2 min read

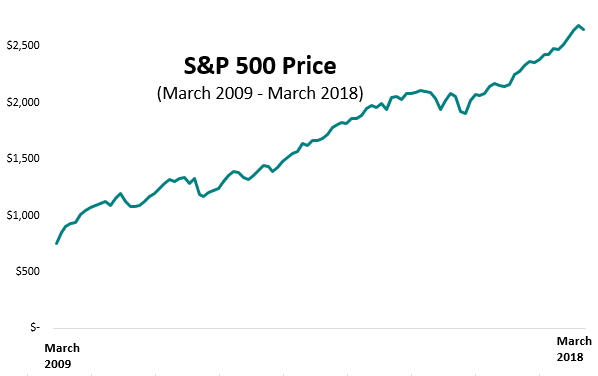

Lately I have been reading a lot of doom and gloom articles about how investors should expect lower stock market returns over the coming decade, given the current elevated prices and the incredible returns we have seen over the past nine years:

Although the future is unpredictable and it’s impossible to time the market, I can’t help but wonder myself: what if the permabears are right, and we really do have a nasty decade of returns ahead of us?

This sets the stage for an interesting thought experiment:

Suppose we experience flat or even negative returns over the coming decade. Could a high savings rate offset the effect of these poor returns?

The Analysis

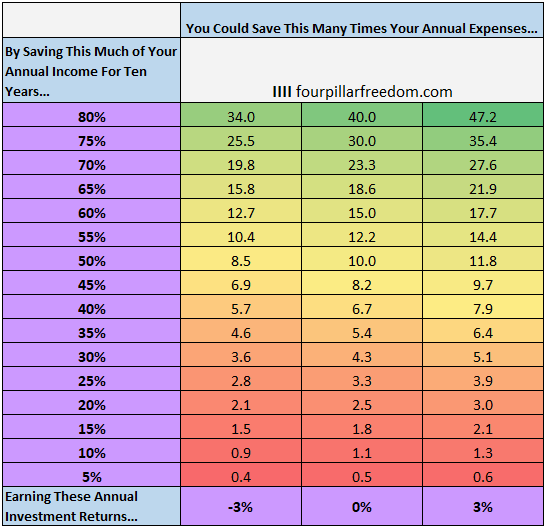

Consider these three scenarios: You invest all of your savings in the S&P 500 each year and it delivers ten years of:

- -3% annual returns

- 0% annual returns

- 3% annual returns

This grid shows how many times your annual expenses you could save in each scenario. It assumes that you save the same percentage of your income each year and earn consistent yearly investment returns.

An Example

Suppose the S&P 500 delivers 0% returns every year for the next 10 years. According to this grid, if you save 50% of your income each year, you could still save 10 times your annual expenses.

To put some numbers to this scenario, suppose your annual income is $100,000 and you save $50,000 each year. Then your total savings at the end of ten years would be $500,000. That’s 10 times your annual expenses.

The grid works at all income levels. If your income is $60,000 and you save $30,000 each year, you’ll have $300,000 after ten years. That’s also 10 times your annual expenses.

Some Interesting Observations

If you are attempting to save 25 times your annual expenses, you could achieve this goal in ten years by saving 75% of your income, even if you earn -3% annual investment returns. That’s amazing.

If you’re looking to save only 15 times your annual expenses before transitioning to semi-retirement with active work, you could achieve this by saving 60% of your income for 10 years, even if you earn 0% annual returns. Again, incredible.

If you’re someone who wants to quit the rat race with only 10 times annual expenses, you could do so by saving 50% of your yearly income for ten years without the help of investment returns, as illustrated in the examples above.

Closing Thoughts

Although I knew a high savings rate was a powerful force, this grid still surprised me. It shows that if you can save close to 50% of your income for ten years, even a decade of 0% investment returns couldn’t stop you from gaining some serious financial flexibility.

I have no idea what the stock market will do over the coming years and I don’t intend to predict it’s price movement. It’s outside of my control. What’s inside of my control is my savings rate, which I plan on maximizing.

If you want to go from cubicle slave to financial freedom warrior, you’re better off increasing your income and living within your means than wringing your hands over stock market returns.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

It sounds weird but sometimes it’s good to just close your eyes and keep chugging along with the consistent and incremental increases in savings. Just tell yourself I’m in it for the long haul and be properly diversified. All the market stuff remains to be noise.

Hi Zach,

I adopted the saving approach right from the start of my working life. I aimed for the target amount in which I can sustain my living expenses by 10 years. Once the target was achieved, all the current savings from my full time employment are channelled into dividend investment.

Ben