3 min read

In a recent post, I shared that I used to work at a grocery store in high school earning $7.80 per hour. About $6/hour after taxes. A common weekday shift lasted from 4 PM to 8PM, which meant my coworkers and I each earned $24 for the whole shift.

Not bad for a kid in high school. That’s enough for three Chipotle burritos.

Unfortunately, most of my comrades didn’t end the night $24 richer. In fact, they often made no money at all. Here’s how.

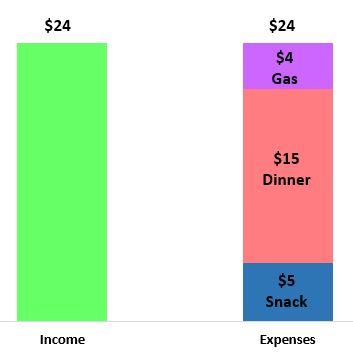

Each of us received one 15-minute break during our shift. During this time, many of my coworkers would buy a drink and a snack (we worked at a grocery store, after all) for $5. Once work ended, they’d head to a nearby restaurant and spend $15. Factor in another $4 for their commute.

So, on a typical night they would earn $24 and spend $24. They’d trade 4 to 5 hours of free time on a weeknight in exchange for zero dollars.

Their income from working was cancelled out by the cost of working.

You might think this is a trivial example. What’s the big deal? Even if they managed to save all of their earnings by taking public transit, packing a snack, and eating dinner at home, that’s all only $24. Peanuts in the grand scheme of things.

And you’re probably right. $24 isn’t much. But when we extend the cost of working into adulthood, the numbers become more serious.

Consider someone who earns $40k per year. That’s about $19 per hour. About $15/hour after taxes.

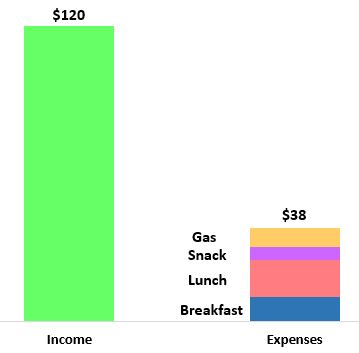

For an 8-hour shift this individual earns $15 * 8 = $120.

If they’re at all similar to people I work with, they likely spend $10 on a breakfast sandwich and/or coffee. Then another $15 on lunch. Perhaps another $5 on an afternoon drink or snack.

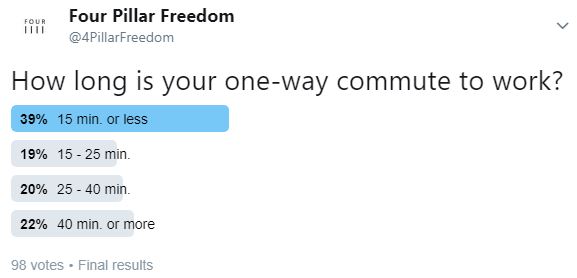

When the work day ends, they commute 40 minutes home. Of course this time could vary:

We’ll conservatively estimate that they spend $8 on commuting each day.

For those keeping track, that’s an average spend of $10 (breakfast) + $15 (lunch) + $5 (drink/snack) + $8 (gas) = $38 per work day.

So they’re only earning $120 – $38 = $82 per day.

If we assume they work an 8-hour shift, spend about 1.5 hours commuting, another 1 hour preparing for and unwinding from work, that’s a grand total of 10.5 hours.

So their hourly wage is more like $82 / 10.5 hours = $7.81 per hour.

This doesn’t even include the potential cost of childcare while this individual is at work, any expenses related to work attire, or any post-work happy hour drinks.

Imagining this individual earning $120 per day and spending $120 per day requires no stretch of the imagination.

Just as many of my high school coworkers managed to end their shifts $0 richer, I can easily imagine how an ordinary white-collar worker could end their workday $0 richer as well.

How to Minimize the Cost of Working

There are a few things you can do to minimize the cost of working and keep more money in your pockets:

Pack your damn lunch. Get in the habit of meal prepping on the weekends for the week ahead. You can easily save $20 each day by packing lunch and snacks.

Minimize your commuting costs. The obvious way to do so is by living closer to your work. You could also carpool or use public transportation. Or you could work out a work-from-home situation a couple days per week. For some individuals this simply isn’t an option and I get that. But if possible, minimize your commuting costs as much as possible.

Become a one-income household. This sounds counter-intuitive, but hear me out. If you have a partner, it might make sense for only one of you to hold a traditional job. By doing so, you could own one less vehicle, the stay-at-home partner could spend time cooking meals, and you could eliminate the need for childcare. These cost savings could easily match the potential income of the second partner.

Keep a simple wardrobe. The clothing you wear can impact your perceived professionalism at work. I get that. But there’s a difference between owning a small, simple wardrobe and a unique-outfit-for-each-day-of-the-month wardrobe. Keep things simple. Save your money.

Closing Thoughts

When you calculate your own cost of working, you’ll likely see that you don’t make as much per hour as you thought. There are ways to reduce these working costs, though. Pack a lunch, minimize your commute, consider becoming a one-income household if you have a partner, and don’t spend exorbitantly on work attire.

By minimizing these common work-related expenses, you can keep more money in your pockets, which means more money to invest towards your financial goals.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Interesting way of calculating the true cost. It scares me quite a bit how few people actually realise this…

Thanks!

Hi Zach, I love this post and feel the same way.

I recently wrote a blog post (which I’ve linked), where I discussed how my colleagues consistently spend A TON of money during their lunch breaks. They’d take a bus ride down to the shopping district, eat an expensive set meal, get some shopping done, before taking another bus ride back to the office. The costs over long periods of time really stack up! I wouldn’t be surprised if they spent everything they made for the day.

They think I have no life because I bring my own lunch to work and I wear the same clothes all the time, but I’m choosing to put my blinders on and grind towards a decently-sized nest egg. 🙂

It seems pretty common for most people to spend serious amounts on work without realizing it. Best of luck in your own financial journey, that frugality will pay off 🙂

I agree with everything here; nicely laid out. However, I’m skeptical about changing to a one-person income household. It may be hard to justify because there are so many variables to consider. The costs of working would have to be high for your partner to consider this. Also if their company has a retirement plan with a match, that could be an opportunity cost.