3 min read

3 min read

Here are some numbers and charts to consider for anyone on the road to saving $100k – $300k.

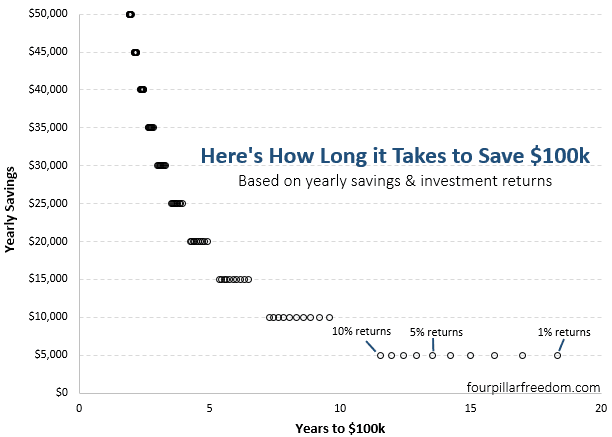

$0 to $100k

If you start with a net worth of $0 and save $5,000 per year, investment returns have a huge impact on how long it will take you to save $100k.

If you earn 1% annual returns, it will take just over 18 years to save $100k. Instead, if you earn 10% returns, it will only take 11 years.

Conversely, if you save $50,000 per year, investment returns hardly impact how long it will take to save $100k.

If you earn 1% returns, it will take 1.99 years. If you earn 10% returns, it will take you 1.91 years. Not much of a difference.

Here’s a chart that shows how long it will take to go from $0 to $100k based on different yearly savings. Each circle represents different annual investment returns.

Some Observations

- Someone who saves $20k per year and earns 1% returns will accumulate $100k before someone who saves $15k per year and earns 10% returns.

- To save $100k in under 5 years, you need to save at least $20k per year.

- To save $100k in under 3 years, you need to save at least $35k per year.

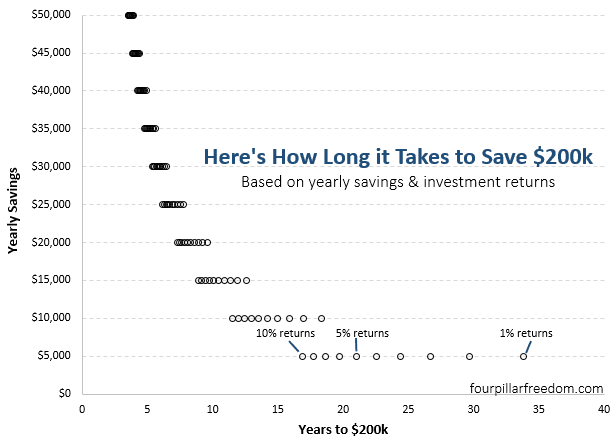

$0 to $200k

Here’s the same chart, but for saving $200k.

Some Observations

- Someone who saves $20k and earns 3% returns will reach $200k at the same time as someone who saves $15k and earns 10% returns.

- If you save anything more than $30k per year, the difference in time it takes to save $200k is less than one year between 1% and 10% annual returns.

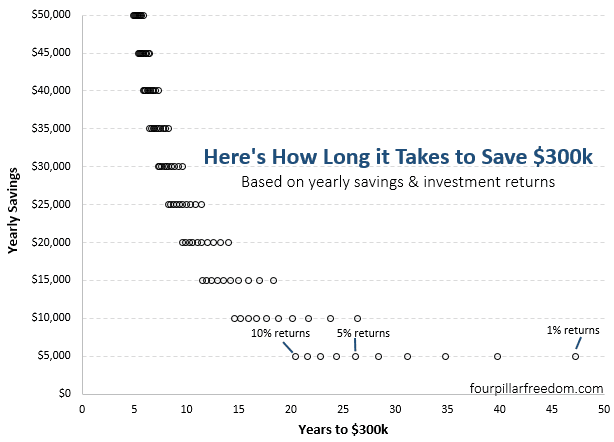

$0 to $300k

Same chart, but for saving $300k.

Some Observations

- Investment returns matter a lot if you only save $5,000 per year. The difference between 1% and 10% returns is 27 years.

- If you save $50,000 per year and earn 10% returns, it will take 4.93 years to accumulate $300k. Instead, if you earn 1% returns it will take 5.86 years. That’s a difference of less than one year.

Spreadsheet: saving_100k_to_300k

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

More mathematical proof that it’s better to consistently save than chase returns! I also find it more enjoyable to focus on my savings rate since it’s much easier to control than my return.