3 min read

Suppose you have $0 and your goal is to save $100,000.

By diligently saving and investing $10,000 each year at a 5% annual rate of return, you would be able to save $100,000 in about 8 years.

Next, you might have a goal to reach $200,000. It turns out it would only take a little under 6 years to go from $100k to $200k, assuming you kept investing $10k each year earning a 5% annual rate of return.

This pattern holds true as your net worth grows. Each $100k comes quicker than the last.

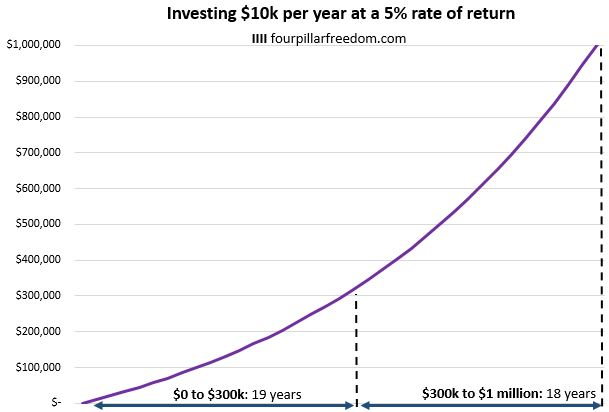

The numbers start to become mind-blowing when we look at how long it takes to save $1 million. Again, assume you save $10k each year earning 5% returns. It turns out that it would take you longer to go from $0 to $300k than it would to go from $300k to $1 million:

This is the nature of compound interest. The more you save and invest, the more investment returns begin to account for more gains.

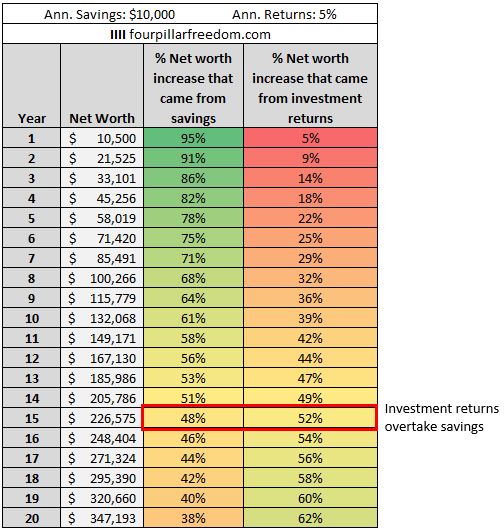

I recently shared the math that shows how investment returns begin to account for more net worth growth over time. This table shows what percentage of net worth growth each year comes from savings vs investment returns, assuming you invest $10k each year and earn 5% annual returns:

Notice how investment returns begin to matter more than savings after about 15 years. This explains why the road from $300k to $1 million is shorter than you’d expect: investment returns do most of the heavy lifting during that time.

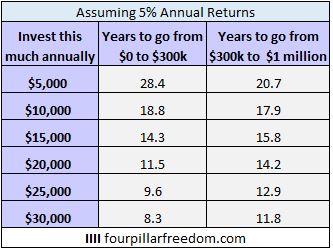

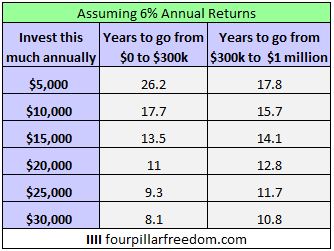

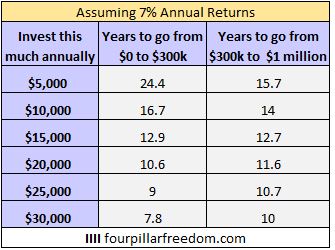

Here’s a look at how long it takes to go from $0 to $300k and $300k to $1 million based on various annual investment amounts and annual returns:

The numbers change a bit depending on our annual return assumptions, but the general pattern holds: saving your first $300k takes roughly the same amount of time as saving the next $700k.

That’s incredible.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I feel like you wrote this post for me 🙂 . Just kidding, but seriously this is exactly where I am right now (close to $300k) and I’m looking at the next couple years like they’re an eon. Seeing this analysis and knowing that accumulating the rest of what I need will take a lot less time (I only need $500k) is very comforting. Thank you for another awesome and thought provoking article!

Thanks for the kind words! Glad you found this post so helpful and best of luck on reaching that $500k 🙂

I understand compound interest at it’s core, but then you drop results like this and it seems like it’s MAGIC again!

Or maybe it has been magic all along???

Magic or math, all I know is “those who understand it (compound interest) earn, those who don’t, pay it.”

Great post!

The results surprised me as well even as I was calculating them. It’s hard to have a good intuition of how powerful compound interest is until you see the numbers and graphs.