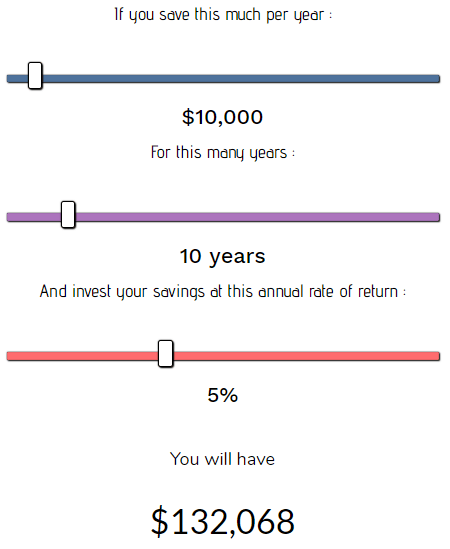

Yesterday I introduced a tool that lets you compare savings vs. investment returns. The tool is quite simple. You select how much you plan on saving per year, for how many years, and at what interest rate you expect your savings to grow. The tool shows how much money you will have based on these inputs:

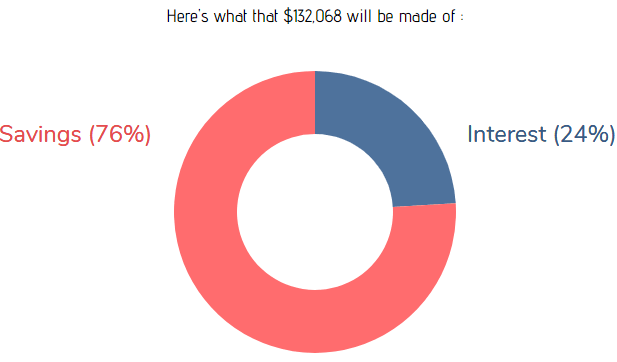

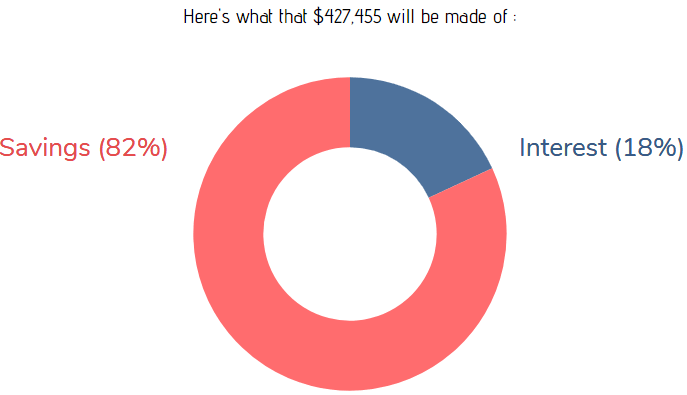

That’s pretty useful. But the part that makes me most excited and has the most potential to be enlightening for people is the second part of the tool, which shows a donut chart depicting how much of your money will be composed of savings and how much will be composed of interest from investment returns:

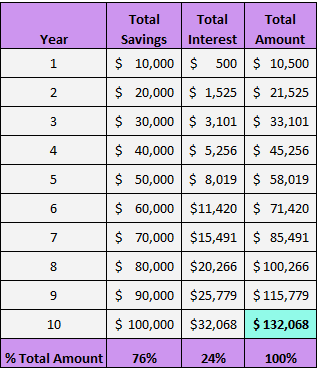

Here’s a quick peek at the math behind the numbers in this example:

I think this offers a wonderful view at just how important savings are compared with investment returns based on your time horizon. In the personal finance space, we all seem obsessed with preaching the message “compound interest is the 8th wonder of the world”. I completely agree that compound interest makes a difference in the long-term over the span of many decades, but in the short-term most of your net worth will actually be composed of savings.

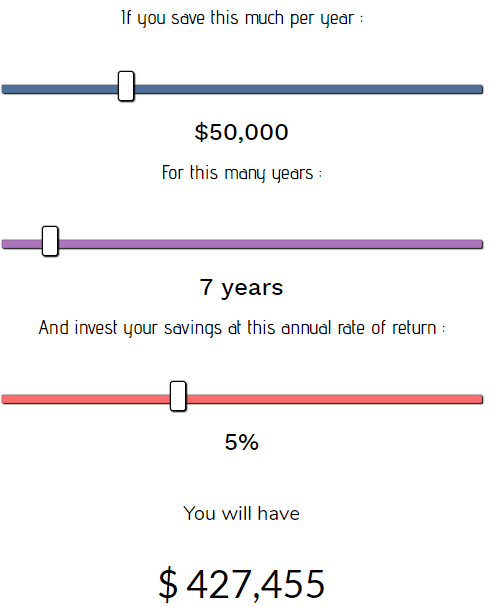

To illustrate this point, I’ll use my own financial situation as an example.

Over the past year I have saved about $55,000. Let’s suppose I set a personal goal to quit my 9-5 job within 7 years before age 30. I’ll assume I can save $50,000 per year and invest my savings at a rate of 5% over these 7 years. Here’s how much of my ending net worth would be composed of savings compared with interest from investment returns:

A whopping 82% of my entire net worth would be composed of purely savings! That’s mind-boggling to me. It makes me realize that how much I save is far more important than how much I earn from investment returns, at least in the short term (i.e. less than 10 years).

A Thought Experiment

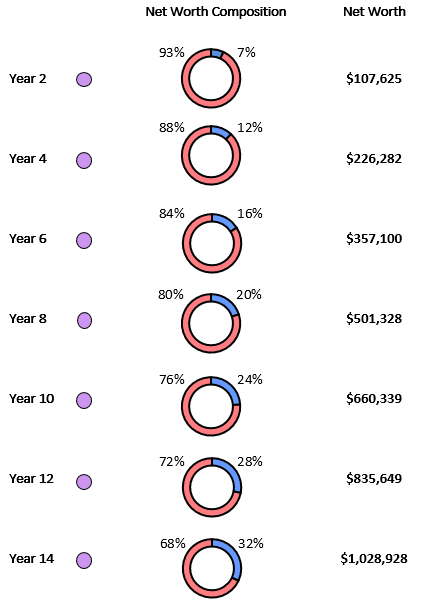

Let’s suppose I want to save one million dollars. Assuming a 5% rate of return on my investments, here’s what that net worth journey would like like:

As time goes on, more and more of my net worth will be composed of investment returns (the blue portion of the donut chart), but even once I hit the million dollar threshold, an unbelievable 68% of my net worth would be purely from savings!

The moral of the story here, and the message I continue to preach for anyone who only plans on working and saving for 10-15 years is: stop fretting over whether to invest in small-cap, large-cap, emerging markets, and every other unique investment option that might outperform by a couple percentage points each year. Go increase your income instead. Start a side hustle. Start a small business. Focus on how much you’re saving, throw your money into index funds, and stop making investing more complicated than it should be.

Some Interesting Observations

I encourage you to play around with the tool yourself here. A couple trends you might notice are:

- The higher annual rate of return, the more investment returns matter.

- The longer your time horizon, the more investment returns matter.

- Changing the amount you save each year won’t change the composition of your savings compared with investment returns, but it will change the total amount of money you will have.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Dude, THANK YOU for sharing this. I’m having a conversation with Mr. Picky Pincher right now about whether we need to be investing right now. Gonna whip out this tool and see what makes the most sense.

I’m glad you like it! Hopefully it’s useful for you guys 🙂

Very useful! I guess it’s true when they say the first million is the hardest. It’s a uphill battle in the beginning to save a lot and bigger than that to be consistent about it. Your numbers say it all. Of course everyone wants more bang for their buck and thus want to see how their money is working for them. But you gotta have money invested to make money right? 🙂

It’s definitely an uphill battle in the beginning (took me a year to save $50k) but as time goes on it just gets easier and easier as you have more money saved up working for you.

As Charlie Munger once said, “The first $100k is a bi*ch, but you gotta do it.”