4 min read

In Part 1 of this series, I explained that earning income by doing work you enjoy in retirement could be the key to retiring much sooner.

In Part 2, I shared a few examples along with the math to support this idea.

I also shared the Active Income in Retirement calculator, which lets you tweak interest rates, inflation rates, and other variables to see how active income could impact your retirement date.

In this post, I show a specific example of how a couple who saves up only 10 times their annual expenses could survive a 40-year retirement through earning part-time income during retirement.

Let’s jump in!

An Example

Susie and Glenn spend $40,000 per year. They have a net worth of $0. They are both 27 years old. Combined, they earn enough money from their day jobs to save and invest $35,000 per year.

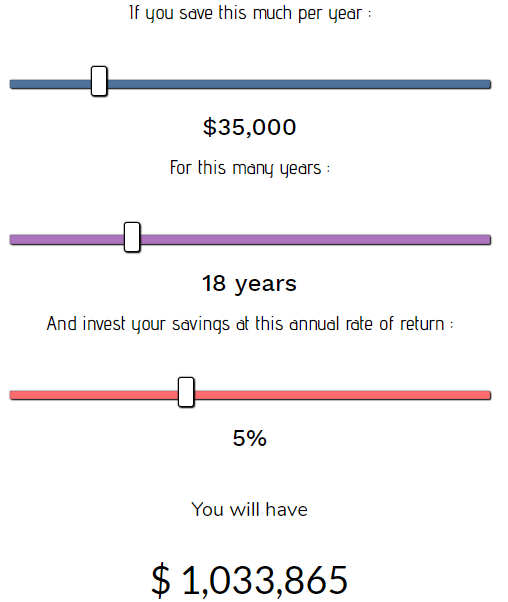

It would take them about 18 years to save up 25 times their expenses ($1 million), if their investments earned a 5% annual interest rate:

They would both be 45 years old at that point.

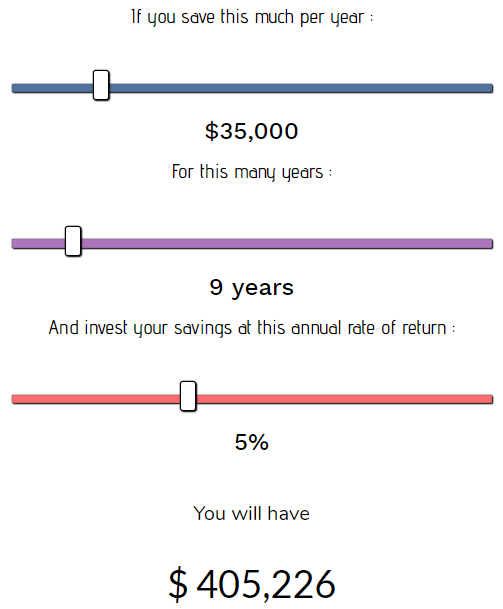

Let’s suppose they only want to save up 10 times their annual expenses ($400k) before quitting their day jobs. Assuming their investments grow at a 5% interest rate, this would take them about 9 years:

They would both be 36 years old at that point.

With only 10 times their annual expenses saved up, Susie and Glenn wouldn’t have enough money to never work again, but fortunately they’re open to the idea of part-time work.

Glenn decides to start tutoring high school and college students in math on the weekends because he has always loved the subject and he finds joy in helping others learn.

He earns $20,000 per year doing this. This is completely reasonable, considering private tutors often charge $40 – $60 per hour.

Thanks to this active income, Susie and Glenn only need to withdraw $20,000 per year from their portfolio to support their lifestyle, assuming Glenn’s income keeps up with inflation.

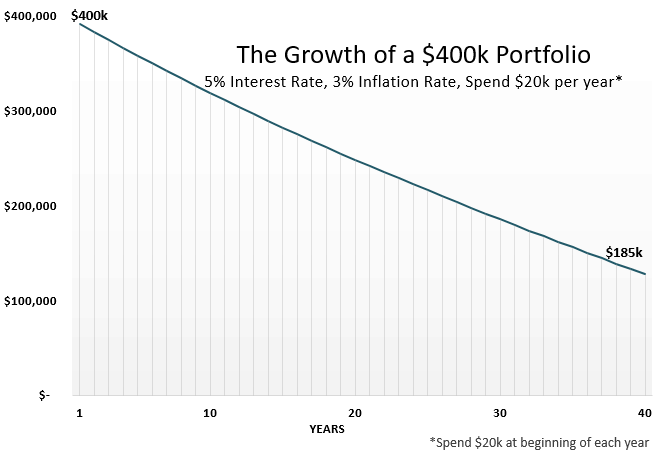

Here’s how their portfolio would perform over a 40-year retirement period if their investments grow at 5% annually and inflation grows at 3% annually:

At the end of this 40-year period, they would still have $185,000 in the bank. Thanks to Glenn’s part-time work, they would be able to quit their day jobs at 36 and enjoy their retirement until age 76 without running out of savings.

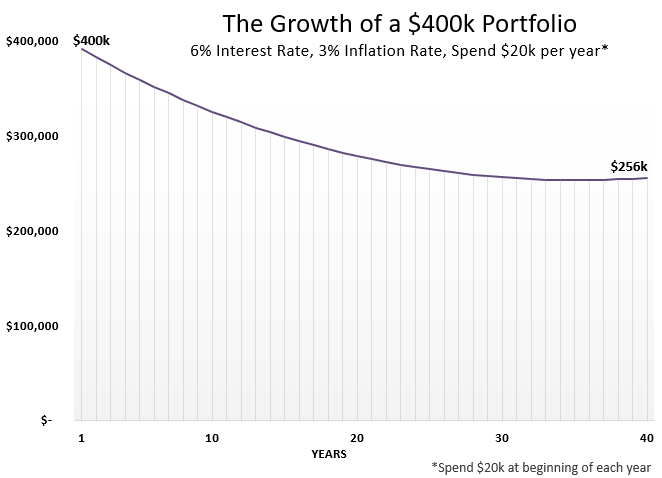

The results are even more incredible if we bump up their investment returns to 6% annually:

They would have $256,000 in the bank at the end of 40 years!

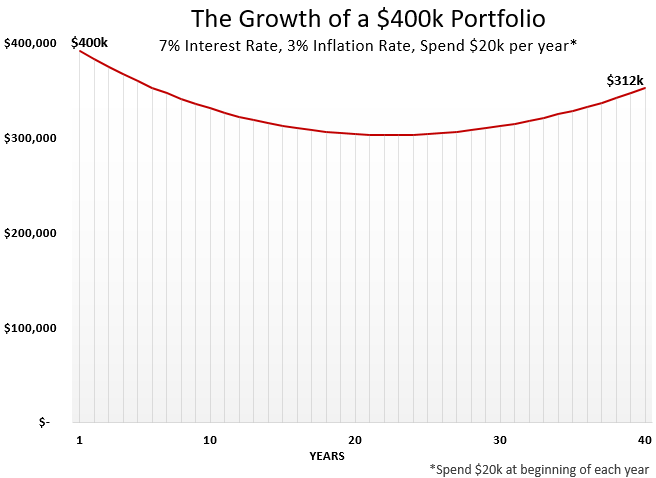

They would be in even better shape if they earned 7% annual returns:

Some Thoughts On Active Income

If you’re thinking, “Most people don’t have the skill set to earn $40 – $60 per hour tutoring part-time”, I agree with you. But there are plenty of ways to earn $20k or more each year doing something you enjoy.

This could be working part-time for a few days each week, starting your own business, only working six months out of the year, or being a freelancer doing something you love.

In this specific example, I also assumed that only one of the individuals worked in retirement. If both Susie and Glenn worked part-time, they would only need to earn $10,000 per year each.

I also assumed that earnings kept up with inflation. More than likely, once you start doing work you enjoy, your earnings will outpace inflation. You’ll find ways to hone your skills, attract more clients, and charge more for your time.

Choosing Your Path

The amount of money you decide to save before quitting your day job depends on your risk tolerance and your appetite for work.

It’s a game of trade-offs.

The more you save, the more likely your portfolio will be able to endure long retirements. Unfortunately, this means you might have to stick it out at a job you dislike for several years to build up this portfolio.

On the other end of the spectrum, the less you save, the more you will be dependent on active income in retirement. Fortunately, this means you can quit a job you dislike several years sooner and start earning money through work that you enjoy.

There is no universal “best path” to choose.

It’s nice to know that there are alternatives to the conventional path of saving up “25 times expenses” before retiring. When you open yourself up to earning active income in retirement, you find that you need far less money in the bank to quit your day job.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

We spent ~$40k last year on things I’d consider normalish. I’d expect that in retirement we’ll aim for something around the 40-48 range, so our target is let’s say ~1.2M just to be safe. I actually asked my wife what her number was, and she didn’t seem super comfortable with 1.2M but I also think she probably doesn’t know that math yet 🙂

Anyway, I would love to do some part-time consulting for a few years in “retirement”. I think I could charge $75/hr, maybe $100 at that point. My goal is to work no more than 3 days a week, 6 months a year.

$75/hr x 24hr x 26weeks = $46800 = more than enough so that we’d barely have to touch our nest egg, most likely.

That’s my ‘early retirement’ plan as of now, and I think it’s semi-reasonable. Other people in similar roles in my industry are making $90-$120 an hour, so the hourly rate should be reasonable.

Thing about all of it though is that I don’t think either my wife or I would feel comfortable shifting to this setup until we have our house paid off. I don’t think either of us want to draw down our nest egg to pay for the mortgage, so we’re kind of timebound by that.

That means I’m trying to find the “perfect” balance where mortgage payoff intersects the amount of money we need to have saved.

Another great post on this subject.

Lost in the usual retirement math is the available income from future SS retirement benefits. When added to savings and earned income, the whole 25 x earnings argument is turned on its head. In our case, my SS (was taken at 62) will soon be expanded by my wifes’ SS. That will be a huge bonus.

BTW, youngsters. SS WILL still be there when you retire. The retirement ages and benefits may be tweaked, but it will survive. As a young insurance salesmen in the late 1970’s, we were taught the nuances of SS benefits. Popular wisdom was that SS would not be available for us young boomers in the future. WRONG. But we did realize that SS alone would not be enough so we planned accordingly.

This was a very well done series! I never realized how big a role that active income could play for retirement savings. I think using these type of examples helps make the huge retirement number feel much more attainable for people.

Thanks, Matt!