Yesterday I released a “Quit Your Day Job” calculator. Here’s a guide on how to use the calculator and why I think it’s useful.

An Alternative to Complete Financial Independence

Financial independence is typically defined as having 25 times your annual expenses. So if you spend $40,000 per year then you need $1 million to be financially independent. Once you reach this point, there’s a high probability that your money will last you indefinitely and you’ll never have to work again if you don’t feel like it.

The only problem with financial independence is that it can take 15-20+ years to achieve for many people. That’s a much shorter working life than average, but it’s still a considerable amount of time.

Many people aren’t looking for complete financial independence. Instead, they’re looking to have enough savings to transition to a new job, start their own business, live off side-hustle income, or just work less hours.

But how can you know when you have enough savings to make this transition? This is where the “Quit Your Day Job” calculator can be helpful. It shows you exactly when you can leave your current day job and still maintain your net worth.

Let’s take a look at an example.

A Real Example

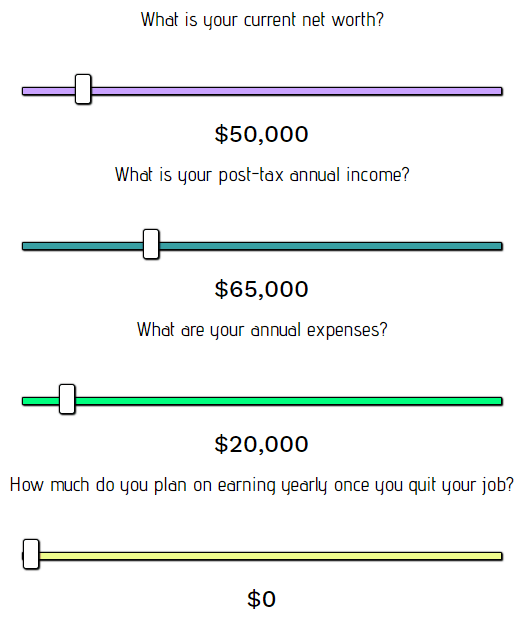

My current net worth is about $50,000. I earn around $65,000 each year after taxes. My annual expenses are around $20,000. I want to know when I can achieve complete financial independence and never have to work again. This means I plan on earning $0 yearly once I quit my day job. Plugging my numbers into the calculate I get:

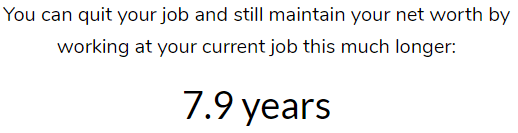

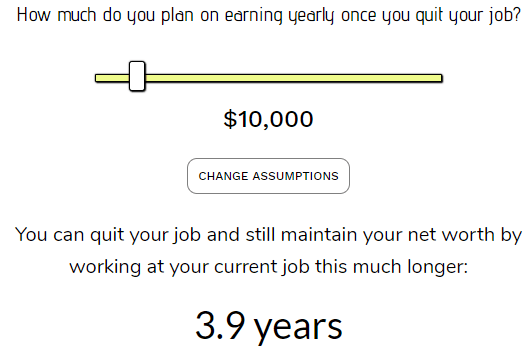

Here’s what that path to financial independence would look like:

Based on annual expenses of $20,000, I would need (25 x $20,000) $500,000 to be financially independent. I could reach this point in 7.9 years.

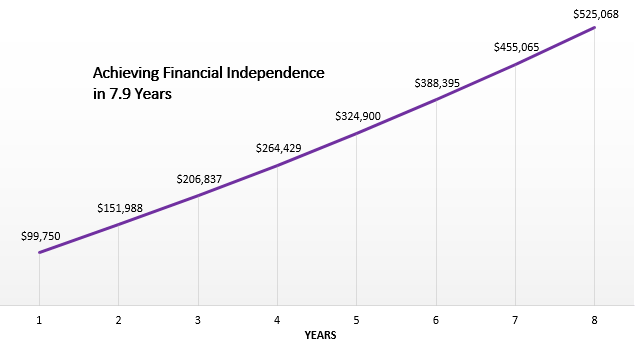

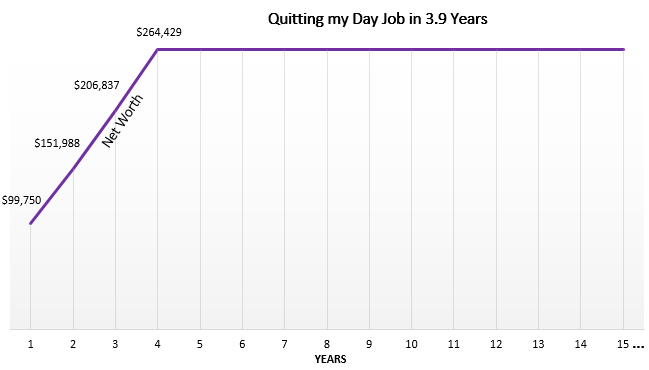

But what if I plan on earning $10,000 per year from blogging and freelance work once I actually quit my day job? If I change the yellow slider to $10,000 I see that I can instead quit my job in just under 4 years:

Here’s what that financial path looks like:

Because I plan on earning $10,000 per year once I quit my job, I only need to work for another 3.9 years in order to save up a total of $264,000. At that point I’ll have enough savings and I’ll be earning enough income that I can cover my yearly expenses without my net worth decreasing at all.

But there’s one last point to be made: what if I want to achieve complete financial independence some day? I might enjoy part-time work, side-hustling, blogging, and freelancing now but maybe at some point in the future I’ll want to have the option to stop working entirely.

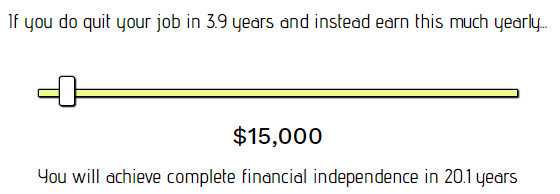

The last part of the calculator takes care of this calculation.

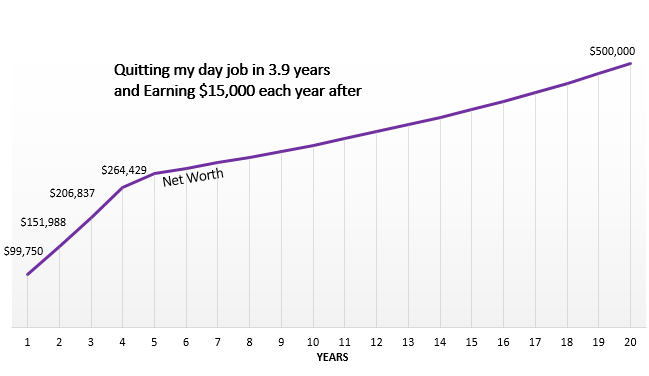

I know that if I quit my day job in 3.9 years and earn $10,000 per year that I can maintain my net worth, but if I earn anything more than that I’ll actually be increasing my net worth slowly over time. For example, if I instead earn $15,000 per year then I can achieve complete F.I. in 20.1 years after quitting my day job:

Here’s what that financial path would look like:

The Great Trade-Off

To put these numbers in context:

I’m 23 right now. With my current annual income and expenses I could achieve complete financial independence in 7.9 years around age 31.

Or I could quit my day job in 3.9 years around age 27 and maintain a net worth of $264,000 indefinitely by earning $10,000 yearly.

Or I could quit my day job at age 27, instead earn $15,000 each year and slowly increase my net worth until I achieve financial independence in 20.1 years at age 43.

There is a simple trade-off that everyone must make: you can choose to work for a longer stretch of time now and achieve complete F.I. The benefit here is that once you quit working you essentially never have to worry about money again. The drawback is that it could mean remaining in a job you hate for longer than necessary.

Or you could instead quit your job much sooner and take a “slow” approach to F.I. over the course of many years. The benefit here is that you can potentially start doing work you enjoy on your own terms much sooner than if you stick it out your current job. The drawback is that you won’t have enough money to be financially independent, which may or may not be stressful depending on how much money you have saved up.

Choose Your Own Route

I built this calculator to show that you might be able to live a life of freedom far sooner than you think. You might not need complete financial independence to be free.

There is no universal “correct” approach to financial independence.

For people who are in a high-income field and genuinely enjoy their job it makes sense to keep working and achieve complete F.I. in 10 years or less.

For people who can’t stand their day job and want freedom as soon as possible, it makes sense to leave your job sooner and start earning money in a different way to maintain or slowly increase your net-worth over time.

It’s not a game to see who can achieve financial independence sooner. It’s about using money to live the best possible version of your life. Whether this means achieving F.I. in 8 years or 38 years, you should decide based on your unique values and goals in life.

A lot of numbers were thrown around in this post. If any of it is confusing feel free to leave a comment or shoot me an email at fourpillarfreedom@gmail.com.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Very cool, you have managed to improve the retirement calculator. Congrats, very useful!

https://piggy-banking.com/

Thanks Piggy-banking!! 🙂

Awesome tool; does it also take into account inflation – how much dollars will be worth in the time we decide to quit our jobs?

On the calculator the interest rate is set to a default of 5%. Over the long-run stocks typically grow at around a 7-8% rate annually and inflation is typically 2-3% annually, which is why I have the default interest rate set to 5%. So yes, it does account for inflation. But these are just assumptions – your savings might actually grow at only 2% annually or maybe 10% annually, feel free to play around with the interest rate settings 🙂

Thanks Zach. Great post as usual. I also appreciated the calculator shared. Based on my results I’d retire in 10 years. That’s a bit concerning in that I do dislike my job (very much). I actually find it pointless. It doesn’t contribute anything to the greater good and these meetings are just a waste of time. Imagine going into a 2 hour meeting and ending more confused than how you went in.

You’ve opened my eyes to a new perspective though. I think I’ll consider staying at my job for the next few years then take the leap to something I’ll like. It may take a longer time for FI, but at least I’ll be sane. 🙂

I’m glad you found it helpful, Krystal. It’s definitely worth considering leaving a job you hate before you achieve complete financial independence. I think many people are in a similar position as you – best of luck on your financial journey 🙂

Great post, Zach! Is there a way I can access this tool to play around with it?

Hey Lane, you can find the tool here: https://fourpillarfreedom.com/four-visuals-volume-3-quit-your-day-job-calculator/

Awesome tool. You’ve opened my eyes & already keep an eye on my monthly spending. I Also use Personal Capital to track my expenses.

Thanks, Jerry! Glad to hear you’re finding the tool helpful 🙂