3 min read

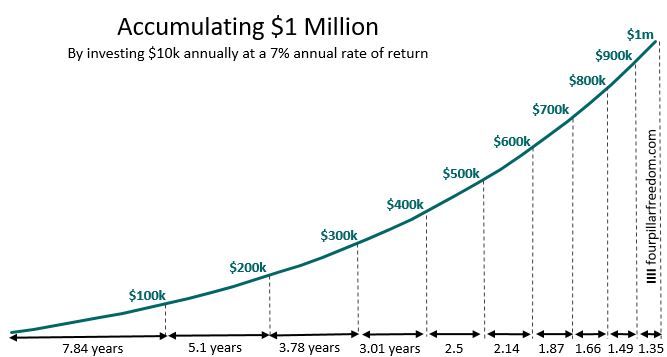

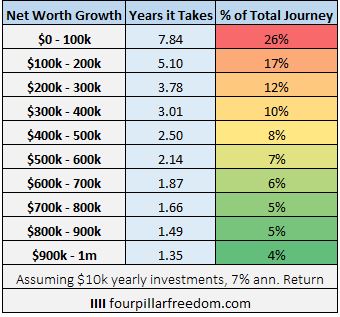

The following chart shows how long it takes to accumulate $1 million by investing $10,000 each year at a 7% annual rate of return:

This is one of my favorite charts to show people because it illustrates how wealth accumulation is slow when you’re just starting out, but speeds up as time goes on.

Notice how it takes less time to go from $600k to $1 million than it does to go from $0 to $100k. That’s insane.

This illustrates an important point: Saving your first $100k is a big deal because it represents the greatest time sacrifice per dollar that you have to make on your net worth journey.

What the heck does that mean?

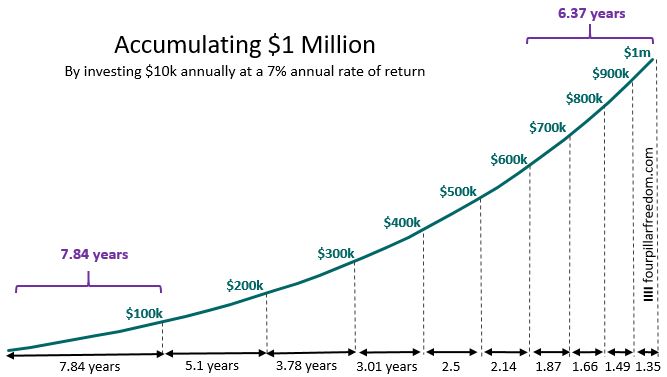

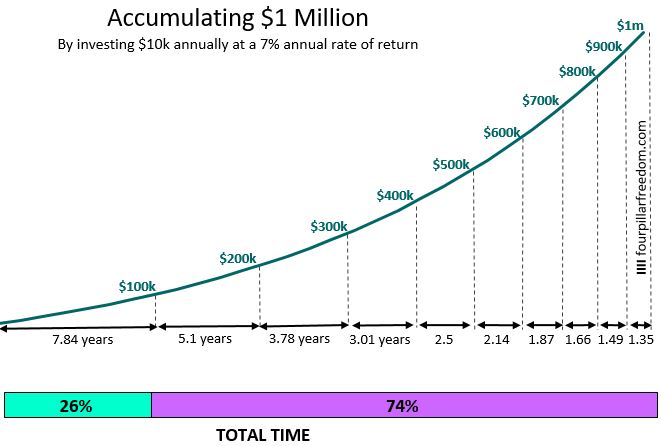

It means that if your goal is to save $1 million, then technically $100k only represents 10% of your total net worth goal. But instead let’s view wealth accumulation from a time perspective: It takes 7.84 years to get your hands on that first $100k and a total of 30.73 years to go from $0 to $1 million.

This means accumulating the first $100k takes up a whopping 26% (7.84 years / 30.73 years) of your total time on the road to $1 million.

This is why the first $100k is the most annoying and cumbersome. It’s like a massive flywheel that you have to keep slowly pushing inch by inch just to get moving.

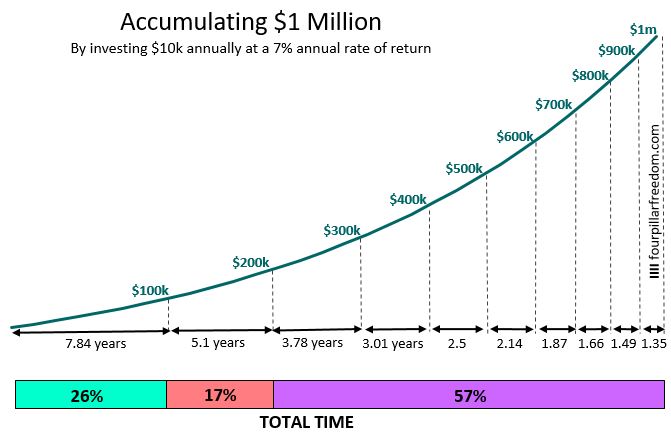

Once you have this initial $100k though, every subsequent $100k comes faster. For example, going from $100k to $200k only takes up about 17% (5.1 years / 30.73 years) of the journey:

And here’s how much time each $100k takes up on the journey to $1 million (again, assuming consistently investing $10k annually at a 7% rate of return) :

Notice just how much time it takes to get the first $100k compared to every subsequent $100k.

This is why accumulating the first $100k is such a big deal.

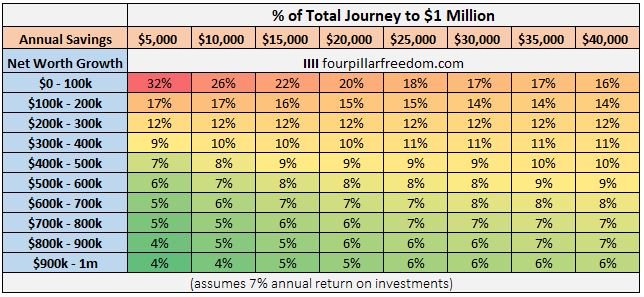

And it’s a big deal whether you save $5k per year or $40k per year. Check out this grid that shows how much time each $100k takes up on the journey to $1 million based on different annual savings:

No matter how much you consistently save each year, the first $100k will always take the longest.

Keep in mind that these examples assume consistent 7% annual investment returns. It’s hard to predict exactly what type of returns you’ll earn on a year-to-year basis, but more than likely if you’re on the road to saving your first $100k, just know that it will take the longest to save.

And if your net worth has already surpassed $100k, just know that the hardest work is likely behind you.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Was just telling my friend about this on Friday! Sending this to her 🙂 you explain better than I do.

Thanks for sharing, Lily! Glad you found it helpful 🙂

Hi! So I recently found your blog and love it, but don’t have the team to necessarily read every email every day. And if I have a particularly busy week your email – along with others – gets piled up and then I have a mountain of emails and … you see where this is going 🙂

Do you have some sort of “weekly” subscriber list to get highlights from the week or something?

Thanks for all you do!

Glad you’re enjoying the blog! 🙂 I don’t have a weekly subscriber list, but each Friday I do have a series called “Here’s What’s Humming” where I share my most popular article from the past week. That might be a good place to look if you only have time to read one of my articles each week 🙂

Literally just had this discussion with my 13 year old daughter today. Great article. I love how you break it down into simple math.

Thanks

Glad you found it helpful, Jon! 🙂

I think your point is really good Zach. The hardest part of getting the first $100K, is the money isn’t working for you yet. That’s why earned income and expense management is so important in early stages of accumulation.

Conversely, going from $1 million to $1.1 million is much easier. You can do it solely by earning a 10% return on the balance while living paycheck to paycheck (not that I recommend that). The money starts to do the work on its own. That’s where the power is if a person can do the hard work of growing earned income and managing expenses in early stages of wealth accumulation.

Tom