3 min read

In a fascinating study on stock performance, Longboard Capital Management analyzed the annual returns of 14,500 individual stocks during the period 1989 through 2015.

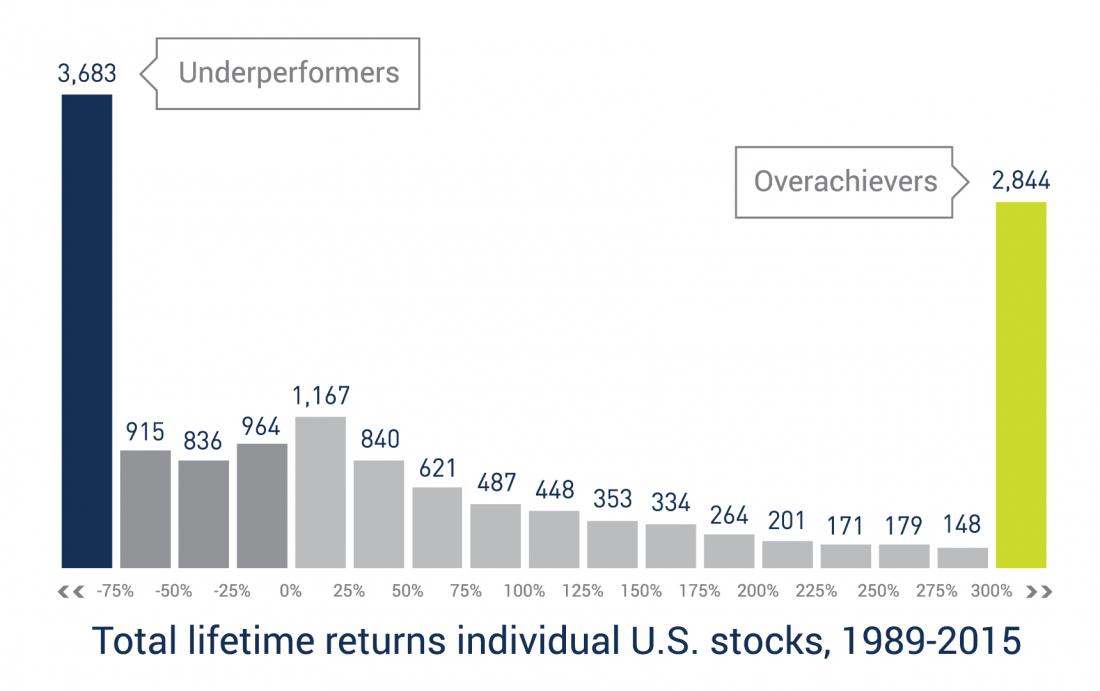

The key findings from the study illustrate why investing in individual stocks is so risky:

976 stocks (6.8% of all active stocks) underperformed the S&P 500 by at least 500%

3,431 stocks (23.7% of all active stocks) underperformed the S&P 500 by at least 200%

3,683 stocks (25% of all active stocks) lost at least 75%, even before inflation

6,398 stocks (44% of all active stocks) lost money, even before inflation.

Nearly two-thirds of all stocks provided no real return, even before taxes.

Only 1,120 stocks (7.7% of all active stocks) outperformed the S&P 500 Index by at least 500% during their lifetimes.

The best-performing 2,942 stocks (about 20%) accounted for all the gains; the worst-performing 11,513 stocks (about 80%) provided an aggregate total return of 0%.

This last point is especially shocking. If you failed to invest in the 20% most profitable stocks from 1989 to 2015, your total gain would have been 0%.

It’s certainly possible that you could have picked a few of the winners, but the odds were not in your favor.

A better strategy would have been to invest in an S&P 500 index fund. Longboard explains why index funds tend to perform well, despite poor performance from most individual stocks within the index:

“Successful companies with rising stock prices carry larger weightings in the index. Likewise, unsuccessful companies with declining stock prices receive smaller weightings. Companies with continued declines are eventually delisted to make way for growing companies. So, despite the fact that the average annualized return for all stocks on the S&P 500 index is negative, the index can still deliver an overall positive rate of return.”

Index funds reward successful companies with larger weightings. Unsuccessful companies receive smaller weightings. And if they’re awful enough, they’re removed from the index entirely to make room for growing companies.

This is why it’s so hard to outperform index funds.

As an investor, your odds of picking the extreme winners are slim. Even if you do pick an outlier stock like Amazon, it’s hard to know exactly when to sell and when to hold. You’re far more likely to pick one of the two-thirds of individual stocks that deliver no real return.

And if you’re thinking “I wouldn’t pick the bad stocks, though, I’d just stick with the big names that everyone knows will do well”, consider some big-name stocks that were among the biggest losers in 2017: Kroger, CVS, General Electric, Mattel, Under Armour, Chipotle, and Foot Locker.

Then consider some of the biggest winners in 2017: ANSYS, FMC, Cigna, Albemarle, and Aptiv. Have you heard of any of those companies?

It’s incredibly hard to pick the winners in a given year. Instead, you’re better off investing in an index fund that offers diversification through ownership of hundreds or thousands of individual stocks. This way you’re guaranteed to own the extreme winners that deliver most of the returns.

Related:

Why It’s So Hard To Outperform Index Funds

A Recap of Warren Buffett’s 10 Year Bet on the S&P 500

The Bogleheads’ Guide to the Three-Fund Portfolio

Nerd Notes

If you’re interested in the methodology for this study, Longboard Asset Management shares:

“Our database covers all common stocks traded on the NYSE, AMEX and NASDAQ since 1989, including delisted stocks. Stock and index returns were calculated on a total return basis (dividends reinvested). Dynamic point-in-time liquidity filters were used to limit our universe to the approximately 4,000 most liquid stocks each year, representing approximately 99% of the investable U.S. equity market. In total, 14,455 stocks were evaluated (due to index reconstitution, delisting, mergers, etc.).”

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Probably the most compelling argument I’ve seen against individual stocks, yet. Thanks for posting!

This is good. I know that most investors underperform index funds, but I didn’t know that about individual stocks. It makes sense and 20% sounds about right.

Companies come and go.