3 min read

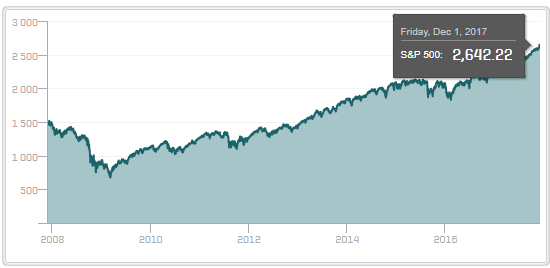

Whether you love it or hate it, the stock market has been an absolute beast over the last nine years.

Any investments made in the stock market in early 2009 have tripled in value and any investments made in early 2012 have doubled in value. Despite the naysayers screaming for the past several years that another crash is coming, the market has steadily risen higher and higher.

But with prices at an all-time high, even the most optimistic investors are beginning to wonder “Can this bull market keep this pace for much longer?”

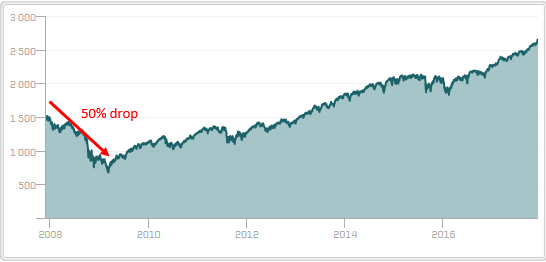

Many argue that the best case scenario would be slow, steady continued growth. On the other end of the spectrum, many consider the worst case scenario to be a potential repeat of the financial meltdown of 2008, when the market dropped roughly 50% in value:

I want to explore exactly what impact a 50% stock market crash would have on anyone who has a net worth of $100k or less.

$100k or Less? No Reason to be Scared

During the last market crash it took about 1 year and 4 months for the market to go from peak to trough. Now imagine if the next crash happens even faster and only takes one year to shed half it’s value.

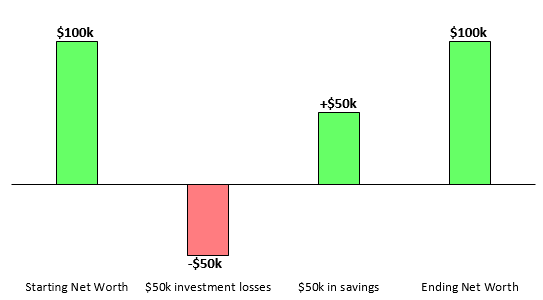

If you have a net worth of exactly $100,000 and have 100% of your money invested in stocks, your net worth would drop from $100,000 to $50,000 over the course of a year…

…but only if you don’t save any money at all during that year.

If you managed to save $50,000 over the course of that year your ending net worth would remain at $100,000.

If you’re a big saver with a low net worth, you can cancel out investment losses with your savings.

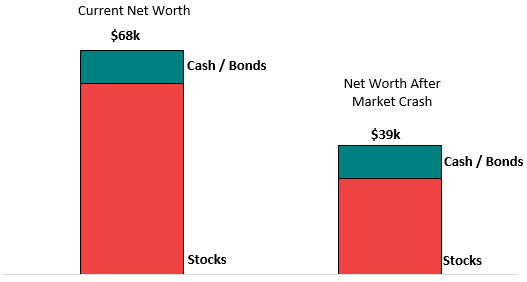

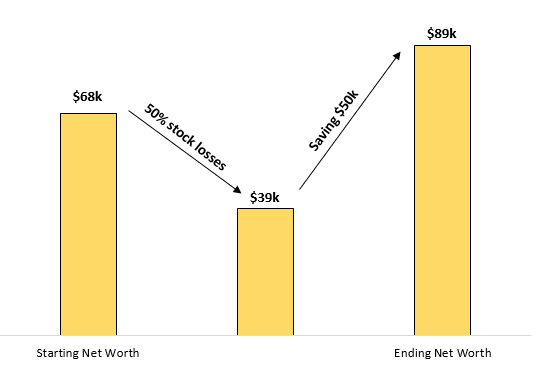

Personally my net worth is about $68k and I can save $50k a year. Around 85% of my net worth is in stocks or similar equities, so a 50% drop in value would mean my net worth would drop to $39k over the course of a year.

But that would only be the case if I didn’t save any money during that year. If I saved my usual $50k my net worth would actually still increase in value that year:

This illustrates an important point: When your net worth is $100k or less, you simply don’t have enough money invested to experience a significant drop in net worth. In many cases you can save enough money to completely offset investment losses and even increase your net worth during a market crash.

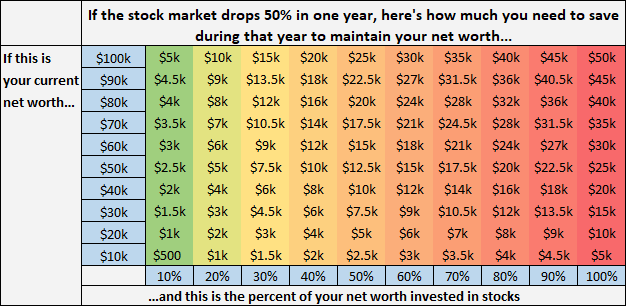

This table shows exactly how much money you would need to save to offset investment losses and maintain your net worth during a 50% stock market drop:

My advice to anyone with a net worth of $100k or less is straightforward: don’t stress about the stock market. It may keep rallying for years to come or it may crash very soon. Nobody knows. Focus on saving as much as you can and increasing your income.

I recently shared my thoughts on this current stock market via Twitter:

This advice is especially relevant for people who have a net worth of $100k or less. Focus on saving money. A potential stock market crash shouldn’t scare you at all.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Assuming you keep your job, of course. 🙂 That’s the kicker – if the economy tanks and the market crashes by 50% chances are a lot of folks are going to see themselves out of work for a while, so saving may not really be an option. That’s why having an emergency fund helps, and keeping costs tamed.

Great point, Dave. With a market crash often comes job layoffs and hard times. For people who are fortunate to keep their job, they should continue to focus on saving as usual. I agree, an emergency fund is wonderful to have as well to help you through the bad times.

Classic case of having more = risk of losing more. Someone I know in his 40s (probably way more than $100k net worth) recently said to me that he has put most of his 401k in bonds/cash because he thinks a correction can happen in 2018, thus locking in his gains. He plans to renter into stocks in a couple of years. I’m not sure how I feel about his strategy.

It all depends on your goals and your financial timeline. If your friend is thinking of retiring relatively soon, transferring money to less volatile assets is a reasonable thing to do. He could lose out on potential gains in the stock market (as many people have over the past couple years) but if he can sleep well at night knowing he has less exposure to stocks, that’s really all that matters.

Hi Zach, great post as usual 🙂 But how should a person with more than $100k deal with a stock market crash?

I believe using DCA during a market crash would help greatly, too.

Great question, JH. Things get a little more complicated with higher net worths. In general, it just depends on your financial timeline. If you plan on working and earning a steady income for several more decades, you can have a higher percentage of your net worth in stocks because you have plenty of time to ride out the dips in the market. It also depends on your risk tolerance. If you have a hard time sleeping at night knowing a huge chunk of your net worth is tied up in stocks, it could be beneficial to transfer some money over to bonds.

If you’re using your investments to live on (by selling stocks periodically or living off dividend income) you could be better off with higher-yield assets (like high-dividend stocks or bonds) that are likely to be less affected by a potential stock market crash. But if you’re purely focused on growing your net worth, stocks have historically offered the highest returns.

Also, dollar cost averaging (DCA) has historically been one of the best ways to invest because it removes the psychological aspect of investing – whether the market is going up or down you’re just steadily investing money. This helps you to avoid over-selling at lows and over-buying at highs. This is essentially the approach I follow.

Thanks for the question 🙂