6 min read

According to most people in the personal finance community, you are “financially independent” once you have 25 times your annual expenses saved up. At that point, you’re able to withdraw 4% of your portfolio each year with a high probability that you’ll never go broke.

Using this metric, many people go through the following process:

- Identify their annual expenses (e.g. $40,000)

- Multiply their annual expenses by 25 (e.g. $40,000 * 25 = $1 million)

- Set this number ($1 million) as the goal line for financial independence.

During every second that their portfolio is less than this value, they’re in a state of failure. Once they cross this threshold, they have achieved success. At this point, they give themselves permission to quit their day job and spend their time however they’d like.

While this approach gives you a formula for a more freedom-filled life than the traditional approach of working 40 hours per week for 45 years, I’d argue that it’s not an optimal approach for most people.

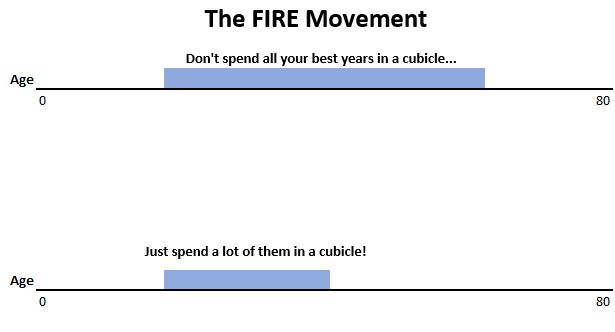

In general, the FIRE (Financial Independence, Retire Early) Movement identifies the correct problem, but provides a lousy solution:

Problem: Life is too short to spend most of it in a cubicle.

Solution: Spend 10-20 years in a cubicle accumulating 25x annual expenses, and only then give yourself permission to leave.

The sad part is that people get so entranced with the motivation behind the FIRE movement – to break free from the shackles of a commute-laden, shitty-boss-controlled, long-hour-filled work situation – that they’re too quick to accept the first solution offered – “save up 25 times your annual expenses, then quit working entirely!”

Yes, life is certainly too short to spend most of it in a cubicle. But no, sitting in said cubicle for one or two decades to save up a specific amount of money is not the only way you can find freedom in life.

In this post, I’ll share an approach that I believe people can use to obtain freedom long before they have 25 times their annual expenses saved up.

Two Crucial Assumptions

It’s important to understand that the traditional approach to financial independence – saving up 25 times your annual expenses – seeks to provide you with a passive income stream that covers all of your annual expenses so that you don’t have to work for an income.

But this approach has two crucial assumptions built in:

Assumption #1: You never want to work again after achieving financial independence.

Assumption #2: Your portfolio will be invested entirely in stocks and bonds.

If one or both of these assumptions don’t hold true for you, then saving up 25 times your annual expenses might not make sense.

Here’s why.

Violating Assumption #1: You may always want to work in some capacity.

The whole logic behind saving 25x expenses is so that you have enough money that you’ll never need to work again. For example, if your annual expenses are $40k and you have a portfolio worth $1 million, you can pull out the inflation-adjusted equivalent of $40k each year from your portfolio to cover your expenses and there’s a high probability that you’ll never deplete your portfolio.

But one of the great paradoxes of FIRE (and one that has always seemed odd to me) is that the people most capable of saving 25x their expenses at a relatively young age tend to be the most driven, productive, ambitious people. These are the exact people who are most capable of generating income from a side business, a blog, or some other entrepreneurial endeavor after they achieve F.I.

This begs the question: If you’re on the path to saving 25x your expenses, yet there’s a high probability that you’ll earn at least some income after reaching this point…what’s the point of waiting until you have 25x your expenses to quit your day job?

Violating Assumption #2: Your portfolio may be invested in assets other than stocks and bonds.

At the time when the 4% Rule and the idea of saving up 25x your expenses became popular in the 1990s, the most common assets to invest in were stocks and bonds.

Fast forward to today. There are tons of different assets that you can invest in that can provide higher returns than a mix of stocks and bonds. My favorite types of assets to invest in are websites because they provide a massive return on investment relative to other asset classes.

For example, consider VYM, the Vanguard High Dividend Yield ETF. It currently has an annual dividend yield of 3.2%. This means that if you invest $10,000 into this fund, you’ll receive $320 in dividends each year.

On the other hand, websites typically sell on marketplaces for 25 times their monthly profit. So, a website that generates $400 each month will typically sell for about $10,000. This means that if you invest $10,000 into a website and the income remains stable at $400 per month, you’ll receive ($400 * 12 months) $4,800 over the course of a year. That’s 15 times more than the stock index fund.

If even a portion of your total portfolio is invested in websites, you wouldn’t need 25 times your annual expenses saved up to be financially free.

How to Gain Freedom Without 25x Expenses

The real reason most people want to achieve F.I. is so that they don’t have to spend so much of their time and energy commuting, sitting in an office, and doing work they likely don’t find meaningful.

Most people yearn for:

- More freedom to spend time with their family.

- More freedom to work on interesting and meaningful projects outside of a distraction-filled, open-office environment.

- More freedom to work during times when they’re most productive (whether that’s mornings or evenings).

- More freedom to travel.

- More control over their thoughts, which comes as a result of being able to unplug and not needing to worry about responding to work emails and texts after normal working hours.

- More energy, which comes as a result of being able to nap when you want to, to go for long walks when you’re brain dead from working, and to be able to wake up without using an alarm clock.

Saving up 25 times your annual expenses can certainly give you the means to quit your day job and obtain all of these benefits, but it’s not the only way.

There exists a new, modern approach to gaining freedom in life, but it requires you to have a few realizations:

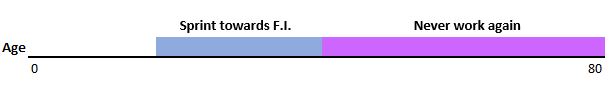

1. You don’t have to separate life into a sprint-towards-financial-independence period and a never-work-again period.

Instead, you can view life as one long journey where your goal is to spend your time doing as much meaningful work as possible while minimizing the time you spend doing work that you have to do just to generate income.

2. Your goal should be to generate income in an enjoyable way. It doesn’t matter if it’s passive or active.

The traditional approach to F.I. assumes that you want to cover all of your living expenses using passive income. Unfortunately, it can take decades to acquire enough assets that will generate this much passive income.

Instead, if you become open to the idea of earning income in an active way that you enjoy – perhaps through a part-time job in a meaningful field, through writing on a blog, or through tutoring in a topic you enjoy – then you can quit your miserable day job much sooner knowing that you don’t need to save up enough money to never work again.

3. You can invest in assets that generate higher returns than a traditional portfolio of stocks and bonds.

As mentioned earlier, there are far more assets that you can invest in today that can generate higher returns than stocks and bonds compared to the 1990s when the 4% Rule became popular. A few popular ones include:

- Websites (my personal favorite)

- Low-maintenance businesses like storage units, vending machines, laundromats, etc.

- Crowdfunded real estate

- Short-term rentals like Airbnb and VRBO

- Peer-to-peer lending

- Rental properties

Check out this post for 19 examples of assets you can invest in.

4. Starting your own business can allow you to quit your day job long before you have 25x expenses saved up.

It has never been easier in human history to start your own online business and generate income without the help of an employer. Literally anyone can create their own website from scratch in under 30 minutes and eventually earn money from ads, affiliate links, or their own products and services.

Granted, it takes most sites about 6 to 12 months to start earning anything, but after that point the sky is the limit.

Building up a portfolio of websites over the course of three years is exactly what enabled me to quit my own day job as a data scientist. Now, although I only have around $150k in the bank and I’m nowhere close to having 25x my expenses saved up, I have complete freedom over my daily schedule. I didn’t have to grind it out in a cubicle for over a decade to build up a portfolio that allowed me to be free.

Instead, I was able to generate enough online income after three years to cover my living expenses. Here’s a look at my monthly earnings during that time frame:

There have been bumps along the way and I’ve made as many mistakes as any solopreneur, but through consistency I’ve been able to create my own income streams which have given me freedom from a traditional day job.

Conclusion

I’ll be the first to admit that it’s possible for some people to actually save 70% of their income each year working at a job they don’t despise and achieve financial independence from scratch in under a decade.

However, these people are outliers.

For anyone looking for a path to freedom that doesn’t entail grinding it out in a cubicle for a decade or longer, it can be found through:

1. Recognizing that you don’t have to sprint towards financial independence. Instead, you can take a more drawn out, enjoyable journey.

2. Recognizing that work can actually play an important role in leading a fulfilling life and that you never have to vow to stop working after your portfolio reaches a certain size.

3. Recognizing that you don’t have to restrict your investments to stocks and bonds.

4. Recognizing that starting an online business has never been easier and that the upside to doing so is unlimited.

This is the new, modern approach to financial independence.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.