5 min read

Suppose you start with a net worth of $0 and you want to save up as much as possible in 10 years. How much can you reasonably expect to save?

To answer this question, we have to take a few factors into consideration:

- Your yearly income

- The percentage your income increases each year

- Your yearly expenses

- The percentage your expenses increase each year

- Your investment returns

For example, consider someone who earns $40,000 per year and spends $30,000 per year each year for 10 years without investing any of their savings. This person would be able to save $10,000 each year and would accumulate $100,000 after 10 years.

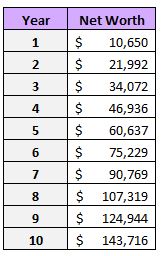

Consider instead if this person invested all $10,000 of their savings into an S&P 500 index fund each year, which has historically had a 10-year inflation-adjusted annualized return of 6.5% since 1928.

They would be able to accumulate a little over $143k in 10 years:

However, we know from historical data that the 10-year returns for the S&P 500 can fluctuate quite a bit depending on the starting year.

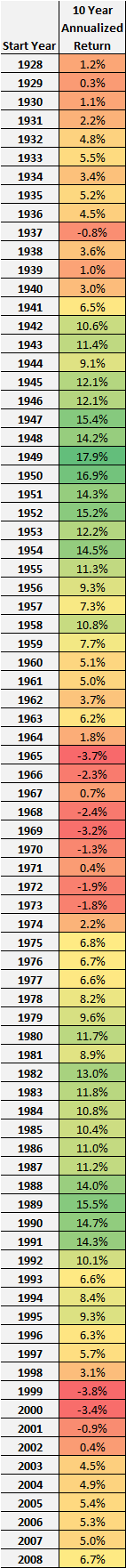

For context, here is the 10-year inflation-adjusted annualized returns for the S&P 500 for every starting year since 1928:

Although the median 10-year annualized return is 6.5%, there have been 10-year periods where the S&P 500 delivered as low as -3.8% (1999-2008) annual returns and as high as 17.9% (1949-1958) annual returns. This wide range of investment returns can have a serious impact on how much you can save in 10 years.

In addition, yearly fluctuations in income and expenses can have a notable effect on how much you’re able to save.

To account for all of these factors, check out the interactive calculator below that shows much you could have saved during every 10-year period since 1928, based on your starting yearly income, yearly income % increase, starting yearly expenses, and yearly expenses % increase.

Fiddle around with the numbers on the left-hand side to see how different yearly income and expenses affect how much you could have saved during different 10-year periods.

How to Use this Calculator

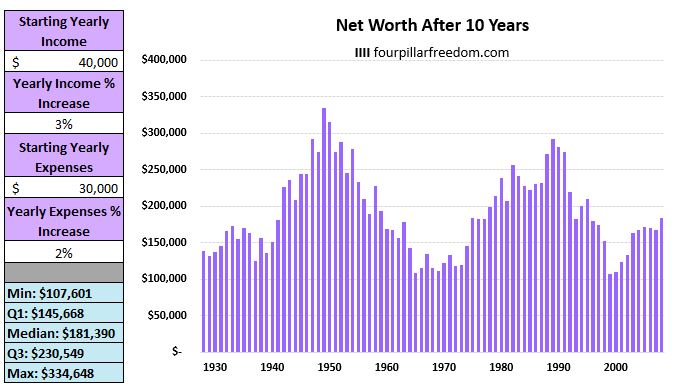

Consider the example of someone who has a starting yearly income of $40,000 and is able to increase their income by 3% each year. This person also has starting yearly expenses of $30,000 and increase their spending by 2% each year.

Assuming they invest all of their savings into the S&P 500 each year, the calculator displays how much this person would have been able to save during every 10-year period since 1928:

During the best 10-year investment return period (1949-1958), this person would have been able to save $334,648.

During the worst 10-year investment return period (1999-2008), this person only would have been able to save $107,601.

The median amount this person could have saved across all 10-year periods was $181,390.

The Importance of Increasing Your Income Each Year

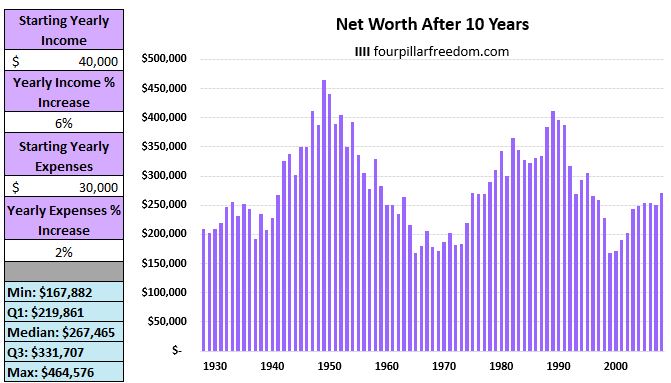

It’s fascinating to see just how much of a difference yearly income increases can make. For example, if the same person above was able to increase their income by 6% each year, instead of 3%, they would be able to save up a median amount of $267,465, which is $86,000 more than if they only increased their income by 3% each year.

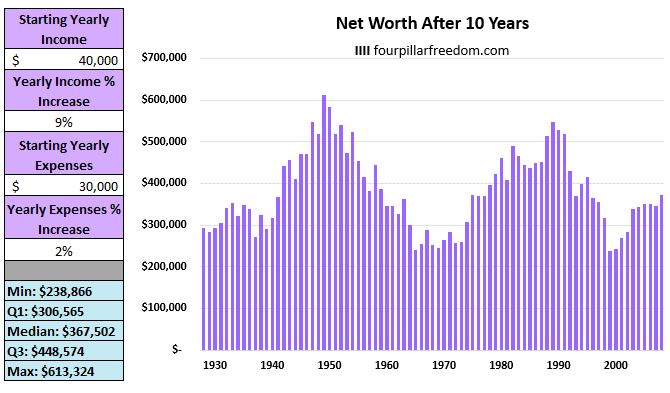

Consider if this person was able to increase their income by 9% each year. Their median net worth after 10 years would jump up to over $367k:

The Importance of Controlling Your Spending Each Year

Just as increasing your income each year can have a huge positive impact on your net worth, increasing your spending each year can have an equally detrimental impact on your net worth.

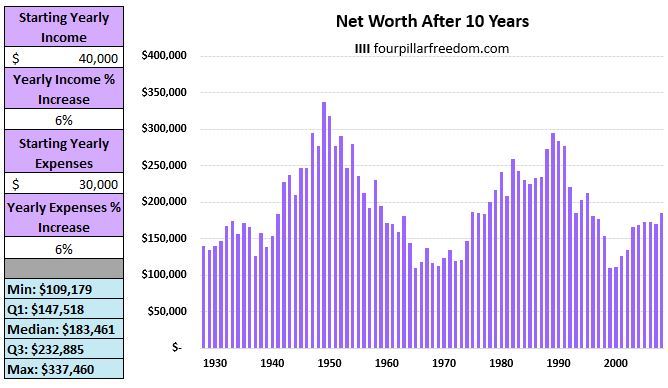

Consider the same person above who could have accumulated a median amount of $267k through increasing their income by 6% each year while only increasing their spending by 2% each year. If instead this person increased their spending each year by 6% to match their income increase, they would only have accumulated a median amount of $183k after 10 years:

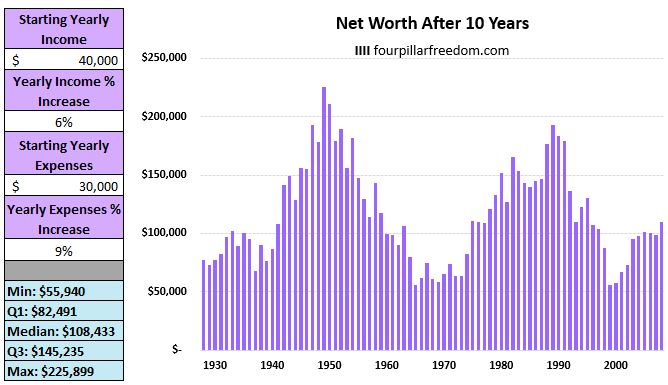

Consider an even worse scenario where this person increased their income by 6% each year, but increased their spending by 9% each year. In this case, they would only have accumulated a median amount of $108k after 10 years:

This is exactly why a high income does not guarantee a high net worth. It’s not about how much you earn, it’s about how much you keep.

Conclusion

You can’t influence how the S&P 500 performs during a given 10-year stretch. You can, however, control your ability to increase your income each year and keep your spending under control.

For anyone who hopes to go from $0 to financial independence or financial flexibility in 10 years or less, recognize that the gap between your income and expenses is often more important than your investment returns.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Nice post. May I make a suggestion?

The current calculator here assumes a net worth of 0 when starting out. One of your other posts in a different blog discussed how investment returns become a larger component of net worth after years of saving. It would be interesting to modify the calculator presented in this page, to take one more input, which would be starting net worth. And even more interesting would be to produce a result that show what percentage of the net worth increase after 10 years was due to stock market gains vs salary increases vs savings rate. I suspect for those who have large portfolios, growing one’s salary may be not be as useful. Or put another way, the enhanced calculator could be used to determine when to slow down in one’s career …