3 min read

Suppose you currently spend $60,000 per year. According to the 4% Rule, you need 25 times your annual expenses to achieve financial independence, which means you need $60,000 * 25 = $1.5 million.

Depending on how much you already have saved, that number might seem daunting.

That’s why the most common advice you’ll hear from myself and other personal finance bloggers is to reduce your expenses.

Suppose you cut your yearly spending to $40,000 per year through joy-based spending, gratitude, and smart consumption.

Now, to achieve F.I. you only need $40,000 * 25 = $1 million.

That’s a serious improvement.

But for some, $1 million still might feel like a long way off.

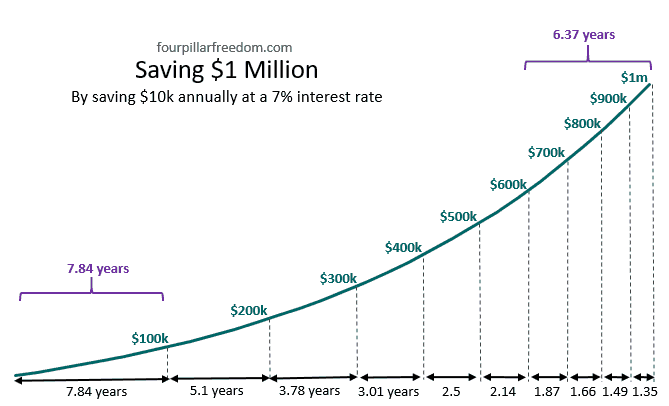

Fortunately, I have some good news: the first few years of saving are the hardest. As time goes on, though, investment returns will help propel your net worth higher at a faster and faster rate, as illustrated in this chart:

Notice how it takes less time to go from $600k to $1 million than it does to go from $0 to $100k. (This chart assumes consistent yearly savings and investment returns)

You might still be thinking, “That’s pretty encouraging…but I want to escape my damn cubicle as fast as possible.”

If that’s you, I have one more financial tool you can use: active income.

Instead of saving so much money that you never need to work again, consider saving up a smaller stack of cash and then transitioning to doing work you actually enjoy, even if that means earning less.

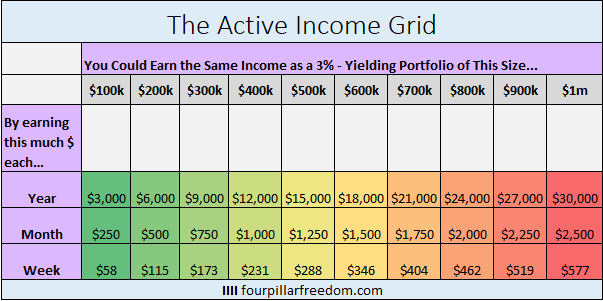

Consider the following numbers:

A $100,000 dividend-stock portfolio with a 3% annual yield will pay you $3,000 per year.

You could also make $3,000 per year by earning $58 per week doing something you enjoy.

For me, I could earn that much with about two hours of stats tutoring.

Two hours of active work I enjoy could produce the same income as a $100,000 dividend-stock portfolio.

Now, there are obvious advantages of having the portfolio. If I didn’t feel like tutoring one week, I would lose out on income. The portfolio, on the other hand, would faithfully pay me whether I work or not.

The drawback of the portfolio, though, is that it takes time to build up. From the chart above, we see that by saving $10k per year and earning 7% investment returns it would take 7.84 years to accumulate $100k. That’s a serious time commitment.

This is why active income is so appealing. It provides the ticket to a shorter cubicle life.

To put some numbers in context, take a look at this grid that shows how much you would need to earn to match the yearly income of different 3% – yielding portfolios:

This grid makes me hyped.

From looking at my February Income & Expenses Report, I see that I earned $105 in dividend income and interest last month. I also earned $516 from blogging. That’s a total of $621.

That’s more income than I would have received from a 3% – yielding $200,000 dividend portfolio.

The best part of all is that this $621 was enjoyable income. It didn’t even feel like work.

Chasing Work You Love – The Fastest Path to Freedom

The traditional financial advice I see thrown around is to cut your expenses drastically, then play the waiting game for 10 – 15 years until you have enough savings to be financially independent.

I do agree that cutting expenses is the first step you should take, but I would argue that the second step should be to pursue enjoyable active income. This could be a variety of things – blogging, writing, freelancing, teaching, tutoring, etc.

It could even be a less stressful full-time job that you have always wanted to pursue – high-school coaching, opening a bakery, starting a photography business, becoming a park ranger, etc.

This type of income might take 2 – 3 years to build up, but during that time your high savings rate will simply add to net worth.

If you haven’t considered it yet, take a step back and look at how enjoyable active income could impact your financial journey. It could be the ticket to a much shorter cubicle life.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I love this idea, and is definitely one I’m considering down the road. Once our house is paid off, our expenses will drop considerably. That’ll give us the flexibility to take lower paying jobs and still save a large percentage of our income.

The great thing about a lot of the active income opportunities like you said is that you enjoy them. If you didn’t, you wouldn’t be pursuing it 🙂

Keep these active income in retirement posts coming! Every single one helps to look at early retirement differently. This article in combination with your calculators is mind blowing. Heck, it’s hard to make no money in retirement–and just $58/week can shave a year off my retirement goal date. Many thanks!

Thanks for putting some broad numbers to this concept. It seems like most bloggers I’ve read who have already retired early use active income as extra security after they’re hit their magic savings number. While conservative assumptions are advisable on one front or another, the reality is that most folks will earn some amount of money over time. In many cases, assuming zero income in early retirement is overly conservative. Thanks for reminding us that there are many different ways to get out of the cube!