3 min read

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO.

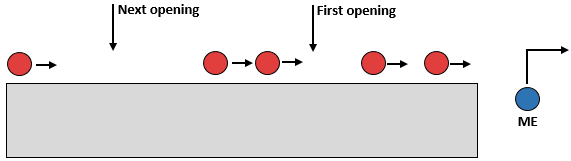

When I was first learning how to drive, my dad taught me a valuable strategy for deciding when to make a right turn at a stop sign.

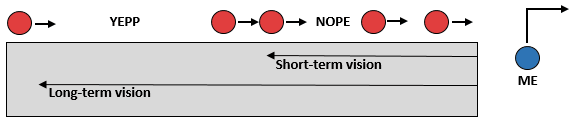

He said new drivers often make the mistake of turning at the first possible opening in traffic. A better strategy is to look farther down the road because usually there’s a wider opening that makes for an easier, slower turn:

By having a long-term vision, you can see farther down the road and identify the best opening.

This illustrates the advantage of long-term vision in driving, but this same principle applies to investing.

The Fallacy of Short-term Thinking

When I first started investing, I thought the fastest way to grow my money was through buying and selling individual stocks. I would pick a stock, hold it for a few months until it went up a bit, then sell it. I had a short-term vision.

What I didn’t realize was how much money I was actually losing in the form of trading fees. Each time I bought a stock, I paid $8.99 Each time I sold, another $8.99 went out the door. This was essentially canceling out any gains.

In a study from 1991 to 1996, researchers analyzed the investment returns of over 60,000 households. The study found that households who traded stocks most frequently earned 10.0% annualized returns, while the market earned 17.1% returns during this same time period.

This finding has showed up in numerous investment studies. In general, active traders severely under-perform the market due to incurring high transaction costs. Even the traders who use no-fee apps like Robinhood typically under-perform due to poor market timing and short-term-gain taxes.

The Knowledge of Warren Buffett

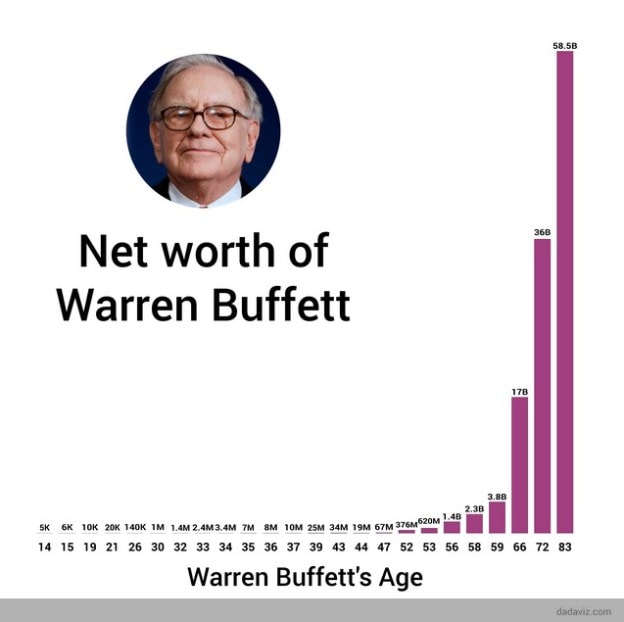

As an investor, you can do yourself a favor by drawing upon the wisdom of investor Warren Buffett, who is a famous long-term thinker.

In reference to Berkshire Hathaway’s investment philosophy, Buffett says,

“Our favorite holding period is forever.”

This strategy has paid off nicely for him over the years:

This long-term perspective is the reason that Warren, along with his partner Charlie Munger, is able to buy stocks during market crashes when most investors are selling.

While most investors focus on returns over the next 30 days, Buffett is looking at the next 30 years. That’s his advantage.

Risk

In the short-term, investing in stocks can be risky.

In one of my favorite investment books, Stocks for the Long Run, Jeremy Siegel explains:

“In the short run, however, stock returns are very volatile, driven by changes in earnings, interest rates, risk, and uncertainty, as well as psychological factors, such as optimism and pessimism as well as fear and greed.”

If you’re someone who has a short investment horizon, this can be scary. In fact, the fear of losing money causes many people to avoid investing entirely.

Part of the reason is due to the phenomenon of loss aversion:

“loss aversion refers to people’s tendency to prefer avoiding losses to acquiring equivalent gains: it is better to not lose $5 than to find $5.”

This means the pain of investment losses is far more powerful than the joy of equivalent investment gains. Despite the fact that the market goes up in most years, the possibility that it could go down in any given year is enough to scare many people away from investing.

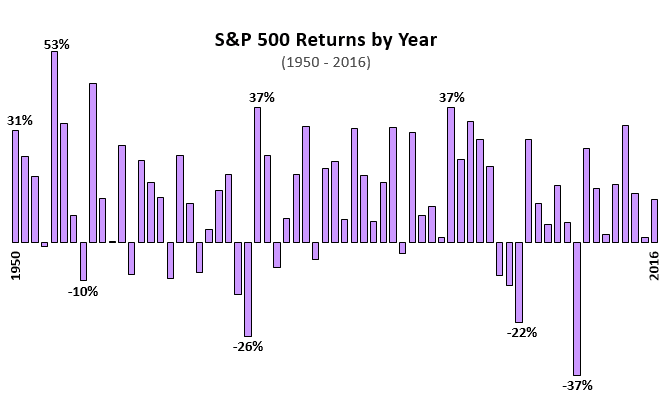

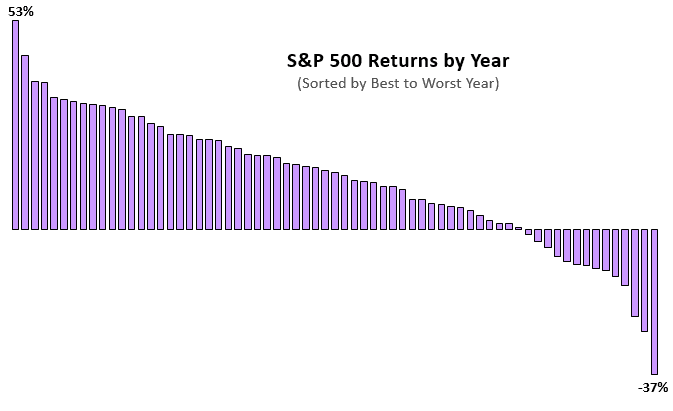

If we only look at yearly stock returns, we can see just how volatile the market can be:

But if we take a slightly different view, we can see that most years the market goes up:

If you’re playing the short game, you might catch one of the down years. But if you play the long game, you’ll catch many more up years than down years.

Playing the Long Game

The best way to invest is to develop a long-term vision. Don’t worry about market returns over the coming weeks or months. Instead, focus on the coming decades.

Financial blogger J.D. Roth says,

“…the best way to approach stock-market investing is to take the long view. Forget about what the market does today or tomorrow. Focus on the future.”

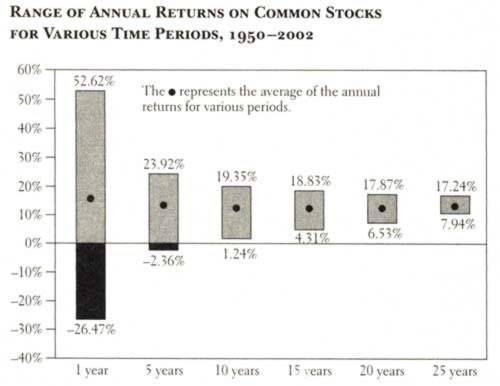

He also shares a wonderful chart from the book The Random Walk Guide to Investing:

Notice how volatile stock returns can be on a yearly basis. As you increase your investment horizon, though, volatility tends to decrease. The worst 25-year period for common stocks from 1950 to 2002 earned 7.94% annualized returns.

I’m Looking at 2048

I have no clue how the stock market will perform this week. Or this month. Or this year. Nobody does.

I do have a pretty good idea, however, of how it will perform over the next 30 years, which is all I care about. I expect stock prices to be significantly higher in 2048 than they are now, which is why a market crash or two over the coming decades doesn’t scare me.

Whether you’re a novice or a seasoned veteran, you can benefit from developing a long-term vision. When you’re focused on investment returns over the course of decades, you’re less likely to sell during downturns, less likely to time the market, and less likely to actively trade stocks in search of short-term gains.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Someone said to me yesterday that buying and selling individual stocks is more fun. I thought to myself, I’d rather have fun watching my investment grow over a long period of time through a low-cost fund that continuously follows what individual companies are doing. I wish I could refer them to this post.

I’ve followed stocks in the past; it’s just more time and energy consuming. And you’re right transaction costs creep up and there’s that psychological thing where you may continue to follow a company even after you sell it.

Great charts by the way; the market has definitely performed well in the majority of its years.

I have dabbled in individual stock picking in the past as well, but for the most part I’m an index investor now. Thanks for the kind words 🙂

That Warren Buffett chart is amazing! That’s why he’s one of the richest people on the planet.

Investing for the long term is the easiest way for regular investors. We can focus on saving more and don’t have to worry about how the stock market is doing. We only really need to worry when we’re ready to retire. That’s when we need to be more conservative.

Couldn’t agree more, Joe!

Solid writing and excellent visualisations, as per usual.

Do you have any thoughts on the long-term vision of Sequence of Risk Returns (SRR) particularly as it relates to those who have recently gone FIRE or are trying to decide when to FIRE?

Thanks, Aaron! I am actually writing a post on SRR right now, which I plan on publishing tomorrow. Hopefully that will answer any questions you have 🙂

Longterm vision is so important, and something that many millennials seem to struggle with. Investing is the best example, but there are other examples such as saving money, and choosing what to spend money on. Will this purchase positively impact the longterm or is it something we’ll quickly forget about?

Thanks, Matt! Great point about long-term views with purchasing as well.