3 min read

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO.

I recently read the book Nudge: Improving Decisions About Health, Wealth, and Happiness by Richard Thaler and Cass Sunstein. It’s a book about the psychology of human judgement and how people can easily be “nudged” into making better decisions to improve their health, finances, and overall happiness.

In one chapter, the authors present an interesting finding on how to “nudge” people towards good behavior. They cite a case study from 1965 at Yale University in which researchers attempted to get students to receive tetanus shots.

In one group, the researchers explained the risks of tetanus and why it was important to get a free inoculation at the campus health center. Although most of the students were convinced of the potential danger of tetanus, only 3% actually went to the health center to receive an inoculation.

In another group, the researchers again explained the risks of tetanus, but in addition they gave the students a campus map with the location of the health center circled and asked the students to write down a day and time that they would go to get their shot. In this group, 28% of the students went to get an inoculation.

It turns out that educating the students was not enough. They needed an extra “nudge” in the form of a map and a scheduled time to go to the health center.

The authors sum up this study by stating, “Often we can do more to facilitate good behavior by removing some small obstacle than by trying to shove people in a certain direction.”

Shoving People Towards Good Financial Behavior

This idea of removing obstacles instead of forcefully shoving people towards good behavior applies wonderfully to personal finance.

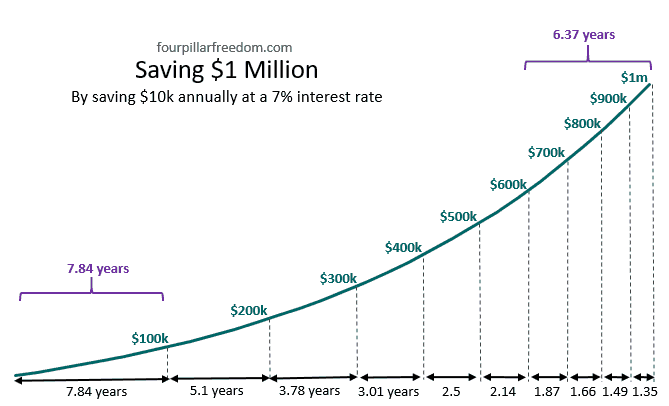

For example, it’s easy to convince people of the power of compound interest. All you need to do is show them a chart:

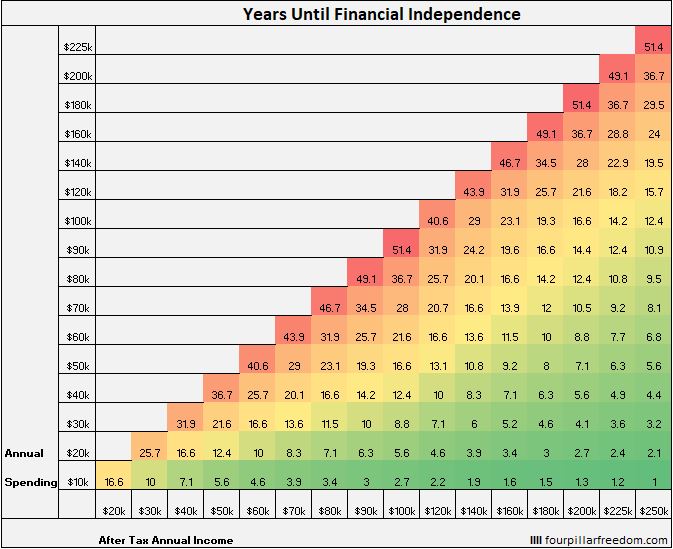

Likewise, it’s pretty straightforward to show someone that a higher savings rate leads to financial independence quicker. You could simply show them this grid:

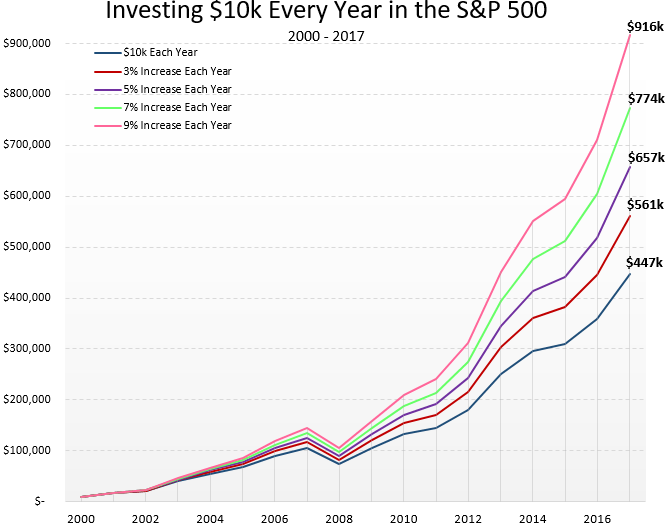

You could also convince someone of the benefits of slowly increasing how much they invest each year by showing them this chart:

But just because people grasp the concepts of financial independence and compound interest doesn’t mean they’ll change their behavior to benefit from this knowledge.

To change their behavior, they need a nudge.

Nudging My Sister

I have a twin sister who finished paying off her student loans a few months ago. At the time, she only had a checking account. I told her that she should open an Ally Savings account and a Roth IRA with Vanguard now that she had some extra cash to invest each month.

She agreed it was a good idea, but one week turned into one month which turned into three months and she never got around to opening the accounts.

Finally, last weekend I visited her in person and walked her through the setup process. In under 30 minutes we had her set up with Ally and Vanguard. I also showed her how to move money around between the various accounts and we bought her first share of VTI (Vanguard Total Stock Market ETF).

It was easy to convince her of the benefits of an interest-yielding savings account and a Roth IRA, but it wasn’t so easy to convince her to take action. To make that happen, she needed an extra nudge.

Education is Not Enough

Financial education by itself is not enough. It’s easy to transfer financial knowledge to your friend, coworker, or partner. It’s not easy to get them to change their behavior. To actually get the people we care about to start making better financial decisions, we need to go one step further:

- schedule time to actually set up savings and investment accounts with them

- sit down and walk through their 401(k) investment options

- show them how to use a basic spreadsheet on budgeting, monthly cash flow, net worth tracking, etc.

Then, if possible, help them set up an automated system that forces them to save and invest a certain amount each week or month. This would ensure that they keep making smart financial decisions for the long haul with little effort on their part.

If you’re having trouble getting someone you care about to start making better financial decisions, you might consider giving them a nudge.

Reference: Nudge: Improving Decisions About Health, Wealth, and Happiness

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I do like the idea of nudging. I think the person already has to be comfortable talking about money and taking advice. Money is a weird thing that people can be very hostile about. I’ve found I can nudge people towards better money habits by setting an example. For example, I’ll talk about paying off student loans and people ask how I did it. When I tell them all the crazy things we did, they do think we’re nuts, but a few weeks later, they’ve started cooking at home, walking everywhere, and using their library.

Monkey see, monkey do. 😉

Thanks for sharing, Mrs. Picky Pincher! I think setting an example is a great way to “nudge” people without actually pushing them in a certain direction 🙂

Funny this…i had to do something similar for my cousin…who mind you is a doctor and her dad is an accountant. We went to her office late one night the same day I found out she wasn’t contributing to her 401k. She had reached her 100k point for a downpayment and hadn’t wanted to spend anymore time at work than she needed to, her words. Luckily, they contributed 5% of her salary whether she did or not. So no “free” money was left on the table. Our late night adventure was successful…a week later when she finally figured out how to log in ?.