4 min read

Consider the following scenario:

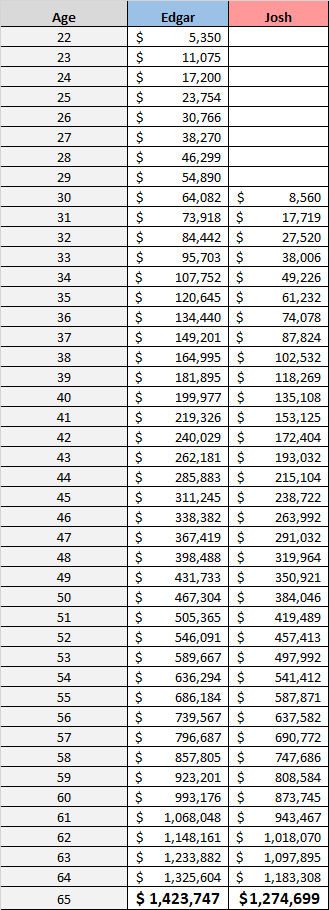

Edgar invests $5,000 each year into the stock market starting at age 22 and earns 7% average annual returns each year until age 65.

Josh invests $8,000 each year and earns 7% average annual returns until age 65, but he doesn’t start investing until age 30.

Despite investing more money each year, Josh ends up with less than Edgar by time they both reach age 65:

Edgar ends up with a little over $1.42 million while Josh ends up with a little over $1.27 million.

Some variation of this example is often used in personal finance to emphasize the point that you should start investing as soon as possible because even if you invest more money at a later date, it’s hard to catch up to someone who started investing even a few years sooner.

Unfortunately, most people draw the wrong conclusion from this example by concluding that there’s something magical about those early investing years. But that’s not true. Compound interest actually sucks early on. The magic only arrives in the later years.

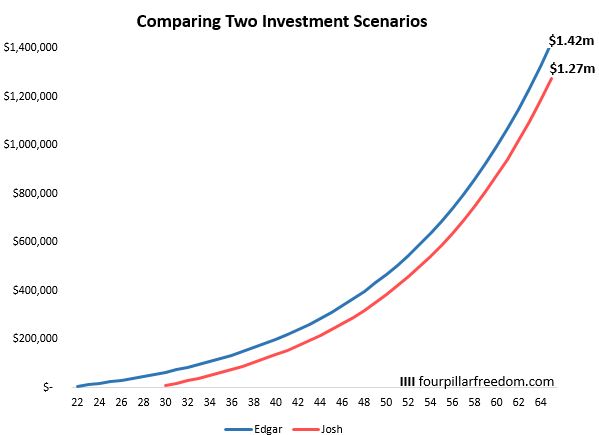

For example:

- In Edgar’s first year of investing he earns a 7% return on his $5,000. That’s $350.

- In his second year he contributes $5,000 more and earns a 7% return on his $10,350. That’s $724.

- In his third year he contributes $5,000 again and earns a 7% return on his $16,074. That’s $1,125.

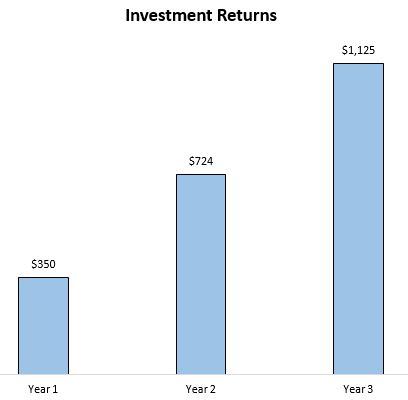

Fast forward to the last three years leading up to age 65. Edgar earns $61,694, $66,280, and $71,187 in those years, respectively, in investment returns.

In other words, the investment returns in the early years are peanuts compared to the latter years.

This also means that investment returns start to impact your net worth much more over time compared to the amount of money you invest.

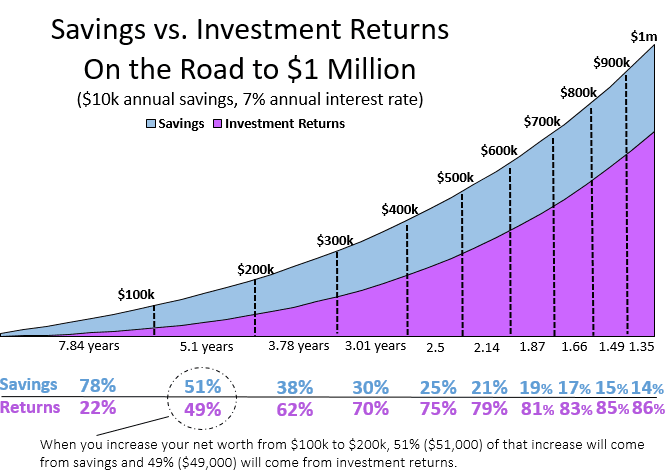

To illustrate this, check out the chart below that shows how much savings (e.g. contributions) contribute to net worth growth compared to investment returns for someone who invests $10k each year at a 7% annual return:

Early on, investment returns don’t matter as much as the amount you save and invest. As time goes on, though, returns start to become the main driver of net worth growth.

What to Do with this Information

The fact that compound interest sucks early on doesn’t mean you should avoid investing in the stock market when you’re young. It simply means that you shouldn’t rely on investment returns too heavily when you’re first starting out.

Instead, your focus should be on finding ways to increase your income. You’re much better off figuring out how to earn $20k more per year than you are figuring out how to earn an additional 1-2% annual investment returns.

Here are some realistic ways you can increase your income.

1. Negotiate Your Salary.

I believe that the best and most enjoyable way to build wealth is to start your own business. However, most people will have to work for someone else when they’re just starting out, which is why the best way to increase your income when you’re young (or at any age, really) is to learn how to negotiate your salary.

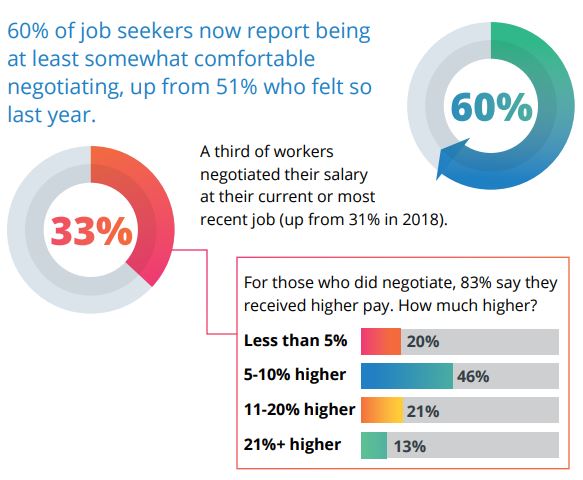

Unfortunately, a 2019 study from Jobvite shows that only 33% of people actually bother negotiating their salary. Broken down by gender, the numbers are even lower for women: only 27% negotiate salary.

But there’s good news for those who do negotiate: a whopping 83% receive higher pay as a result.

And about one-third of people who negotiate salary end up receiving pay that is 11% or higher. For someone who receives an offer of $60k, an 11% increase would be an additional $6,600. That’s a lot of money for only a little work.

For those who are willing to negotiate, there’s significant upside. But it helps to know which techniques and tactics can actually help you negotiate a higher salary. For a list of actually helpful negotiation tips, check out this roundup I created.

2. Provide a Service

One of the easiest ways to increase your income is to provide a service in a niche you’re knowledgeable in at a high hourly rate.

For example, I used to tutor college students in statistics at a rate of $40 – 50 per hour. Students would gladly pay this rate because there are very few people out there who are knowledgeable in college-level statistics, yet there’s a huge pool of people who have to take at least one introductory level stats course in college.

This mismatch between supply and demand meant that I could charge a fairly high hourly rate and earn some nice side hustle income.

Depending on the hourly rate you charge and the amount of hours you’re willing to work, providing a service could make a significant difference in your total income.

3. Build Assets

Another way to increase your income is to build an asset that generates income for you while you sleep. My personal favorite example of this is a website. I currently own five websites that all generate income for me in the form of ads, affiliate links, and products I’ve created. Each day these websites earn income for me without my attention.

You won’t get rich fast from building a website, but you can certainly build a semi-passive reliable income machine that has the potential to grow over time.

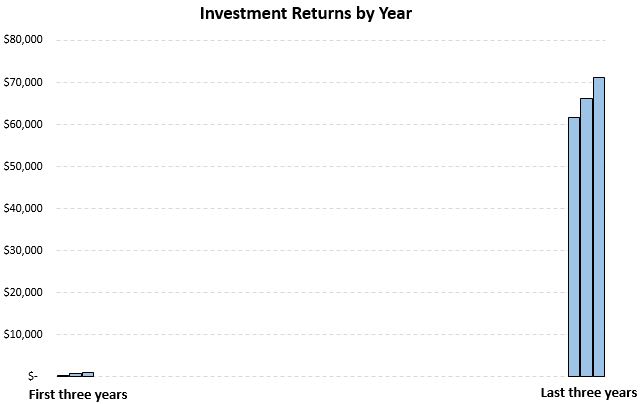

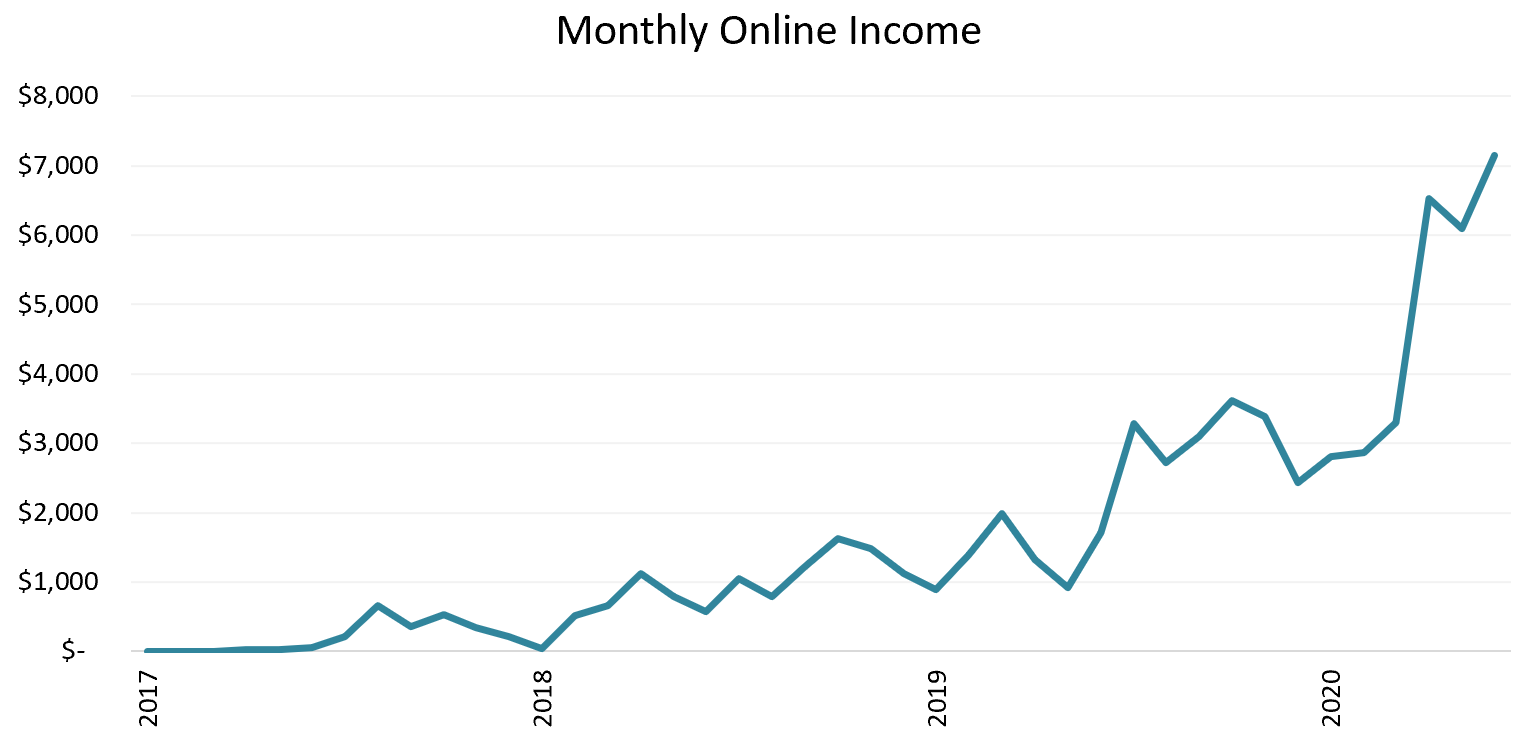

Here’s a look at how I’ve grow my own online income over the past three years:

If you’re interested in starting your own website, I recommend joining the Income Community.

4. Buy Assets

Instead of building an asset from scratch, you could also buy one. The benefit of buying one is that you can start earning money immediately as opposed to slowly building up income over time.

One example of an asset that you can buy is a website. I personally bought my first website ever a few months ago. It generates around $700 per month in the form of ads and affiliate links, and I paid just $7,000 for it. I now own a website that generates mostly passive income and only requires a few hours of work from me per month.

For anyone who is interested in purchasing a website to increase your income, there are plenty of small websites out there that you could purchase for between $5,000 and $15,000, which would provide much higher return on investments compared to traditional assets like stocks and bonds.

Conclusion

Many people mistakenly believe that there’s something magical about investing as early as possible. But the magic is in the later years, not the early years. This is why you should focus on growing your income when you’re just starting out.

You can certainly invest your savings along the way, but just know that wild investment returns only come as a result of having a lot of money invested.

First, grow your income through negotiating salary, providing services in niche topics, building assets that earn money for you, and buying assets that offer high rates of return.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.