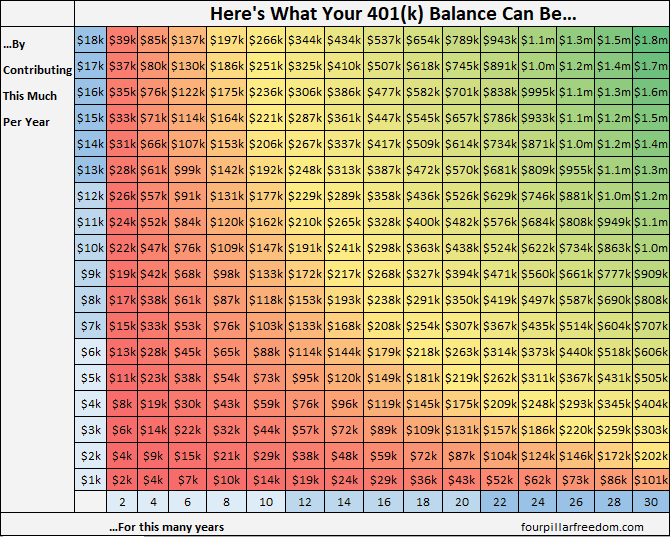

A 401(k) is a retirement savings plan offered by most employers to employees. It lets employees save and invest part of their paycheck before taxes are taken out. The most an employee can contribute to their 401(k) in a given year is $18,000. This grid shows how much you can save using your 401(k) based on how much you contribute each year and how many years you contribute.

This grid assumes your investments will grow at a rate of 7% annually and that your starting balance is $0. It does not take into account any employer match.

Some Interesting Observations

- By contributing the maximum of $18,000 per year for only 10 years you can save $266,000

- By maxing out your contributions each year, you can become a 401(k) millionaire in just 24 years (assuming a 7% annual growth rate on investments)

- In a How America Saves report by Vanguard, among a sample of 3 million people with Vanguard 401(k) accounts, only 11% maxed out their yearly contribution in 2012.

- Contributing to a 401(k) is one of the best ways to reduce your taxable income each year and turbo-charge your path to financial independence.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

This is a great visual! It very clearly shows the power of compounding and the importance of saving for retirement starting as soon as you possibly can.

I’m glad you found it useful! 🙂