6 min read

When I first started college, I knew that I wanted to get a degree in a high-income field. I didn’t care much about the specific field. I just wanted to make a lot of money.

This narrowed my potential majors down to STEM (science, technology, engineering, mathematics) fields where even entry-level individuals could make $70k+ in most places around the U.S.

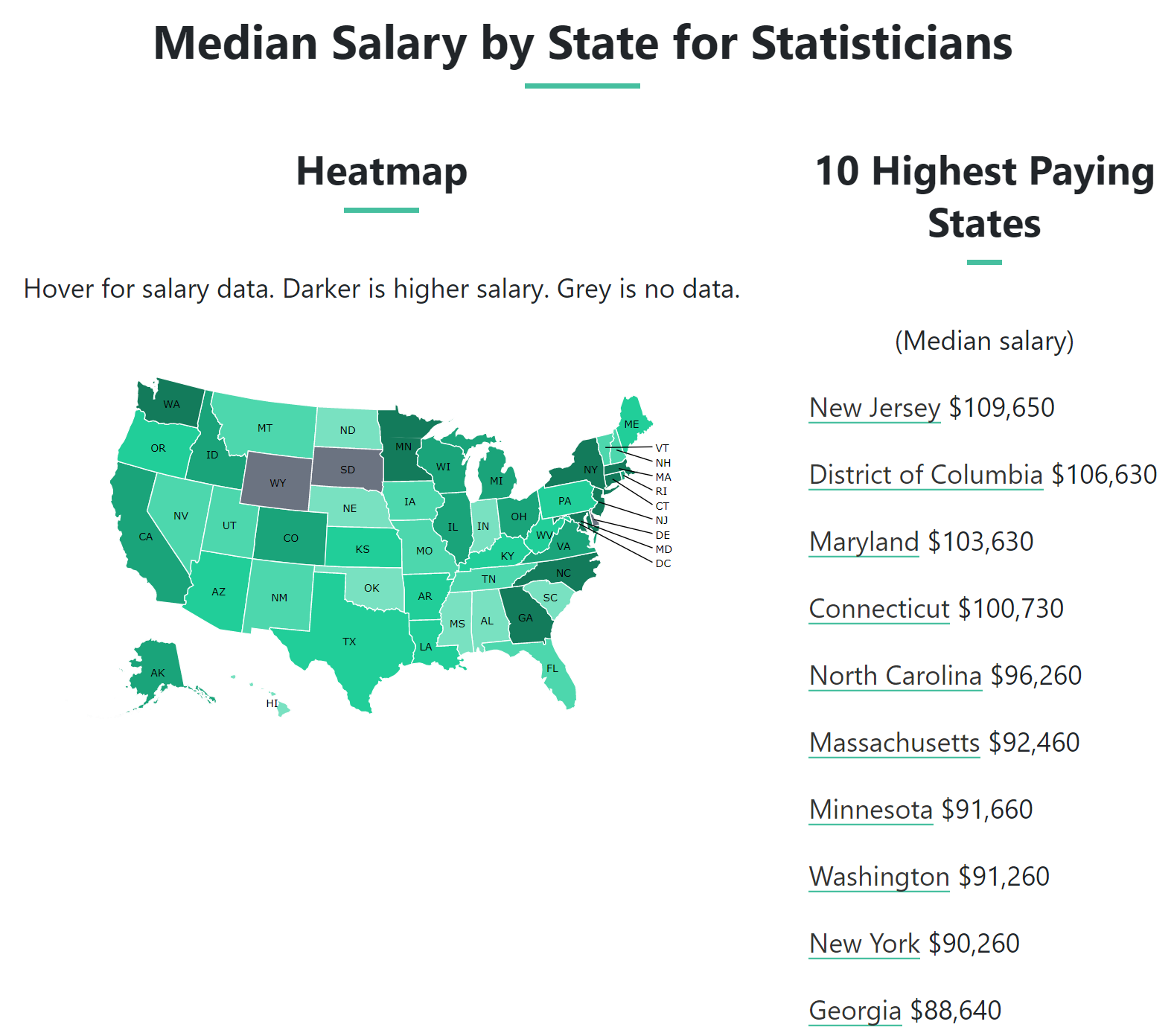

After a bit of exploration, I landed on the field of statistics. The median salary for a statistician in the U.S. is about $83k according to the Financial Toolbelt Career Database and in some states it’s significantly higher:

At the time when I chose statistics as my major, I was thinking purely about income and not about wealth.

In the eight years since then, I’ve developed a more holistic framework about wealth creation. Namely, I’ve come to realize that building wealth isn’t just about generating a high income, although that certainly helps. I’ve learned that it’s also about understanding some important concepts about personal finance and business.

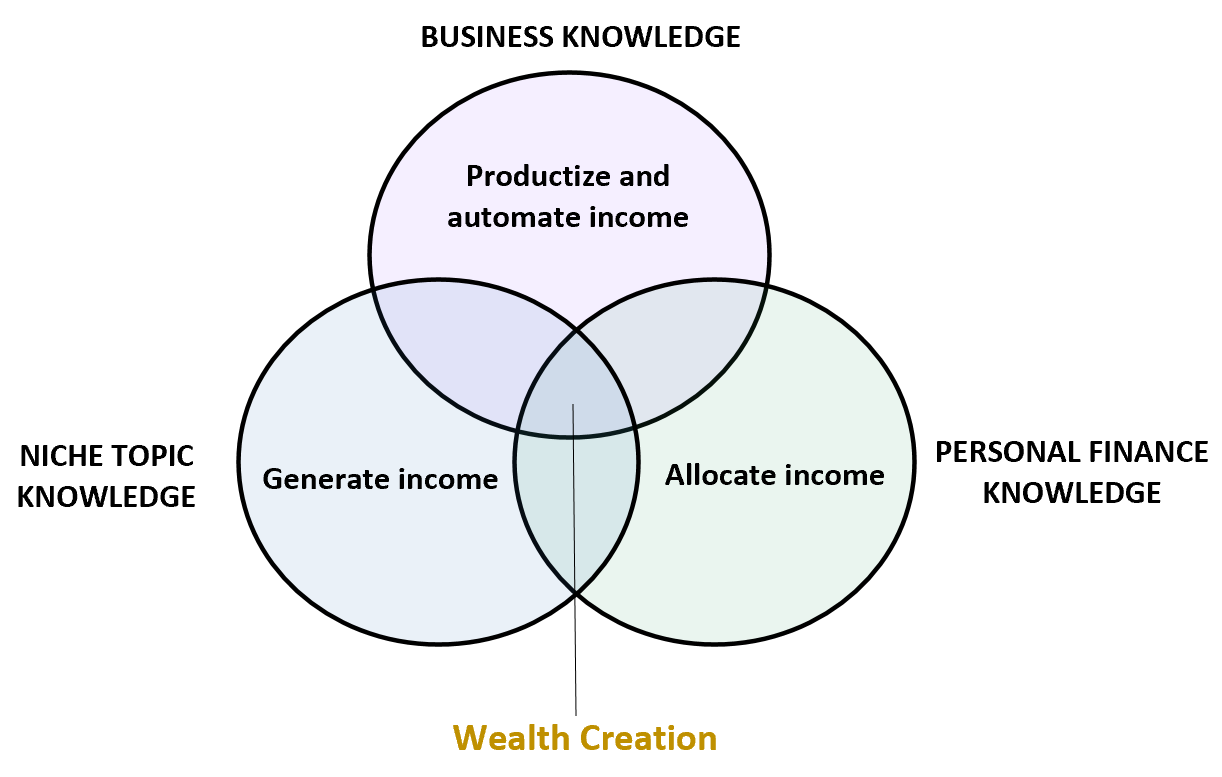

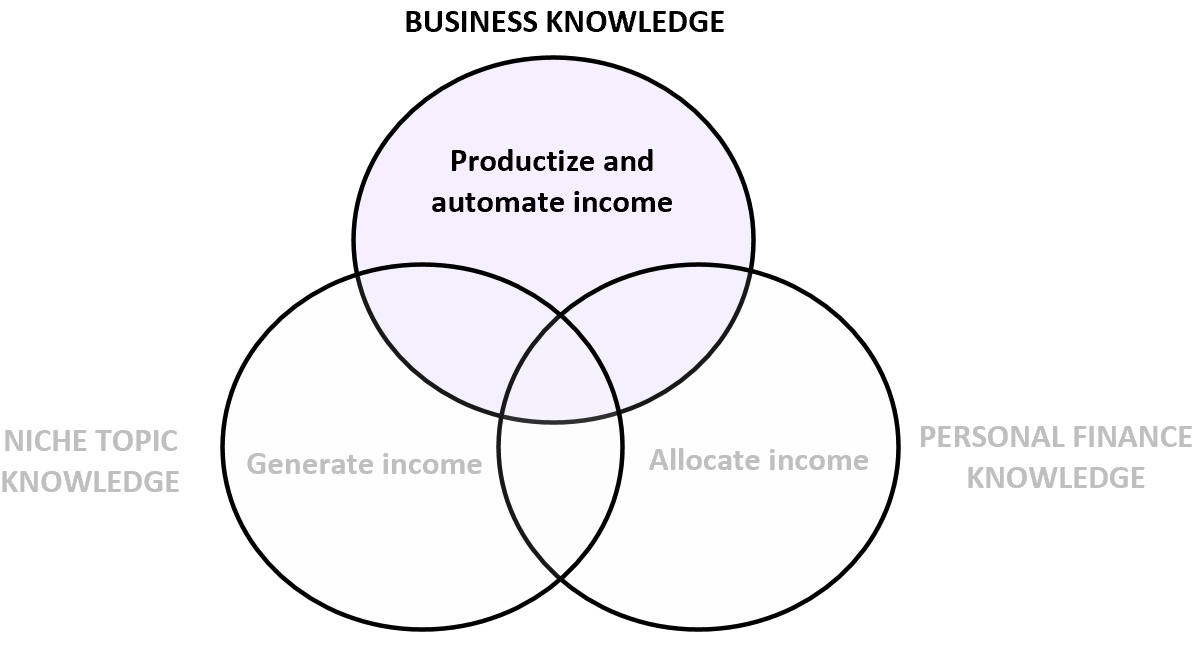

I now think that wealth is the natural result of having knowledge in three different fields:

1. Niche topic knowledge – Possessing knowledge in a niche topic can help you generate a high income.

- Example: earning $80k+ per year as a statistician.

2. Business knowledge – Knowing how to productize and automate income.

- Example: building a website to sell info products around a certain niche topic.

3. Personal finance knowledge – Knowing how to allocate income.

- Example: not spending every dime you make and investing leftover money into assets that grow over time.

When you possess knowledge in all three of these areas, wealth creation becomes inevitable.

Let’s take a closer look at each of these three circles and find out how to acquire knowledge in each.

Circle 1: Niche Topic Knowledge

There is a reason that cashiers earn minimum wage: most people can learn how to operate a cash register in under 30 minutes with no prior training.

And there is a reason that neurosurgeons earn starting salaries of $300k or higher: it takes over a decade of formal training and studying to acquire the knowledge and experience to become licensed.

In terms of how much income you can generate from holding a certain set of skills, here’s the rule of thumb: the harder a skill is to learn, the more income you can earn.

This is why the first step to generating wealth is to acquire knowledge in some niche topic that most people find difficult to learn.

I personally chose statistics. In the modern world there is a serious demand for people who know how to work with numbers and data, but not enough people who are willing to acquire this knowledge and skill set. Thus, by getting a master’s degree in applied statistics I was able to earn a high income for my unique knowledge.

There are hundreds of thousands of different niche topics that you could specialize in and use to generate a high income.

Don’t believe me? Check out this article from Niche Hacks that shares 23 highly specific niche websites that generate revenue through a combination of courses, e-books, coaching calls, physical products, affiliate links, and ads. Here are a few sites on the list I couldn’t believe were real:

Attorney Rankings: A firm that provides SEO services specifically for lawyers.

ProChurchTools: A site that provides tools and digital marketing strategies that leaders of churches can use to spread their message and their church presence more effectively online.

52Kards: A site that sells accessories to magicians along with digital courses on how to perform various magic tricks.

Niches get riches. And there are plenty of niche topics to specialize in.

Circle 2: Personal Finance Knowledge

Once you’ve acquired knowledge and skills in a niche topic, there’s a good chance that you can earn a high income. Unfortunately, most people are unable to use this high income to generate wealth because they spend most or all of it.

This is why you must also develop knowledge in personal finance. In a nutshell, personal finance tells you how to allocate your income and it basically comes down to understanding three things:

1. You need to save a portion of your income.

2. You need to invest those savings into assets that will grow over time. Here are 19 examples of assets you could invest in.

3. You need to automate your savings and investments. As my friend The Luxe Strategist once said: “Money needs to be told where to go and when.”

Without knowledge in personal finance, it doesn’t matter how much income you earn. You’ll never become wealthy if all of your income slips through your hands each month or simply sits in a low interest savings account.

Read this article to learn about five steps you can personally take to optimize your finances.

Circle 3: Business Knowledge

Once you’re able to use your niche knowledge to generate income and your personal finance knowledge to preserve and grow your wealth, the final area you must acquire knowledge in is business.

The whole idea behind business knowledge is to productize and automate your income.

- Productize income: Turn your knowledge in a niche topic into a product that you can sell over and over again.

- Automate income: Automate the process of selling your product.

The point of doing these two things is to break beyond the inherent income ceiling that you’ll hit with a traditional 9-5 job.

For example, I acquired niche knowledge in statistics. As a statistician, I could work for one company and earn ~$80k per year. Depending on the company and industry I work in, I would likely top out at ~$120k per year after 10-15 years.

However, I decided to use my niche knowledge in statistics to create an educational website called Statology, which I currently monetize with ads. Now I can help tens of thousands of people around the world each month with my tutorials. Best of all, each tutorial is like a tiny product: I make it once, then earn income from it over and over again each month as people find it on search engines.

I have productized my knowledge in statistics through tutorials, automated the income I earn from tutorials since they show up on search engines each day, and there is no inherent ceiling I face on how much income I can earn from the website.

In fact, the site traffic should continue to grow each year as I add more tutorials to it and as it slowly gains ground in search engine rankings. This means the income from the site should also increase over time without any additional effort on my part.

Why You Need Knowledge in All Three Circles

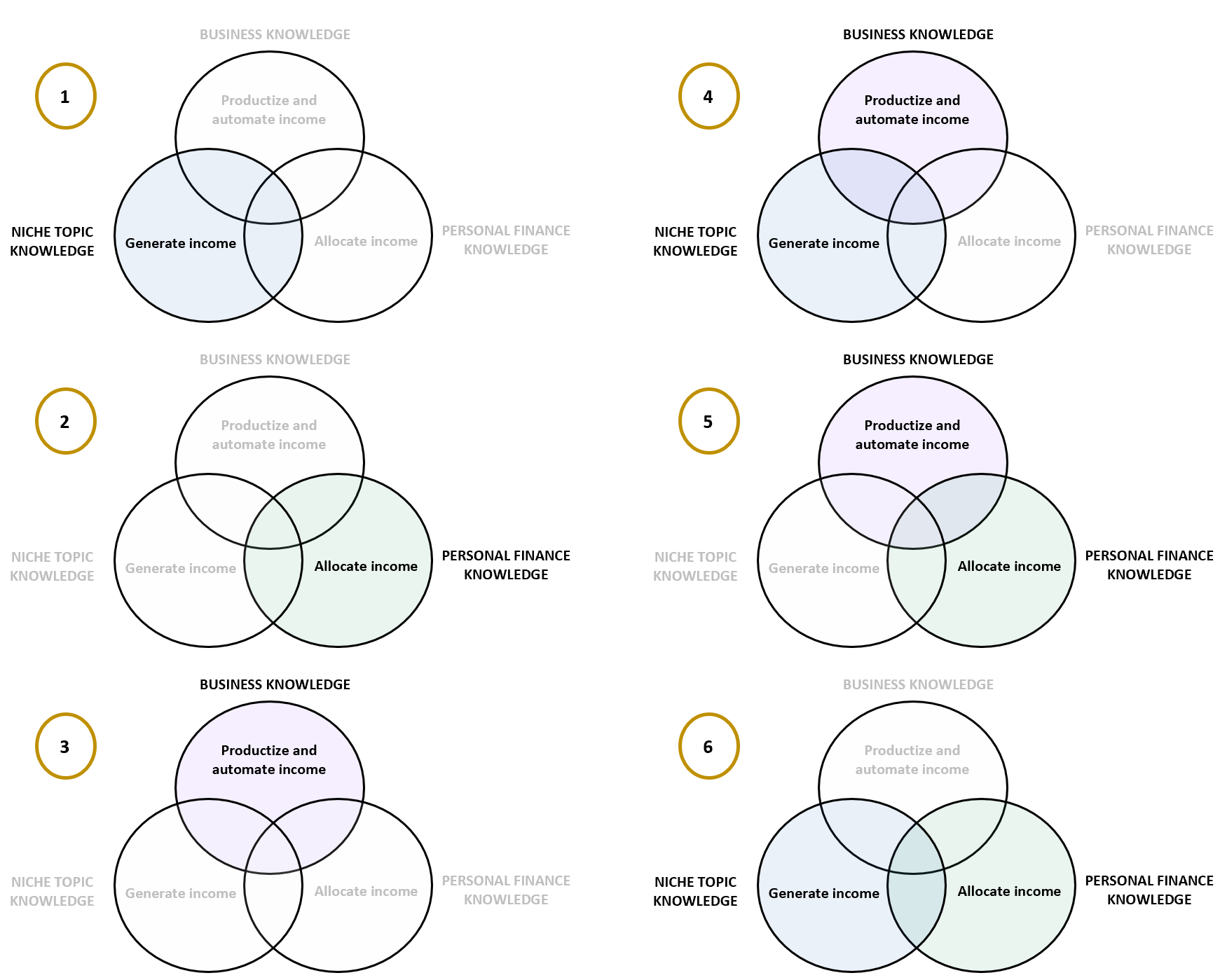

If you lack knowledge in any of the three circles, you will be limited in your ability to grow wealth. For example, consider the following six scenarios:

Scenario 1: You are able to generate a high income, but have no ability to allocate your income in ways such that you can grow your wealth. You have also no ability to productize or automate your income, which means you’ll always be stuck working at a job for someone else.

Scenario 2: You are able to allocate your income efficiently, but due to lack of niche topic knowledge and business knowledge, it’s unlikely that your income is high enough to build significant wealth.

Scenario 3: You understand how to productize and automate income, but without knowledge in a specific niche and knowledge in personal finance it’s unlikely that you can generate a high income and even if you do you won’t have the ability to allocate it in ways that grow your wealth.

Scenario 4: You are able to earn a high income as well as productize and automate that income, but without personal finance knowledge your income will always slip through your fingers and won’t be invested in assets that will grow your wealth over time.

Scenario 5: You have business knowledge and personal finance knowledge, but without knowledge in a niche topic it’s likely that you’ll have stiff competition and you’ll have a hard time generating a high income.

Scenario 6: You are able to use niche knowledge to earn a high income and personal finance knowledge to allocate that income efficiently, but are unable to productize and automate your income. This scenario isn’t actually that bad: with niche knowledge and personal finance knowledge, it’s likely that you can achieve financial freedom and early retirement long before most people, but you won’t have the means to build next-level wealth that naturally comes with business knowledge.

Conclusion

If you want to earn a high income, you need to acquire knowledge in a niche topic.

If you want to understand how to effectively use that income to grow wealth, you need to acquire knowledge in personal finance.

And if you want to break through the inherent income ceiling that comes with a traditional job, you need business knowledge.

When you possess knowledge in all three of these fields, wealth creation becomes inevitable.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.