3 min read

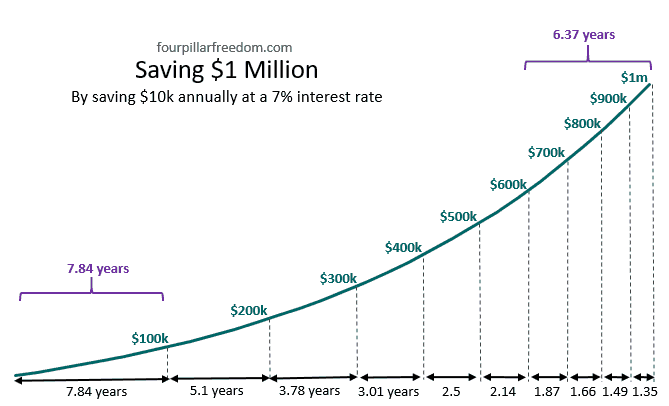

In a previous post, I explained that saving the first $100k is the hardest net worth milestone to reach. Every subsequent $100k takes less and less time to save, though.

In fact, it takes more time to go from 0 to $100k than $600k to $1 million, assuming consistent $10k annual savings and 7% annual investment returns:

Recently, I was thinking about this chart when a thought popped into my head:

How much do investment returns account for net worth growth over time?

For example, when your net worth increases from $0 to $100k, how much of that increase comes from savings and how much comes from investment returns?

What about when you go from $100k to $200k?

Or $200k to $300k?

Savings vs. Investment Returns

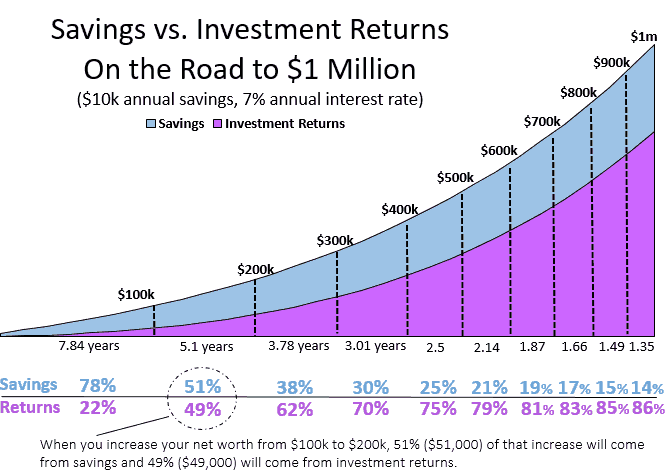

To answer this question, here is a chart that shows how much investment returns account for net worth growth, for every $100k net worth milestone up to $1 million:

Someone who saves and invests $10,000 each year at a 7% interest rate will accumulate $100k in 7.84 years. Out of this $100k, 78% of it will be composed purely of savings. The other 22% will be composed of investment returns.

This is why, if you’re at the beginning of your net worth journey, you should focus on saving as much of your income as possible. Most of your net worth increase in those early years will come from savings, not investment returns.

Notice how investment returns start to become more influential as your net worth increases, though.

When you increase your net worth from $100k to $200k, 51% of that increase will come from savings and 49% will come from investment returns.

For each $100k net worth milestone, investment returns begin to account for more and more of the increase.

By the time you reach $900k, a whopping $86,000 of the last $100,000 you need to reach $1 million will come from investment returns.

Savings as a Percentage of Net Worth

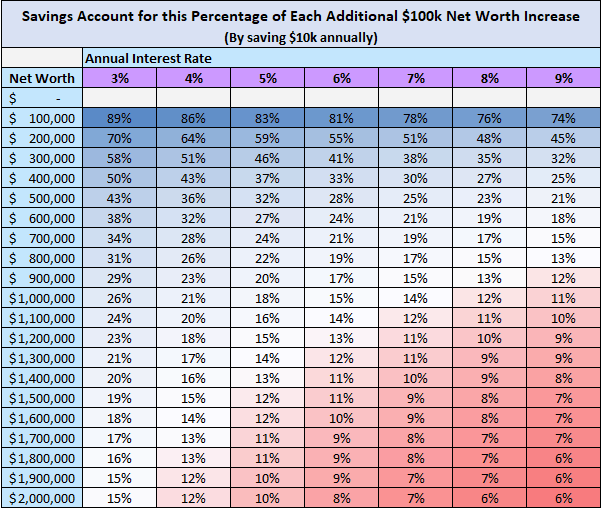

To see the effect of different interest rates, here is a chart that shows what percentage of $100k net worth increases are composed of savings:

How to interpret this chart: Take a look at the 3% Annual Interest Rate column. When you increase your net worth from $0 to $100k, 89% of that increase will come from your savings. When you increase your net worth from $100k to $200k, 70% of that increase will come from your savings, and so on.

Notice how the majority of your first $100k will come from savings, no matter how stellar your investment returns are. But as your net worth increases, savings account for a smaller and smaller percentage of each $100k increase.

The Takeaway

Keep in mind that this specific example assumes you save $10,000 every year. If you save more than that, your savings will account for a higher percentage of each $100k net worth increase.

No matter how much you save each year, a similar trend shows up: In the early years, your savings are far more important than your investment returns. As time goes on, investment returns become more influential.

Once your investment returns begin to overtake your savings, your net worth begins to skyrocket. That’s why, in the first example, it takes more time for someone to increase their net worth from $0 to $100k than from $600k to $1 million.

The takeaway here is simple: Grind it out in the beginning to build a solid foundation. After you reach a certain point, investment returns will begin to make life easier.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Another excellent one, Zach. You do a great job of letting the numbers present these concepts in an easy to understand, but impactful way.

I agree with the takeaway, for me it really reiterated the value in saving diligently in the early years so that later on the compounding returns will do the majority of the heavy lifting. This then opens up so much freedom to choose how we spend our days because there isn’t as much need to trade time for money.

Love the charts to illustrate this. We’re near that cross-over point, but with us saving a lot more this year than we had in the past, we probably are delaying that ‘tipping’ point for a little while. It’s still a good move because it just means our trajectory steepens a bit compared to previously! Can’t argue with that, haha.

Everyone starting out should look at this. Getting set up with that foundation early was huge for me, but if I’d been even more diligent on it I’d have probably 4-5x what I do today.

I’m still on my journey to that first $100K and there are definitely days when I feel discouraged by the progress others have made by starting earlier. I appreciate posts like these that remind me to focus on my own efforts and to remember that investing is a marathon, not a sprint 🙂

Great message. Start now and start hard so then you can cruise to the finish line. Would it be appropriate to look at the 7% column since that’s the average market return over time?

That’s great! Super motivating stuff! I recently passed the $100k milestone, and while it feels spectacular, it seems like real significant money is still well out of reach.

I’m glad to hear it gets better, thank you!