5 min read

Investopedia defines lifestyle inflation as:

Lifestyle inflation refers to increasing one’s spending when income goes up. Lifestyle inflation tends to continue each time someone gets a raise, making it perpetually difficult to get out of debt, save for retirement or meet other big-picture financial goals. Lifestyle inflation is what causes people to get stuck in the rat race of working just to pay the bills.

Two of the most common reasons for lifestyle inflation include:

- The desire to impress peers and flaunt your success. After that big pay raise or promotion, it’s common to upgrade your house, car, wardrobe, dining habits, etc. to show your peers how well you’re doing in life.

- The feeling of “I worked hard so I deserve this.” After all that time spent studying in the library or putting in extra hours at the office, it’s common to feel that you “deserve” to treat yourself with your increased income.

No matter what you believe is the true reason (or combination of reasons) for lifestyle inflation, one fact remains undeniable: lifestyle inflation is a wealth killer.

Here’s the math that explains why.

The Math That Explains Why Lifestyle Inflation is a Wealth Killer

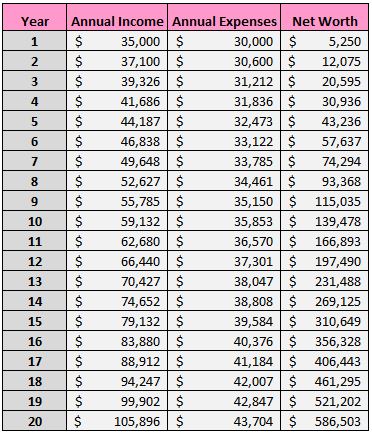

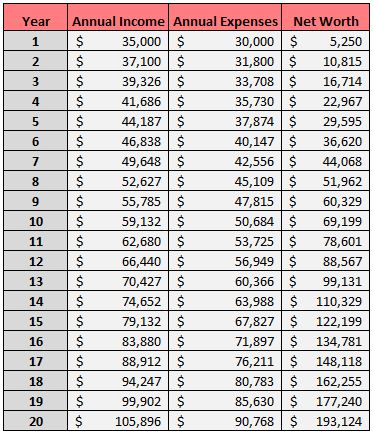

Consider our friend Bob. In his first year out of college, Bob has a net worth of $0, a yearly income of $35,000, and yearly expenses of $30,000.

Let’s assume Bob is able to increase his income by 6% each year while only increasing his expenses by 2% each year.

Here is how Bob’s net worth will grow over the course of 20 years:

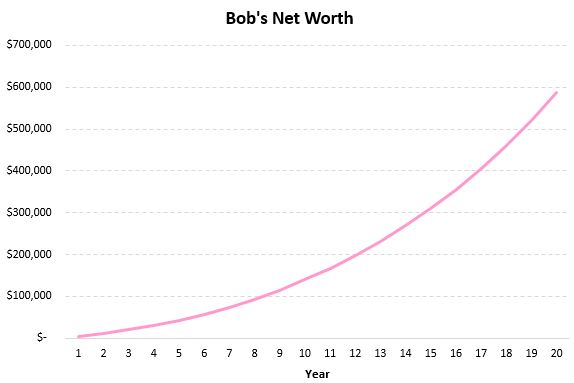

And here’s a look at Bob’s net worth trajectory over this time period:

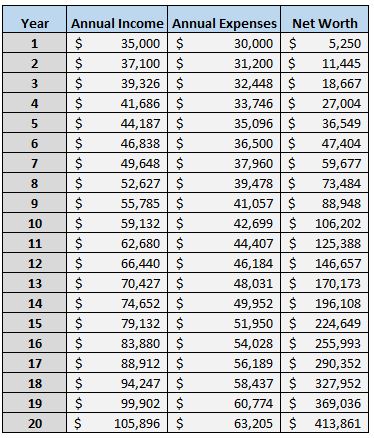

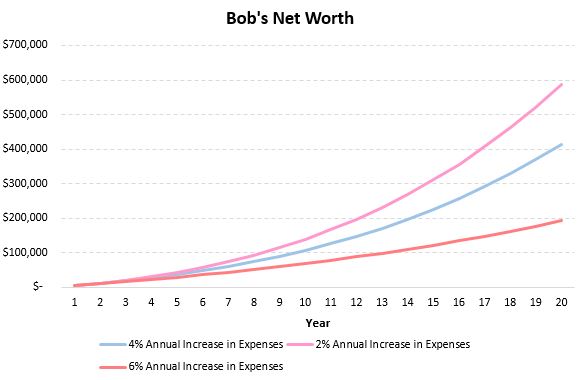

Consider another scenario: Bob again starts with a net worth of $0 and increases his income by 6% each year, but this time he increases his expenses by 4% each year, instead of 2%.

Here is how Bob’s net worth will grow over the course of 20 years:

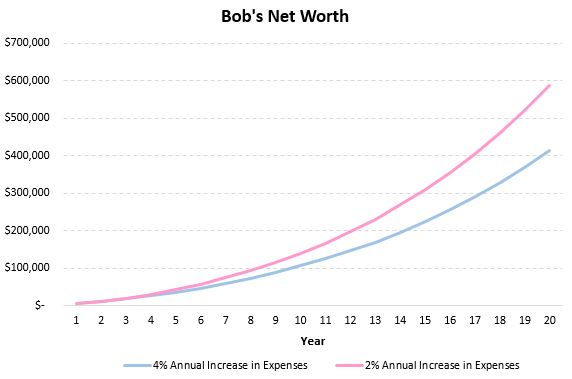

And here’s a look at Bob’s net worth trajectory over this time period, compared to the previous example:

By increasing his spending by 4% each year, instead of 2%, Bob will lose out on over $172k over the course of 20 years!

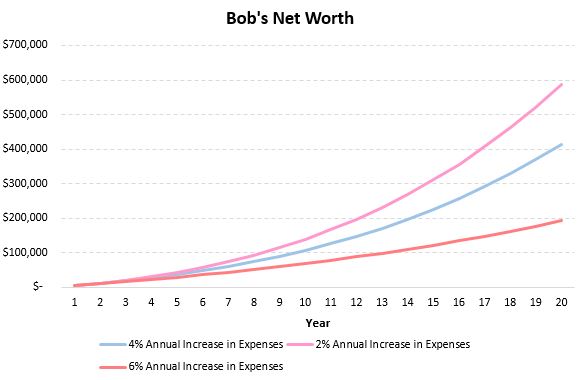

Consider one more scenario: Bob again starts with a net worth of $0 and increases his income by 6% each year, but this time he increases his expenses by 6% each year. In other words, Bob is increasing his spending at the same pace as he is increasing his income.

Here is how Bob’s net worth will grow over the course of 20 years:

And here’s a look at Bob’s net worth trajectory over this time period, compared to the previous two examples:

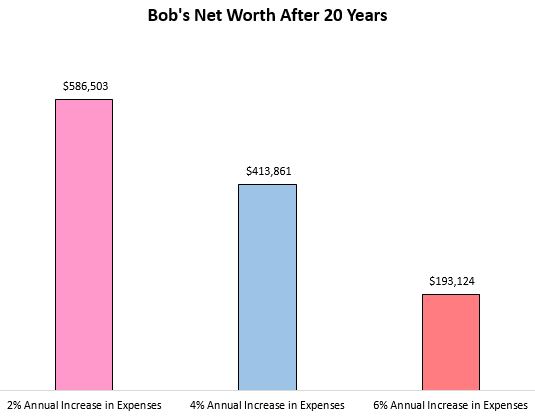

Here’s a look at Bob’s final net worth after 20 years in all three scenarios:

By increasing his spending by just 2% per year as opposed to 6% per year, Bob would come out ahead by over $393k!

The Benefits of “Living Like a College Student”

You’ve probably read elsewhere about the benefits of continuing to “live like a college student” during the first few years out of college. The math supports this idea. Although it doesn’t seem like subtly increasing your spending during those first few years out of college has much of an impact early on, the effects reveal themselves in the later years.

Just take a look at Bob’s net worth in the three different scenarios after his first 5 years:

There’s not that much of a difference. Bob has a net worth of $29k, $36k, and $43k in each of the three scenarios after five years. That’s a fairly small difference. But as time go on, the differences grow larger and larger.

This is the nature of exponential growth. Although increasing your expenses by 6% each year doesn’t sound like much, it begins to seriously add up over time in ways that are hard to predict.

In the scenario where Bob increases his expenses by 6% each year, he is spending over $90k per year by year 20. Conversely, in the scenario where Bob only increases his expenses by 2% each year, he’s only spending a modest $43k per year by year 20.

Conclusion

Lifestyle inflation is a subtle wealth killer because it creeps up on you. When you receive your first raise out of college, you don’t have the means to buy a mansion but you do have the ability to buy a new watch or a new pair of shoes. Then, with each subsequent income boost, you gain the ability to buy something else or upgrade some area of your life in some small way.

As you inflate your lifestyle bit by bit, your expectations begin to rise as well. Suddenly you feel that you need to maintain a certain level of spending to maintain your happiness. This is where most people trap themselves. Despite having a high income, their expenses rise to a point where they suddenly need that high income to maintain their standard of living.

Fight lifestyle inflation by spending exclusively on things that bring you joy or add value to your life. Practice being grateful for the things you already have and recognize that there are perks to living small and owning less. Focus on growing your income over time without increasing your expenses. This is how to achieve financial flexibility.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Good to see all of that mathed up.

One of the best pieces of advice I was given when I started my career was to say half of any pay rise that I got. If I never had it I would never miss it. While I wasn’t on the FI path for years after I started work it’s meant that my lifestyle has kept relatively modest. Particularly as, after a while, I didn’t know what I wanted to spend more money on so I saved almost all of my pay rises. We didn’t quite live like students, but we weren’t that far away.

That all meant that when we had kids it was no real issue for my wife to drastically cut back her hours. We weren’t spending what we already had so, financially, our lifestyle didn’t need to change (obviously it changed in a lot of other ways though!)

I would see it as a corporate organization where we focus on keeping costs down.

The bottom line cannot be allowed to rise in tandem (or worse more) with the top line, it must always be lower or best, none at all.

Hi Zach

Fantastic read, the calculations and graphs really visualize how important it is to focus on the cost base. Increasing the savings rate over time is a wealth and freedom booster as it means that lifestyle inflation is under control. That’s why I like to keep an eye on our Jaws Ratio, the difference over Income growth rate and growth rate of our costs. When the difference (Jaws Ratio) is positive, a household or company is building wealth over time, otherwise – with negative Jaws Ratio – Financial resources are not used efficiently, as your calculations and graphs so clearly show. There might be a year with negative Jaws Ratio in our household but on average, we had positive JRs over the past ten years.

Again, great read and thanks for sharing.

Cheers

This is an awesome write up and explains what I was just explaining to a couple buds at work. They can’t belive I only live on half my paycheck. Once daycare is over and I get my 14yr raise we will be at a 48% savings rate and still living really well! Like you said In your conclusion, it’s all about being content with what you have and being happy with less.

Great post visualising this well known phenomenon. It’s widely advised, but this post makes it really clear.

I have increased my spending from when I got my first paycheck (earning 29k per year) to where I am now (50k + bonus) only a little. Every raise and every bonus I receive now goes towards my savings. I honestly don’t know what else I have to spend money on on top of what I already do.

Thanks B! Glad to hear you liked this one!