3 min read

I think anyone who discovers the concept of financial independence before age 30 is uniquely blessed and cursed.

Blessed, in the sense that you’re aware of the importance of saving money as early as possible. We have all read about the scenario of two friends who start investing five years apart. By her late sixties, the one who starts investing at age 20 finds herself with hundreds of thousands, if not millions, more than her friend who delayed investing until 25.

Cursed, in the sense that you’re keenly aware that compound interest doesn’t actually help you much early on. For the first few years of any financial journey, it’s just you and your savings. Grinding it out.

This slow start doesn’t mesh well with the impatient nature of most of us 20-somethings.

I often question, does discovering the idea of F.I. at an early age make us young people more likely to hate our day job? Does it cause us to see jobs purely as a barrier to financial freedom, as opposed to an opportunity to learn and acquire skills?

I think your age matters when you discover F.I.

Contrast the situation of a 22-year-old with a 37-year-old who discovers F.I. for the first time. If this 37-year-old has been contributing regularly to a retirement plan over the years, they may have a few hundred thousand in savings.

They actually have enough money for compound interest to work its magic. Combine this with a dash of frugality, and with three to six more years of diligent saving, they may be able to call it quits on full-time work.

For a 22-year-old who discovers F.I., three to six years of diligent saving might not even be enough to accumulate their first $100,000.

The Launching Point

I think discovering F.I. at an early age is more of a blessing than a curse, but not for the reason you might think.

See, I think the real blessing is being able to go from a net worth of $0 to $150k before age 30, not being able to go from $0 to $1.5 million by 40.

In previous posts, I have referred to the concept of saving up $100k – $200k before quitting your day job as a “launching point strategy.” You don’t have enough money to be financially independent, but you do have enough to launch towards a new lifestyle and walk away from a job you hate.

Venture Capitalist Paul Graham refers to this phenomenon in startups as Ramen Profitable:

“Ramen profitable means a startup makes just enough to pay the founders’ living expenses. This is a different form of profitability than startups have traditionally aimed for. Traditional profitability means a big bet is finally paying off, whereas the main importance of ramen profitability is that it buys you time.”

The idea is simple: As long as a startup company earns enough to cover their living expenses, they don’t have to seek out investors to give them a salary so they can keep working on their business.

Saving up a few hundred thousand is the equivalent of becoming ramen profitable. If you can cover your living expenses through a combination passive income from investments and active income from work you enjoy, you don’t have to seek out a full-time job that you hate for a salary.

The Marathon

The ramen profitability approach forces you to view life as a marathon. You build up an initial financial foundation quickly, possibly doing work you don’t enjoy, so you can exit the rat race as fast as possible and earn income doing something you do enjoy over the course of several decades.

The more time I spend thinking about money and life, the more I warm up to the idea of taking a multi-decade slow approach to accumulating wealth so I can spend more time enjoying life along the way.

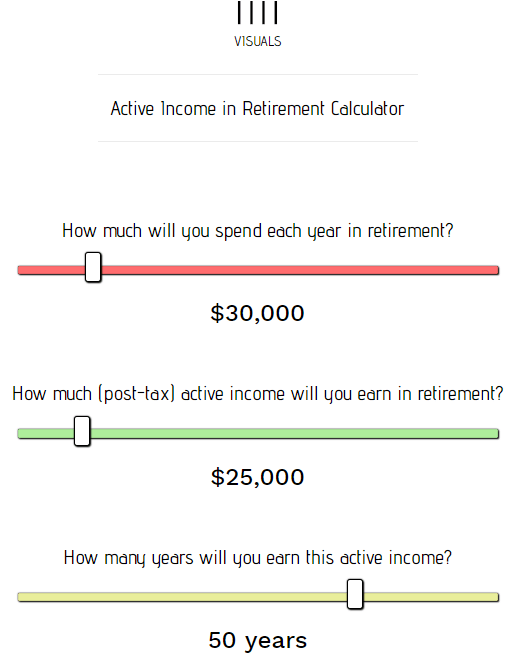

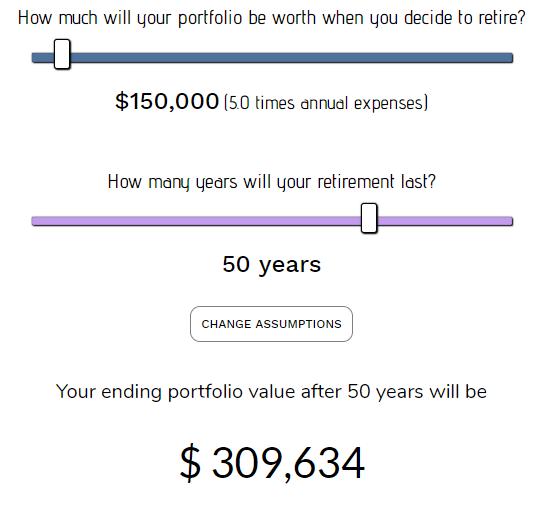

That’s why I have written so much recently about the impact of active income on retirement here, here, and here. It’s why I built the Active Income in Retirement Calculator.

Using this calculator, it’s fun to plug in different numbers to see exactly how little I need to save before quitting my day job.

For example, if I spend $30k per year in retirement, and earn $25k per year doing something I enjoy for the next 50 years, I could walk away from my day job with only $150k in the bank and never run out of money over the course of these 50 years (assuming 7% ann. investment returns, 3% ann. inflation rate):

Sure, this assumes I have to earn active income each year in retirement, but the number of people who achieve financial independence only to create their own business, blog, or product and earn $25k or more each year is quite high.

If I can quit my day job a decade sooner and cover my expenses doing something I love, that’s ten years of my life I can get back from Corporate America.

Little Expenses = Large Living

No matter how you slice it, minimizing your expenses is the ticket to achieving your financial goals as fast as possible. If you can happily live on $30k per year instead of $50k, you can become ramen profitable years sooner and your savings will cover your annual expenses for much longer.

For young people in particular, who have no kids or a mortgage, $100k – $200k can cover basic living expenses for several years. This can buy you the time to create that blog, business, or product that will help you cover your living expenses in the future.

Thoughts?

To me, the allure of ramen profitability is strong. What are your thoughts? Drop a comment below 🙂

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Interesting article Zach. What worries me is the FIRE community getting younger and younger. FIRE is growing in popularity among the late 20/early 30-year olds when our economy is robust and jobless numbers are at lows. We will have a recession again and it could be a doozy!

That’s when many qualified people with impressive resumes compete for the same scarce job. A 34 year old whose been retired for the past 3 years is going to be at the bottom of the resume heap!

This is the dark side of “Young FIRE” that no one is considering. Another factor, social security benefits for that individual is be non existent and they’re not paid enough in due to the short tenure in the workplace.

These arguments I’m making should be the topic of a future blog posting.

I think you brought up good points for discussion and to think about MrFIREby2023. I have never thought about the other impacts you brought up.

For the social security benefits portion, I think it might still be “enough” if the individual still has active income during FIRE. Even if they are self employed, they’d be paying social security taxes to receive the benefit later on. And also, the hope of FIRE is that social security is the icing on the cake once retirement age is attained instead of a necessary source of income. That’s just my two cents, I may be wrong, but thanks for the food for thought.

I only learned recently that when Social Security is calculated, the 35 highest earning years are used to figure out the monthly benefit.

Truly early retirees may not be counting on Social Security (and it is fashionable to assume it won’t be around!) but I’m personally planning to self-fund an early retirement for between 5 and 10 years before I can tap my tax-deferred accounts at age 59 1/2, and then live on those until I can draw SS at either age 67 or 70, depending on how things are going.

Therefore I am very keenly aware of the 35 years of earnings rule, and will have as few years of 0 earnings as possible. I’ve even worked out at what point I’ll start replacing the very low income I made as a young adult with some serious salary jumps as a peak career adult, and how sticking around a year or so might affect the total amount of my SS payout. But I’m definitely not going to work one more year just to top off SS.

Thanks for the kudos Ernie. The other major concern I have is that most of the FIRE bloggers invest solely in index funds. I understand that saving on fees is very important and so is not being to active in trading.

However, Indexing and passive investing seems to be a herd mentality. All of the major index funds hold the same stocks in their top 10 holdings, lots of FAANG stocks.

When stocks have to be sold in order to meeting redemption requests (during the next BIG selloff), the index funds will all be bailing out of those same top ten “liquid” stocks at once. Katie bar the door!

I’ve shared my diversified, non-correlated portfolio on my blog recently: https://firechecklist.net

MrFIREby2023

It’s all about tradeoffs – if you’re worried about a market downturn or having trouble finding employment after an extended break, then save more money at the outset. With anything, there are pros and cons to “Young FIRE”, the most obvious pro being more freedom over your time and the most obvious con being the possibility of running out of money. To hedge against running out of money, it helps to build a larger pile of savings before quitting your job to pursue your own work.

I’ve been reading your posts with great interest and I think you are doing a nice job with the data crunching.

One thing I notice is that your posts seem focused on just two versions of life: high-paying job a person loathes, vs a low-paying job that the person can tolerate indefinitely. I realize it’s far easier to write by using extremes, but if a person worked a loathed job for a decade and then dropped dead, it would be a terrible tragedy, no matter how much money was in the bank, or what their next set of plans may have been.

One of the biggest gifts in my life was discovering Your Money or Your Life when I was in my early 20s and making a very low salary. I learned quickly to think of my finite lifetime when making decisions, and as I made more money and found better-fitting jobs, my emphasis was always on listening to my gut and finding jobs I could tolerate, if not love. I would definitely rather NOT work, but I’ve never worked a job I loathed, not even for one day, and I have always always lived an extracurricular life that I love. I hope to live a really long time, but if I drop dead tomorrow, I have minimal regrets (and a decent net worth!).

I really appreciate the message you’re getting out there about getting a certain amount in the bank and then embracing a more enjoyable career path, but if someone is really loathing their day job – I think that should be fixed before getting a certain amount of money in the bank. Life is way too short to hate 40+ hours per week of it!

Great pints and that book “Your money or youth life” is the first early retirement book I ever read and it’s a darn good book!

https://firechecklist.net

MrFIREby2023

I am actually in agreement with you – if you have a high-paying job but it’s absolutely dreadful, it’s not worth your health to stick it out. I have written in a few posts that the point of life is not to quit your job, but rather to build up skills and save money so you’re always gaining more freedom over time.

I appreciate your feedback and thanks for reading through some of my posts 🙂

I’ve never heard the term “ramen profitable” before, really interesting concept. I love the idea of savings up your first $100-150k to use as a launching point. I think it comes down to finding the right balance of when to utilize that launching point. Using it to move or make a career change is a great idea, but using it to leave full time work completely would still make me a bit nervous. Personally, at this point I think I’d rather save more up front (maybe $500k) so that I wouldn’t have to make $25k every year of retirement. I think active income during retirement is likely, but I’d rather put in a few more years up front to buy myself some more flexibility for my income to fluctuate in the future. It definitely has me considering a variety of options/lifestyles.

It’s a game of tradeoffs – the more you save, the longer it takes, but the more confident you can be that your savings will support your lifestyle. The less you save, the less time it takes, but the less confident you can be that your savings can support you. Sounds like you have identified a target savings goal that aligns with your interests 🙂