3 min read

I recently read an article on Wait But Why that discussed the difference between the mindsets of a chef and a cook.

A chef is someone who uses raw ingredients to invent recipes. A cook, on the other hand, is someone who follows recipes.

A chef reasons from first principles. They get their hands dirty, analyze data, and attempt to create something from nothing. A cook merely follows the instructions already set by a chef.

Recently I have been trying to cultivate a chef mentality in regards to personal finance. I don’t want to just blindly follow traditional financial advice. I want to look at raw data, do my own analysis, and develop my own opinions.

So far, from doing my own analyses I have discovered that:

Investing in individual stocks is probably a horrible idea.

Saving up 25 times my expenses is probably overkill.

Earning active income in retirement is a wonderful idea.

Savings matters far more than investment returns for early retirees.

Today I want to tackle another classic personal finance topic: does dining out actually hurt your finances that much?

The Analysis

In an earlier post, I shared that I can make a meal at home for around $2.

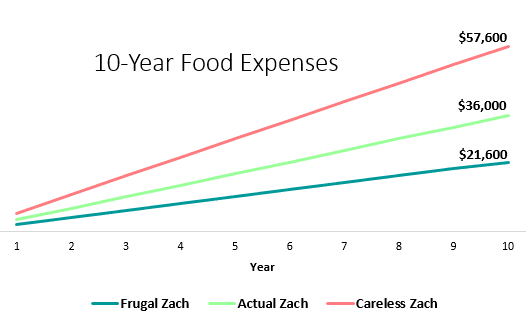

If we assume I eat three meals per day and cook each meal at home for around $2, then over the course of a month that’s $2 * 3 meals * 30 days = $180 spent on food.

This would be the minimum I could spend each month on food. This would be “Frugal Zach.”

Instead, consider the other extreme where I only dine out and never cook at home. There’s this great Mediterranean joint near my apartment where I occasionally buy $8 platters. These platters are massive so hypothetically I would only need to eat two per day to be full.

Obviously I wouldn’t eat at this same restaurant for every meal, but let’s assume that it costs about $8 per meal each time I dine out.

If we assume I eat 2 meals per day at $8 per meal for 30 days, I would be spending $8 * 2 meals * 30 days = $480 per month on food.

This would probably be the maximum I could spend each month on food. This would be “Careless Zach.”

In reality, I typically spend about $200 per month on groceries and $100 per month dining out, for a total food bill of $300. This would be “Actual Zach.”

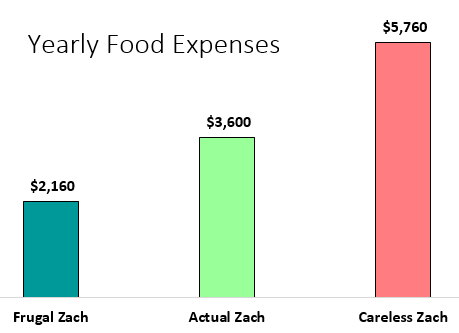

Here’s how much I would spend over the course of an entire year for these three scenarios:

Here’s how much I would spend in each scenario over the course of 10 years:

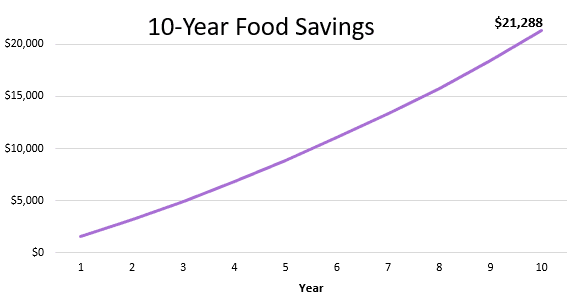

Suppose I transitioned from $3,600 yearly “Actual Zach” spending to $2,160 yearly “Frugal Zach” spending.

This would be a yearly savings of $1,440. Suppose I invested that $1,440 each year and earned a 7% rate of return:

That’s a decent chunk of change.

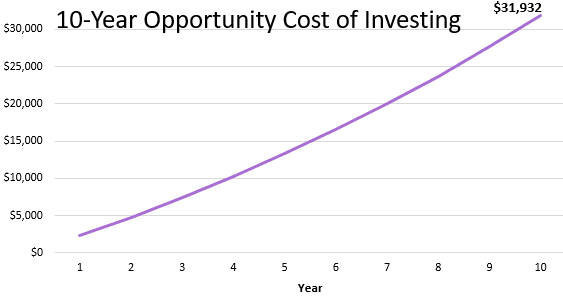

Consider instead if I transitioned from $3,600 yearly “Actual Zach” spending to $5,760 yearly “Careless Zach” spending.

This would be a yearly spending increase of $2,160. Suppose I invested that $2,160 each year and earned a 7% rate of return:

I would lose out on $31,932 over the course of 10 years.

Closing Thoughts

- If I buckled down and cooked all my meals at home, I could save about $1,440 per year, which would grow to $21,288 if I invested it for ten years at a 7% rate.

- If I threw cooking out the window and dined out for every meal, I would spend $2,160 more per year, which would be a loss of $31,932 if I instead invested it for ten years at a 7% rate.

- I could either stop dining out entirely and save $1,440 per year or I could just find a way to earn $1,440 more per year to cancel out those costs.

- Dining out has obvious benefits – it’s a time saver, it requires little work, and it’s convenient. In my mind, it provides value. And it’s okay to spend on things that bring value.

- Dining out doesn’t break the bank for me, but I’m sure it’s a bigger financial burden for larger families with more mouths to feed. In addition, learning to cook is a valuable life skill. I’m not as frugal as I could be with my food expenses, but I have found that a healthy blend of cooking at home with ocassional dining out works best for me and my daily schedule.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Oh a topic close to my heart. I really enjoy eating out. It’s the convenience (no dishes), taste (some dishes I just never make quite right at home) and the social aspect when it’s with friends. For me, my compromise is to bring lunch to work and try to stick to one meal out a week. Some weeks I’m not so successful in sticking to that though. Maybe 50/50 success rate.

Lately, I have been buying coffee more. I am in the latter part of my working career and I am at the FI state of mind.

I look at the cost of a coffee($3) and how much I get paid per day. If I get paid $400/ day, I figure the coffee or reasonably price lunch won’t bother me. Will the coffee add more value now for me or is it better to save and assume 7% return? Those are the questions we all have to answer.

For my wife and I, cooking almost all our meals at home has been a huge key for us in paying down debt and building up our investments. Not only for the cost savings, but mainly in the mindset shift. By developing a more frugal mindset of cooking meals for ourselves, this trickles down to other areas of our budget. We don’t miss eating out and instead put this money towards other areas (travel).

I like your analysis on this though. Especially being 1 person, it’s perfectly reasonable to have a mix of dining out and cooking at home. Like any spending decision, it all comes down to whether it’s a mindful purchase that’s bringing value.

Another hidden savings and value of cooking at home, provided you’re cooking nutritional foods, is the health benefit. Eating less salt, fat and processed foods along with more nutrient dense foods is going to add to your quality of life by prolonging good health. That in turn will decrease medical expenses now and down the road. So, I would argue the long-term savings are even more than you’ve forecast here. Great post as always!

Bingo. Bingo. Bingo.

Was going to add my 2 cents here, but you beat me to it. The health benefits of cooking nutritionally at home far, far, far compound the cost savings benefit vs eating out or buying highly processed food. The extra salt, sugar, and oils of commercially produced food (and animal proteins) are poisoning people, resulting ultimately in heart disease, diabetes (they say 1 out of 11 now), cancers, and other diseases. Don’t believe me? Read Dr Greger’s recent best seller “How Not To Die” for an exhaustive explanation of this (pro tip – just watch him for free on YouTube to get the gist). The cumulative costs of this nutritional nightmare may ultimately bankrupt this country once you start looking at the trends. For now, one of the best FIRE tips you can have has nothing to do with $. It is to look at what you are eating and improve on that, because if/when you get sick, its going to cost you big time $ and greatly inhibit your life style.

I enjoyed the comparison between the three Zachs, and how your Careless Zach is like my Frugal Luxe. For me, I’d rather hack my housing to save money than food. Easier to make a good decision every few years than one almost every day. But I do have the privilege of being able to pick and choose like that.

We had to do this exact math a few years ago. We were spending $1,000+ a month just on groceries. At that time, it actually made sense to exclusively eat out for us to save money. That is, until we learned how to cook good, healthy, cheap homemade meals. Now the numbers are, of course, in favor of cooking at home.

But it’s worth doing the math to know your cost per meal for sure. Any time someone tells you one way is cheaper, always do the math for your specific situation. This goes doubly so for people who are differently-abled and might save money with takeout or prepared foods.

Food is still rather cheap compare to a car or a house..or god forbid a overpriced wedding. And it ties to health and energy and so many important things. I would not cut back on food. It just means too much for not that much gains. Also…it’s important to support responsible farming which impacts everybody.

Timely post

I’m currently trying to get our current grocery spend for our family, which includes six kids, out of Mrs FU . I think she’s avoiding me though.

The potential savings do add up over time and you have to be sensible, especially in our house!

Like most other analyses, I think the outputs depend a lot on the variables. In big cities like the one we live in, unless you eat off dollar menus, it is very hard to find a good lunch for less than $10. Therefore, dinner costs even more, and the savings from making your own meals is substantially more.

I do think dining out significantly penalizes your early retirement so when we put together a budget in 2018, we made sure to ratchet down our restaurant spending significantly. I’ve seen the dollars flow to our bottom line so far this quarter and it is great!

Dining out is definitely a large expense. But you could always try a dish and if you like it try to make it home and increase the size of your personal cookbook.

Always enjoy the articles keep it up!

We try to look for deals as much as we can (e.g., coupons, Groupon, advertisements, taco Tuesday etc.). We treat ourselves to maybe one night a week of take-out or dining out. It gives us a break from prepping and cleaning up and we get to put our feet up and let someone else take care of the cooking. 🙂