6 min read

Author and entrepreneur Tim Ferriss has a simple question that he asks himself when life gets stressful:

“What would this look like if it were easy?”

By asking this question, he forces his mind to find simple solutions to tough problems.

I asked myself this very question a couple years ago when I found myself spending way too much time tracking and optimizing my finances each month. This included things like:

- Manually tracking my income and expenses

- Manually tracking my net worth

- Tweaking my investment allocation constantly

- Spending too much time thinking about how to reduce tiny expenses and not enough time thinking about how to increase my income

- Spending too much time looking for deals when shopping

By asking myself, “What would this look like if it were easy?” I was able find automated solutions to each of those bullet points.

In this post, I share the exact steps I took to optimize my finances so that I now only spend 15 minutes per month analyzing them while having the reassurance that the systems I have in place will naturally lead to wealth generation over time.

Step 1: Make a Money Map

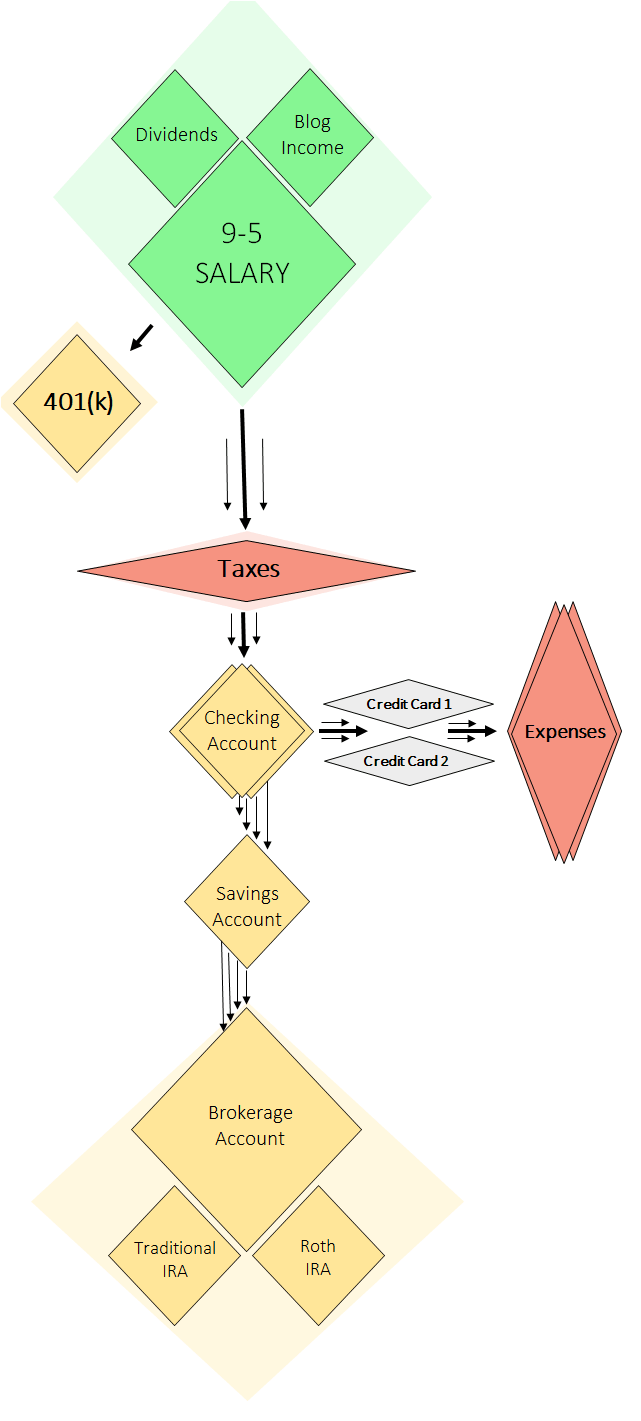

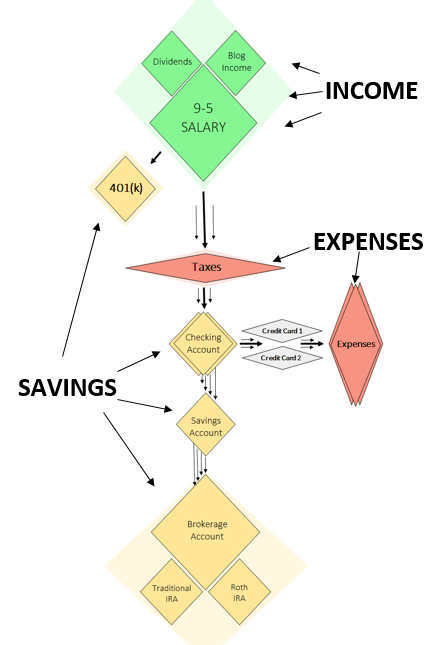

It’s tough to optimize your finances if you don’t know exactly how money is coming and going in your life. That’s why the first step I recommend taking to optimize your finances is to create a money map.

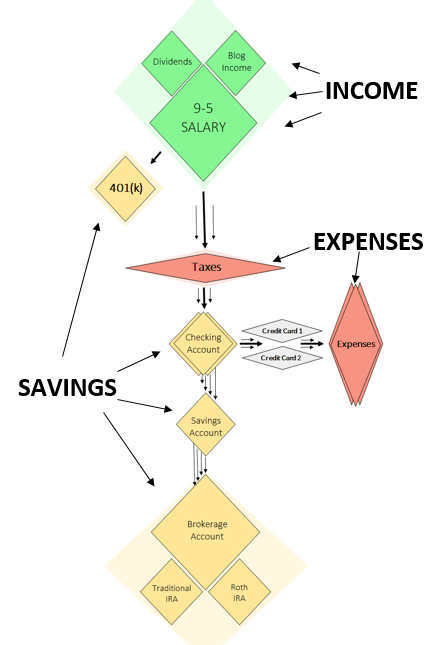

This is a map that shows exactly how money flows in your life, starting with income coming in the door and ending with every dollar either landing in an investment account, savings account, or being spent.

Here’s a look at the money map that I created a couple years ago when I still had a 9-5 job as a data scientist:

The map is color-coded to differentiate between my income, savings, and expenses.

By creating this map, I was able to see exactly how money came and went in my life. This gave me a clear overview of my finances in one simple image.

I used Microsoft Excel to create this money map, but you can use any program you’d like, including pencil and paper.

You can then hang it on your fridge or a whiteboard if you’d like so that you have quick access to it.

Step 2: Automate Tracking

Once you have a money map, you can then begin to optimize the map.

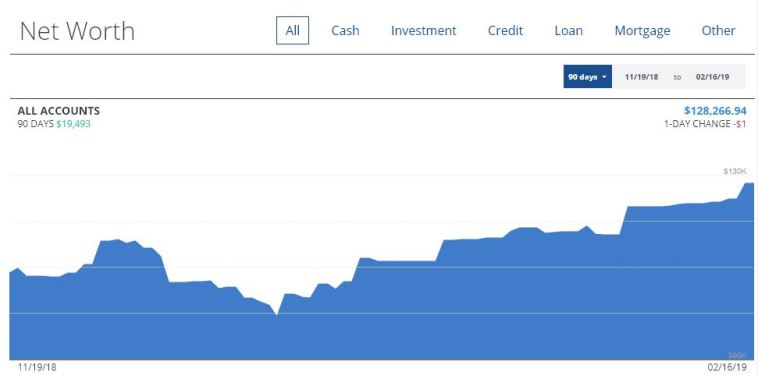

The first step I recommend taking is signing up for Personal Capital – a free online platform that tracks your cash flow and net worth for you, and provides helpful visualizations so that you can keep an eye on your progress.

Now that I use Personal Capital, I don’t have to spend any time manually logging in to different savings and investment accounts and updating balances on a spreadsheet. I can conveniently see my cash flow and net worth all in one place.

You can get set up with Personal Capital yourself in under 15 minutes here.

Step 3: Automate Checking & Savings Accounts

Once you’ve automated the tracking of your finances, the next step is to automate your checking and savings accounts.

This step is pretty simple – you want to use direct deposit payments to funnel your post-tax income into either a checking account or a savings account that pays a decent annual interest rate.

For example, when I worked for an employer I had a direct deposit set up so that each paycheck landed straight in my savings account.

Now that I work for myself, I have direct deposit set up for each advertisement company and affiliate company I work with, so a payment lands straight in my bank account on the first day of each month from theses companies.

Step 4: Automate Payments

Once you have direct deposit set up so that your income funnels into checking or savings accounts, the next step is to automate your monthly bill payments.

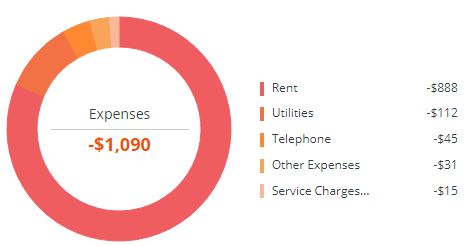

Personally I have the following bills set up on autopay each month:

- Rent

- Utilities

- Car Insurance

- Health Insurance

- Phone payment

This means that money is withdrawn from my savings account on a specific day each month and sent to the necessary companies, so I don’t have to set up reminders to manually log in to different websites and pay my bills.

You can also set up your credit card payments on autopay each month, but I personally choose to pay my credit card bills off manually so that I can glance at the various charges I incurred over the course of the month.

If I had this set to autopay, it would be too easy to never look at the various things I spent money on. This holds me accountable so that I can see if I overspent on certain things and determine if I need to reel in my spending a bit in certain areas.

Step 5: Automate Investing

Once you’ve created a money map, automated your tracking with Personal Capital, automated your income flow with direct deposits, and set up autopay on your monthly recurring bills, the last step is to automate your investing.

401(k): A retirement savings plan offered by employers to employees, with tax advantages. You can set up automatic 401(k) contributions to be taken out of each of your paychecks and invested in index funds. Max yearly contribution is $19,500.

IRA: An individual retirement account that anyone can set up, with tax advantages. You can also set up automatic contributions to index funds within an IRA. You can set this up yourself on any major investment platform including Vanguard, Fidelity, and Schwab. Max yearly contribution is $6,000.

Brokerage Account: An investment account that anyone can set up, with no tax advantages. You can set up automatic investments within a brokerage account as well. There is no max yearly contribution on this type of account.

When you set up these accounts, you will also be given the option to automatically rebalance your investments on a certain basis to maintain a specific asset allocation. I personally choose to do this.

If you automate both your investments and your rebalancing, then you will have to spend literally zero time each month maintaining your portfolio.

Bonus: Surround Yourself with Money-Saving Apps

In addition to following the steps above, there are several free financial apps out there that can help you save money in your everyday life. Best of all, you only need to set up these apps one time and you can receive recurring benefits over and over again.

Wikibuy: A free chrome extension that automatically tells you if an item that you’re about to buy on Amazon can be bought somewhere else (like eBay or some other site) for a lower price. This is truly a no-brainer extension that you should have installed. Download the extension for free here.

Trim: A free financial app that negotiates lower cable, internet, and phone bills with any provider on your behalf. This is hands down one of the simplest ways to save money on recurring monthly bills that requires virtually no effort on your part.

Acorns: A free micro-investing app that takes just 5 minutes to set up and allows you to invest your spare change in a diversified portfolio.

M1 Finance: A site that allows you to build a custom portfolio of stocks for free, has no trading or maintenance fees, and even allows you to set up automated target-allocated investments. I personally like to use this site for investing “play money” into individual stocks, since they have no trading fees. While the bulk of my money is invested in index funds, M1 Finance offers the perfect platform to maintain a small portfolio of individual stocks.

Collecting Wisdom: A site ran by yours truly that features three excellent personal finance articles each day. This is a simple way to absorb daily financial knowledge from the brightest minds around the financial blogosphere.

The Gift of Optimization: Free Mind & Free Time

The real gift of optimizing your finances is that you gain free time and a free mind. The less time you have to spend thinking about how your money flows in your life, the more time you can spend figuring out how to earn more.

In regards to your money map, your goal should be to have everything related to savings (the yellow diamonds) and expenses (the red diamonds) completely automated. This allows you to focus the majority of your attention on income generation (the green diamonds).

Outside of checking my cash flow and net worth on the first day of each month, I spend no time thinking about paying bills, moving money around, and tweaking investments. All of those things run like a well-oiled machine.

This means my days are spent either working on my websites (i.e. growing my income), working out, hanging with friends and family, or just relaxing. This is the gift I’ve received from optimizing and automating my finances.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.