3 min read

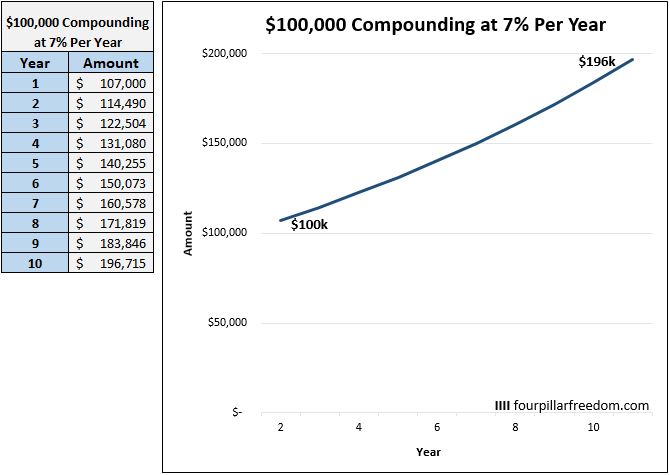

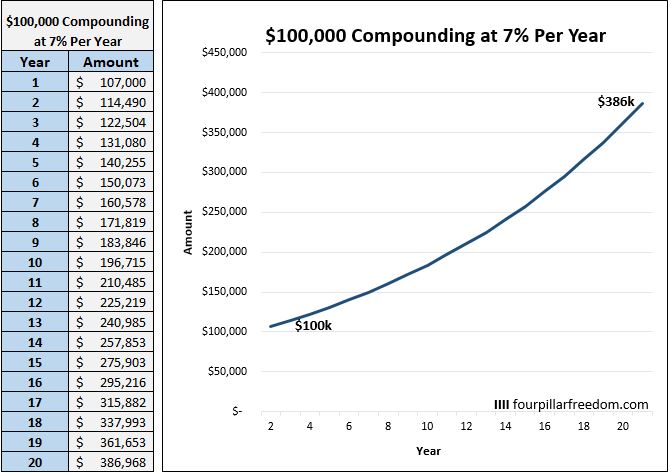

If you invest $100k and earn a 7% return each year, here is how your money will grow over the course of 10 years:

Your $100k will blossom into $196k, which means your investment will be worth 1.96 times ($196k / $100k = 1.96) its original amount after 10 years.

What’s fascinating is that no matter how much you start with, your initial investment will always be worth 1.96 times its original amount after 10 years (assuming a 7% annual rate of return and no additional annual contributions).

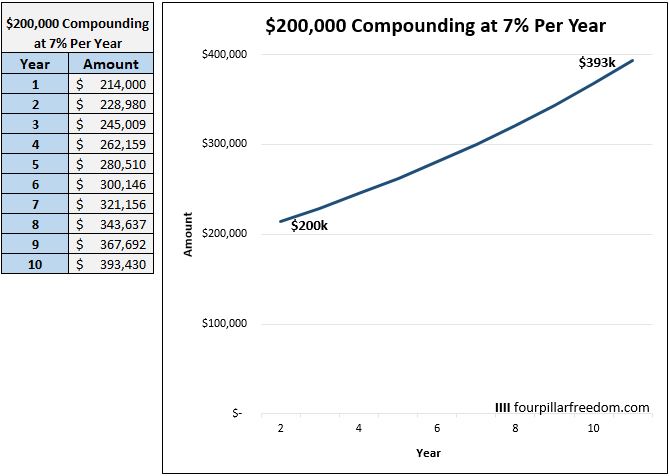

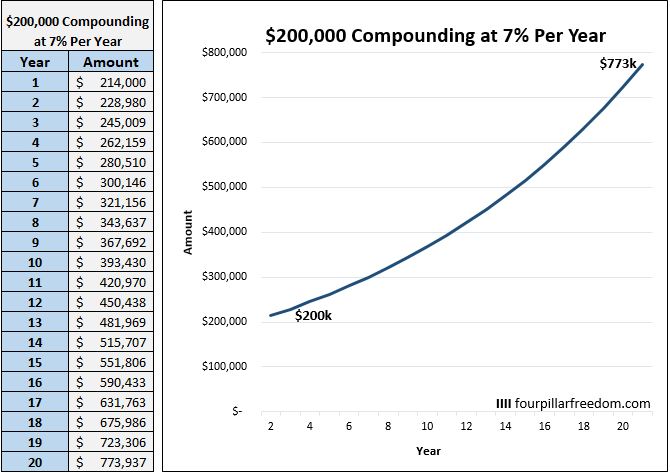

For example, suppose you start with $200,000 instead:

Your $200k will turn into $393k, which means your initial investment will again be worth 1.96 times ($393k / $200k = 1.96) its original amount after 10 years.

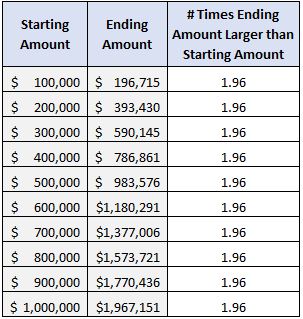

This table shows how much various initial investments will be worth after 10 years assuming they compound at 7% each year:

No matter how much you start with, your initial investment will always be worth 1.96 times its original amount after 10 years.

This fascinating phenomenon is consistent across different time spans too. Suppose you let that $100k earn a 7% annual return for 20 years instead:

Your $100k will turn into $386k, which means your initial investment will be worth 3.86 times ($386k / $100k = 3.86) its original value after 20 years.

And no matter how much you start with, your initial investment will always be worth 3.86 times its original value after 20 years, assuming a 7% annual rate of return.

Suppose you start with $200k instead and let it compound at 7% for 20 years:

Just like the previous example, your ending amount is 3.86 times bigger ($773k / $200k = 3.86) than the initial amount.

To more generally summarize these results, this table shows what an initial investment will be worth after different spans of time for different annual rates of return:

Compound interest has the ability to generate real wealth over the course of decades. It’s up to you to supply it with enough capital to generate that wealth.

Spreadsheet: compound_interest_patterns

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Yup, the cool part is that if you can get your expenses down low, you will cross over a point when the yield off the growth starts to payoff your lifestyle and then you are on easy street. The secret is to start as early and contribute as much as you can so you can pull that point in time when the growth of of that yield passes that lifestyle expense as far to the left as you can – perhaps another blog post showing that visualization? If you have enough of a nut, you can simply live off dividends and yield or reduce your assumed returns by 4% and use the 4% rule (although it might have to be derated for longer retirement duration assumptions).

Exactly – once you reach a point where your investments can cover most of your lifestyle expenses, you can begin to coast 🙂

Zach,

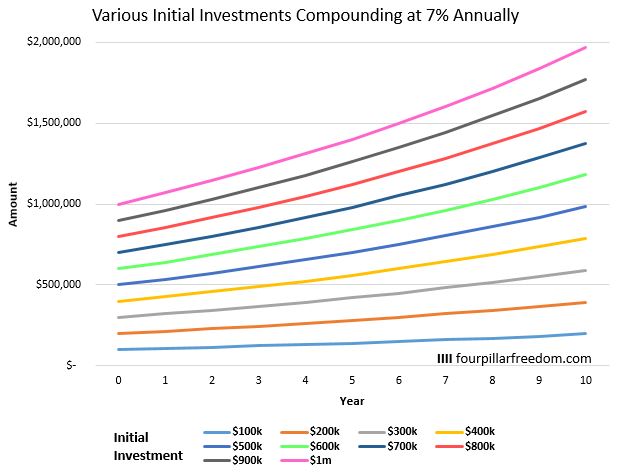

You do such a great job of visualizing information. I did have one question on your third chart in this post. It looks like all the initial investments are starting from basically the same point. Shouldn’t they be spaced out in $100k increments as indicated by the legend (it currently looks like the bright green line starts at about $200k and ends at $2MM when it should actually start at $1MM).\?

Hey Kit! Thanks for the heads up, you were right, the graph was incorrect. I just updated it 🙂

After the 30 year mark, it really takes off. It’s almost ridiculous. By then it’s enough to spend without denting the balance. It just spurs more wealth!