3 min read

Consider the following thought experiment:

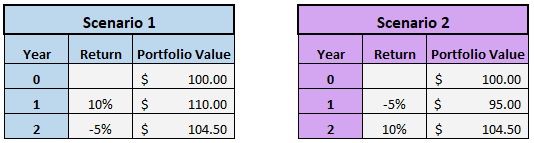

Scenario 1: Bob starts with a portfolio of $100. In year one, his portfolio earns a 10% return. In year two, it earns a -5% return.

Scenario 2: Bob starts with a portfolio of $100. In year one, his portfolio earns a -5% return. In year two, it earns a 10% return.

Question: Which scenario ends with a higher ending value?

Answer: Both result in the same ending value.

The sequence of returns – the order in which the returns occurred – didn’t matter.

Since Bob doesn’t withdraw any money from his portfolio in either scenario, the sequence of his investment returns doesn’t affect the ending portfolio value.

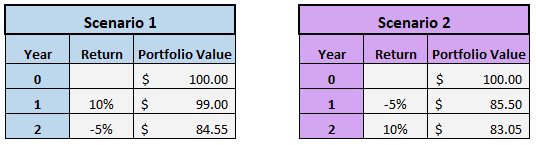

But let’s see what happens when Bob decides to withdraw $10 from his portfolio at the beginning of each year:

Explanation: In scenario 1, Bob withdraws $10, which takes his portfolio down to $90. He earns a 10% return in year 1, which takes it up to $99. Then he withdraws another $10, which takes his portfolio down to $89. He earns a -5% return in year 2, which takes it down to $84.55.

In this example, the sequence of returns does matter. In scenario 2, the bad return in the first year caused the portfolio to have a lower ending value compared to scenario 1. This illustrates the first important rule of sequence of returns:

Bad returns in early years cause more damage to portfolios than bad returns in later years.

This is the basis for the term “Sequence of Return Risk”, which is the risk that all retirees face. When you retire, you rely on your portfolio to earn investment returns to offset the money you’re withdrawing to support your lifestyle.

Based on research, it has been shown that bad returns in the first year or two of retirement don’t actually matter much in the long run as long as your portfolio recovers its lost value within the first decade.

The real threat comes from earning poor returns overall during the first decade of retirement.

These poor returns in the early years could wipe out enough of your portfolio that even good returns in later years wouldn’t be enough to keep your portfolio alive.

Let’s use some real-world numbers to illustrate this concept.

Example

The numbers used in this example are grossly oversimplified, but they’re useful in illustrating the sequence of return risk.

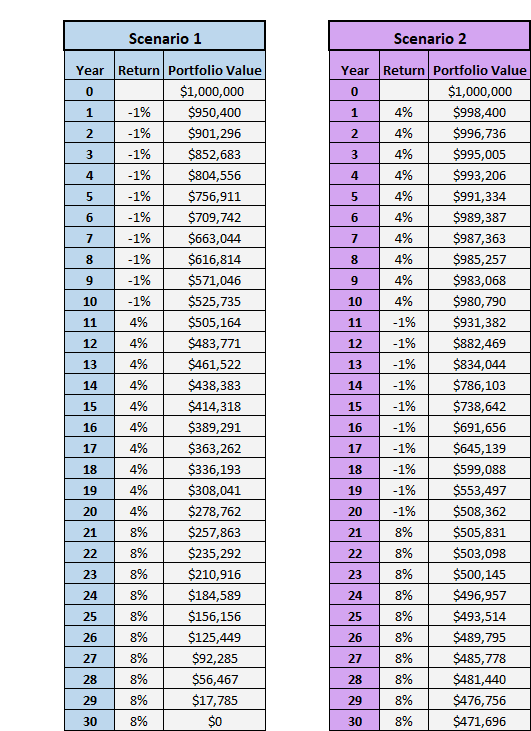

Suppose Bob retires with a portfolio worth $1 million. His retirement lasts 30 years. At the beginning of each year, he withdraws $40,000 from his portfolio to support his lifestyle.

Bob experiences three decades of market returns.

In one “bad” decade, he earns -1% annual returns.

In one “mediocre” decade, he earns 4% annual returns.

And in one “good” decade, he earns 8% annual returns.

The sequence in which he experience these returns matters.

Consider scenario 1, where he experiences the “bad” decade first, followed by the “mediocre” decade, then the “good” decade.

In scenario 2, he experiences the “mediocre” decade first, followed by the “bad”, then the “good” decade.

Assuming Bob withdraws $40,000 from his portfolio at the beginning of each year, here is how his portfolio performs in each scenario over 30 years:

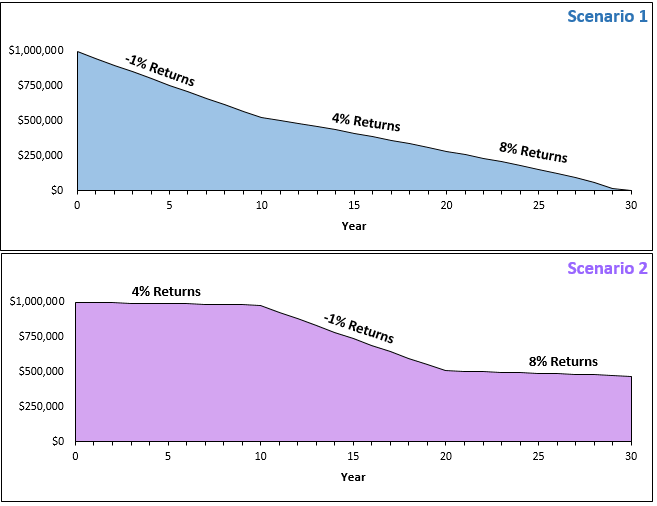

Here’s a visual look at both scenarios:

In scenario 1, the bad returns in the first decade depleted his portfolio so much that the better returns in the following two decades weren’t enough to keep his portfolio afloat.

Conversely, in scenario 2, the mediocre returns in the first decade were enough to keep his portfolio alive until the good returns showed up in later years.

Dealing with Risk

If history is any indicator of future stock market performance, we know that there will be a mix of bad, mediocre, and good decades in the years ahead for investors. If your first decade in retirement is a “bad” one, with poor returns, your portfolio is at risk of drying up during a multi-decade retirement.

On the other hand, research shows that if your portfolio maintains or increases in size during your first decade of retirement, the odds of your portfolio surviving over the long haul are fairly high.

So, to prevent your portfolio from getting crushed in the early years of retirement, there are a few steps you can take:

1. Invest in bonds. If the market flops in your first decade of retirement, it’s helpful to own bonds, which will maintain their value far better than stocks. In the event of a flop, you can sell off some bonds.

2. Hold cash. As we saw in the very first example of this post, if you don’t touch your investments, your portfolio can endure a downturn if the market recovers in later years.

To avoid selling your stocks, it helps to have cash on hand. Many early retirees hold as much as 1 – 3 years of cash in a savings account to ensure they don’t have to sell their stocks to support their lifestyle in the early years of retirement.

3. Keep spending in check. The most obvious way to give your portfolio a boost is to simply kick up your frugality and spend less during market downturns. This will help you stretch your cash reserves and avoid selling stocks.

What are your thoughts on sequence of return risk? Do you have any other tips to deal with this risk?

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Wow! Scenario 1 was a scary chart. Do you have a chart where in the past there has been negative returns for over a decade?

I think after the first year, I would want to go totally conservative.

I believe there have been a couple 10-year periods where returns have been negative. I’m actually working on a post to explore investment returns based on rolling 10-year periods, so stay tuned for that 🙂

Another tip is to plan for taxes and expenses. I just did an analysis on Roth conversion and found nearly emptying my IRA into a Roth resulted in $100K greater portfolio size on a $1M portfolio after 30 years of withdrawal. I have money in pre-tax, post tax, and already been taxed accounts. When RMD comes around the government forces you to annuitize your IRA which can force you into a higher tax bracket so you wind up paying more taxes than you want. By Roth converting you reduce the size of the RMD and you can fulfill your income needs by pulling a blend of money from the three account types. This flexibility becomes critical when one spouse dies, as the taxes on a single can kick you up 2 tax brackets compared to the taxes on a married filing jointly, Basically Uncle Sam moves into your bedroom and eats an extra XX% of your stash. If you plan early enough you have some room to keep the wolf at bay. How this relates to SORR is if you Roth convert in early retirement the taxes are a kind of SORR. The way around that is to plan the for the taxes prior to retirement. Understanding and planning for taxes is a REALLY good reason to work one or two or three more years IMHO.

Thanks for the in-depth comment, Gasem! Taxes can take a huge chunk of your savings if you don’t navigate them carefully.