7 min read

“Many circumstances that seem to block us in our daily lives may only appear to do so based on a framework of assumptions we carry with us. Draw a different frame around the same set of circumstances and new pathways come into view.” -Rosamund Stone Zander, The Art of Possibility

Retirement is a human invention.

According to Wikipedia it was a concept invented by Otto Von Bismark in the late 1800s:

“In 1883, the Germanchancellor, Otto Von Bismarck, in a maneuver against Marxists who were burgeoning in power and popularity, announced that anyone over 65 years old would be forced to retire and that he would pay a pension to them.”

Before Bismarck created the concept of retirement, people simply worked until they physically couldn’t. But with the invention of retirement, people suddenly had a specific framework to structure their lives around: work full time until age 65, then retire and stop working altogether.

Then, as early as the 1940s, a new concept began to bubble into existence: early retirement. This concept proposed a new way to structure ones life: work for 10 to 20 years and save up enough money during this time to retire decades before the normal retirement age.

As time went on, the concept of early retirement started to gain traction.

The idea that you could use money to buy freedom instead of more stuff became popular when Vicki Robin and Joe Dominguez published Your Money or Your Life.

Then, the Trinity Study provided the analytical evidence to show that one could draw down on a sufficiently large portfolio with a high likelihood of never running out of money in retirement.

Years later, blogs like Mr. Money Mustache and Early Retirement Extreme demonstrated real life examples of people who had achieved early retirement in their 30s simply by saving and investing a huge chunk of their income for a decade.

Recently we’ve seen more examples of people who have successfully exited the rat race in their 30s like Frugalwoods, Mr. Free at 33, Our Next Life, Millennial Revolution, and a list of others.

As early retirement starts to become more mainstream, it’s easy to forget that the concepts of “retirement” and “early retirement” are both simply human inventions. They’re both potential ways to structure ones life, but they’re not the only options on the table.

Barista FIRE

Barista FIRE is a term that I first discovered from my friend Kevin over at Financial Panther. As he explains it:

“Basically, the idea behind Barista FIRE is simple – save enough so that you only need to make a little bit of income each year from work in order to fund your lifestyle. If you think about it, if you have enough savings on hand to cover the majority of your life, you only need to earn a little bit more in order to live.

Making a legit, full-time income is hard to do and might require you to do work you don’t really want to do. Unless you’re some baller, you’re also probably going to have to work 40 hours per week for most of the year.

But imagine the flexibility you gain in your life when you only need to make $5,000 or $10,000 in a year in order to live. If you’re in a position like that, you can basically do anything you want.”

It’s a simple, yet powerful idea. If saving up 25 times your expenses to achieve financial independence sounds daunting, perhaps consider saving up a smaller amount and choosing to earn active income once you quit your day job through working a part-time job, doing freelance gigs, or running your own small business.

To illustrate this with some numbers, consider a family that needs to spend $40k per year to live comfortably. If they follow the traditional path of “financial independence” then they would need to save up 25 times their annual expenses ($1 million) before they could quit their jobs. This way, they could pull out 4% of their portfolio each year to support their annual expenses with a high likelihood of never going broke.

Consider instead if they only saved up $500k before leaving the rat race. Pulling out 4% of this portfolio would only give them $20k per year. But if they found a way to earn $20k in active income through running their own small business or working part-time at a low stress job, they would be able to cover their $40k in annual expenses just fine.

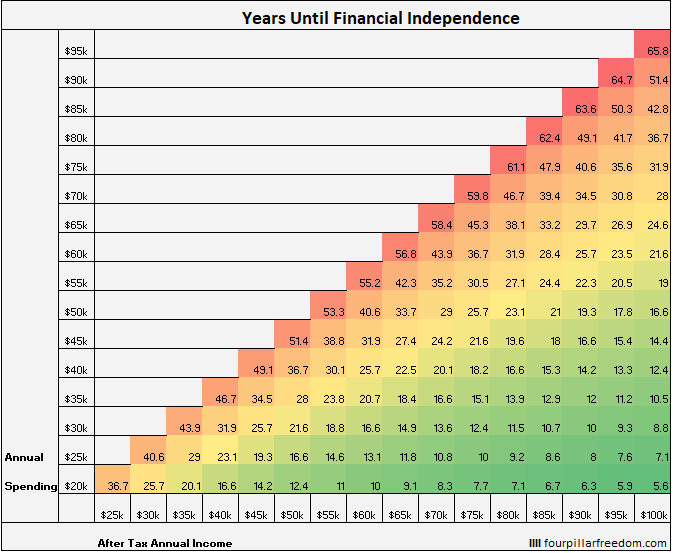

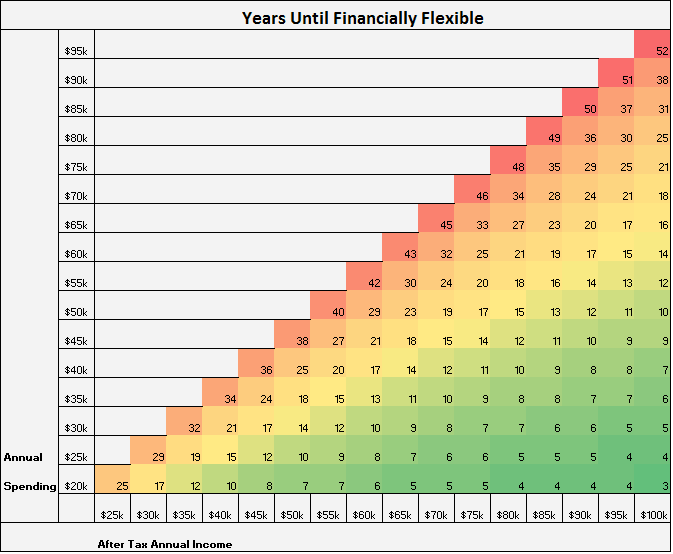

To see the impact that this has on how many years they have to hang out in a cubicle, let’s consider the example of a household that earns $60k per year post-tax and spends $40k per year. According to the Early Retirement Grid, it would take this couple over 25 years to save up 25 times their expenses, assuming they start with $0 and earn 5% annual investment returns.

Instead, suppose they only want to save up $500k before quitting the rat race, which is 12.5 times their annual expenses. According to the Financial Flexibility Grid, which shows how long it takes to save up 12.5 times your annual expenses, it would only take this couple 17 years to save this much, again assuming they start with $0 and earn 5% annual investment returns:

That’s a difference of 8 years.

And once this couple leaves the rat race, they would have more free time to figure out how to earn $20k each year. They could do this through running their own business or doing part-time work.

One real-life example of this that I wrote about in a previous post is a coworker of mine at a math tutoring center who only worked on Saturdays:

In college I used to work at a math tutoring center where tutors got paid $12 per hour. One of my coworkers was a guy in his 40s who only worked on Saturday mornings. He told me he did it just because he loved math and helping students.

Each Saturday we would work a six-hour shift, which meant we earned about $60 after-tax. This guy worked every Saturday which meant he earned an extra $3,120 ($60 * 52 weeks) in income each year.

To put that in perspective, that’s the same as earning dividends from a $104,000 dividend stock portfolio with a 3% dividend yield. By working one day a week at a job he loved, he had the same spending power as a $100k portfolio.

Hypothetically, if he worked twice a week he could earn an extra $120 each week, which would be an extra $6,240 each year. That would be the same as receiving a 3% dividend yield from a $207,000 stock portfolio. It would take most people a decade to build up that type of portfolio.

By working at a job that this guy loved for just six hours each Saturday, he was able to effortlessly bring in an extra $3,120 per year. He would need a $104,000 dividend stock portfolio with a 3% yield to match this income.

My Own Path

Ever since reading Kevin’s post, the idea of pursuing Barista FIRE has been stuck in the back of my head. It simply made more sense to me than sticking it out in a cubicle for a decade or more to accumulate enough money to never work again.

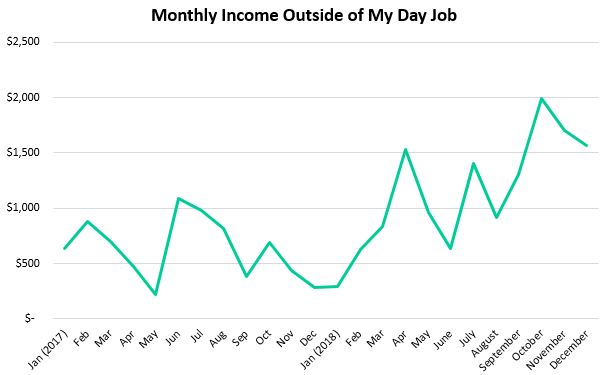

So, I’m actively working on building up my income streams outside of my day job so I can make Barista FIRE a reality. Right now I earn income through dividends from stocks and REITs in my brokerage account, blogging, and stats tutoring. Here is how much I’ve earned each month from these three income streams since January 2017:

This monthly income has been trending erratically upwards over the past two years.

Typically I spend between $2,000 to $2,500 per month, which means I’m incredibly close to covering all of my expenses purely through my income streams outside of work. Most months I’m able to cover 60-70% of my total spending just through these income streams.

The reason I haven’t quit my day job yet, despite the fact that I could survive on just savings and these alternative income streams, is that I know my spending will increase in the future once I decide to start a family.

I would also feel more comfortable with more savings in the bank. I currently have around $115k in various places including a brokerage account, tax-advantaged accounts, and money market accounts, but I’d like to boost this number higher over the coming year.

In addition to the dividends, blogging, and tutoring, I’m actively growing two more websites that I hope to start monetizing by this summer. With the addition of these income streams, I think I could hit $3,000 in online monthly income by the end of 2019, which would make me seriously consider quitting my day job. Then, with that extra 50 hours of time each week, I could focus on growing my income even more.

The reason that barista FIRE makes sense for me is twofold:

1. I have been able to grow my monthly income outside of work from $0 to $1,500 per month in just two years. I think I can grow this number to $3,000/month and beyond with another 12-18 months of work, which would give me freedom to work for myself now rather than a decade from now when I have $800k -$1m in the bank.

2. I love building websites and blogs because it doesn’t feel like work to me. It’s something I happily do in my free time. Even if I had enough money to never work again, I’d still work on things that I love. I might as well do this work I love now rather than delay it until I’m completely financially independent.

All Financial Paths are Inventions

Retirement is an invention.

Early retirement is an invention.

Barista FIRE is an invention.

All financial paths are inventions. They’re all potential paths you could pursue. If early retirement makes the most sense for you, then go for it. If barista FIRE is more appealing, go for that. I simply encourage you to be open to different paths.

When I first started my financial journey, I was dead set on early retirement. Then, as I began to realize that I love working as long as I own the work and can determine my own hours, I decided that it made the most sense to pursue barista FIRE and start growing my income outside of my day job as fast as possible.

Perhaps you don’t hate having a cubicle job as much as I do and you simply want to take mini-retirements on your way to a full retirement. You’re free to pursue that route as well.

All financial paths are inventions. It’s up to you to pursue one of many paths that already exist or simply invent your own.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

After initially discovering the concept of FI I was all about the early retirement, but now a few years into the journey I am much more in favor of the FI part. I still want to do challenging work, but work that I enjoy. So I’m also leaning towards barista FIRE.

The other option of 25 x expenses now seems to much of an all or nothing proposition. Work, work, work and then what? Nothing, nothing, nothing. I would much rather my life in moderation where it is part work, part leisure. And if that means cutting many years of full time unsatisfactory work then great.

I also commend you on considering your future expenses with a family being higher. I see many young people planning FIRE based on their current expenses, without consideration of how much their lives can change in their 30s and 40s with kids and mortgage.

“Work, work, work and then what? Nothing, nothing, nothing.” Exactly. The more I thought about it, the less sense this path made to me. Coupled with the realization that I actually enjoy working, it makes sense for me to pursue income streams outside of my day job so I can leave the cubicle as fast as possible. Thanks for the feedback!

Very cool perspective. Basically every concept is a human invention and there is no one path for all. I’m super excited for the possibility of you Barista FIREing and living the life you want now! I’ve been working on that myself (outside of the career front), but I could definitely step it up a notch. Thank you for the inspiration as always!

Thanks APL! Glad you found value in this article 🙂

I love this! I’m starting to strategize on some passive income streams. The dream is to be able to work on whatever you want, really; if it brings in money, that’s great!

Ever since becoming self-employed, it feels like I’ve been living out my retirement. I’m not technically retired since I do have to work to pay my bills, but the lifestyle is amazing. 🙂

If you want to taste freedom without abandoning your job, that’s also an option!

I love how you’ve created so much freedom in your own life with freelance writing. Even if you aren’t FI, it sounds like you have a much more flexible lifestyle since you’re your own boss in a sense 🙂

While the ultimate goal is different, this is what I have realized over the end of ’18 myself. In my case, my wife and I shooting for part-time work/semi-retirement. We actually like what we do now but wouldn’t mind shaving off a few hours is all.

baristaFIRE for you sounds like a perfect solution. Enjoy! I’m looking forward to reading about that and all your other stuff.

Thanks for the kind words Pete! BaristaFIRE definitely makes the most sense for me since I enjoy working and plan on working for many years, but on projects I find meaningful rather than projects that someone else tells me to work on.

Hope you continue to find value in the blog 🙂

Wow! You just blowed my mind with your post! I just discovered the whole concept of early retirement last november and I seriously felt so sad to be so late… you see, i’m 35 , my husband 42 and we have 2 kids. But it feels so good to know that there’s an attainable alternative for us . I want to thank you really for all the brain work you do for everybody here on your blog! And keep on doing it! Now I’m always waiting for your next post :). And maybe you can post something someday about rental property because we have a building with 3 apartments that we got 10 years ago and my husband count on it for his retirement. Thanks and nice job!

Glad you found this post so helpful Evelyn! Also glad to hear that you’ve realized there is more than one way to gain financial flexibility in life without being completely financially independent. I don’t have much experience with rental properties but if you’re looking to read more about real estate investing and rental properties, I’d suggest https://www.coachcarson.com/.

I fat fired but also work a day or two a week because I like it. It coincidentally earns 100% of our expenses so we have a zero withdrawal rate. I’m not sure what to call that. I don’t think it is all that uncommon with several of the better known personal finance and FIRE bloggers being in that same situation (I’m not one of those, my blog costs me money!). They retired FI but were having fun being active in this community and it just makes money they don’t really need. You need a why after you FIRE or barista FIRE and if one of your why’s also makes some money then its a good thing. Like the math tutor example, if you’d do it for free but also get paid, it isn’t really a job!