“A house may be large or small; as long as the neighboring houses are likewise small, it satisfies all social requirement for a residence. But let there arise next to the little house a palace, and the little house shrinks to a hut”

-Karl Marx

Housing costs are undoubtedly the biggest expense for most people. To become wealthy, it’s important to keep your housing expenses under control, whether that means renting, buying less house than you can afford, living with roommates, or simply living with your parents for a while.

Unfortunately most Americans are inclined to spend as much as the bank is willing to lend them on housing, which led to the financial crisis of 2008 and continues to prevent many Americans from accumulating any type of wealth.

To understand this obsession with overspending on housing, let’s dig into some data.

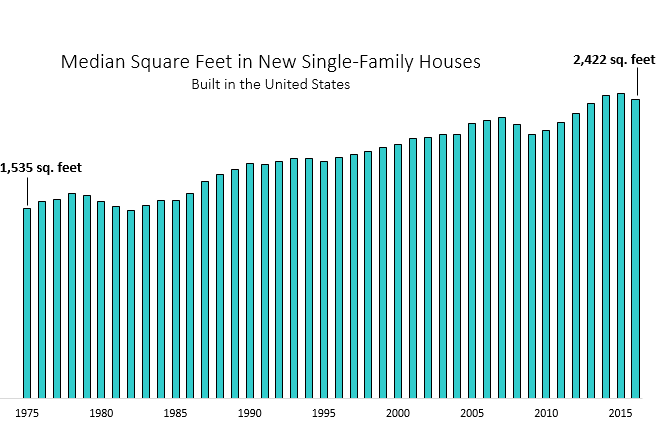

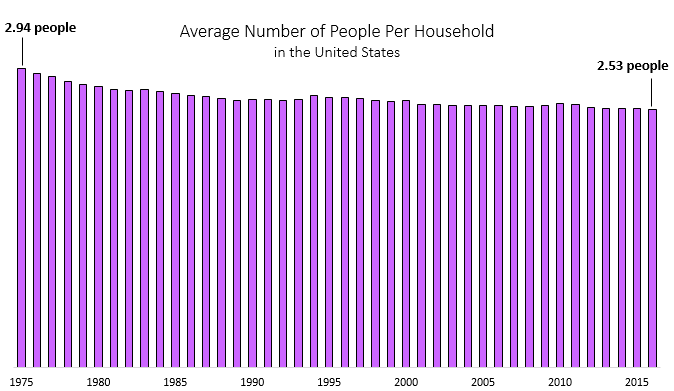

The median square footage of new single-family homes in the U.S. has risen from 1,535 square feet in 1975 to 2,422 square feet most recently in 2016.

At the same time, the average number of people per household in the U.S. has declined from 2.94 in 1975 to 2.53 in 2016.

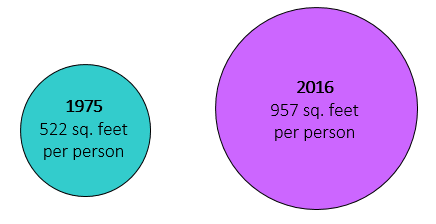

This means in 1975 each person could enjoy 522 square feet all to themselves (1,535 sq. ft. / 2.94 people).

In 2016 this number expanded to 957 square feet per person (2,422 sq. ft. / 2.53 people).

The square footage of living space per person has nearly doubled in just over 40 years.

This almost begs the question: Were people in 1975 living in deprivation? Or are people now living in complete excess? I think the answer is the latter.

It goes without saying (but I’ll say it anyway) that the place you choose to live and the home you choose to buy can make or break your financial life. For people on the road to financial independence, one of the best decisions they can make is to avoid overspending on housing.

In the classic personal finance book The Millionaire Next Door, the authors reinforce this point:

“Nothing has a greater impact on your wealth and your consumption than your choices of house and neighborhood. If you live in a high-price home in an exclusive community, you will spend more than you should and your ability to save and build wealth will be compromised…. People who live in million-dollar homes are not millionaires. They may be high-income producers but, by trying to emulate glittering rich millionaires, they are living a treadmill existence.”

Most of the people who buy million-dollar homes aren’t actually millionaires. Instead, they’re high income families who have low savings rates, place too much importance on status, and never achieve a high net-worth. But the people who do eventually become millionaires are the ones living in homes that suit their needs, not McMansions. True millionaires practice stealth wealth.

Whether your goal is to become a millionaire or to simply have enough money to be financially independent, buying a house within your means is the most important financial decision you can make.

Living Small & Earning Big

Personally I live in an apartment. I believe that a house is a place to live, not an investment. I’m not opposed to buying a house at some point in my life, but it doesn’t make sense for me right now as I have no kids, no wife, and I want the option to pick up and move whenever I feel like it.

This decision to rent allows me to live with a roommate, split the costs of renting, and save a ton of money while I quietly work a fairly high-income job and throw thousands of dollars per month into my savings and brokerage accounts. Instead of going out and placing a down-payment on the largest house I can finance, I’m more than content to live small and stack money.

There’s Nobody to Impress

It’s easy to live small when you recognize that there’s nobody to impress. The truth is, the people that matter in your life don’t actually care what type of place you live in. The people that do care aren’t worth keeping around. I see plenty of my fellow recent college grads out buying houses and posting about them on Facebook, Twitter, and Instagram. There’s nothing wrong with buying a house, but I genuinely wonder if they’re buying it because it will improve their life or if they just want it as a status symbol.

I think two big reasons people spend excessively on housing is because they believe:

1) A bigger house = greater happiness

2) A big house = a sign of success.

I think both of these beliefs are flawed.

It’s simply a fact that humans grow accustomed to whatever their living situation happens to be. Whether you live in a large or small home, over time you just get used to it and it becomes untied to your happiness. After all, your happiness is based on how your life feels, not how it looks.

For people who associate a big house with a sign of success, they’re making a classic mistake of associating success with stuff. Not only is this a fantastic way to kill your wallet, but it’s a great way to always remain unsatisfied with your accomplishments.

If you reward your for hard work with stuff, you will never reach a place of satisfaction. There will always be something better to buy, something newer, shinier, more impressive. But once you break the link between accomplishment and things, both your finances and your happiness are boosted. Instead of buying that new house to show off your success, save your money and practice being grateful for all you already have.

Be Honest

When assessing your current housing costs and living situation, it helps to be honest with yourself. Does your current living situation suit your needs, or is it a bit excessive? Are you living in a place because it looks good or because it actually feels good and improves your quality of life?

There’s nobody to impress. Focus on living within your means. Practice the art of gratitude, recognize that a big house does not lead to greater happiness, save your money, and gain freedom both financially and psychologically.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Yup. I know people who have these McMansions and then talk about how they’re paying over $1,000 per mo. in utilities. And then they say McDonalds has gotten expensive and it’s not worth it to go to the movies. Hmmm, I wonder if they are making an excuse because of possibly being house poor. I hope they are not fooling themselves. As long as you can make your living experience comfortable for yourself and family that’s all that matters.

I only pay $600 per mo. in rent right now, so I can’t even imagine paying $1,000 per mo. in utilities. I think it just comes down to how much space is being USED. Most people with large houses don’t actually use most of their space, except on rare occasions. I’d rather pay less, save money, and live in a place where I use most of the space on a regular basis 🙂

My wife and I raised three millennials in a 2850 Sq ft four bedroom four bath two story house on a couple of acres. While that might sound like a fancy house it was very inexpensive and we paid it off early. It was affordable because it is in a rural flyover state. Geographical arbitrage let’s you have nice house for small change. It is too big for us now but why downsize when the equity we could pull out of it is insignificant versus our investments?

“Geographical arbitrage let’s you have a nice house for small change.” That’s a great housing hack, Steve. I live in the midwest myself, where housing costs are considerably lower than in other parts of the country so I can relate. Cheers to low housing costs 🙂

Great post, Zach!

Re-evaluating our housing needs was a HUGE game changer for our FIRE timeline. For us, selling our too-big 1,400 SF house and becoming renters of a 670 SF apartment was a decision and will allow us to exit the 9-5 grind earlier than we originally thought possible.

We’re also much happier owning less stuff.

Your living small/earning big strategy is brilliant and your journey is inspiring!

Your story always inspires me – I love hearing about people who downsize to pursue a life that aligns more with DOING stuff instead of OWNING stuff. I find that owning less stuff makes me happier and much less stressful as well. It’s a wonderful recipe for increasing happiness and saving money at the same time 🙂

“Nothing has a greater impact on your wealth and your consumption than your choices of house and neighborhood.”

Very powerful quote, completely agree with your thoughts in this post. People often buy way too much house and then are chained to the huge mortgage payments instead of being able to pursue financial freedom.

Housing costs kill a lot of high-income professionals in particular. A high-income doesn’t mean much if it’s all being used to pay for a house that you only get to enjoy in the evenings and the weekends.