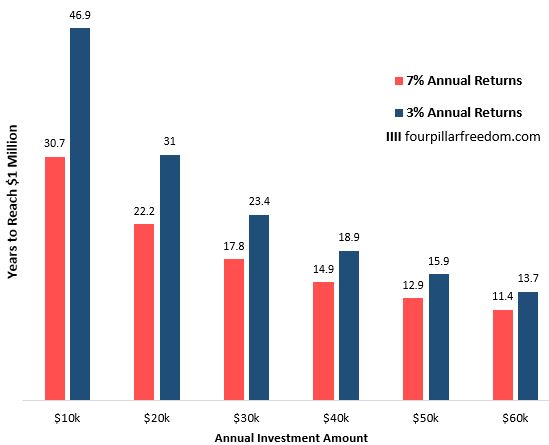

Check out the difference in the time it takes to reach $1 million based on different annual investment amounts and returns:

Notice how the difference in the time it takes to reach $1 million based on 3% and 7% annual returns becomes smaller and smaller as you increase the amount you invest each year.

If you only save and invest $10k per year, the difference between earning 3% and 7% annual returns leads to a 16-year difference in the time it takes to reach $1 million.

On the other hand, if you save and invest $50k or more per year, the difference between 3% and 7% annual returns causes less than a 3-year difference in the time it takes to reach $1 million.

The Takeaway

In the U.S., the stock market has historically delivered 7% average annual returns to investors after taxes and inflation. Unfortunately, nobody knows how markets will perform over the coming decades. Perhaps markets will continue to deliver 7% returns. Or perhaps only 3%.

For those who only save a small amount each year, investment returns will have a massive impact on the time it takes them to reach their financial goals, whether that number is $1 million or not. They’ll be like a tiny sailboat in a large ocean. Perhaps strong winds will propel them forward, but these winds are not guaranteed.

For those who are able to save a significant portion of their income each year, investment returns will have a much smaller impact on the time it takes them to reach their goals. They’ll be like a cruise ship. Whether or not strong winds come, they’ll keep steadily cruising along.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Zach, yet another great post. One major topic today in the investment community is the possibility of lower returns over the next decade or so and no one knows for sure what future returns will be. However, what gets lost in these debates are the things that we do have some control over. How much we save and invest can have a huge impact over time.

We are much older than you and never did make a huge income over the years. However we saved and invested as much as we were able to. Financially Independent today. Keep up the good work.

Oh well. My savings rate is so much below the numbers included here it will take two or three lifetimes to reach my $1M goal. All I can do is the best I can and hope to increase my rate with time, while living and enjoying my life. Thank you for the information.