5 min read

Almost all retirement number calculations are based on the 4% Rule, which originated from the Trinity Study. This rule states that once you save up 25 times your annual expenses, you can retire and “safely” withdraw 4% of your portfolio each year with a high likelihood that you’ll never run out of money.

There are pros and cons to following this rule. On one hand, if you are able to save up 25 times your annual expenses, you can be confident that your portfolio will survive most retirement periods. The downside, unfortunately, is that it can take a considerably long time to save up this much money. How long exactly? That depends on your savings rate.

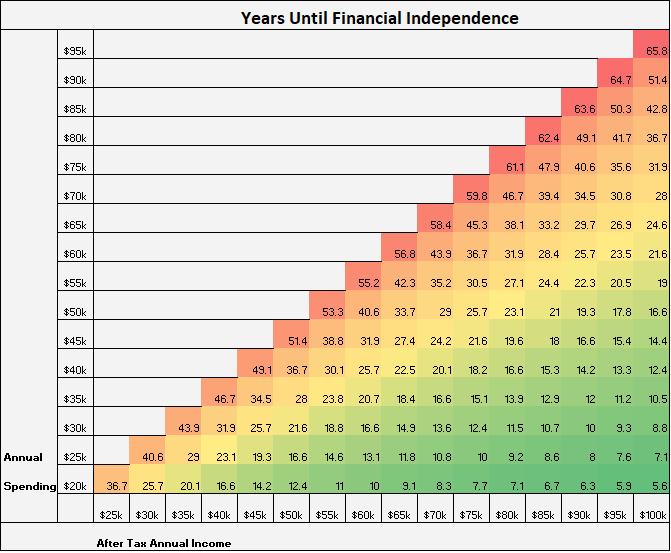

The grid below shows how long it takes to save up 25 times your expenses, based on your annual income and spending. The grid assumes you start with $0 and that your savings grow at a rate of 5% annually.

For a more dynamic tool, check out this calculator that lets you change the annual interest rate and your starting net worth.

Consider a couple who finishes paying off their student loan debt and achieves a net worth of $0 by age 30. By saving 50% of their after-tax income each year, it will take them just over 16 years to achieve financial independence (F.I).

If this same couple can push their savings rate to 60%, they can achieve F.I. in about 12 years (take a look at $100k in income and $40k in spending on the grid).

Granted, they’ll be able to retire far sooner than most of their peers, but they’ll still have to stick it out at their day jobs well into their 40’s.

If they like their jobs, this might be a viable option. Unfortunately, most people either hate their day job or they feel ambivalent about it. Even people who enjoy their job often wish they could work less so they could spend more time with family. This is why the thought of spending another decade or more in a lousy work situation just to achieve F.I. can be incredibly discouraging.

Fortunately, I believe there is an alternative path.

Active Income

There is one major assumption boiled into the 4% Rule that many people overlook:

The 4% Rule assumes that you earn zero dollars of active income in retirement.

If you’re willing to incorporate part-time work into your retirement, you can quit your day job before you save up 25 times your annual expenses. The trick is to rewire your brain to recognize that work is not evil.

If you’re thinking to yourself “I don’t want to work at all in retirement, I just want to spend my days relaxing in the sun“, I have a rebuttal to that.

I have a hypothesis that most of us hate the thought of “work” because the only type of work we have ever known has involved spending 40-50 hours each week in an office working on uninteresting projects with soul-sucking commutes.

This causes us to associate our one-week vacations each year with relaxation and happiness, while associating “work” with unhappiness and dread. I believe this is why most people assume that not working at all in retirement must be the formula for a happy life. Unfortunately, this isn’t the case.

The Role That Work Plays in a Meaningful Life

I have read many accounts of people who have achieved financial independence, only to realize that having the freedom to lay around and do nothing all day quickly becomes boring.

One example of this comes from the well-known YouTuber Alex Ikonn, who had read The 4-Hour Workweek by Tim Ferriss, started his own online business, and earned enough passive income that he no longer needed a traditional job. He was financially independent.

Yet, in this video, he explains that his life began to feel “meaningless” once he achieved F.I. because he found himself with so much free time and nothing to do all day. It wasn’t until he started to build new things and help people that life started to feel meaningful again. He mentions this at around 13:55.

The true path to happiness doesn’t involve lounging around the house all day doing nothing. It involves finding ways to contribute to society through work you enjoy.

One example I gave in an earlier post was that of a coworker I had at a tutoring center who worked part-time on the weekends because he enjoyed the job so much:

“In college, I used to work at a math tutoring center where tutors got paid $12 per hour. One of my coworkers was a guy in his 40’s who only worked on Saturday mornings. He told me he did it just because he loved math and helping students.

Each Saturday we would work a six-hour shift, which meant we earned about $60 after-tax. This guy worked every Saturday which meant he earned an extra $3,120 ($60 * 52 weeks) in income each year.

To put that in perspective, that’s the same as earning dividends from a $104,000 dividend stock portfolio with a 3% dividend yield. By working one day a week at a job he loved, he had the same spending power as a $100k portfolio.”

This guy is a prime example of someone who found work he enjoyed and used it to supplement his income. To him, tutoring didn’t even feel like a job. This is the type of work situation we all crave – earning money doing things we would gladly do for free.

If you’re someone who thinks “I don’t feel passionate about any type of work, though. All work just feels boring and monotonous to me“, I suggest reading this post.

Getting Started: The Hard Work

This financial path is not all sunshine and rainbows. There is some hard work that has to be done up front. While you don’t need the massive “25 times expenses” portfolio, you will still need to save up a decent chunk of money to give yourself financial flexibility.

For a young person like me, with only myself to look after and many working years ahead of me, I might be fine with saving up as little as 3 – 7 times my annual expenses before quitting my day job. For someone with a family and a lower risk tolerance, they may want to save closer to 10-15 times their annual expenses. How much you save up front will be determined by how much you’re willing to work during retirement.

Closing Thoughts

When you’re on your deathbed, you won’t care about how much money you saved to live a life true to yourself. You’ll only care about what that money allowed you to do – your contribution to others, your work, how you were known by your family, and who you inspired.

If you’re willing to incorporate work into your retirement, you can start living a life true to yourself much sooner than if you force yourself to save up 25 times your expenses.

In upcoming posts, I’ll show the math that determines how much you need to save up front, based on how much you’re willing to work during retirement.

NOTE: Saving up 25 times one’s annual expenses can be the right financial path for some people. This is simply an alternative approach for people looking to quit their day job sooner who are willing to take a slower, more drawn out approach to financial independence.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

BaristaFI for the win! Hahah

I think once we hit a certain number we’ll start looking at ‘BaristaFI’ type opportunities and save up some cash for a bit of a runway on them.

Best of luck on your BaristaFI approach, Dave!

I look forward to the other parts of this post. I’m interested in pursuing “Coast FIRE”.

I am a few years past FI but continue to work. I just am careful about what I choose to do. It’s the best way.

I saved well over 25x and still decided to work a 16 hour week(not a 4) after I early retired because 16 hours feels right when it comes to keeping me happy. I didn’t use it to accelerate my FIRE date, in fact I worked way past FIRE because I was having too much fun to quit. I just do it because I still get to enjoy the fun parts of my old 9 to 5 world but instead of a five or six day work week I now have a five or six day weekend every week! But sitting here with a zero withdrawal rate I do sometimes ponder if I should have gone FIRE ten or fifteen years earlier? Using your very sound reasoning I probably could have safely done that.

You probably could have left your day job sooner, but it sounds like you enjoyed it so much that quitting wouldn’t have raised your happiness substantially. Congrats on saving well over 25x your expenses 🙂

Brilliant, Zach! Maybe because I can imagine writing the same exact thing. 🙂

Passive income is a game changer. We were fortunate to dip our toes into real estate rental investment back when the market was still in recovery mode. In early retirement, I can count on rents to keep our cash flow in good health.

There’s other options, like inventing bogus supplements to market to idiots, like Mr. Ferriss, or you could write a book about it that seems to sell like hotcakes all on its own (yeah, I own a copy.)

Thanks, Cubert! That’s great to hear you have rental investments to generate some cash flow for you in retirement. That will make a huge difference. Despite Tim Ferriss receiving plenty of hate for his Four Hour Workweek book, I think he has added actual value to people’s lives through his two most recent books Tools of Titans and Tribe of Mentors. Perhaps it’s because he is already financially independent that he can focus on writing books for enjoyment rather than for the monetary benefits. I’d recommend checking them out if you haven’t already 🙂

Retirement is the most desperate period of life in a way that finances getting shorter while expenses getting bigger. That’s why it will be a wise strategy that you manage to create some active income resources at this stage. This will enable you to retire early and enjoy the life before getting too old to travel.

Completely agree, Paul!