3 min read

In personal finance, the “Latte Factor” is the idea that spending ~$5 per day on something small like a latte might not seem like a lot, but if you instead invest that $5 each day you would be left with an enormous sum several decades from now.

For example, if you stopped buying a $5 latte each day for 365 days, you would have an additional $1,825 to invest each year. If you invested this much each year for 40 years while earning 5% annual returns, you would accumulate a whopping $231,483:

If instead you earned 7% annual returns, you’d accumulate $389,837:

The math doesn’t lie. By investing a small sum of money each day for several decades, you can accumulate a serious pile of cash.

The problem with the latte factor, though, is that it emphasizes cutting out a tiny expense that is enjoyable for most people. So, despite investing more money each year using this method, your overall quality of life might take a dip.

Instead, what if you considered the opposite of the latte factor? That is, instead of cutting $1,825 from your existing level of spending each year, try earning an additional $1,825 each year.

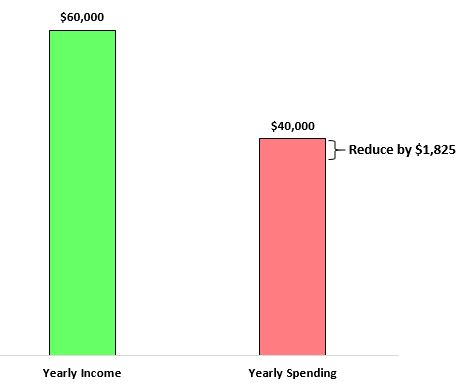

For example, consider a household that earns $60k and spends $40k each year. According to the latte factor, they should cut out a $5 morning latte to free up an additional $1,825 each year:

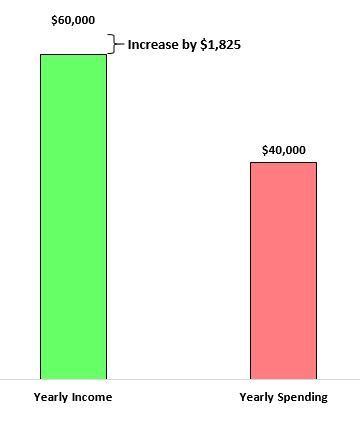

The opposite of this logic would be to increase your yearly income by $1,825:

In both scenarios you get the same end result: an additional $1,825 that you can invest each year. However, by taking the opposite approach of the latte factor and by increasing your income, you don’t have to worry about cutting a small recurring expense that brings you a bit of joy each day.

Reducing Spending vs. Increasing Income

At its core, the latte factor makes a simple point: By investing what feels like a small amount each day, you can actually accumulate a huge sum of money over the course of decades. The problem comes with where that additional money is coming from: a latte, which is something that many people look forward to spending money on each morning.

This is a strategy that has become fairly popular in the personal finance community: cut expenses, cut expenses, cut expenses. While it does make sense to question your spending to see if the things you’re throwing money towards actually improve your quality of life, there is a point at which spending less is likely to lead to a lower quality of life.

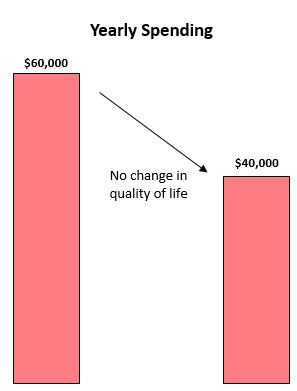

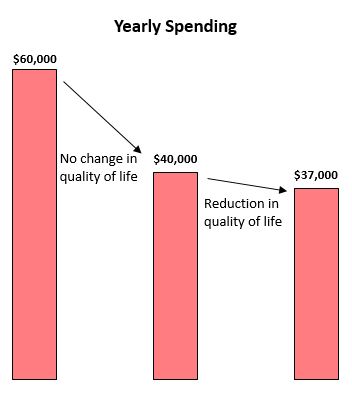

Consider a household that spends $60,000 per year. Suppose they make several life changes that target their big three spending categories of housing, transportation, and food and manage to reduce their yearly spending all the way down to $40,000 without reducing their quality of life.

At this point, the only fat they may be able to trim from their expenses are little things like a monthly Netflix subscription, the occasional movie night, or a morning latte. Sure, cutting these expenses would free up some cash for investments, but it might remove the little things that bring daily joy.

At some point, it makes sense for a household to shift their focus from reducing spending to increasing income. After all, there exists a limit on how low you can push your spending, but there doesn’t exist a limit on how high you can push your income.

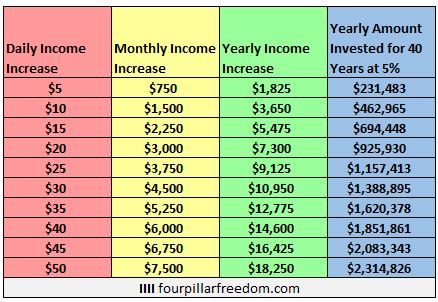

Just like cutting a $5 latte could lead to a huge amount of money if invested over several decades, so could a small daily increase in income:

In personal finance, there are two levers you can pull to free up more money for investments: income and spending. It’s easy to impulsively think that reducing spending is always the answer, but keep in mind that increasing your income can lead to the same result without removing spending on something that brings you joy.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.