4 min read

Earlier this week I met up with a friend to talk about personal finance stuff and during our conversation she said something that caught my attention:

“I don’t want to have to think about my finances all the time and track every dollar I spend, I just want to live my life each day.”

Outside of the small group of us who are obsessed with personal finance and get an adrenaline rush from filling in spreadsheets, I think 95% of the population shares the sentiment of my friend.

For most people, personal finance is either intimidating, confusing, or just downright boring. It’s not something they want to spend a significant amount of time on each day.

And although I do love my collection of spreadsheets I update each month, I completely understand this feeling. After all, even those of us who love personal finance don’t live to optimize our finances, we optimize our finances to live better lives.

Even though I spend a great deal of time writing about personal finance, creating personal finance apps, and sharing my thoughts on money, I personally only spend about 30 minutes each month tracking my own finances.

Here’s how…

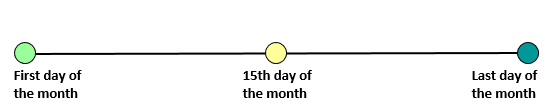

The Beginning – Middle – End Approach

I have a simple approach of only checking and updating my finances three days per month.

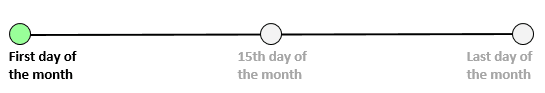

The Beginning

On the first day of each month I update my net worth. This means I check my account balances in my savings account, checking account, retirement accounts, my brokerage account, and update my numbers in my net worth spreadsheet. This only takes 5 – 10 minutes.

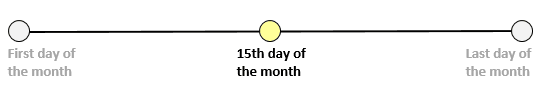

The Middle

On the 15th day of each month I check my credit card spending online and pay off the balance. This is a simple way to make sure I wasn’t charged double for any of my purchases and that all the purchases were made by me. I don’t have to pay off the balance until the end of the month, but I pay whatever balance I have anyway just because it makes me feel better. This takes about 5 minutes.

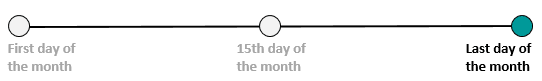

The End

On the last day of each month I update my monthly income and expenses.

I update my income by looking at what dividends I received in my brokerage account, what paychecks were deposited in my checking account, and what blog income was deposited in my PayPal account.

I update my expenses by going online and downloading all my credit card transactions for the month. I add up my expenses and visualize them in Microsoft Excel. This whole process takes about 10 – 15 minutes.

You could use a software like Mint to track all your income and expenses for you, which would make this process even faster. Part of the reason I manually update my numbers is because I just enjoy the process of doing it (don’t judge).

In total, it takes me 30 minutes or less to check and update my numbers during these three days each month.

Personal Rules of Thumb

The reason I only spend 30 minutes each month tracking my finances is because I have rules of thumb that greatly simplify my financial decision-making and tracking process.

Rule of Thumb #1: No Budget

I have nothing against budgets. For some people they work wonderfully. But I have never used one and instead I use a simple rule of thumb: when I add up my expenses on the last day of each month, I make sure I didn’t go crazy in any category and that my total expenses were similar to previous months.

I’m a naturally frugal person. I cook most of my meals, rarely buy new clothes or tech gadgets, and I don’t need much stuff to be perfectly happy. I personally don’t need a budget to ensure my spending remains low.

Rule of Thumb #2: Simple Money Rules

I have three income streams and simple rules for each stream to ensure my money is flowing into the right places at all times.

Paychecks

I have $650 deducted from each of my two-week paychecks and automatically invested in my 401(k). The remaining amount gets dumped into my checking account.

When my checking account exceeds $1,000 I transfer the excess to my savings account.

When my savings account exceeds $6,000-ish I invest in index funds in my brokerage account.

Dividend Income

When I receive dividends from individual stocks, REIT’s, and index funds I automatically have them reinvested. I don’t even see the dividends hit my bank account.

Blog Income

When I earn money through advertising, affiliate links, and promoted posts on my blog it all gets dumped into my PayPal account. At the end of each month when I total up my monthly income I simply transfer any money in my PayPal to my savings account.

Rule of Thumb #3: Long-Term Thinking

When I invest in anything I plan on holding it for several decades, if not forever. I’m investing for the long haul. Whether the market is roaring or crashing, I don’t stress about prices. I know that my investments will likely increase in value over the years and continue to pay me higher dividends as time goes on, so I just sit back and let the investments do the work. I spend very little time obsessing over stock prices each month.

The Background Machine

My finances are like a machine that’s always running in the background of my life. With every dollar I save and investment I make, the machine grows stronger and works even harder to grow my money. But I don’t actually want to check up on the condition of the machine constantly, I just want simple rules in place that keep it running smoothly.

The whole point of personal finance is to optimize your money so you can live your best life without stressing about how to pay for it. By creating your own financial rules of thumb and maintaining a long-term mindset, you can create a money machine that runs in the background of your life without constantly needing to watch over it.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

“Outside of the small group of us who are obsessed with personal finance and get an adrenaline rush from filling in spreadsheets, I think 95% of the population shares the sentiment of my friend.”

Agreed 🙂 . To your point though, it doesn’t and shouldn’t have to take a lot of time. Combining an automated platform like Personal Capital with a few additional manual tracking / analyzing elements is what I also find to be helpful.

I also liked your rules for simplicity (not necessarily frugality in every sense) and no budget. We remain frugal but still spend a healthy portion of our incomes while still meeting our goals. To your point, a budget can be very helpful to a lot of people tough. It’s all about life style choice.

Related:

https://www.balanceddividends.com/how-we-got-to-averaging-1000-a-month-in-passive-income/

Agreed – there’s no one size fits all solution. As long as you find something that fits your needs and is relatively simple, you should be good to go 🙂

First thing I do in the morning is check my account, I know its not a healthy habit but can not stop watching the pot. Not sure how to get out of it, although I don’t spend lot of time it takes about 10 min every day plus an hour every month to track my savings and expenses. On the other hand thinking about money is something which consumes a lot of time.

There’s nothing inherently wrong with checking your accounts daily, but if you do want to spend less time tracking your finances just know that it’s possible by using simple rules of thumb and automation 🙂

Love the system! I do think that obsessing over money too much can make you feel more insecure about money management, too. Once you have your system figured out, a hands-off approach is best for your mental health.

Thank you, Mrs. Picky Pincher! 🙂 And you nailed it – once you have a system set up you can sit back and let your investments do the heavy-lifting without much effort on your part.

Nice system! I personally use a combo of YNAB and Personal Capital. PC tracks my overall net worth and I use YNAB to budget my income and better organize my categories where the money goes. I get paid weekly so Wednesday evenings I take about 10 minutes to budget this income and I’m done. I like to manually enter transactions into YNAB (except for bills which are scheduled) but I don’t spend that much time entering transactions since I barely buy stuff. Mostly it’s just grocery shopping 🙂

Then once or twice a month I do a reconcile between YNAB and my bank account, credit card, retirement accounts, etc. to make sure everything checks out. I guess I spend less than an hour per month doing actual finance stuff. It helps to keep things simple (one checkings/savings, one credit card for everyday purchases, etc.).

I have heard a lot of good things about YNAB, although I have never personally tried it myself. That’s great you’re able to use a combo of YNAB and Personal Capital to simplify your finances, I think most people will find that they only need a couple (if any) tools to keep all their accounts and spending in check.

Great system. While I’m one of the 5% who love money, finances and spreadsheets, I also like to keep things simple.

I check my accounts once every two weeks when I get paid. I’m a bit too much of a control freak to let auto transfers do their thing so I log in and transfer the money where it needs to go to hit my goals. Similar to yourself I don’t have strict rules but general ideas such as investing each time my ‘shares’ account hits $5k.

Love that you also have simple rules you follow to invest excess money when your ‘shares’ account hits a certain number. I understand your manual transfers as well – there’s a certain peace of mind that comes with knowing exactly when and where your money is moving. Thanks for sharing 🙂

Great approach; can’t beat it! I do a similar approach about once a week – on Fridays and manually because I enjoy it too. Therefore I won’t judge 🙂

It takes all in all 30-40 minutes per month but I got other stuff going on too like wifey’s 401k, IRAs, kid’s 529 plan, and more than one brokerage. I need to figure out a way to optimize it a bit more.

Right now I only have my own accounts to think about, which greatly simplifies things. I can imagine managing your wife and kid’s accounts can take a bit more time each month. I think following simple rules of thumb and using a bit of automation can be the trick to optimizing and simplifying your finances 🙂

I totally agree, simplicity is best. I used to try and track my investments to see how they were doing, but now I just look at them every three months, when I have enough accumulated to buy more shares.

I also check out my net worth once a month!!! It’s a fun and special ritual to see the numbers constantly increasing. I used to check my accounts more often but all it did was make me anxious.

I also found that tracking my accounts too frequently was giving me anxiety, which was completely unnecessary because no matter what the asset prices were in those accounts I didn’t plan on selling them anyway. I find that updating my net worth once a month is a good frequency as well 🙂

I spend 30mins once a year talking with my advisor,that’s it,I also don’t believe in budgeting just put 55% of each check to work in the market.

Everything else comes out of what’s left and never go into the red.People make things way to complicated in their life,just”set it and forget it”.

Also this is by far the best blog going,keep it up!

I’m with you – as long as I’m saving and investing a huge chunk of each paycheck every month I know I’ll be on track to hit my goals without the help of a budget. And thanks so much for the kind words Mike, I appreciate all your feedback 🙂

I love using Mint to track all my finances, but I’ve found myself checking it way too often. Most of the time I’m not doing anything with the money, I just like seeing when money comes in and being aware of when money flows out. I like how your approach centers around checking on your finances at 3 points each month. This keeps things simple. I’d like to get to the point where I’m checking a few times per week instead of a few times per day.

I have never personally used Mint but I have heard it’s a great way to keep an eye on your spending and for many people it works well. I agree with you though, I like seeing my money enter my accounts as well and also being aware of when it flows out.