2 min read

Here are some numbers.

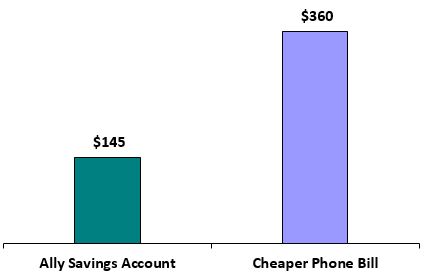

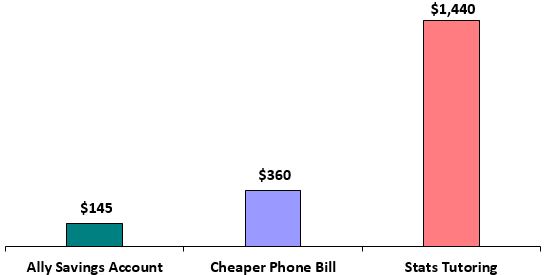

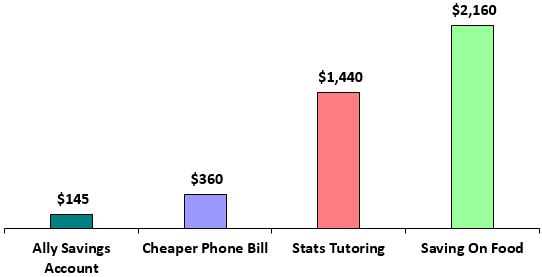

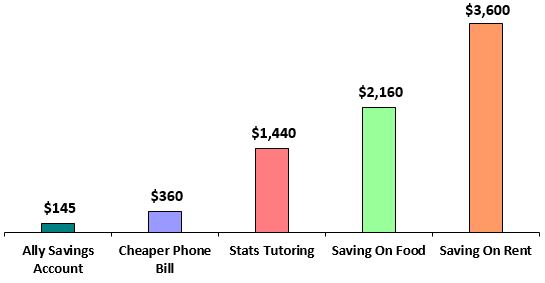

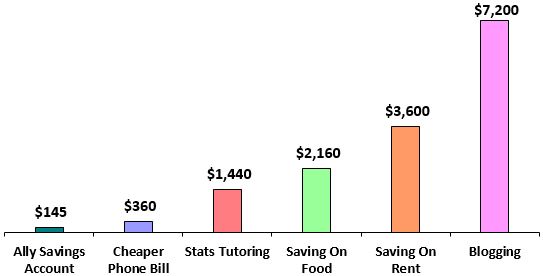

I currently have about $10,000 sitting in a savings account at Ally Bank earning 1.45% annual interest. This means I’m on pace to earn $145 over the course of one year.

When I switched from an unnecessarily high-cost phone plan to a cheaper one, I saved $30 per month. That’s equivalent to saving $360 over the course of one year.

Last month I got back into the side hustle of stats tutoring and made $120. That’s equivalent to earning $1,440 over the course of one year.

In this analysis, I found out the difference between dining out for every meal compared to my actual eating habits is about $180 per month. That’s equivalent to saving $2,160 over the course of one year.

When I moved to Cincinnati, I had the option to move into a slightly larger apartment for $300 more per month, but chose a smaller one with a roommate. That decision will save me about $3,600 over the course of one year.

I also earned a bit over $600 from blogging last month. If I consistently earn that much each month, that’s equivalent to $7,200 over the course of one year.

Combined, all of these savings and earnings add up to $14,905 over the course of a year.

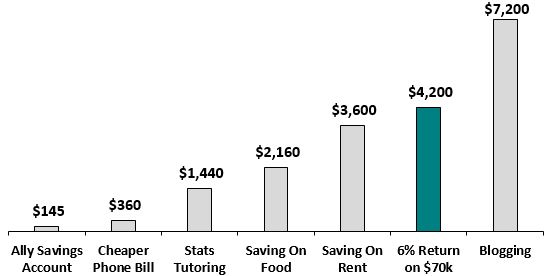

Currently I have around $70,000 invested in various assets across brokerage accounts, IRA’s, and 401(k)’s. In total, these investments would need to earn over a 21% yearly return to match the amount I’m currently saving and earning through my six lifestyle choices listed above.

In a good year, I might expect this $70k to earn a 6% total return, which is equivalent to $4,200. That’s a decent amount, but it’s still less than one-third of the guaranteed return I can get from my combined lifestyle choices.

For anyone in a position like myself, with a net worth less than $100k, the fastest way to make progress financially is through making the right lifestyle choices. Starting a side hustle, finding a cheaper phone plan, living in a reasonable place, dining out just a bit less, etc. These choices often have a bigger impact on your wallet than your investment returns.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Loved this post! I am in a position much like yourself (inching my way toward $100K net worth) and this gave me grave perspective. BRAVO on another great post!

Yup, the best thing about lifestyle choices is that they are 100% under your control, vs investment returns which are a function of the market. Its even better when you compute the pretax value that would needed to be earned to pay for that savings.

I LOVE how you so very clearly lay out how cutting expenses can make/save you the most money in the long run. As someone watching her tiny account numbers creep up almost imperceptibly, it’s a good reminder that the things I actually have control over (aka NOT the market) are the things that’ll help me most right now.

Thanks, Erin! You nailed it – focus on the things you can control and let the market do whatever it may. The best thing for you to do is increase your income and keep your spending in check 🙂

Being disciplined about how much you spend is an important part of the journey to financial independence . It doesn’t always seem like small expenditures will make a difference, but as you show above, they do.

BTW, I used to live in Cincinnati. It’s a great town and so affordable!

Agreed, Cincy is one of the more affordable cities in the midwest. It’s a great place to save money – small world 🙂

Love this post man, such a simple concept yet the graphs hammer the point home. Small lifestyle choices applied consistently over time make a huge difference.

Thanks, Matt!

Such a great way of explaining things and keeping it simple.

I like how the story built from paragraph to paragraph.

We should all be careful about the lifestyle choices we make. Live on less than we earn. Then save (for short-term) and invest (for long-term) the rest. After 20+ years we will acclimated a serious amount of wealth!