2 min read

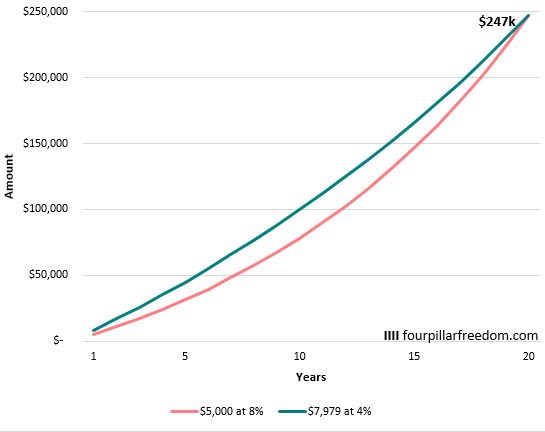

Thought experiment: Person A invests $5,000 each year for 20 years and earns 8% annual returns. Person B invests $7,979 each year for 20 years and earns 4% annual returns. Which person will have more after 20 years?

It turns out that they will both have $247k.

Although person A experienced two decades of solid 8% annual returns compared to the mediocre 4% annual returns of person B, the higher savings amount by person B allowed her to make up the difference in investment returns.

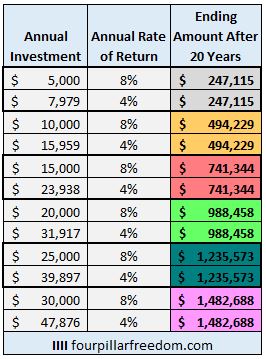

The table below further illustrates this point. It shows how different annual investment amounts can lead to the same ending amount after 20 years, despite differences in 4% and 8% annual returns:

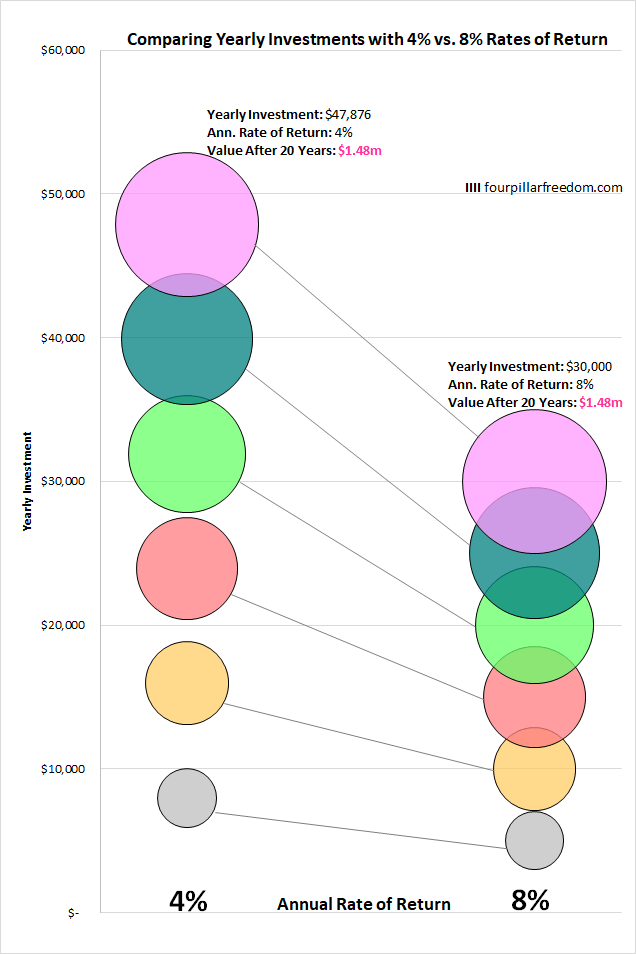

The chart below shows another way to visualize these numbers. The size of the circle represents the ending value after 20 years. The-x axis represents the annual rate of return on investment. They y-axis represents the yearly investment.

This little thought experiment proves an important point: A high savings rate can often offset sub-par investment returns. While it’s impossible to predict what type of returns the market will provide in the future, it’s possible to make up for mediocre returns through maintaining a high savings rate.

Note: I was able to find equivalent combinations of savings and investment returns by using this tool: The Equivalent Savings Plan calculator

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Hello,

Thanks for the article. I’m just wondering when you say high savings rate, do you mean the amount of capital injected into the stock market yearly or savings into the bank?

I try not to hold too much cash; 6 months of emergency and a war chest and some spending money. The rest I’d like to deploy them to investments when the bear comes.

The higher the savings rate, the less important the return, especially over the relatively short-term (a decade or so).

An interesting side note, though, comes from the $15,959 a year at 4% versus the $15,000 a year at 8%. The latter comes out ~ 50% (or about $250,000) ahead after 20 years. That effect is of course magnified the further out you look.

Without savings to invest, returns are meaningless. But once you start investing significant amounts, even a percent or two can make a seven-figure dollar difference over many decades.

Love the illustrations. Keep ’em coming.

Cheers!

-PoF

“Without savings to invest, returns are meaningless.” Exactly! This is something that is true but doesn’t get discussed enough in the finance community. Thanks for the feedback, PoF 🙂