2 min read

Last night I met up with a reader to talk personal finance at a local juicery. As we got to talking, I shared with her that I only track two financial metrics each month:

1. My net worth (using Personal Capital)

2. My monthly spending (using Excel and my Monthly Spending App)

In regards to my monthly spending, she asked something along the lines of:

“What is your philosophy on spending?”

I explained that I have a simple method of keeping my monthly expenses fairly low without meticulously tracking every dollar I spend as I spend it. I classify each of my expenses as:

“Steady”: Expenses that are pretty steady from month to month.

or

“Wobbly”: Expenses that wobble quite a bit from month to month.

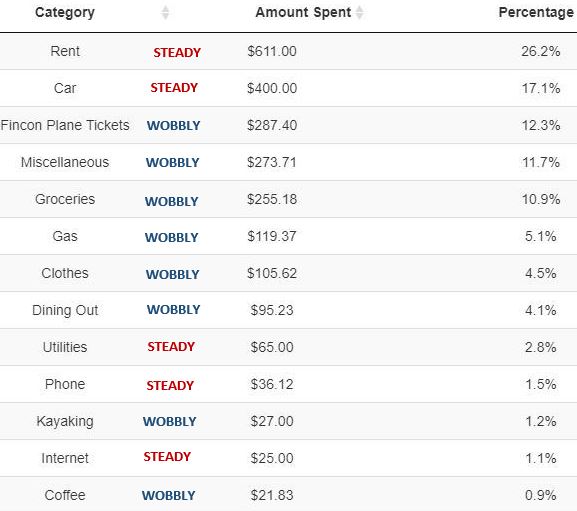

For example, here’s how I would classify each of my expense categories from last month:

The Steady expenses: My rent payment and car payment don’t change at all from month to month. My utility, phone, and internet bills fluctuate only a little each month. These expenses are fairly steady.

The wobbly expenses: My food expenses – grocery, dining out, coffee – vary quite a bit from one month to the next. Same with my other random expenses like FinCon plane tickets, kayaking, clothing purchases, gas, miscellaneous expenses, etc. These expenses wobble up and down each month.

Here’s what my total spending looked like last month by category:

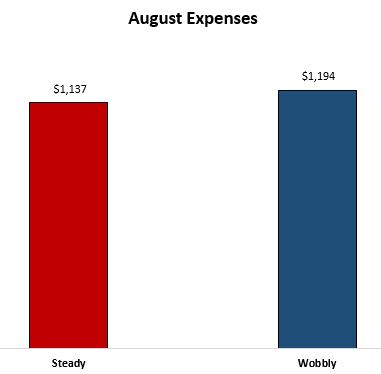

The way that I keep my monthly spending in check is by keeping my “steady” expenses low. Each month I know that I will spend around $1,100 on rent, car, utilities, phone, and internet combined. And I’m okay with this number.

My “wobbly” expenses, on the other hand, can wobble from $800 up to $1,400 depending on the month. I don’t track these expenses closely because I know that even if I dramatically overspend on them, my total monthly spending will only be around $2,500.

I keep my “steady” expenses low so that I can spend freely on my “wobbly” expenses without fearing that I’ll overspend.

Interestingly, I find that my “wobbly” expenses are often the ones that bring the most joy. Last month these expenses included dining out at Chipotle with friends, traveling to Michigan to go hiking and kayaking, buying FinCon plane tickets, and getting coffee at local coffee shops. I spent far more than I usually do on these “wobbly” categories, but it didn’t kill me financially because my “steady” expenses held steady at a low $1,100.

My advice for anyone who wants to keep their monthly spending low without fretting about overspending: get your “steady” monthly expenses to be as low as possible so that you have room to spend more freely on “wobbly” monthly expenses, which are often the ones that bring the most joy.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Love it because the steady expenses are the ones you really won’t remember or enjoy so might as well keep those low.

That’s a great way to break it down Zach. I have a similar breakdown to you, but a higher cost of living.

I actually wanted to comment on your article from yesterday. You have such an aptitude for data analysis and gift for presentation. I really like how cleanly you put together the charts. You also have an intelligent write-up, but let the readers draw their own conclusions based on the facts presented.

Thanks Kit! I really appreciate that feedback on the data visuals. I’m quick to share data and facts but slow to jump to conclusions, so I often let the readers handle that part on their own. Glad you enjoyed the article 🙂

Interesting way to think about it. I think in a similar way too, with our fixed and variable expenses. We’ve been able to get to the point where even most of our variable expenses end up being a similar amount month-to-month.

I like to keep tabs on our “baseline expenses,” and as long as that number is manageable it takes a lot of the pressure off. Definitely a huge win if you can keep your “steady” expenses low, it makes everything else a lot easier.

Completely agree – if you can keep the steady expenses low each month, it can give you tremendous peace of mind and some room to overspend on wobbly expenses occasionally.

I use the same method as well. Keep the fixed expenses low then have a general idea of what you spend in other flexible categories. You’ll know if you’re getting close to going over if you check Personal Capital every few days.

In business terms, Fix (Overhead) vs. Variable (Cost of Goods Sold) expenses. Keeping our cost of living low so that we can enjoy life. I love it! A simple theme to your personal financial management strategy.