I live like a college student.

I share an apartment with a roommate, I drive a Honda Civic, and I buy food in bulk.

I have a dirt cheap phone plan, a high-interest savings account, and can fit everything I own in one suitcase.

Here’s what makes this situation abnormal: I have the financial means to live in a much larger space, purchase a much nicer car, and dine out far more often than I do now, and yet I choose not to.

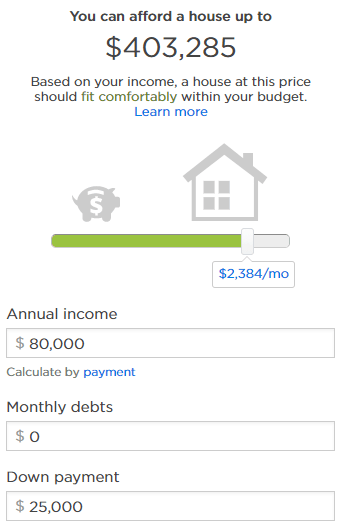

Using the Affordability Calculator on Zillow, with my current income, monthly debts, and a potential down payment, I could afford to spend $2,384 per month on housing alone.

Taking this one step further, I could inflate all my spending to match my yearly income. Between my side hustles (blogging and tutoring) and my 9-5 job I bring home around $65,000 after taxes each year. With a house payment of $2,384 per month I would still have plenty of money left over to spend on dining out, upgrading my car, and buying some new tech gadgets.

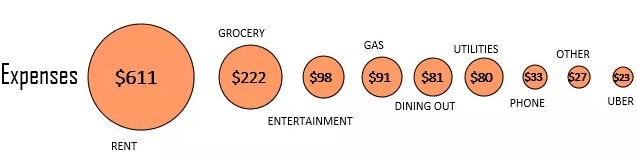

I could easily spend $65,000 per year if I wanted to. Instead, I’m choosing to live on about $15,000 per year – similar to a college student. As evidence, here’s the $1,266 I spent last month:

Extrapolating this monthly spending, I see that I’m on track to spend about $15,000 this year. That means I have about $50,000 left over to save each year.

Why Not Upgrade?

If I have so much money left over each month, why am I not spending it? I’m glad you asked. Here’s a few reasons why.

1. I have a long-term focus. What I really want in life – the ability to be my own boss, the financial means to travel, the freedom to work as much as I want and when I want, free time to spend with my family and friends – won’t fall into my lap overnight. This freedom requires financial backing, which takes years to accumulate.

When you have a sufficient amount of money, nobody can tell you what to do. I like that. If I upgrade my lifestyle and start spending more now, I’ll hinder my chances at saving a ridiculous sum of money and achieving the freedom-based lifestyle I want.

I don’t care what my lifestyle looks like right now, I care what it can become in the long-run. I’m practicing patience.

2. I like to focus on what my life feels like, not what it looks like. There’s a reason most college grads land their first corporate-salaried job and immediately upgrade their lifestyle. They expect the new lifestyle to bring increased happiness and attention. But happiness is based on connection, competence, and autonomy, not the things you own. The new car, house, furniture, and technology all start to become familiar and lose their appeal over time. Freedom never loses it’s appeal.

I spend very little because I know that most purchases won’t bring me lasting satisfaction. Instead I’m focusing on how I can feel great everyday through connecting with people, doing meaningful work, and striving for freedom. This helps me stay focused on what actually matters in life while saving an absurd amount of money.

3. The earliest years of saving are mathematically the most important.

Here’s some math:

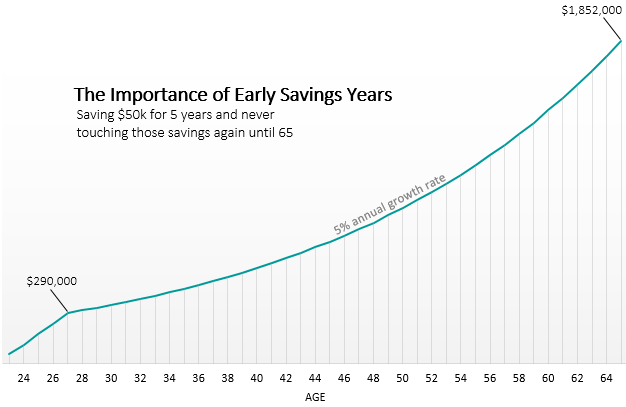

If I save $50k per year for the next 5 years, never touch that money again, and find ways to meet my spending needs (hopefully through doing work I love) until I’m 65, here’s what those savings will grow into:

In the first five years I could hypothetically save $290,000. By simply letting those savings grow at a 5% interest rate each year, they would blossom into $1,852,000 by time I’m 65!

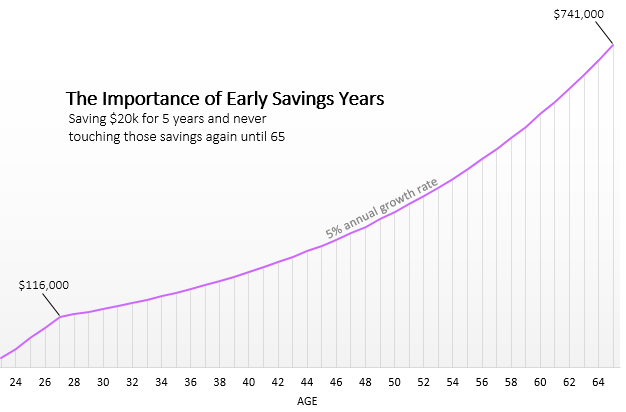

But let’s pretend I wanted to upgrade my lifestyle, triple my yearly spending to $45,000 and only save $20,000 per year. If I saved this $20k for 5 years and didn’t touch it until 65, here’s what those savings would grow into:

I would end up with far less than half of the total ending amount if I only saved $20k per year. Keep in mind, we’re only talking about 5 short years of saving!

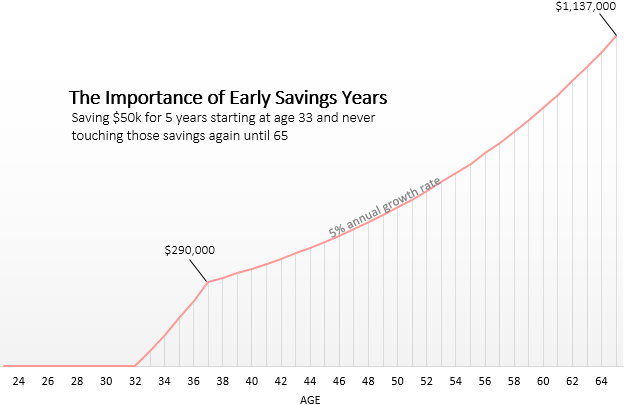

Just to drill this point home further, consider the scenario where I delay my savings for ten years. Let’s say I upgrade my lifestyle right now, but then have a financial awakening at age 33 and start saving $50k per year for five years. Here’s what those savings would grow into:

I would still cross the million dollar threshold, but I would have $715,000 less than if I started saving at age 23.

The wild part about all of these scenarios is that I’m spending the same amount of time saving (5 years), but my decision of when and how much I choose to save makes an unbelievable difference.

By saving as much as possible, as early as possible, I am taking full advantage of the long-term effects of compound interest.

Live Simple, Save Big, Practice Patience

I live like a college student so I can save a huge sum of money in a short period of time. I’m taking advantage of the mathematically most important savings years of my life. If you’re a recent college graduate, you can do the same. You just need to follow three simple principles.

1. Live simple. Don’t buy the new house, the new car, or the new gadgets. There’s a time and a place for spending. Immediately after college is not that time.

2. Save big. Set up systems and habits that will allow you to save as much as possible. Contribute a significant chunk of each paycheck to your 401(k) plan. Set up automatic recurring investments into index funds. Live with less. Push your income higher through promotions, job-hopping, and side hustles all while keeping your spending low.

3. Practice patience. This is the most important advice I can give to my fellow college grads. Cultivate patience. Your dream lifestyle won’t develop overnight. Focus on the process, not the outcome. Ignore everyone acting flashy on Instagram. You don’t need to be successful now. You don’t need recognition or attention now. Quietly sit and work. Save money. Eliminate your ego. The money, the freedom, and the lifestyle flexibility will all come with time, but only if you’re patient.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Great post Zach! This stuff is gold and always helps me stay focused on playing the long game. It’s interesting to see how you compare and contrast the scenarios. When looking back at my last 10 years in the financial wilderness I can now quantify what my choices have meant. Not to say I regret anything, I take full responsibility and have a plan to reach FI within 10 years anyway!

Keep up the intelligent writing, great to have your perspective in the community.

Thanks, Mr. Mofi! I appreciate the kind words. Personal finance really is a long-term game. Saving and investing takes time and diligence. Best of luck on your own financial journey and stay in touch 🙂

Practicing patience is great advice. We really don’t need much if we really think about it. And even when we do splurge, it’s short-lived and makes us wanting the next thing hot thing to splurge on. 🙂

I think most people would be shocked at just how little they need to live the best version of their life possible. So much of our lives tend to get cluttered by things that are adding no value, but there’s a huge sense of relief and joy that comes with letting go of stuff.