I have this hypothesis that the world operates on time scales.

For example, the U.S. has created a time scale of 12 years for primary and secondary education.

Our institutes for higher learning have created a time scale of four years for students to earn a bachelor’s degree.

Common knowledge dictates that the time scale for a mandatory working life should be 40 – 45 years.

The time scale for paying off debt is decades for most people.

But most of these time scales are arbitrary. They don’t actually have to be followed.

Most of these traditional time scales suck anyway.

Young People Get Screwed By Following Traditional Time Scales

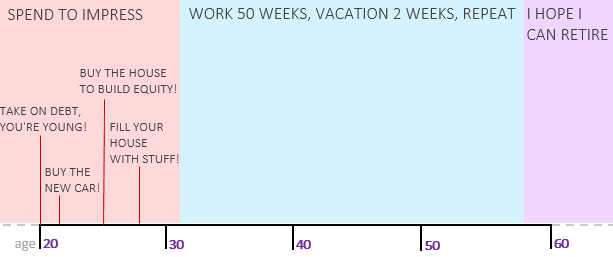

The time scale that young people are often pressured into following is:

Prove your success fast. Buy the new car upon graduation to reward yourself. Put a down payment on the most expensive home the bank will give you a loan for. Fill said house with stuff. Lots of stuff. Go out on the weekends and make sure your social media accurately reflects your fun-filled life. Make sure everyone around you knows you’re successful.

The problem with this time scale is that it encourages short-term lifestyle inflation at the expense of decades of mandatory work. Spending frivolously in your 20’s leads to a poor financial foundation to build the the rest of your life on:

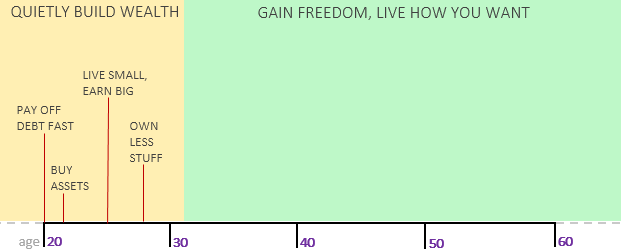

I would argue that there’s a better time scale for young people to follow. It’s not a flashy time scale and it won’t garner you thousands of social media followers, but it will help you gain freedom.

The time scale that I propose young people follow is:

Screw proving your success at a young age. Nobody cares if you buy that new car, move into that nice house, or upgrade your wardrobe. Owning new stuff is fun for about a week before you get used to it. Then it just morphs into another thing lying around your house, not being used. The new car loses it’s appeal after a few months. The Instagram pictures and the temporary attention become drowned in the never-ending social media feeds.

Instead of spending to impress, quietly build wealth. Let everyone obsess over their social media profiles and participate in the never-ending spending race. Let them buy stuff. You should go buy assets. Buy stocks, real estate, websites, whatever will appreciate in value over time. Live small. Own less. Become debt-free. Gain financial freedom at an absurdly young age and spend the next 50 + years of your life doing whatever you want:

Create a Financially Forward Time Scale

Traditional time scales dictate that young people should spend now and save later. But to gain financial freedom in life, young people should be doing the exact opposite: save now and spend later. Place emphasis on your finances in the younger years of your life, not the latter years.

In other words, create a financially forward time scale, not a financially backwards one. By saving and investing in your 20’s, you’re taking advantage of the mathematically most important years to save money.

If you want financial freedom, forego the traditional time scale of spending money to impress people in your 20’s. Follow a financially forward time scale instead. Practice humility, quietly build wealth, accumulate assets, and set yourself up for a freedom-filled life for several decades to come.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Zach,

Your blog is the first thing I read in the morning. I really enjoy the graphics that you create — this is what separates you from other people in your “side hustle,” in my opinion.

Congratulations on your growth mindset, the new job, the new place, and here’s to all of your hard work!

Michael,

Thanks so much for the kind words, I really appreciate that! I like to think that the graphics add an element to the articles that makes them more interesting and fun to read. Thank you for the congratulations, best of luck on your own financial journey, and be sure to stay in touch 🙂

I totally agree to whatever you say but there is one caveat. How will you answer to those who questions if you don’t spend money on the things you enjoy now (i mean when one is young) then that money will not worth when you are old.

Lets say bungee jumping that costs 500$ ,I would love to do it when i am young and in my 20s. But once you grow old you may not even feel like doing such a thing.Isn’t it?

I understand not to buy a house and take debt but you must not be frugal enough so that you don’t do what you like. If travelling is your passion then you much work extra hard and fulfil it .

Monu, you bring up a great point. I’m not advocating spending no money at all, but rather being highly selective with what you spend on and recognizing that you don’t have to buy a new house, car, etc. and experience lifestyle inflation as soon as you can afford it. This way you can save a ton of money but still do fun things (i.e. bungee jumping) if you feel like it.

Check out these two articles if you’d like a more in-depth look at my thoughts on spending money:

https://fourpillarfreedom.com/the-joy-driven-guide-to-spending/

https://fourpillarfreedom.com/align-your-spending-with-your-unique-nature/

Great post as always, Zach, and I agree with it almost completely.

The exception is that I like things. Quality things that I can use or enjoy, and sell should I need money for close to what I paid for or even more.

Having all your wealth in one or two markets isn’t safe either. Inflation is over 2% and the value of the USD has gone down 10-15% since Trump took office (1 year).

Just some things to think about.

There’s nothing wrong with owning things as long as they add value to your life. I just think most young people are too quick to inflate their lifestyle by buying things that actually don’t add value to their life, which screws them financially. It helps to be aware of what things actually enhance your life and only bring those things into your life. This helps foster a mindset of gratitude and it helps save money.