3 min read

“Financial Independence” is typically defined as having 25 times your annual expenses saved up.

For example, if you spend $40,000 per year, you need $1 million ($40,000 * 25) to achieve F.I.

But there’s a problem with this line of thinking. It assumes your expenses will be the same before and after retirement. It also assumes you earn no active income in retirement.

For many people, expenses actually decrease a bit once they quit their day job due to less commuting, more time to cook meals, lower business clothing expenses, and generally a more simple lifestyle.

Even people who travel the world during retirement seem to find that it’s cheaper to live abroad than in the U.S.

Also, if you’re the type of person who can save up 25 times your annual expenses by age 30-something, you probably have the ambition to do some type of work even after you leave your 9-5. This translates into active income.

Knowing these facts, let’s consider the following thought experiment…

Thought Experiment

If you’re able to reduce your annual expenses and pursue active income in retirement, you could quit your day job far sooner than you think.

Let’s run some numbers.

Pretend this tiny red block represents $1,000 in annual spending:

![]()

Maybe you spend it on Chipotle, Netflix, buying groceries, paying rent, attending concerts, purchasing clothes, paying bills, taking vacations, or whatever else. It simply represents $1,000 you spend each year.

Pretend this tiny green block represents $1,000 in savings:

![]()

For every tiny red block, you need 25 tiny green blocks to be financially independent:

![]()

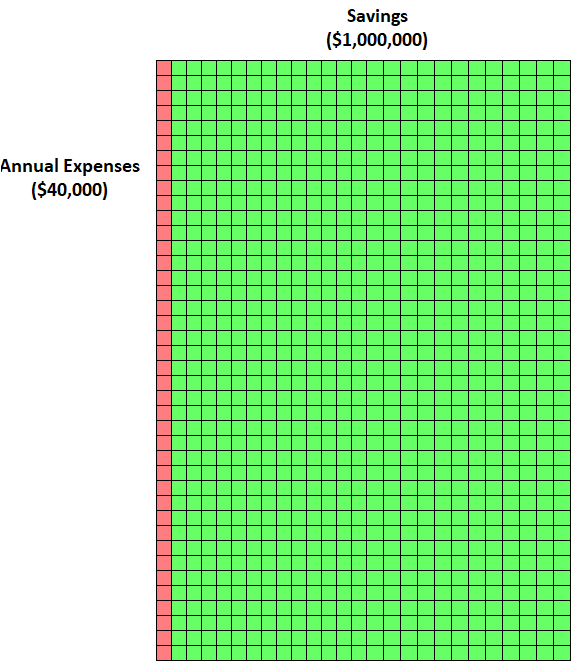

If you spend $40,000 per year, you need $1 million to be financially independent:

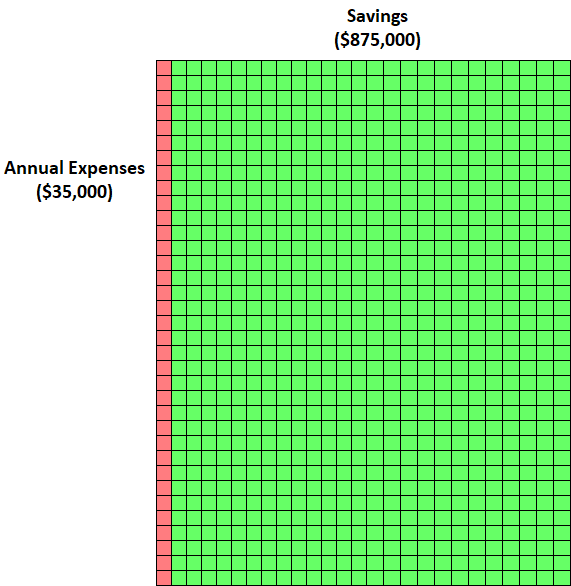

Let’s suppose your annual expenses will drop to $35k each year in retirement. In that case, you only need $875,000 (25 * $35,000) to reach F.I.

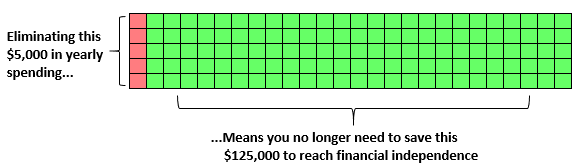

Reducing yearly retirement spending by $5,000 each year means you need to save $125,000 less to achieve F.I.

This is the power of reducing your annual expenses.

Now, let’s add active income into the equation. Suppose you find part-time work doing something you love in retirement and earn $10,000 per year (post-tax) from it. That’s less than $1,000 per month.

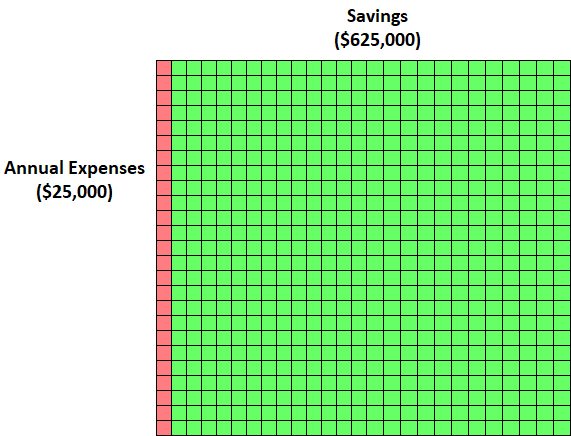

By using this $10,000 to cover some of your annual expenses, you only need to cover $25,000 of your yearly expenses with savings. This means you only need to save $625,000 (25 * $25,000) :

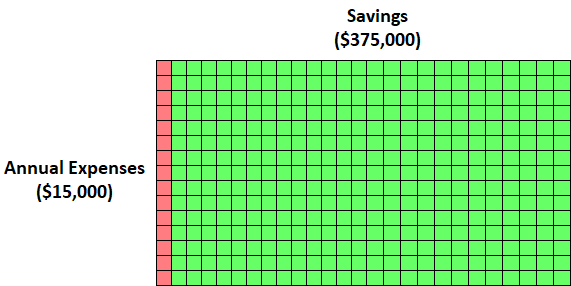

Or suppose you find work doing something you love that earns $20,000 per year (post-tax). If you put this $20,000 towards your annual expenses, you only need to cover $15,000 of your yearly expenses with savings. This means you only need to save $375,000 (25 * $15,000) :

Conclusion

By reducing expenses and actively earning income in retirement, you could quit your day job much sooner than you think.

Of course, this is a game of trade-offs.

If you choose to embrace active income in retirement, you can leave your job sooner, but you’ll be less financially secure and more dependent on that active income. Depending on your unique situation, this might be worth it. It might not. That’s up to you to decide.

Further Reading:

Active Income in Retirement Calculator

How Active Income in Retirement Impacts When You Can Retire: Part 1

How Active Income in Retirement Impacts When You Can Retire: Part 2

How Active Income in Retirement Impacts When You Can Retire: Part 3

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

It’s admirable when people retire and reduce expenses as finely illustrated in your blog posting. Here’s the one outlier; the burden of health insurance expenses after retiring Early! This is something everyone needs to seriously consider before quitting their day job.

I have a great insurance plan through my day job. It costs me $300 per biweekly pay period to cover my family. The annual deductible is only $2500. It pays off our prescriptions and the co pay for doctors visits is $25.

If I retired this year, a compatible plan thru the marketplace would cost me $1800 per month, and God only knows what it’ll cost next year and the year after and so on.

This is dilemma WE ALL face! We are in this one together and it should be the biggest concern/fear anyone has who desires to retire early. Frankly, it’s so concerning that this problem could invalidate the points you made in this fine article. What are we all to do if there’s a large gap in time between our retirement age and our age for Medicare eligibility (age 65)?

Health insurance is a massive issue that many early retirees will have to deal with. I wouldn’t say it invalidates all the points I made, though. Keep in mind there are plenty of expenses that tend to decrease in retirement, which will offset some of the increased health insurance costs. Also, it’s entirely possible that the state of health insurance will improve and become more affordable in the future. No doubt it’s a huge issue, though.

Thank you for this post. Its very inspiring.

Thanks, Hector!