5 min read

In Part 1 of this series, I explained that actively earning income during retirement can be the key to retiring sooner, with less savings in the bank. In this post, I share the math to support this idea.

Let’s run some numbers!

The Traditional Retirement Route

Consider a couple who typically spends $40k per year. They decide to follow the traditional 4% rule and save up 25 times their annual expenses before quitting their day jobs. They decide to earn no active income during retirement.

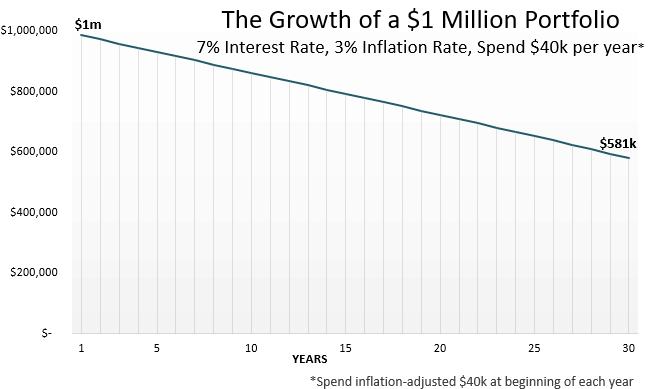

If we assume their savings grow at 7% annually, inflation grows at 3% annually, and each year they spend the inflation-adjusted equivalent of $40k, here’s how their portfolio will do over the course of a 30-year retirement:

After 30 years, their portfolio will be worth $581k. Clearly saving up 25 times their annual expenses would be more than enough to support this couple during retirement, based on these specific interest rate and inflation rate assumptions.

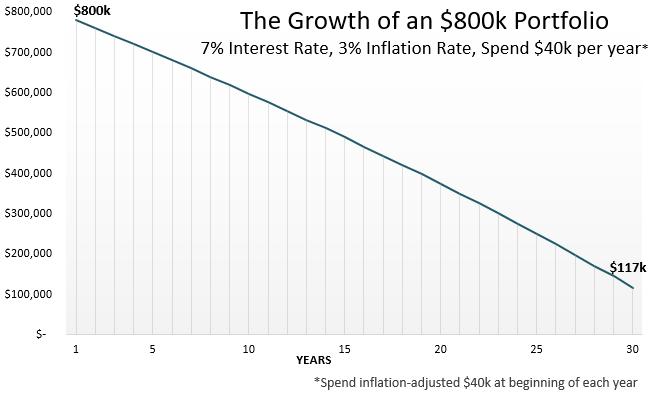

Consider instead if this couple only saved up 20 times their annual expenses ($800k) before retiring. Using the same assumptions, here’s how their portfolio would do over time:

Again, their portfolio would survive this retirement period, but this time with only $117k left after 30 years.

If this couple knew for a fact that all these assumptions (a retirement period of 30 years, inflation grows at 3% annually, interest rate of 6% annually) would hold true, of course they would only save up 20 times their expenses before retiring.

Unfortunately, the future is unpredictable.

What if this couple instead lives long enough to experience a 40-year retirement period? What if their investments only grow at 3% annually? Because of these uncertainties, this couple would be in a safer position if they instead saved 25 times their annual expenses.

These simple examples illustrate why saving 25 times your annual expenses is a good idea. It holds up well over typical 30-year retirement periods.

But these examples assume this couple earns zero dollars in active income during retirement. What if they worked part-time in retirement?

The Active Income Retirement Route

Suppose this couple earns $15,000 (post-tax) each year during their 30-year retirement doing something they enjoy. That’s only $7,500 per year for each of them. That’s about $144 per week.

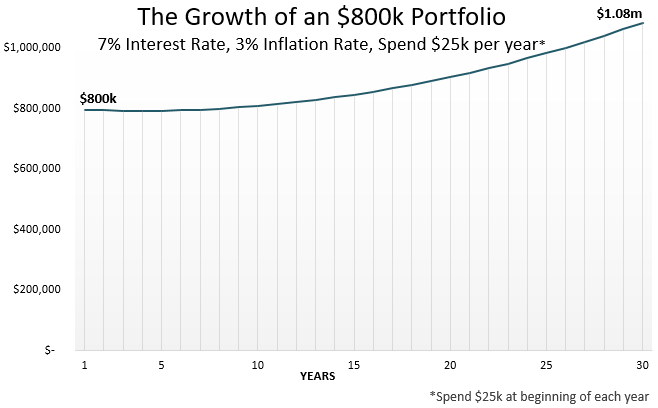

Let’s assume their earnings keep up with inflation, so each year they only need to withdraw $25k from their portfolio to support their living expenses. Here’s how their “20 times expenses” portfolio will grow over the course of a 30-year retirement period:

In this scenario, the portfolio actually increases in value to over $1 million by the end of the 30 years. Keep in mind, this is a “20 times expenses” portfolio!

To me, this result is mind-blowing. Each individual in this couple only needs to earn a measly $144 per week in order for their portfolio to maintain and even increase in value during retirement.

This begs the question, “how would an even smaller starting portfolio perform over time?”

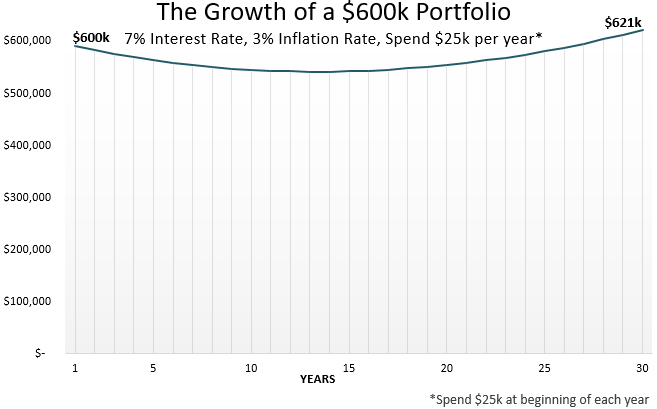

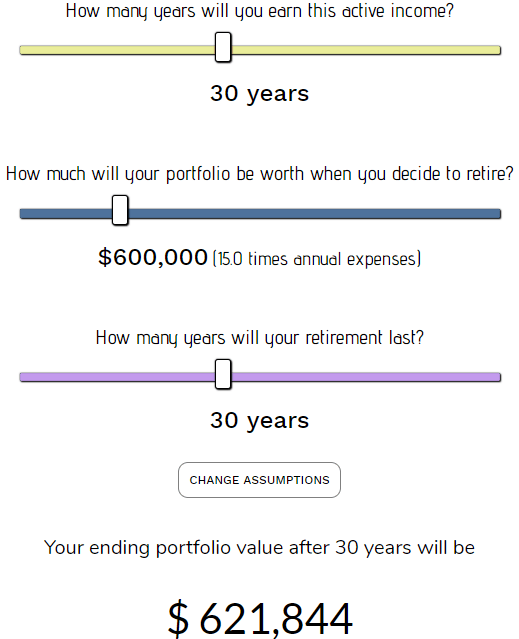

Suppose this couple only saves up 15 times their annual expenses ($600k) before retiring. Assuming they earn the inflation-adjusted equivalent of $15k each year (so they only need to withdraw $25k per year from their portfolio), here’s how their portfolio would perform over 30 years:

Even this portfolio increases in value over 30 years!

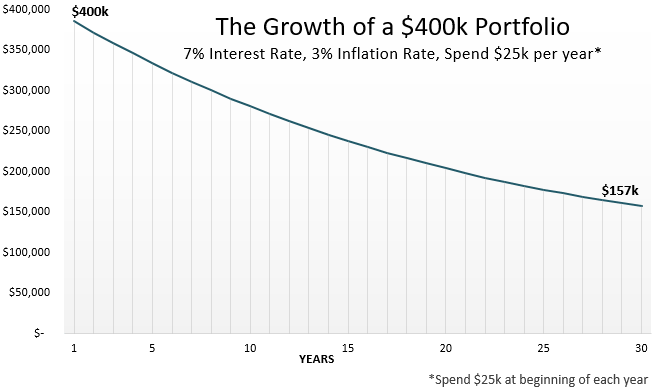

Suppose they only save 10 times their annual expenses ($400k) before retiring. Assuming they earn the inflation-adjusted equivalent of $15k each year (so they only need to withdraw $25k per year from their portfolio), here’s how their portfolio would perform over 30 years:

In this scenario, their portfolio dropped in value to $157k after 30 years, but it still survived this entire retirement period.

Under these assumptions, a couple who saves only 10 times their expenses before retiring could support themselves for 30 years if they’re willing to earn the inflation-adjusted equivalent of $15k per year through active work.

Unbelievable.

These findings are encouraging, but they do make the assumption that you (and possibly your partner) are willing to work every year in retirement to earn income. As I wrote in Part 1 of this series, work is an important component of a meaningful life, but there may come a time when you no longer want to work at all.

Maybe you want to work part-time for the first 20 years of retirement and then quit working entirely. Or maybe you only want to work for the first 10 years. To account for these types of scenarios, I built an interactive calculator.

The Active Income in Retirement Calculator

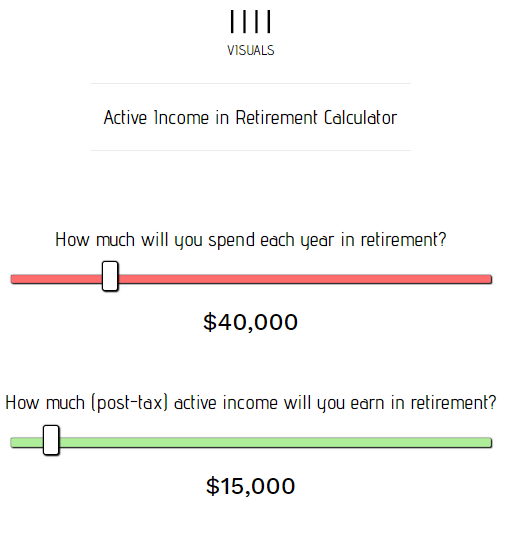

Yesterday I shared the Active Income in Retirement Calculator, which shows how active income during retirement impacts how much you need to save to retire.

Using this calculator, you can tweak the inflation rate and interest rate assumptions:

I could literally run through a million different examples to show how active income impacts retirement, but I’ll leave it to you to play around with the calculator. This way, you can change the assumptions and numbers to reflect your specific situation.

The Takeaways

1. The more you’re willing to earn in active income in retirement, the less you need to save before you quit your day job.

2. The assumptions you make on inflation rate, interest rate, and how long you expect your retirement to last, will dramatically impact these calculations.

3. If you’re willing to work part-time during every year of retirement doing something you enjoy, you may need to save as little as 5-10 times your annual expenses before quitting your day job.

I encourage you to play around with the calculator to see how different assumptions lead to different results. Set the retirement period to 70 years. Change the annual interest rate to 2%. Adjust the starting portfolio value. Go wild.

I think you’ll be surprised at just how much active income can impact how much you need to save before you quit your day job.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Do these scenarios even factor in social security benefits? If not, there’s your active income with no need to work!

Nope, they don’t factor in social security benefits!

That’s is such a relief for your loyal readers Zach! That is HUGE! Which makes your blog posting all the more re interesting.

That means a 55 year old with $1 million saved could retire on 5-6% withdrawal (4% is a Lock!) and plan to take S.S. Distributions at age 62 and still be in great shape, simply ratcheting the withdrawal back down to 4% and not outlive the neat egg. It’s a “Me Love You Longtime” moment! LOL.

Boom. And there you have it. Skinny FI with something like Barista income. This is awesome. This isn’t showing probabilistic market returns, but its a good start to show people that this could be an early exit strategy for them, if the they want to do this. This of course assumes that people can continue to work – there are people who become disabled over time, reducing or eliminating their ability to secure employment. Good job.

All great points. Some people do decide not to work after retiring for various reasons, but hopefully this math encourages some people to consider a longer working life, if they can find something they enjoy doing 🙂