3 min read

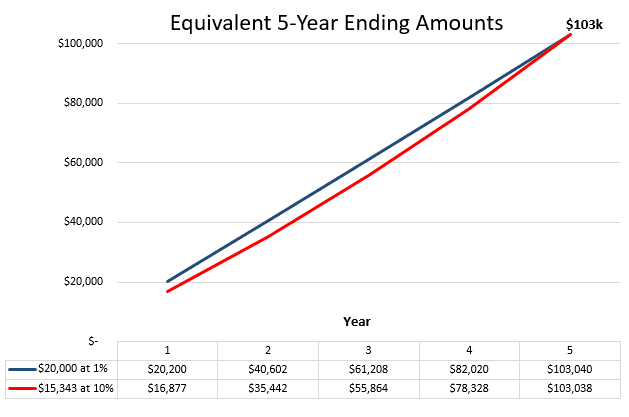

Fun fact: Someone who invests $20,000 per year at a 1% interest rate will have $103,040 after 5 years. Someone who invests $15,343 at a 10% interest rate will also have (roughly) $103,040 after 5 years.

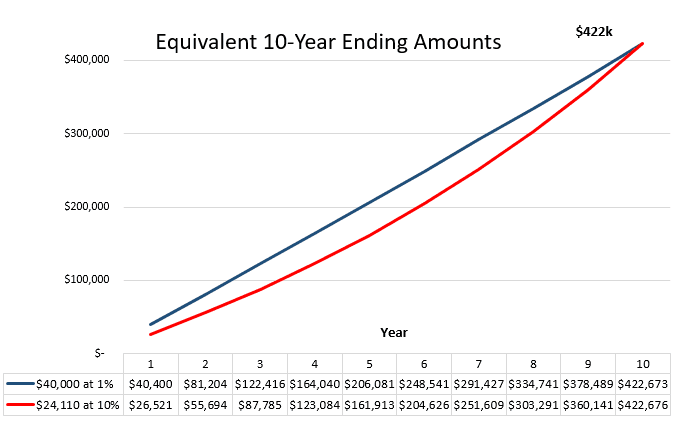

Another fun fact: Someone who invests $40,000 per year at a 1% interest rate will have $422k after 10 years. Someone who invests $24,110 at a 10% interest rate will also have $422k after 10 years.

These two examples illustrate an important concept in personal finance: a high level of savings can help offset poor investment returns while stellar investment returns can help offset a low level of savings.

This is why person A who saves $40k and earns pathetic 1% annual returns can accumulate the same amount of money as person B who saves about $24k and earns incredible 10% annual returns.

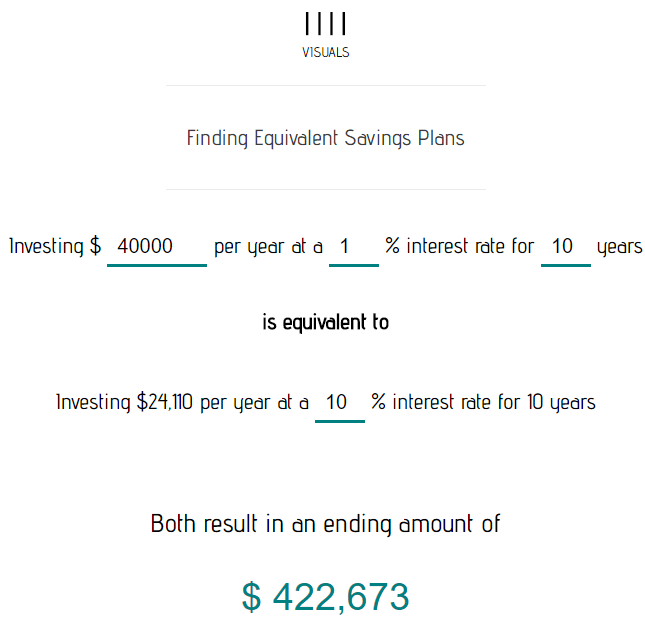

To further explore this idea, yesterday I shared a tool that shows how different levels of savings and investment returns can lead to the same ending amount during equivalent time horizons:

Using this tool, you can change the amount invested, the annual interest rate, and the time horizon on two different savings plans to see how two different levels of savings and investment returns can lead to the same ending amounts.

Savings vs. Investment Returns

In the finance world, we have a tendency to glorify investing and ignore good ‘ol fashioned saving. Part of the reason is because investing sounds exciting.

With investing, there are so many levers you can pull and dials you can tweak. You can change your asset allocation, your re-balancing schedule, and your investment vehicles. You can buy, sell, and track investments online at any hour of the day.

Saving money, on the other hand, just seems so boring. It’s more exciting to see your net worth grow by $10 thanks to investment returns instead of depositing $10 in your savings account from not buying that burrito.

But the truth is, the amount of money you save is often more important than the investment returns you earn, especially when you’re just starting out.

Going back to the first example, why is it that someone who saves $20k earning 1% returns can save $100k just as fast as someone saving about $15k earning incredible 10% returns? It’s because investment returns just don’t matter much when saving your first $100k.

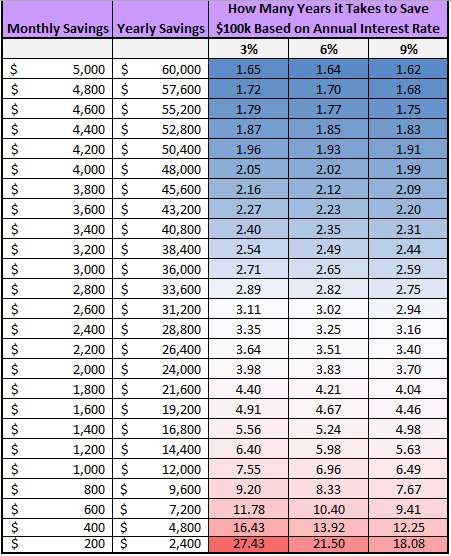

Consider this chart, which shows that if you can save more than a few hundred bucks per month, different investment returns hardly impact the time it takes to save your first $100k:

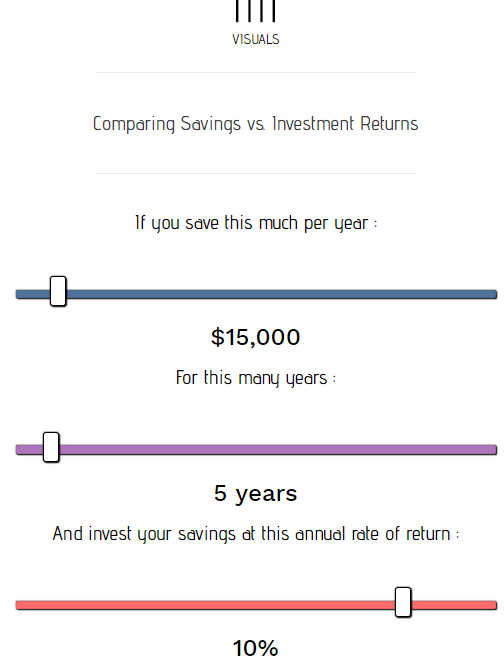

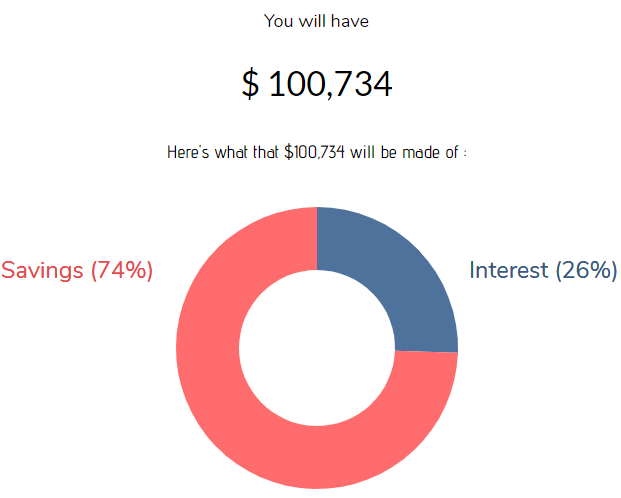

Here’s another useful tool that compares savings vs. investment returns. Using this tool, we can see that someone who saves $15k earning 10% returns for five years will accumulate just over $100k. Despite their incredible 10% returns, their raw savings still account for the bulk (74%) of their net worth:

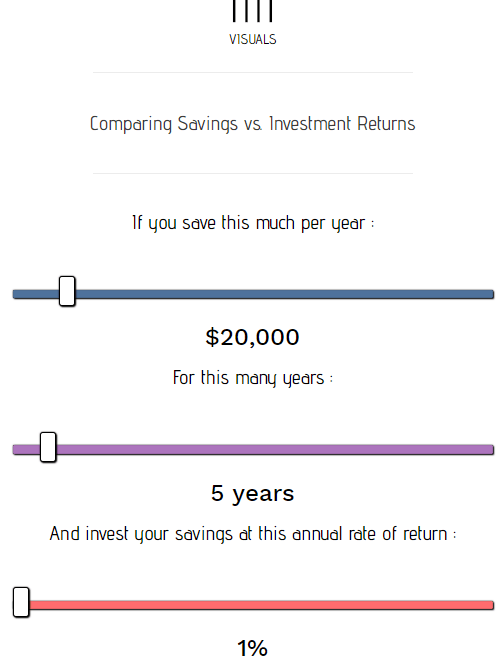

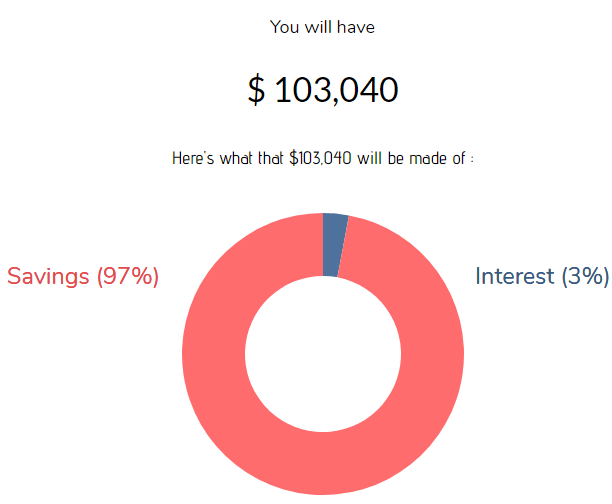

The person who saves $20k per year earning a 1% interest rate will have a whopping 97% of their net worth comprised of savings:

Focus On What You Can Control

Your net worth is simply a sum of your savings and your investment returns. It’s obviously more fun to see your net worth grow as a result of investment gains as opposed to saving a huge chunk of your paycheck, but at the end of the day they both help you achieve a common goal.

It’s important to remember that investment returns are mostly outside of your control, while your savings is entirely within your control. Sure, you can practice smart investing through index fund investing, re-balancing, and dollar-cost averaging, but ultimately you can’t control stock market returns.

You can, however, control how much of your income you save. You can pursue side hustles to increase earnings. You can practice living with less to reduce your spending. These variables are within your control.

By increasing how much you save, you give yourself the ability to offset poor investment returns. If your investments do perform well over time, that’s just icing on the cake.

Be sure to check out both of these interactive tools to see exactly how savings and investment returns impact net worth:

The Equivalent Savings Plan Calculator

Comparing Savings vs. Investment Returns as a % of Net Worth

Thanks for reading 🙂

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Nice post, Zach. As always, very helpful stuff.

Thanks, Mike! Much appreciated.

Great lesson here. I have a question not related to this article/posting.

It someone has saved 25x their expenses they’re assumed to be financially independent and can retire using the 4% rule.

Here’s what I’m interested in knowing: what is the asset allocation of those savings in order for this theory to work?

You see, I have 25x my annual expenses already accumulated (at the age of 50) yet my assets have only 10% allotted to equities at present due to my recent profit taking, paring down equities due to my lower tolerance for risk and my desire to retire early.

Only problem from a personal Gina ace standpoint is the equity allocation doesn’t allow for any portfolio growth.

Great question, Kirk. I believe the 4% rule is based on a 60/40 (stock/bond) portfolio mix. Michael Kitces wrote a nice article on the 4% Rule here: https://www.kitces.com/blog/how-has-the-4-rule-held-up-since-the-tech-bubble-and-the-2008-financial-crisis/

A 60/40 usually survives 30-year time periods more often than a 100% equities, but with lower median ending values. Obviously the more equities you have in your portfolio, the more growth you’ll see over time, but you run the risk of having your portfolio crushed during stock market crashes. Your personal allocation really depends on your risk tolerance. Equities are necessary for growth, but adding bonds to the mix can increase the probability that your portfolio survives all types of market fluctuations. In your position, since you already have 25x annual expenses it probably makes sense to have at least some bonds in the mix. 10% seems low for equity allocation, but again you have to choose an allocation that matches your risk tolerance.

Thanks Zach for the article. I’m currently 10% equities but will redeploy this cash back into equities When they’re at lower levels than here. Meanwhile I’ve picked up some 2year CD’s currently yielding 2.4%! Also, allow me to clarify something; I have 30% allocated to Real estate Crowdfunding, paying a current 8% preferred return with IRR’s ranging from 13-20%. The thing I like about this asset class is that unlike stocks or REIT’s they’re not marked-to-market each day.

I appreciate that due to my risk aversion.

Kirk

Kirk, good to hear that you have some of your savings in some growth-oriented assets. Seems like you have aligned your finances with your risk tolerance, which should give you peace of mind about your money.