2 min read

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO.

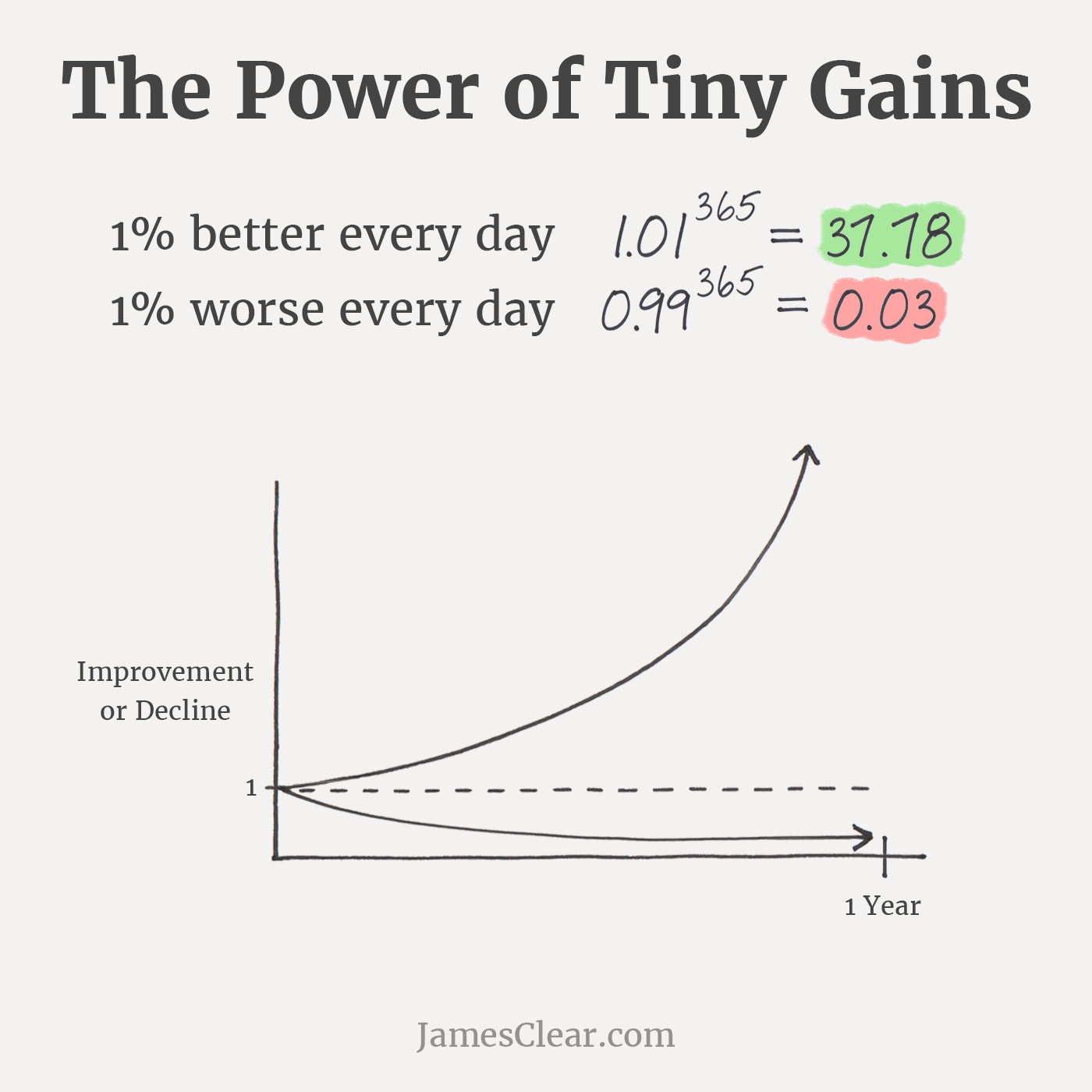

A couple days ago I stumbled across this beautiful chart from James Clear:

It shows the difference between getting 1% better every day for one year vs. 1% worse every day for one year.

Notice how there is only a subtle difference early on between getting 1% better and 1% worse. But as time goes on, this difference grows larger and larger at a faster rate due to the nature of compound growth. Those tiny daily improvements aggregate into massive long-term gains.

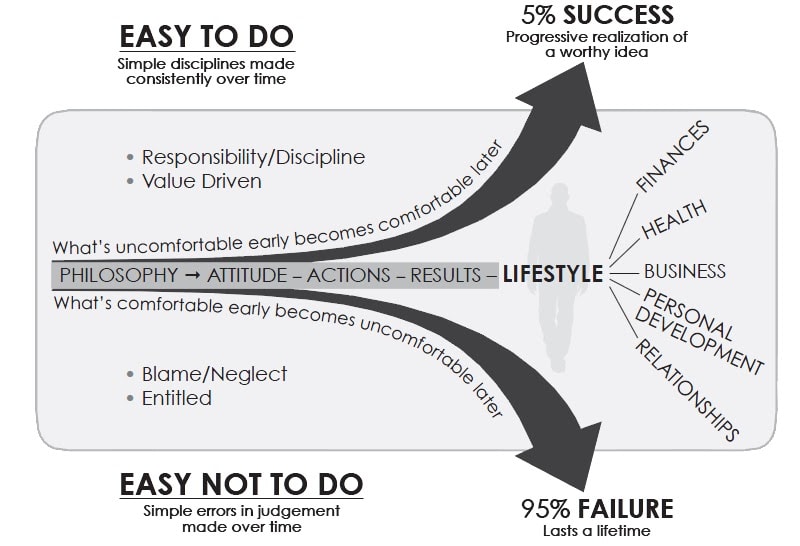

This visual reminded me of a similar graphic I came across in The Slight Edge by Jeff Olson, which depicts the contrast in paths between simple disciplines made over time vs. simple errors in judgement made over time:

This visual tells a similar tale: the key to crazy long-term growth lies in making incremental improvements each day, which are hardly noticeable in the short term, but make all the difference in the long term.

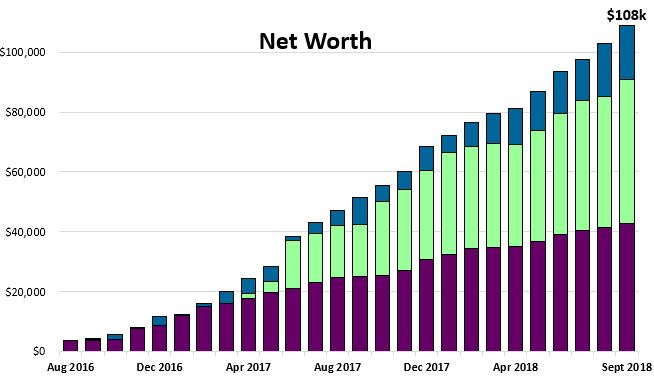

I have noticed this phenomenon play out in my own financial life. On the first day of each month I track my net worth using Personal Capital. My net worth increases by around $2,000 – $5,000 most months, which doesn’t feel like much. And it can be discouraging especially during months when it increases by less than $1,000.

But over the past two years, these mild monthly increases have accumulated into over $100,000:

This growth has been the result of consistent monthly gains, which have been born from a few simple habits:

Tracking my net worth on the first day of each month.

Tracking my total spending on the last day of each month.

Ensuring that my “steady” expenses – rent, utilities, and transportation – are kept fairly low (usually under $1,200) each month.

Consistently investing in index funds each month.

These habits are fairly simple and mundane, but they have helped me save $100k in only two years.

While I only make a little financial progress each month, it’s over the course of years that this progress becomes substantial and will eventually be life-changing.

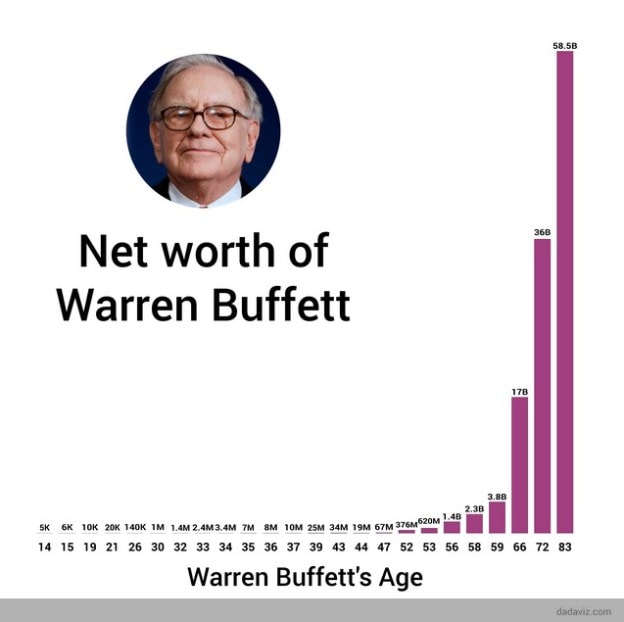

On a much larger scale, this is what has helped Warren Buffett accumulate billions of dollars in net worth over the years. Consistent, steady gains that resulted in insane long-term growth:

Tiny, consistent gains are hardly noticeable as they’re happening, but once they begin to accumulate they become an incredible force.

And to make these tiny, consistent gains, you need to embrace repetition and patience. As Bruce Lee said,

“I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times.”

And as Angela Duckworth wrote in Grit:

“Enthusiasm is common, endurance is rare.”

Don’t just practice healthy financial habits for a few weeks. Practice them for years. Integrate them into your life.

Focus on making tiny financial gains through tracking your spending, tracking your net worth, minimizing your “steady” monthly expenses, growing your income each year, and investing wisely. Over time, these tiny gains lead to financial freedom.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Zach…do you buy index funds shares whenever you get paid during a month (end of month or every 2 weeks depends on your pay period) regardless of the price of it or you wait until the shares go down in price to buy them?

I buy shares whenever I get paid, which happens to be once per month. While it would make sense to wait for prices to decrease before buying, it’s impossible to time the market and to know when prices will actually go down. In particular, since the stock market tends to increase over time, attempting to wait until prices decreases means you’ll often be waiting far longer than you think. This is why I invest consistently no matter what the market is doing.

Your net worth chart looks great. You can already see the compounding effect and that’s just 2 years. This is really the flat part of the curve. In 20 years, the gains will be much more awesome. Nice job and keep at it.

Thanks Joe! I’m stoked to see how this chart looks a couple decades from now as well.

“Enthusiasm is common, endurance is rare.”

Love this quote. Might have to steal it for my own use!

Definitely a quote I think about often. Feel free to steal it!

Your reference to the Grit quote reminds me of a Latin saying ”fortitudine vincimus, ” which means ”by endurance we conquer.”

Love that quote – it captures a similar idea. Thanks for sharing Dom!

“The Power of Aggregating Tiny Gains” made me think of compounding immediately! BTW how old are you? What age are you aiming to retire?

I’m 24. I don’t ever plan on “retiring” but I hope to have the financial means to quit my day job by age 27-28.

Continuous improvement starts small but soon enough becomes an 800-pound gorilla. It takes patience and endurance, but the end is so worth the sacrifice.

Hi Zach. What would you do with a big chunk of money in terms of this? Go all in, all at once? Create an automatic buy over time (e.g., a certain quantified amount every month/week)?

This post may answer your question 🙂 https://fourpillarfreedom.com/the-math-psychology-behind-lump-sum-vs-dollar-cost-average-investing/